Uncategorized

Disney Stock Could Double: Return To Historical Performance

Key Points Shares of Walt Disney (NYSE:DIS) were trading as high as $203 per share just two years ago when … Read more

Key Points

- Disney stock has fallen to a critical technical level, posing a significant discount to its 2021 highs. However, investors should know what will drive the price upward.

- Analysts see double-digit potential in the stock price, with top-side estimates pointing to a double—growing fundamentals with massive room to recover, which may be the drivers of these assumptions.

- As streaming segments take the bulk of investor attention, parks are growing rapidly, with a great way to go until they reach pre-pandemic levels. Streaming, however, will be another cash cow once stabilized.

- Looking at the company’s historical performance, investors will notice that earning capacity is merely a tenth of what it could be. Closing the gap to these historical figures could be the key to unlocking the upside potential in the stock.

- 5 stocks we like better than Walt Disney

Shares of Walt Disney (NYSE:DIS) were trading as high as $203 per share just two years ago when justifiable reasons to worry about the underlying business fundamentals and drivers should have been at all-time highs. Today, the stock broke below $90 per share for a 58% decline since 2021.

Considering the massive ‘moat’ around the Disney brand and its reliability to continue to expand into high-growth markets like streaming services, the case for this stock reaching its former highs is stronger than ever.

Over a ten-year, nearly uninterrupted rally, today’s stock price would represent a ‘golden ratio’ Fibonacci retracement level. This ratio comprises the 61.8% to 78.6% retracement points, where most traders – and even investors – hope a stock will cease its decline, consolidate, and pivot its price action into a longer-term bull run.

However, investors should understand what is happening to Disney today and where the jet fuel may come from to return the stock price to its former glory days.

Same Company, Different Sentiment

Disney’s analyst ratings point to a potential 34% upside from today’s prices, with a top-side price target landing at $177, a more reasonable valuation considering the following trends. Historically speaking, revenue from domestic and international Disney parks locations have represented north of 40% of the company’s net revenue; as of the second quarter of 2023, this number fell to 25%.

As the company keeps growing its top line via further market share gain through acquisitions and expansion within its streaming and content segment, revenues from parks and experiences are set to more than double.

Within the latest earnings presentation, total revenue derived from parks rose by 17% year over year, accruing to a 23% increase in the segment’s operating income. The drivers behind this growth came from post-pandemic recoveries in traveling, massively helping the cruise lines division. Despite higher input costs due to national inflation rates rising, spending per capita (per guest) in parks rose to more than offset these costs.

International location growth, which stood over 100% year over year, was mainly driven by the company’s Shanghai location, where the reopening of the Chinese economy has helped Disney see a kickstart in attendance and spending volumes.

Apart from an apparent tailwind growth in the parks segment, other more profitable and scalable operations may bring about the whole recovery play. Streaming users ended the second quarter of 2023 at 157.8 million for a total of Disney+; considering the platform launched in 2019 into a highly competitive space, this is nothing to scoff at.

Average monthly revenue per user rose to $7.14 to end the quarter, posing a 20% increase from the previous year. Two important things here, the fact that this revenue (amounting to roughly $13.5 billion annually) is mainly recurring and stable should command a higher multiple given the quality and stability of its roots. Secondly, a 20% increase in subscription costs followed by a mere 1% decline in total users speaks volumes to Disney’s sizable moat around its brand, as virtually all users saw enough value in the service to justify such a significant increase.

Normalized Performance

When looking at Disney’s financials, investors can find a massive discrepancy between previous results and those seen in today’s market environment. Before the effects of COVID-19 made their presence across the economy, Disney generated a six-year average net income of $9.6 billion. In contrast, today, this figure stands to be only $3.1 billion.

The contraction in the bottom line can be attributed to a similar halving in operating income, as nearly half of all expenses (and growth of the same) came from broadcasting operations. Investors saw their dividend payouts cut back in April of 2020, as the company deemed it necessary to recoup as much free cash flow as possible to navigate the pandemic and handle such a significant investment as Disney+ and other platforms.

Whereas the pre-pandemic norm for Disney’s free cash flow generation stood at a normalized range of $7 to $10 billion, today, it is only a tenth of this range. Not only is Disney struggling to generate operating cash flow as before, but it is also allocating much capital to these higher-growth markets.

These are not necessarily bad news, however, as when revenues derived from parks inevitably return to their previous levels and resume standard growth rates, coupled with the profitability and scalability milestones to be reached in streaming; the bottom line will likely end up following its pre-pandemic margins.

Disney’s price-to-book ratio, a more tangible value metric, is trading at its lowest level since 2012 (ex., COVID sell-offs). This lays the foundation for a double-momentum rally; as the free cash flow of the business starts to improve (with a 7x growth potential), book value will ultimately expand as there are more retained earnings and possible share repurchases.

Considering the stock’s book value ratio has typically been 2.5x, investors can buy this metric today for only 1.7x and still be exposed to these tailwinds, which will expand the ‘book.’ Ultimately, increased free cash flows and streaming income stabilization will influence management into reinstating the dividend payouts, a significant event that could attract masses of investors into DIS stock.

Should you invest $1,000 in Walt Disney right now?

Before you consider Walt Disney, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Walt Disney wasn’t on the list.

While Walt Disney currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

The post Disney Stock Could Double: Return To Historical Performance appeared first on MarketBeat.

reopening pandemic covid-19 stocks recoveryUncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

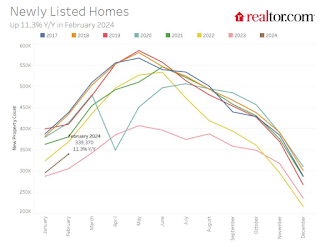

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

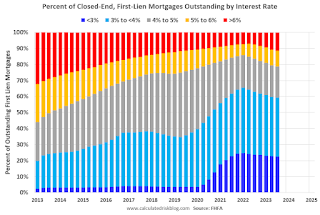

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges