Crypto derivatives gained steam in 2020, but 2021 may see true growth

Crypto derivatives showed enormous growth in 2020 as nearly $2 billion worth of BTC options expired on Christmas day.

2020 was the most important year for the crypto derivatives market so far. Both Bitcoin (BTC) and Ether (ETH) derivat

Crypto derivatives showed enormous growth in 2020 as nearly $2 billion worth of BTC options expired on Christmas day.

2020 was the most important year for the crypto derivatives market so far. Both Bitcoin (BTC) and Ether (ETH) derivatives steadily grew throughout the year, with their futures and options products available across exchanges such as the Chicago Mercantile Exchange, OKEx, Deribit and Binance.

On Dec. 31, Bitcoin options open interest reached an all-time high of $6.8 billion, which is three times the OI seen 100 days before that, signifying the speed at which the crypto derivatives market is growing amid this bull run.

The bull run has led to a lot of new investors entering the market amid the uncertainty that plagues traditional financial markets due to the ongoing COVID-19 pandemic. These investors are looking to hedge their bets against the market through derivatives of underlying assets like Bitcoin and Ether.

Institutional investors are bringing the key change

While there are multiple factors driving the growth of crypto derivatives, it’s safe to say that it has primarily been driven by interest from institutional investors, considering that derivatives are complex products that are difficult for the average retail investor to understand.

In 2020, a variety of corporate entities such as MassMutual and MicroStrategy showed considerable interest by purchasing Bitcoin either for their reserves or as treasury investments. Luuk Strijers, chief commercial officer of crypto derivatives exchange Deribit, told Cointelegraph:

“As Blackrock’s Fink put it ‘cryptocurrency is here to stay’ and bitcoin ‘is a durable mechanism that could replace gold.’ Statements like these have been the driver for the recent performance, however as a platform we have seen new participants joining the entire year.”

Strijers confirmed that as a platform, Deribit sees institutional investors entering the crypto space using trade instruments they are familiar with, like spot and options, which led to the tremendous growth in open interest throughout 2020.

The Chicago Mercantile Exchange is also a prominent marketplace for trading options and futures, especially for institutional investors, as the CME is the world’s largest derivatives trading exchange across asset classes, making it a familiar marketplace for institutions. It recently even overtook OKEx as the largest Bitcoin futures market. A CME spokesperson told Cointelegraph: “November was the best month of Bitcoin futures average daily volume (ADV) in 2020, and the second-best month since launch.”

Another indicator of institutional investment is the growth in the number of large open interest holders, or LOIHs, of CME’s Bitcoin futures contracts. A LOIH is an investor that is holding at least 25 Bitcoin futures contracts, with each contract consisting of 5 BTC, making the LOIH threshold equivalent to 125 BTC — over $3.5 million. The CME spokesperson further elaborated:

“We averaged 103 large holders of open interest during the month of November, which is a 130% increase year over year, and reached a record 110 large open interest holders in December. The growth of large open interest holders can be viewed as indicative of institutional growth and participation.”

The fact that the crypto derivatives market is now in demand is a sign of maturity for assets like Bitcoin and Ether. Similar to their role in the traditional financial markets, derivatives offer investors a highly liquid, efficient way of hedging their positions and mitigating the risks associated with the volatility of crypto assets.

Other macroeconomic factors are also pushing demand

There are several macroeconomic factors that are also causing the boost in demand for the crypto derivatives market. As a result of the COVID-19 pandemic, several large economies including the United States, the United Kingdom and India have been stressed due to limited working conditions and growing unemployment.

This has caused several governments to roll out stimulus packages and engage in quantitative easing to reduce the impact on the base economy. Jay Hao, CEO of OKEx — a crypto and derivatives exchange — told Cointelegraph:

“With the pandemic this year and many governments’ responses to it with massive stimulus packages and QE, many more traditional investors are moving into Bitcoin as a potential inflation hedge. Cryptocurrency is finally becoming a legitimized asset class and this will only mean a greater rise in demand.”

There is a growing interest from the mining community and other companies generating income in Bitcoin looking to hedge their future earnings so as to be able to pay their operating expenses in fiat currencies.

Besides institutional demand, there is a significant increase seen in retail activity as well, Strijers confirmed: “The unique accounts active on a monthly basis in our options segment keep rising. Reasons are overall (social) media attention to the potential of options.” The CME spokesperson also stated:

“In terms of new account growth, in Q4 2020 to date, a total of 848 accounts have been added, the most we’ve seen in any quarter. In November alone, 458 accounts were added. In 2020-to-date, 8,560 CME Bitcoin futures contracts (equivalent to about 42,800 bitcoin) have traded on average each day.”

Ether derivatives grow due to DeFi and Eth2

Apart from Bitcoin futures and options, Ether derivatives have also grown tremendously in 2020. In fact, the CME even announced that it will be launching Ether futures in February 2021, which in itself is a sign of the maturity that Ether has reached in its life cycle.

Previously, the crypto derivatives market was monopolized by products using Bitcoin as the underlying asset, but in 2020, Ether derivatives grew to take a significant share of the pie. Strijers further elaborated:

“When looking at USD value of turnover we see that on Deribit the BTC derivatives contributed the majority of volume, however the percentage has decreased from ~91% in January to ~87% in November. During the peaks of the DeFi summer, the BTC percentage dropped to mid seventies due to the increased ETH activity and momentum.”

The reason that Bitcoin derivatives make up a larger portion of the crypto derivatives market is that BTC is now well understood by the market and has received validation by large institutions, governing bodies and several prominent traditional investors. However, in 2020, there were several factors that influenced the demand for Ether derivatives as well. Hao believes that “The huge growth in DeFi in 2020 and the launch of ETH 2.0’s Beacon chain has definitely spurned more interest in Ether and, therefore, Ether derivatives.”

However, even though Ether is continuing its bull run alongside Bitcoin and will likely see a further increase in demand for derivatives, it’s highly unlikely that BTC will be overtaken any time soon. Hao further elaborated: “We will see rising demand for both of these products, however, BTC as the number-one cryptocurrency will likely see the steepest growth as more institutional dollars flood the space.”

2021 set to be a crucial year

Starting with the launch of CME’s Ether futures product in February, this year is set to be an even bigger year for crypto derivatives if the bull run continues. The market also recently witnessed the biggest options expiry yet, with nearly $2.3 billion worth of BTC derivatives expiring on Christmas.

With traditional markets, the derivatives market is several times larger than the spot market, but it’s still the opposite with crypto markets. So, it seems the crypto derivatives market is still in its nascent stage and is set to grow exponentially as the industry expands in size. As volumes increase, markets tend to become more efficient and offer better price discovery for the underlying asset, as Strijers added:

“Due to the overall increase in market interest, [...] we see more market makers quoting our instruments, increasing our ability to launch more series and expiries, tightening spreads which acts as a fulcrum for further interest as execution becomes cheaper and more efficient.”

Apart from Bitcoin and Ether derivatives, there are altcoin derivatives products that are offered on various exchanges, most popularly perpetual swaps but also even options and futures. Hao elaborated further on these products and their demand prospects:

“Many other altcoins are already on offer to trade derivatives particularly in perpetual swap but also futures. [...] The demand for this is largely driven by retail traders as some of these assets haven’t won over the confidence of institutional traders yet.”

Even though institutional investors are not flocking to the derivatives products of these altcoins just yet, that is set to change with the further growth of decentralized finance markets and the use cases that they can offer. Ultimately, this can translate into a rise in demand for more crypto derivatives in the near future.

cryptocurrency bitcoin crypto btc pandemic covid-19Uncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

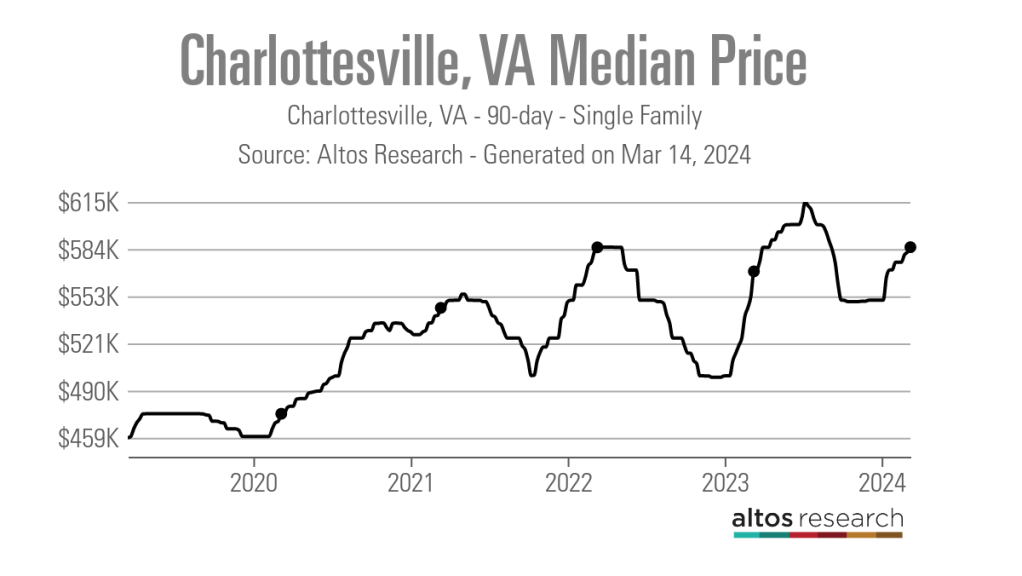

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest ratesInternational

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges