Uncategorized

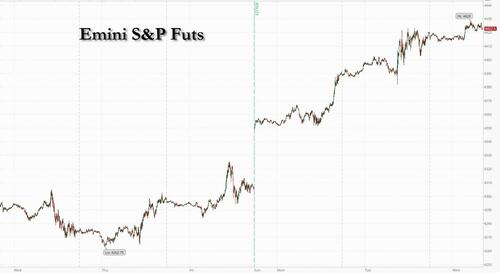

Futures Extend Gains Into Fed’s Pause Announcement

Futures Extend Gains Into Fed’s Pause Announcement

US equity futures are higher – again – with markets positioned for Jerome Powell to announce…

US equity futures are higher - again - with markets positioned for Jerome Powell to announce a hawkish, yet bullish pause, in the Fed's rate hiking campaign at 2pm today. S&P futures rose 0.15% as of 7:45am ET following the S&P 500’s fourth consecutive increase — the longest winning stretch since early April - which approached the 4,400 mark, the highest level in over a year. Small caps/Russell outperformed (in line with what we said last night) as bond yields reverse an earlier drop into Fed Day, while the USD is again weaker pre-mkt. Commodities are rallying led by Energy and Metals, WTI oil rises back over $70 and base metals are up 4% - 7% MTD on hopes of Chinese stimulus. In Europe, a rally in miners helped push the Stoxx 600 benchmark to the highest in three weeks.

In premarket trading, Google parent Alphabet slipped as the European Union accused the unit of abusing its dominance over advertising technology. Advanced Micro Devices shares gained 1.6% in premarket trading after the chipmaker showed off its planned line of artificial intelligence processors. The shares had drifted lower during the presentation in San Francisco, closing down 3.6%, but analysts responded positively to the event. Meanwhile, Tesla was set to extend gains for a record 14th consecutive session, after already adding $240 billion during its winning streak, as the world’s most valuable automaker shows no sign of stopping. Here are some other notable premarket movers:

- Nikola leads fellow electric- vehicle stocks higher in premarket trading as the cohort looks set to extend Tuesday’s gains.

- NextDecade rose as much as 17% in US premarket trading after TotalEnergies agreed to buy a 17.5% stake in the company, which is developing a terminal to export liquefied natural gas in Texas.

- RadNet dropped 8% in postmarket trading Tuesday after the network of outpatient imaging centers offered $175 million shares via Jefferies and Raymond James.

- MicroVision shares slumped 14% postmarket after the company filed a shelf registration for potential sale of common and preferred shares and warrants.

- Iteris shares dropped 14% in extended trading, after the engineering services company reported adjusted fourth quarter Ebitda below expectations. It also gave a full-year revenue forecast.

Global investors rejoiced at Tuesday’s CPI data which showed the 11th consecutive month of slowing inflation as confirmation that the FOMC will hold rates in the 5%-5.25% range. Swap traders put the odds of an increase at only 10%, while still seeing the potential for a July move, given that inflation is still more than twice the central bank’s goal.

Indeed, as noted earlier, the Fed is poised to pause the hiking cycle for the first time in 15 months, in a rate decision that will land at 2:00 p.m. (see our full FOMC preview post is here).

Fed Chair Jerome Powell has signaled that he’d prefer to wait to evaluate the impact of past hikes on the economy, as well as the recent banking turmoil. The Fed’s likely to keep options open to hike again. Meanwhile, Ken Griffin’s hedge fund Citadel is bracing for a US recession by ramping up high yield credit trades. He expects the Fed to raise interest rates one more time this year and then pause for an extended period.

“A hawkish skip is the most likely scenario for today’s FOMC,” said Evelyne Gomez-Liechti and Helen Rodriguez, strategists at Mizuho International. “We expect Powell will follow up with a relatively hawkish tone in the press conference in order to prevent a dovish market reaction, stressing that inflation is still too high and the Fed will be resolute in returning inflation to target.”

Meanwhile, CNBC is reporting that CFOs have told regional Fed presidents to halt the hiking cycle and not just skipping a meeting or two. Expectations of a pause have pushed the VIX back below 15, against an average of 23 for the past year, underscoring support for risk assets. In another sign of the calm prevailing in equity markets, it’s now almost 80 trading days since the S&P 500 declined by 2% or more.

European stocks gained as miners rallied for a second day, while investors awaited the Federal Reserve’s policy decision for clues on the path of interest-rate hikes. The Stoxx Europe 600 Index was up 0.6% and on course to rise for a third straight session with miners gaining 1.8% as optimism around stimulus in China kept iron ore prices near a two-month high. Barclays strategists upgraded their rating on the sector to overweight, saying bets on the stimulus would boost cyclical sectors in the second half. Autos and real estate stocks also rose, while tech and travel & leisure underperformed. Shell shares recovered early declines as the energy giant said it would increase its dividend by 15% and boost natural gas production. Casino Guichard-Perrachon SA jumped after billionaire Xavier Niel and two partners approached the grocer with a €1.1 billion-euro ($1.2 billion) rescue plan. Logitech International SA dropped after it said Chief Executive Officer Bracken Darrell would leave the company. Here are the most notable European movers:

- Grifols shares surge as much as 12%. The Spanish pharmaceutical firm expects to get $1.5b upon “satisfactory closing” of Shanghai RAAS deal, according to regulatory filing

- Shell shares turned positive after falling as much as 0.5%, with brokers highlighting the oil major’s capex reduction plan as positive, tempering the effect of a smaller-than-expected dividend increase

- Colruyt shares jump as much as 11% after the Belgian retailer reported better-than-expected full-year results. The outlook suggests “significant” upgrades to consensus earnings estimates, MS says

- Games Workshop shares advance as much as 6.2% after the maker of the Warhammer series of games showed an “impressive” improvement in revenue growth in 2H, Jefferies says

- DoValue gains as much as 8.6% after the loan management servicer said Fortress and Bain Capital signed a shareholders’ agreement related to corporate governance. Equita said the move is positive

- Entain shares fall as much as 11% after the gambling operator raised about £600m through a stock offering to fund the acquisition of Poland sports-betting operator STS

- Boliden shares fall as much as 9.1%, the most since October, after the Swedish mining firm cut its guidance following a large fire at the Ronnskar copper smelter in northern Sweden

- Victrex shares drop as much as 11% to the lowest since June 2016 after the UK-based chemicals company gave a full-year earnings outlook that missed analyst estimates

- Robert Walters shares drop as much as 20% and drag down other recruitment stocks in the UK and Europe after the firm said its FY profit is set to be “significantly” below expectations

- CompuGroup Medical drops as much as 6.5% as Morgan Stanley cuts to underweight, giving the stock its only negative analyst rating. The broker sees better risk/reward elsewhere within its coverage

Earlier in the session, APAC stocks were mixed with the region's bourses tentative ahead of the FOMC policy announcement.

- Hang Seng and Shanghai Comp. were kept afloat after the PBoC cut rates for its Standing Lending Facility by 10bps and the NDRC issued a notice on lowering costs this year with VAT to be exempted and reduced for small businesses until year-end. China was also said to be weighing broad stimulus with property support and rate cuts, although the gains in Chinese stocks were limited amid ongoing growth concerns and following softer-than-expected loans and financing data.

- ASX 200 was led by strength in the commodity-related sectors after China’s support pledges and PBoC cuts.

- Nikkei 225 extended its advances as automakers and other exporters benefitted from recent currency moves and amid broad consensus for the BoJ to maintain its ultra-easy policy later this week

- Indian stock markets rose for a third session, supported by gains in metal and commodities firms. The S&P BSE Sensex rose 0.1% to 63,228.51 in Mumbai, while the NSE Nifty 50 Index advanced 0.2%. Reliance Industries contributed the most to the Sensex’s gain, increasing 1.2%. Key stock gauges in India traded near their all-time highs, after gaining more than 9% since March, helped by the strength of India’s domestic economy and purchases by foreigners. “India’s growth cycle is here to stay,” Morgan Stanley equity strategist Ridham Desai said in an interview with Bloomberg Television. “A lot of factors have combined together, like political, social, and economic, and it does seem like a sweet spot.”

In FX, the Bloomberg dollar index held near a one-month low, dropping another 0.1% on Wednesday on speculation the Federal Reserve will skip an interest-rate hike at a policy meeting ending Wednesday. “Although US bond yields are now back up near late-May highs, that hasn’t helped the US dollar,” Australia & New Zealand Banking Group Ltd. analysts Miles Workman and David Croy wrote in a research note. While US CPI data has cemented bets on a Fed pause, “it also suggests we’ll see more tightening later, and that’ll ultimately slow the US economy,” they said.

- Kiwi underpinned around 0.6150 vs Greenback and 1.1000 against Aussie after better than expected NZ current account data, AUD/USD relatively bid near 0.6800 with support via strength in iron ore.

- Sterling retains 1.2600+ status vs Dollar as UK GDP matches consensus and Euro probes 1.0800 where mega option expiry interest resides.

- Yen takes advantage of softer US Treasury yields to rebound through 140.00.

- Lira regains poise as Turkish President gives new Finance Minister and CBRT Governor go ahead to revert to orthodox policies ahead of next week's CBRT.

In rates, Treasuries are marginally cheaper across the curve after Tuesday's sharp post-CPI drop, led by German bonds, where 10s trade cheaper by around 4bp vs Treasuries. Treasuries bull steepened slightly in muted price action ahead of the FOMC rate decision when policymakers are expected to pause tightening for the first time this cycle. Money markets assign 15% odds on a quarter-point increase later and maintain an 80% probability of such a hike at next month’s outcome. Yields are cheaper by around 1bp across the Treasuries curve with 10-year around 3.81% and spreads within 1bp of Tuesday session close.

In commodities, crude futures advance with WTI rising 0.9% to trade near $70.00. Spot gold adds 0.4% to around $1,951. Bitcoin gains 0.3%

Looking the day ahead now, and the main highlight will be the Federal Reserve policy decision, along with Chair Powell’s press conference. Data releases will include the US PPI reading for May, as well as UK GDP and Euro Area industrial production for April.

Market Snapshot

- S&P 500 futures up 0.2% to 4,381.25

- MXAP up 0.4% to 168.02

- MXAPJ down 0.2% to 526.61

- Nikkei up 1.5% to 33,502.42

- Topix up 1.3% to 2,294.53

- Hang Seng Index down 0.6% to 19,408.42

- Shanghai Composite down 0.1% to 3,228.99

- Sensex up 0.2% to 63,253.81

- Australia S&P/ASX 200 up 0.3% to 7,161.75

- Kospi down 0.7% to 2,619.08

- STOXX Europe 600 up 0.3% to 464.84

- German 10Y yield little changed at 2.43%

- Euro little changed at $1.0797

- Brent Futures up 1.3% to $75.23/bbl

- Gold spot up 0.4% to $1,950.56

- U.S. Dollar Index down 0.13% to 103.21

Top Overnight News

- China’s foreign minister tells Blinken in a phone call that the US should “show respect” to Beijing and stop undermining the country’s sovereignty, security, and development (Blinken is supposed to visit China this weekend, although the trip hasn’t been confirmed). SCMP

- Senior Chinese officials are holding urgent meetings with economists and business leaders on how to supercharge the economy, people familiar said. In response, execs are calling on the government to adopt a more market-oriented, rather than planning-led approach, to growth. BBG

- Citadel’s Ken Griffin expresses optimism about the growth outlook in China (“They’re very clearly putting economic growth back at the top of their priority list”). FT

- India’s wholesale price index for May sinks to -3.48% Y/Y, down from -0.92% in April and below the Street’s -2.5% forecast. RTRS

- Generative AI could boost the global economy by up to $4.4T annually by enhancing worker productivity according to a new McKinsey report. NYT

- Biden coming under growing pressure to support an accelerated timeline for bringing Ukraine into NATO. NYT

- The FOMC is likely to pause today and let the haze clear before it considers another rate hike. The Fed leadership has signaled that it sees pausing as the prudent course because uncertainty about both the lagged effects of the rate hikes it has already delivered and the impact of tighter bank credit increases the risk of accidentally overtightening. We expect the median dot to show one additional hike to a new peak of 5.25-5.5%, in line with our own forecast. GIR

- Global oil demand is nearing its peak and will slow sharply in the next few years as high prices and Russia's war in Ukraine speed the transition from fossil fuels, the IEA said. In the near term, oil markets may tighten "significantly" as China's consumption rebounds from the pandemic. In the US, crude and fuel inventories rose last week. BBG

- Money-market funds are already scooping up the Treasury’s growing bill issuance now that the government has suspended the debt ceiling until 2025 and the Federal Reserve is nearing the end of its rate-hiking cycle. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were somewhat mixed with the region's bourses mostly tentative ahead of the FOMC policy announcement. ASX 200 was led by strength in the commodity-related sectors after China’s support pledges and PBoC cuts. Nikkei 225 extended its advances as automakers and other exporters benefitted from recent currency moves and amid broad consensus for the BoJ to maintain its ultra-easy policy later this week. Hang Seng and Shanghai Comp. were kept afloat after the PBoC cut rates for its Standing Lending Facility by 10bps and the NDRC issued a notice on lowering costs this year with VAT to be exempted and reduced for small businesses until year-end. China was also said to be weighing broad stimulus with property support and rate cuts, although the gains in Chinese stocks were limited amid ongoing growth concerns and following softer-than-expected loans and financing data.

Top Asian News

- Chinese Foreign Minister Qin Gang held a call with US Secretary of State Blinken and said the US should stop interfering with China's internal affairs and should respect China's concerns such as the Taiwan issue, while he added the US should stop hurting China under the excuse of competition and hopes the US will meet China halfway, effectively manage differences and promote communication and cooperation, according to state media.

- Japanese PM Kishida is reportedly considering dissolving the Lower House of Parliament on the same day if the opposition submits a no-confidence vote on Friday, according to Fuji TV.

European bourses are firmer across the board, Euro Stoxx 50 +0.7%, having shrugged off the tepid open after a busy stock-specific pre-market though fresh macro drivers remain light. Sectors are similarly supported with Real Estate leading after marked UK-related pressure on Tuesday while Autos and Banks benefit from a Barclays note and yields/BBVA's ATI sale respectively. Travel & Leisure bucks the trend after a downbeat update from Entain. Stateside, futures are edging higher and moving in tandem with the above as the ES attains a firmer hold above 4400 pre-FOMC; newsquawk preview available here. EU Antitrust Chief Vestager to hold a news conference at 11:45BST/06:45ET, expected to be on Alphabet's (GOOGL) Google. Shell (SHEL LN) announces a 15% dividend/shr increase from Q2 2023; Capital Spending reduced to USD 22-25bln/year for 2024 & 2025; Buybacks of at least USD 5.5bln for H2 2023. Airbus (AIR FP) raises 20 year delivery forecast to 40.85k (prev. 39.45k); sees 17.1k aircraft replacements in the next 20 years (prev. 15.4k).

Top European News

- Turkish President Erdogan says he has accepted steps that the CBRT and Finance Minister Simsek will take.

- French Finance Minister Le Maire vowed to put France's finances back on track with spending cuts, according to FT.

- Downing Street has ordered banks to protect struggling homeowners from increasing mortgage costs as markets speculate over the possibility of the Bank Rate rising to as high as 6%, according to The Telegraph.

- German Economy Ministry says economic data points to moderate recovery over further course of the year; "economic recession" in sense of more sustained downturn is not currently expected

FX

- Buck on the backfoot approaching Fed, with DXY heavy on the 103.000 handle awaiting guidance after a widely expected FOMC pause.

- Kiwi underpinned around 0.6150 vs Greenback and 1.1000 against Aussie after better than expected NZ current account data, AUD/USD relatively bid near 0.6800 with support via strength in iron ore.

- Sterling retains 1.2600+ status vs Dollar as UK GDP matches consensus and Euro probes 1.0800 where mega option expiry interest resides.

- Yen takes advantage of softer US Treasury yields to rebound through 140.00.

- Lira regains poise as Turkish President gives new Finance Minister and CBRT Governor go ahead to revert to orthodox policies ahead of next week's CBRT.

- PBoC set USD/CNY mid-point at 7.1566 vs exp. 7.1550 (prev. 7.1498)

Fixed Income

- US Treasuries retain bid ahead of PPI data and FOMC as T-note hovers closer to top of tight 113-00/112-24 range.

- Bunds remain heavy between 133.71-33 parameters after less than rousing finale for German 2033 benchmark.

- Gilts claw back post-UK labour data losses within 94.65-21 bounds as monthly GDP metrics match consensus.

Commodities

- Crude continues to consolidate with WTI Jul’23 and Brent Aug’23 inching above the USD 70.00/bbl and USD 75.00/bbl handles, specific drivers light.

- Spot gold is incrementally firmer and at the top-end of the sessions range which is yet to see it gain any real traction above the USD 1950/oz mark as the broader risk tone remains robust and serves to offset any USD-driven upside.

- Base metals are somewhat mixed, though this is seemingly more a function of yesterday’s pronounced gains for the complex earlier in the week.

- US Energy Inventory Data (bbls): Crude +1.0mln (exp. -0.5mln), Gasoline +2.1mln (exp. +0.3mln), Distillate +1.4mln (exp. +1.2mln), Cushing +1.5mln.

- IEA Monthly Oil Market Report: oil demand is set to increase by 2.4mln BPD in 2023 to a record of 102.3mln BPD (vs. May view of 102mln BPD). Click here for more.

Geopolitics

- Russia urged for a transparent investigation into the Nord Stream blasts after reports that the US warned Ukraine not to attack Nord Stream, according to Reuters.

- White House said US President Biden met with the NATO chief and they underscored their shared desire to welcome Sweden to the alliance ASAP, while they also discussed the need for allies to build on the 2014 Wales summit defence investment pledge.

- German National Security Strategy Document says China remains a partner without which cannot solve the many global challenges; China is increasingly pressuring regional stability and disrespecting human rights. Germany aims to spend 2% of GDP on defence on average over several years.

- UN Nuclear Chief to visit Zaporizhzhia nuclear power plant on Thursday, one day later than planned, according to IFAX citing an official.

- Turkish President Erdogan says constitutional amendments in Sweden are not enough to address Turkey's concerns, the police should not allow such protests; adds, Sweden should not expect "anything different" from Turkey at the Nato summit.

Crypto

- Binance and SEC are reportedly not far apart on a deal to avoid a full asset freeze, according to Bloomberg.

- Binance CEO Zhao denies rumours of selling Bitcoin to bolster BNB, according to Cointelegraph.

US Event Calendar

- 07:00: June MBA Mortgage Applications 7.2%, prior -1.4%

- 08:30: May PPI Final Demand MoM, est. -0.1%, prior 0.2%

- 08:30: May PPI Final Demand YoY, est. 1.5%, prior 2.3%

- 08:30: May PPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- 08:30: May PPI Ex Food and Energy YoY, est. 2.9%, prior 3.2%

- 14:00: June FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

Investor risk appetite has remained pretty strong over the last 24 hours, with the S&P 500 (+0.69%) hitting a fresh one-year high and posting a 4th consecutive advance. That follows the US CPI print for May, which was broadly in line with consensus and means that the Fed are now widely expected to keep rates on hold today after 10 consecutive increases. This optimism was evident across multiple asset classes, with oil prices rising and credit spreads tightening as well. But the flip side of all this positivity has been growing scepticism that central banks will cut rates at all this year, which led to a sovereign bond selloff as investors priced in higher rates for longer. At the extreme end of this was the UK with 2yr notes soaring +26bps, comfortably past the Liz Truss related mini peak in October last year and to the highest since summer 2008. 2yr US yields rose +8.9bps and closed near the top of a +21bps range yesterday with a big lurch lower to c.4.49% after CPI but then trading above 4.70% late in the session before closing at 4.666%, a post-SVB high.

This focus on the front end makes tonight’s dot plot from the Fed one of the most important events today, since it’ll provide a big steer on how far the FOMC want to keep pushing rates. Market pricing is currently pointing towards just one more rate hike in July, so any indication there’ll be more (or less) than that could lead to a big reaction.

When it comes to the Fed today, the overwhelming consensus is that they’ll stay on hold, keeping the target range for the fed funds rate between 5% to 5.25%. In fact, futures are now pricing just a 12.6% chance of a hike at this meeting, so by this point anything other than a hold would be a big surprise. There had been some sense that a bad CPI print yesterday might lead to a further hike, but in reality, monthly headline CPI came in at just +0.1% as expected. In turn, that took the year-on-year rate down to just +4.0% (vs. +4.1% expected), which is the slowest inflation has been in 26 months.

The main problem for the Fed is that core CPI has still been stubbornly persistent, with yesterday seeing another +0.4% monthly rise (0.44% unrounded so a strong +0.4%). That’s the 6th consecutive month where core CPI has been at least +0.4%, and it meant that the year-on-year rate only fell back to +5.3% (vs. +5.2% expected). So whether you look at a 1m, 3m, 6m or even 12m horizon, core CPI has still been running at an annualised pace of more than 5%. That persistence means that investors still think that today will only mark a “skip” on rate hikes rather than a pause, with futures pointing to a 72% chance of a hike by next month’s meeting in July. If you were looking for hope, rents should ease in the months ahead if the models the likes of which we mentioned in CoTD here yesterday prove correct.

This rates sell-off was driven by real rates, with the 2yr real TIPS yield (+8.7bps) hitting a post-GFC high of 2.527%. 10yr nominal yields saw a similar strong move higher to the front end, with a +7.8bps rise to 3.813%. This morning in Asia, we've edged back down to 3.80% as we go to press.

With all this in mind, our US economists think that the Fed’s statement will see a hawkish adjustment, and will note the potential for more tightening at “coming meetings”. They also think the dot plot will show a further hike pencilled in for this year. And at the press conference, they think there’s little downside from Chair Powell delivering a hawkish message, considering the resilient data recently, easing financial conditions, and a desire to prevent near-term rate cuts being priced. See there full preview here for more details.

Whilst attention will be on the Fed today, there were some interesting headlines out of the UK yesterday as we mentioned at the top, where investors priced another full 25bp rate hike from the BoE after the latest employment data showed a very tight labour market. In particular, wage growth excluding bonuses was up by +7.2% (vs. +6.9% expected), whilst the unemployment rate fell back to 3.8% over the three months to April (vs. +4.0% expected). And with that data in hand, markets are now pricing in more than five 25bp hikes by the December meeting, which if realised would take the Bank Rate up to 5.75% from its current 4.5%. Indeed, it’s worth noting that investors are even placing some weight on the prospect they might go as far as 6%. As someone with a 1.4% 5-year fixed mortgage that rolls off in January 2025, I’m going from fairly relaxed to starting to take some serious refinancing risk notice!!

Those numbers led to a massive selloff in gilts, with the 2yr yield (+26.1bps) hitting a post-2008 high of 4.90%, and the 10yr yield (+9.6bps) reaching its highest level since Liz Truss was PM back in October. Another effect was it left the 2s10s yield curve at its most inverted since 2007, although to be fair, the UK 2s10s has been a less reliable recession indicator than its US counterpart. We heard some brief comments from BoE Governor Bailey as well yesterday, who acknowledged that inflation was “taking a lot longer than expected” to come down. Their next meeting is a week tomorrow, and whilst a 25bp hike is fully priced, investors are still placing a 13% chance that it might be a larger 50bp move.

When it came to equities, there was no sign of any let-up in the latest rally, and the S&P 500 (+0.69%) continued to power forward. In fact, as it stands the index is on track for its 5th consecutive weekly advance, which is the first time that’s happened since late-2021. The big tech stocks again rose, with the FANG+ index gain (+0.89%) taking its YTD rally up to a massive +72.07%. That said, the equity rally was broader as small-cap stocks outperformed, with the Russell 2000 index up +1.23%, while the rate-sensitive utilities (-0.06%) and Telecom (-0.55%) stocks dragged on the broad equity rally.

Back in Europe, the picture was similarly buoyant, and the STOXX 600 posted a +0.55% advance. Growing risk appetite also meant there was a continued tightening in sovereign bond spreads, with the gap between Italian and German 10yr yields falling to another one-year low of 163bps. However, yields themselves mostly rose across the continent, with those on 10yr bunds (+3.5bps), OATs (+3.1bps) moving higher, while BTPs (-0.2bps) were virtually unchanged.

Asian equity markets are mostly trading higher this morning with the Nikkei (+0.87%) leading gains across the region and continuing to extend its three-decade highs. Meanwhile Chinese equities are also in the green with the CSI (+0.40%), the Shanghai Composite (+0.23%) and the Hang Seng (+0.10%) holding on to their gains. Elsewhere, the KOSPI (-0.47%) is the only major index trading in the red. US stock futures are little changed with those on the S&P 500 (-0.04%) and NASDAQ 100 (-0.02%) trading almost flat. Early morning data showed that the unemployment rate in South Korea unexpectedly dropped to 2.5% in May, a level last seen in August 2022 (v/s 2.7% expected) from 2.6% in April.

Although the data focus was on the CPI print yesterday, there were some interesting findings in the NFIB’s small business optimism index from the US. One notable warning was that the percentage of firms reporting an easing in credit conditions fell back to a net -10%, which is the lowest that’s been since 2012. Otherwise, the overall small business optimism index did rise to 89.4 (vs. 88.5 expected), but that’s still the second-worst reading of the last decade, having only seen a slight improvement on the previous month. Meanwhile in Germany, the ZEW survey showed a rebound in the expectations component to -8.5 (vs. -13.5 expected), ending three consecutive months of declines. However, the current situation fell back to a 5-month low of -56.5 (vs. -40.2 expected).

To the day ahead now, and the main highlight will be the Federal Reserve policy decision, along with Chair Powell’s press conference. Data releases will include the US PPI reading for May, as well as UK GDP and Euro Area industrial production for April.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire