Uncategorized

Crypto remittances offer cheaper alternative, but still face challenges to adoption

Crypto remittances are a lifeline for many people who need to send money to their loved ones, as they provide faster, cheaper and more transparent transactions…

Crypto remittances are a lifeline for many people who need to send money to their loved ones, as they provide faster, cheaper and more transparent transactions than traditional methods.

As the cryptocurrency market moves sideways and amid a deepening stablecoin exodus, the sector remains a vital lifeline for many sending money to loved ones while dodging extremely high fees that can be life-changing over time.

Cryptocurrency remittances have been seeing their adoption grow, and the low volatility seen in the space over the last few months might just be the silver lining that encourages more people to transition from mere spectators to active users, harnessing the true potential of this financial avenue.

Compared to traditional methods, crypto remittances sport numerous advantages, which include faster processing time, lower transaction costs and more transparency. Speaking to Cointelegraph, Brendan Berry, Ripple’s head of payments products, noted that for both fiat and crypto, the basic tenets of payment success are “speed, low-cost settlement, security and reliability.”

Berry noted that from a macro perspective, existing domestic payment rails work “relatively well” but face difficulties when cross-border payments are made. Berry added:

“There is no third party or global central bank, so the world has created this complex system of correspondent banking that is costly, error-prone, slow and leaves trillions of dollars in locked-up capital.”

He said that remittances have become a lifeline for millions worldwide and can be greatly improved through new technologies like crypto and blockchain. According to World Bank data, remittances grew 5% in 2022 to reach $682 billion.

Berry added that the high cost of remittances — ranging from 5% to 7% worldwide — and their slow speeds burden millions of families. He stated that the global economy “may seem like an always-online global marketplace, but traditional finance still operates on a 9 to 5, Monday to Friday, schedule.”

Cutting through high costs

The World Bank estimates the global average cost of sending $200 is 6.5% — a massive amount of money for families living on $200 or less a month.

Speaking to Cointelegraph, a Coinbase spokesperson said that whether consumers use banks, money transfer operators or post offices, the impact of fees on their remittance payments is enormous, ranging from 10.8% with banks to 5.5% with post offices.

The spokesperson added that the U.S. average fee rate is 6.18%, which means that every year, Americans, on average, spend “close to $12 billion on remittance fees.” They added:

“Cryptocurrencies like Bitcoin or Ether can greatly cut the cost of sending money internationally by about 96.7% vs. the current system. Sending Bitcoin to another wallet costs an average of $1.50 per transaction, and Ether costs an average of $0.75 per transaction.”

It’s worth pointing out, however, that security concerns associated with custodying cryptocurrencies remain a deterrent for many to enter the space, as managing the private keys to a cryptocurrency wallet can be a challenge, especially to those less tech-savvy. On top of that, the consumer protections offered by the traditional financial system may leave some at ease despite the high fees.

Coinbase added that the time cost is also significant, with the average remittance taking between one and 10 days to settle, while cryptocurrency transactions take on average just 10 minutes.

Adding to this, a spokesperson for Circle — the firm behind the USD Coin (USDC) stablecoin — told Cointelegraph that a key feature of blockchain-powered remittances is “accessibility and inclusivity, requiring only a phone and internet connection to transfer funds across borders and at low-cost.”

Moreover, Lesley Chavkin, head of policy at the Stellar Development Foundation, a nonprofit organization supporting the Stellar network, told Cointelegraph that for remittances sent on a blockchain, preliminary data from “a small, limited-scope pilot focused on the United States to Colombia payment corridor” showed fees were half of those paid for traditional remittances.

Recent: From payments to DeFi: A closer look at the evolving stablecoin ecosystem

As transactions on the network scale up, Chavkin said, remittance fees could drop even more, furthering their advantages. Pavel Matveev, the co-founder and CEO of Wirex, told Cointelegraph that these don’t have to navigate through numerous intermediaries.

Despite their advantages, cryptocurrency remittances aren’t as widespread as one may think. For one, ease of use isn’t at the point of mass adoption, while the cryptocurrency market’s volatility keeps many on the sidelines.

Overcoming fundamental inefficiencies

Ripple’s Berry said that accessibility and user-friendliness are “critical components for the mainstream adoption of crypto remittances.”

User experience, he said, has been a problem for the industry but is arguably the easiest one to solve. He added that legacy payment solutions may appear to be more user-friendly with the use of modern interfaces “that marginally improve the customer experience, which creates the illusion of advancement,” while in reality, there has “been little improvement to the foundational infrastructure that underpins our global financial system which would ultimately unlock true progress and by extension the user experience.”

Nevertheless, Brendan conceded that while cryptocurrencies can be faster and cheaper for sending funds, a “successful remittance solution must also help the customer off-ramp funds in the currency of their choice.” He added:

“The ability for users to transfer value from fiat to crypto or vice versa has historically been a challenge at both the individual and enterprise levels. While individual users have more options than ever before through more than 600 crypto exchanges globally, enterprise-grade off-ramp solutions are sparse.”

Indeed, one has to consider the costs associated with existing cryptocurrency infrastructure and how it interacts with the traditional financial system. While receiving a cryptocurrency transaction may be fast and cheap, paying with crypto isn’t as easy.

Commenting on the situation for Cointelegraph, Gero Piskov, card and payments manager at digital wealth platform Yield App, said that in “regions where crypto remittances thrive, accessibility and UX [user experience] have indeed been hurdles, which have hindered broader adoption.”

Often, the solution involves converting cryptocurrencies into fiat currency, which may incur additional transactions, trading fees and potential withdrawal fees. Converting to fiat currency, however, may be a bigger challenge than it should be, especially in regions where crypto-to-fiat liquidity isn’t significant enough to not add more complexity to the process.

Speaking to Cointelegraph, a Binance spokesperson said that the World Bank’s Global Findex 2021 shows 42% of adults in Latin America and the Caribbean still lack access to a bank account, with the segment representing 24% of the total adult population.

Cryptocurrency solutions, the spokesperson said, have the “potential to fill this gap while also reducing the financial transaction’s time and costs for people who already participate in the traditional system.”

In countries where paying with crypto with one solution or another is possible, users may be exposed to heightened spread they may not be aware of, as well as crypto market volatility. This volatility can completely nullify the advantages of paying less for the transaction itself.

Binance’s spokesperson added that the main goal of blockchain and cryptocurrencies is to simplify the entire process for users; hence, industry players are “dedicating significant efforts and resources into innovating and enhancing its platform with the users’ experience in mind.”

However, they noted that given the nascency of blockchain technology, there are still people without the technical know-how to process crypto transactions efficiently. The spokesperson said:

“One solution that has emerged would be liquidity services on particular blockchains. These international crypto liquidity service providers facilitate the transfer of money from one country to another, with cryptocurrencies acting as a bridge.”

In these blockchain-based liquidity services, Binance’s spokesperson clarified, a sender would transfer money in their own local currency, while the recipient would receive it in their local currency. Such a service would make the process friction and almost instantaneous for users across all backgrounds, they said.

Simplifying remittances and greatly reducing their cost is extremely important, especially for people losing between 5% and 10% of the money they need to survive on fees. This means that remittances have actually become a use case for digital assets, as noted by a Circle representative who spoke to Cointelegraph and added that crypto is expanding access to financial services across the globe.

Crypto as a tool to reduce poverty

Binance’s spokesperson seemingly corroborated the words from Circle, saying that remittances are “the primary economic lifeline for millions of families worldwide, and a major driver of economic growth for developing countries, totaling $589 billion in 2021,” according to World Bank data.

Cryptocurrencies are improving the lives of people relying on remittances, according to experts Cointelegraph spoke to, thanks to the numerous advantages being offered. One example the Stellar Development Foundation’s Chavkin pointed to us is Félix.

Félix is a Whatsapp-based payments platform in Latin America that allows users to send money through an AI chatbot on Meta’s popular messaging platform. According to the platform’s co-founder and CEO Manuel Godoy, Félix uses USDC on the Stellar network to boil the process of remittances down to “seconds.”

Chavkin noted that the figure showing remittance payments grew by about 5% in 2022 “represents only recorded transactions; the true number is most likely significantly higher.” She concluded:

“Providing solutions that are faster, cheaper and more accessible is one tool to help reduce poverty and improve outcomes. Focusing on crypto remittances as a solution is critical to serving these populations.”

Wirex CEO Matveev told Cointelegraph that more may be coming in the near future as technology evolves and collaborations with traditional financial institutions are expected to, along with regulatory developments, make cryptocurrency remittances “even more widely accepted and efficient.”

The costs associated with reentering the fiat currency system may nevertheless hinder the advantages of cryptocurrency remittances. Conversion costs, according to Ripple’s Berry, may not necessarily impact remitters as various companies who support crypto-enabled payments have protections to avoid exposing users to volatility. Blockchain-based transactions, on the other hand, don’t.

Berry noted that forex transactions are also susceptible to volatility, with smaller fiat currencies being more volatile. The cryptocurrency space is nevertheless well-known for its volatility, which could keep some remitters on the traditional financial system, deciding that the fees are less problematic than the volatility and the challenges associated with using cryptocurrency for payments.

On top of that, the uncertain regulatory environment surrounding cryptocurrencies in various jurisdictions only further complicates their adoption as remittance solutions.

Magazine: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

Cryptocurrency remittances are effectively revolutionizing the way individuals across the globe who can rely on them exchange value, offering unprecedented advantages over traditional systems, with the crypto realm standing as a beacon of development for those currently losing part of their money to the high fees of a decades-old system.

While challenges persist, especially in terms of user experience and widespread adoption, a future in which cryptocurrency remittances do even more to alleviate poverty likely awaits, adding a new use case to an asset class already helping millions preserve value.

Cryptocurrency education and awareness, however, still has a long way to go to help crypto remittances become a viable long-term solution, as specialized knowledge is necessary to safely use these assets regularly.

cryptocurrency bitcoin blockchain crypto currencies cryptoUncategorized

Rising insurance costs, ample inventory create a unique market in Southwest Florida

Despite a slower housing market, agents are optimistic about what the spring and summer will bring

Unlike many other metropolitan areas across the country, the housing market in Southwest Florida is comparably flush with for-sale inventory.

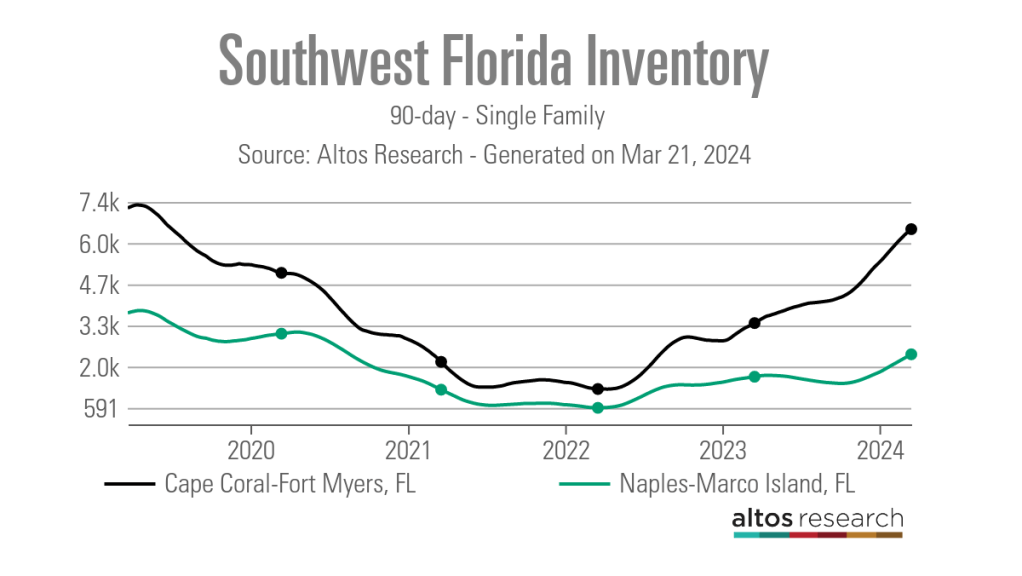

“I think one of the major trends we are seeing is that our overall inventory is up 60% year over year compared to 2023,” said PJ Smith, president of the Naples Area Board of Realtors and the broker-owner of Naples Golf to Gulf Real Estate. “We are seeing a healthy increase in inventory, which we really needed.”

According to data from Altos Research as of March 15, the 90-day average number of single-family active listings in the Naples-Marco Island metro area was 2,362, up from 1,605 one year earlier but down from the 3,760 listings recorded in late March 2019 prior to the COVID-19 pandemic.

In the nearby metro area of Cape Coral-Fort Myers, active single-family inventory over the previous 90 days averaged 6,500 listings as of March 15, above its March 2020 level of 5,044 listings and approaching its March 2019 level of 7,243 listings.

Smith attributes the uptick in inventory to a bump in new listings. The 90-day average number of new listings as of mid-March 2024 was 170 in Naples-Marco Island, and 432 in Cape Coral-Fort Myers). There is also some pent-up desire to sell being released by a steadier interest rate environment and an overall slower market.

“Last year we were still adjusting from the effects of the pandemic market, but now the trends seem to be getting back to our baseline, which is more like our 2019 market,” Smith said. “Days on market is also trending back to what is more normal for our market as well.”

Data from Altos Research shows that the 90-day average median number of days on market in the Naples-Marco Island metro area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022.

While some properties are sitting on the market longer, Smith noted that those in good condition, priced well and in a desirable location are still selling quickly.

“I just sold a property after two days on the market,” Smith said. “We are still seeing properties go pending quickly and some with multiple offers.”

Local real estate professionals attribute the slower market to a variety of factors including higher home prices, which have remained steady despite the slowdown, higher interest rates, and rising costs for homeowners and flood insurance.

“Florida, like many places, is seeing the insurance piece of the component impacting people’s payments in a way that is making it hard to them to navigate the market,” said Cyndee Haydon, a Seminole-based agent for Future Home Realty agent.

According to an analysis by S&P Global, between 2018 and 2023, homeowners insurance rates in Florida have jumped by 43.2%. From 2022 to 2023 alone, rates rose 15%. And data from the Insurance Information Institute shows that Floridian homeowners are paying an average of nearly $6,000 a year in insurance, which is nearly three times what they paid in 2019. In comparison, the average U.S. homeowners insurance policy was roughly $1,700 in 2023.

Compounding the rising insurance costs is the fact that many insurers and reinsurers have made the decision to leave the state. These companies have cited the recent uptick in the number and severity of hurricanes and other weather-related disasters impacting the Sunshine State.

“Florida is seeing notably more hurricanes, so continuous years of poor experience, meaning losses for the insurance carriers, they have no choice but to increase those premiums,” said Sean Kent, the senior vice president of insurance at FirstService Financial.

“Additionally, there are just a few carriers that are willing to participate and insure some of those units, so accessibility to coverage has been reduced significantly.”

These rising costs are understandably impacting the ability or willingness of some buyers to purchase specific properties.

“Insurance is an expense that is expected — but nothing as substantial as we are seeing today,” said Sheryl Houck, a Tampa-based eXp Realty agent. “We are seeing contracts fall through during the due-diligence period because of the sticker shock on insurance costs, so that is definitely a problem.”

Due to this, real estate professionals are bringing insurance partners into their transactions much earlier than before.

“It is definitely a significant concern and issue,” Smith said. “What we recommend is that before you put a property under contract, you consult and get a quote so that you know what your potential insurance costs will be.”

In addition to navigating rising insurance costs with buyers, agents said they have also had to field questions from past clients about the rising premiums, who often need help in finding ways to lower their costs.

“We have instances where clients reach out and ask why they are seeing a 62% jump in their insurance, but we have been able to help them, whether that’s raising their deductible or putting them in touch with some of our other insurance contacts,” Houck said.

Despite rising insurance costs that make homeownership in these markets more costly, local real estate professionals don’t feel that this is behind the recent uptick in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Houck said, ”but it is all relative because we are also seeing a lot of people moving in, because our market is more affordable than New York or California.”

Still, if premiums continue to rise, agents feel like this could become a bigger issue, especially for the area’s large population of retirees.

“When we look at people that are getting closer to retirement or have a fixed income, it becomes more and more of a concern,” Haydon said. “People are really being pinched with affordability.”

But while rising insurance costs are certainly a challenge for owners and buyers in Southwest Florida, Haydon said the slower housing market is good news for a lot of buyers.

“I have negotiated some of the most incredible deals for my buyers that are in the market right now that I have seen since the 2008 housing market crash,” Haydon said. “I had a buyer last month and the property was listed as $475,000, but with the necessary repairs, its value was $410,000 and we were able to negotiate an offer for $410,000.

“Normally, I would tell buyers that if they are 10% off the list price, they are dealing in different realities than the seller.”

Haydon said she has also recently had offers accepted with sale contingencies, closing cost coverages and a variety of other seller concessions.

Although things have slowed from the height of the frenzied post-pandemic market, local agents are optimistic about where the market is headed this spring and summer.

“It is very busy. Literally since Jan. 1, the spigot has turned on,” said Dyan Pithers, co-founder of The Pithers Group, a Tampa-based and Coldwell Banker Realty-brokered firm. “There are a lot of buyers in the market, and we are really focusing on showing value to sellers to get those listings out there so there are homes for buyers to purchase. It is going to be a really strong spring and summer.”

real estate housing market pandemic covid-19 interest ratesUncategorized

NBC says fans will have an enhanced viewing experience for the Summer Olympics

NBC says sports fans will have an enhanced viewing experience for the 2024 Summer Olympics.

It's March Madness season — which alongside the Super Bowl — is one of the biggest sporting events in the U.S. But we're also just a few months away from the biggest sporting event in the entire world as the 2024 Summer Olympics Games in Paris start on July 26.

Olympics viewership has seen a pretty substantial dip in recent iterations, especially during the recent Tokyo Olympics that were delayed from 2020 to 2021 and marred by the Covid-19 pandemic.

NBC is paying a whopping $7.65 billion to broadcast the Olympics until 2032 — and while the game still has viewership in the tens of millions, it's clear that the network needs to find a way to bring back its audience to justify its investment.

Related: How you can attend the 2024 Paris Olympics in person

Over the last few days, the network has announced a few changes that could enhance the viewing experience in an effort to bring in more fans or have them watch the games for longer.

On Wednesday, Mar. 20, NBCUniversal (CMCSA) announced that it would be taking the "RedZone" style of programming made popular with the NFL and bring it to the Olympics. NBCUniversal's Peacock streaming service will offer the "Gold Zone," bringing a format that will move around the different events of Olympics during the most important times of an event.

The show will be hosted by Scott Hanson, Andrew Siciliano, Matt Iseman, and Akbar Gbajabiamila. Hanson and Siciliano are mainstays in the NFL Network's coverage of the football league, with the latter hosting the "RedZone Channel" on DirecTV for nearly two decades.

"Gold Zone" will be available on Peacock from 7 a.m. to 5 p.m. ET from July 26 to Aug. 10. NBCUniversal began streaming some events exclusively on Peacock during the last Summer Olympics — and it has continued to push its streaming platform for other live sporting events like a 2024 Wild Card NFL playoff game — so this move further shows the company's commitment to the service.

Shutterstock

Moreover, NBC also announced that it is going to have the Olympics Opening Ceremony on Friday, July 26 available for viewership at IMAX locations around the country.

This is the first time that the event will be presented on IMAX screens and will be available at 150 IMAX locations, according to the press release.

These two moves further showcase that NBC is looking to throw anything at the wall to maximize and unlock the value of the Olympics broadcasting rights.

Related: Caitlin Clark may already make the WNBA a lot more money before even going pro

gold pandemic covid-19Uncategorized

The New York Fed DSGE Model Forecast—March 2024

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE)…

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since December 2023. As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE model Q & A.

The New York Fed model forecasts use data released through 2023:Q4, augmented for 2024:Q1 with the median forecasts for real GDP growth and core PCE inflation from the January release of the Philadelphia Fed Survey of Professional Forecasters (SPF), as well as the yields on ten-year Treasury securities and Baa corporate bonds based on 2024:Q1 averages up to February 27. Starting in 2021:Q4, the expected federal funds rate (FFR) between one and six quarters into the future is restricted to equal the corresponding median point forecast from the latest available Survey of Primary Dealers (SPD) in the corresponding quarter. For the current projection, this is the January SPD.

Once again, the model was surprised by the strength of the economy. The model attributes this forecast error in part to higher-than-expected productivity, and in part to stimulative financial conditions. This positive surprise leads to a sizable upward revision of the output growth projections for 2024 relative to the December forecast (1.9 versus 1.2 percent). Growth projections for the remainder of the forecast horizon are not very different from what they were in December (0.7, 0.5, and 1.0 percent in 2025, 2026, and 2027 versus 0.7, 0.9, and 1.5 percent in December, respectively). Inflation projections are slightly lower in 2024 than they were in December (2.0 versus 2.2 percent), mostly because 2023:Q4 inflation surprised the model on the downside (although we should note that the model did not take into account the January core PCE readings, as they were not yet incorporated in the February SPF nowcast). The expected path for inflation is otherwise essentially the same as in December (2.0, 2.1, and 2.2 percent in 2025, 2026, and 2027 versus 2.0, 2.0, and 2.1 percent in December, respectively).

The short-run real natural rate of interest is expected to remain at roughly the same elevated level as projected in December for 2024 (2.1 percent versus 2.2 percent in December), declining to 1.9 percent in 2025, 1.6 percent in 2026, and 1.4 percent in 2027. The expected path of the policy rate is essentially unchanged relative to December. The model continues to see policy as being restrictive through the end of 2024, with the real federal funds rate remaining above the short-term natural rate of interest.

Forecast Comparison

| Forecast Period | 2024 | 2025 | 2026 | 2027 | ||||

|---|---|---|---|---|---|---|---|---|

| Date of Forecast | Mar 24 | Dec 23 | Mar 24 | Dec 23 | Mar 24 | Dec 23 | Mar 24 | Dec 23 |

| GDP growth (Q4/Q4) | 1.9 (-2.2, 6.1) | 1.2 (-3.8, 6.2) | 0.7 (-4.3, 5.6) | 0.7 (-4.3, 5.7) | 0.5 (-4.7, 5.8) | 0.9 (-4.5, 6.3) | 1.0 (-4.6, 6.5) | 1.5 (-4.1, 7.1) |

| Core PCE inflation (Q4/Q4) | 2.0 (1.5, 2.6) | 2.2 (1.5, 2.9) | 2.0 (1.1, 2.8) | 2.0 (1.1, 2.9) | 2.1 (1.1, 3.0) | 2.0 (1.0, 3.0) | 2.2 (1.1, 3.3) | 2.1 (1.0, 3.1) |

| Real natural rate of interest (Q4) | 2.1 (0.8, 3.4) | 2.2 (0.8, 3.6) | 1.9 (0.4, 3.3) | 1.8 (0.3, 3.3) | 1.6 (0.0, 3.2) | 1.6 (0.0, 3.2) | 1.4 (-0.3, 3.1) | 1.4 (-0.3, 3.1) |

Notes: This table lists the forecasts of output growth, core PCE inflation, and the real natural rate of interest from the March 2024 and December 2023 forecasts. The numbers outside parentheses are the mean forecasts, and the numbers in parentheses are the 68 percent bands.

Forecasts of Output Growth

Source: Authors’ calculations.

Notes: These two panels depict output growth. In the top panel, the black line indicates actual data and the red line shows the model forecasts. The shaded areas mark the uncertainty associated with our forecasts at 50, 60, 70, 80, and 90 percent probability intervals. In the bottom panel, the blue line shows the current forecast (quarter-to-quarter, annualized), and the gray line shows the December 2023 forecast.

Forecasts of Inflation

Source: Authors’ calculations.

Notes: These two panels depict core personal consumption expenditures (PCE) inflation. In the top panel, the black line indicates actual data and the red line shows the model forecasts. The shaded areas mark the uncertainty associated with our forecasts at 50, 60, 70, 80, and 90 percent probability intervals. In the bottom panel, the blue line shows the current forecast (quarter-to-quarter, annualized), and the gray line shows the December 2023 forecast.

Real Natural Rate of Interest

Source: Authors’ calculations.

Notes: The black line shows the model’s mean estimate of the real natural rate of interest; the red line shows the model forecast of the real natural rate. The shaded area marks the uncertainty associated with the forecasts at 50, 60, 70, 80, and 90 percent probability intervals.

Marco Del Negro is an economic research advisor in Macroeconomic and Monetary Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Pranay Gundam is a research analyst in the Bank’s Research and Statistics Group.

Donggyu Lee is a research economist in Macroeconomic and Monetary Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ramya Nallamotu is a research analyst in the Bank’s Research and Statistics Group.

Brian Pacula is a research analyst in the Bank’s Research and Statistics Group.

How to cite this post:

Marco Del Negro, Pranay Gundam, Donggyu Lee, Ramya Nallamotu, and Brian Pacula, “The New York Fed DSGE Model Forecast—March 2024,” Federal Reserve Bank of New York Liberty Street Economics, March 22, 2024, https://libertystreeteconomics.newyorkfed.org/2024/03/the-new-york-fed-dsge-model-forecast-march-2024/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges