International

CIBT Education offers small-cap GROWTH and STABILITY

For investors used to one-way markets, 2022 has been a tough year.…

The post CIBT Education offers small-cap GROWTH and STABILITY appeared first on The…

For investors used to one-way markets, 2022 has been a tough year. It’s also been an invaluable learning experience.

The days of being a ‘lazy’ investor and just riding index stocks higher are over (at least for the foreseeable future). Instead, investors once again need to be astute stock-pickers in order to manage current tough market conditions.

A small-cap stock for stock-pickers

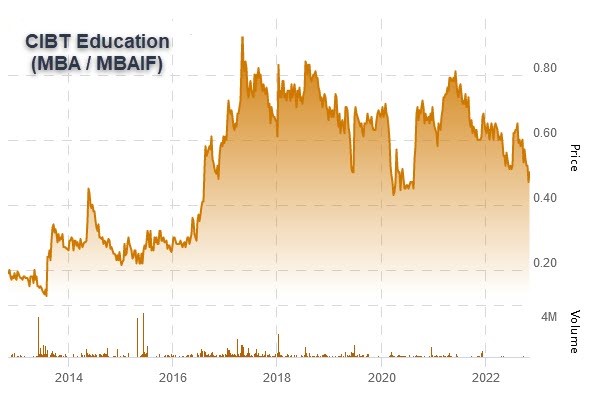

CIBT Education Group Inc. (TSX:MBA/OTC:MBAIF) is a stock for stock-pickers. Take a look.

At first glance, investors might think that the strong, steady growth pattern for this 10-year chart belongs to some Fortune 500 companies. But, no, this is the 10-year chart of a CAD$33 million small cap.

The stable, consistent growth that one would expect of a large-cap stock. But CIBT has the growth potential of a small cap.

In a year in which the charts of even many blue-chip stocks look terrible, CIBT Education has held up remarkably well.

The recent market meltdown has hit small caps especially hard. Most are down 70 – 80% YTD (if not more). CIBT’s 52-week trading range? Roughly 30%. Strong and stable.

Why? Why does the chart of this small cap, over both shorter and longer durations, look so good?

There is nothing magical about CIBT Education’s formula for market success: loads of experience, an extremely well-positioned business model, and consistently strong execution.

Student housing: the best fundamentals in real estate today

CIBT Education (as its name implies) is in education. However, CIBT is also a vertically-integrated student housing and property management company.

Education has been a consistent growth industry. Real estate has been a consistent growth industry.

With CIBT Education, 2 + 2 = 5. That’s the ‘math’ of vertical integration.

This Company is no stranger to The Market Herald audience. We previously featured CIBT in a full-length feature from September 2021.

Vancouver’s Red Hot Real Estate Market Increases Demands for CIBT’s Student Housing Business

A lot has changed in the 14 months since, in both stock markets and real estate markets. Both previously looked like can’t-miss propositions for investors.

Since then, equity markets have suffered a meltdown. And most real estate markets are under extreme pressure in this environment of rapidly rising interest (and mortgage) rates. But not student housing.

The Market Herald recently sat down for a chat with CIBT’s CEO, Toby Chu. We expected to hear a ‘tale of caution’: difficulties weathering Covid lockdowns and other restrictions, storm clouds on the real estate horizon. We got the opposite.

Covid had only a mild impact on both CIBT’s top-and-bottom-line results. And while other real estate markets are already sagging under the strain of higher interest rates, Chu was gushing about the continuing strong fundamentals of the student housing market.

The CEO explained how and why student housing is such a bellwether housing market.

“Most students’ education plans do not change permanently, and the plan could be delayed due to the pandemic and their education re-starts after the pandemic is over. Schools across the education sector are seeing strong enrollment growth in the 2022 – 2023 academic year. When students come to study in Vancouver, our rental properties become full because we provide our housing services to over 90 schools in Metro Vancouver.”

A counter-cyclical bellwether for investors

While student housing is a real estate niche, it has several important characteristics that make it entirely unique versus other real estate sub-sectors.

Lower sensitivity to interest ratesLower sensitivity to recessionary conditionsMinimal competition due to significant capital requirementsStrong demand and a large addressable marketWith all other segments of the real estate market, market strength is ultimately driven by real estate purchases – purchases financed with significant levels of debt. As interest rates shoot higher, this automatically puts the brakes on those markets.

Student housing, however, is a rental market. Changes in interest rates have no direct impact on demand. Most parents pay for their children’s education, including their housing needs.

Similarly, student housing is a relatively recession-proof market. Education, in general, is one of the last family expenditures to get reduced in recessionary conditions.

More importantly, roughly 75% of the student housing market (in Canada) is comprised of international students. These are generally all children of affluent families and are, therefore, even less likely to make cuts in their education budget.

Imagine operating in a large market where your biggest competitor is quite happy to see you increase your market share. That’s student housing.

The largest competitor of CIBT Education in the student housing market is government. Canada’s federal government, via the Canadian Mortgage and Housing Corporation (CMHC) is active in providing student housing.

However, this isn’t a for-profit enterprise seeking to grow. This is publicly-funded support for student housing.

The government’s objective is to minimize this spending and have as small a footprint as possible in the student housing market. The more success that CIBT Education has in providing privately funded-and-operated student housing, the fewer tax dollars the federal government needs to invest here.

Major barriers to entry, a huge addressable market

Despite the lack of for-profit competition in the off-campus student housing market, this is still a real estate market. This means that there are major barriers to entry for new competitors.

With prospective competitors of CIBT needing first to buy or develop their own student housing properties, substantial capital needs and rising interest rates increase these barriers to entry. And this is a big market.

CIBT Education is based in Canada and provides education services and student housing for the Canadian market. More specifically, CIBT is heavily focused on the Vancouver (British Columbia) student housing market.

In Vancouver alone, this is a $1.6 billion housing market.

Let’s put this into context.

CIBT Education is the largest off-campus housing provider in this $1.6 billion market via its subsidiary, Global Education City (GEC). The fundamentals for the B.C. student housing market are extremely robust.

Not surprisingly, CIBT is executing well in this robust market. In the Company’s most recently reported results (Q3 2022), CIBT reported YTD revenues of CAD$52.67 million, an 18% year-over-year increase during the pandemic periods. Adjusted EBITDA (YTD) rose to CAD$14.96 million, a 39% y-o-y increase.

Looking for more growth?

The graphic above shows a rising growth curve for CIBT in terms of its total bed count and the total square footage of property under its GEC brand. The Company’s best years are projected to be immediately ahead. Is this plausible?

Let’s crunch the numbers. CIBT is forecasting its total bed count to rise from 1260 in 2022 to 3732 by 2025, ~200% growth over the next 3 years.

As noted above, the University of British Columbia alone has a 5,000-student waiting list for student housing. Bed count numbers certainly look achievable.

But CIBT can’t simply conjure new rental units into existence. It needs additional properties (and student housing units) to fill this unmet demand. Here is where sharp investors will start to salivate.

A large-and-growing property management portfolio

CIBT’s $520 million property portfolio comprises 7 student housing properties currently in operation and 8 under development, adding another $900 million to its planned portfolio. More than half of CIBT’s total pipeline of student housing has yet to come online.

As these under-development projects are completed, they will account for the expected/projected growth in gross buildable square footage.

CEO Chu told The Market Herald that one of these development projects is due to be completed by year-end (GEC King Edward). Each new student housing facility that is added means a large incremental jump in revenues.

Translation: 2023 is looking like a much better year for revenue and earnings growth than 2022. How much potential revenue growth is ripening on the vine for CIBT? Let’s do some more crunching.

The average rent for a single-occupancy student housing unit: C$14,000 per year.

The waiting list for UBC: 5,000 students.

5,000 X CAD$14,000 = CAD$70 million.

CIBT Education can more than double its total revenues just by addressing the student housing waiting list of one educational institution, as an example.

B.C.’s other major university, Simon Fraser University, reports an official waiting list of ‘only’ 1,240 students (CAD$17.3 million per year in potential additional revenues). However, SFU is only serving 7.5% of SFU’s total student population, according to a recent Vancouver Sun newspaper report.

Besides the two largest universities in Vancouver, there are over 200 other public and private colleges and universities in Metro Vancouver. Most of these institutions do not provide housing.

CIBT Education Group didn’t just stumble into this lucrative and recession-proof housing market. CIBT’s roots are in education.

The Company has 28+ years of experience in providing education services in Canada. This includes Sprott Shaw College.

The company has its own pipeline of students requiring student housing. Via GEC, CIBT then offers a full spectrum of services to meet students’ housing needs.

Excellent demographics for Canadian (and B.C.) student housing

U.S.-based investors might wonder why CIBT is operating in the Canadian student housing market. Here, a number of important factors drive the strength of this student housing market.

As previously noted, the B.C. student housing market alone is a very robust market: $1.6 billion per year. Demand for student housing is heaviest among international students (75% of CIBT’s student housing population), and the number of international students in Canada rose by 150% from 2010 – 2020 alone.

The Canadian housing market, in general, has seen its vacancy rate shrink to an ultra-tight 0.8%. Students looking for accommodations outside of on-campus “student housing” units have very few options.

Canada has become the preferred destination for international students.

While CIBT generates its own pipeline of students for student housing, the overall “pipeline” of foreign students seeking student housing in Canada (and Vancouver) is poised to continue to grow.

CIBT offers a superb value proposition

The Company is operating primarily in a CAD$1.6 billion market, with substantial barriers to entry and mostly only passive competition. Its market cap is only CAD$32 million.

CIBT Education Group has CAD$520 million of assets on its balance sheet and completed financings of CAD$0.50 billion during the past few years. But its market cap is only CAD$32 million.

CIBT offers investors CAD$60.9 million in annual revenues currently, with CAD$5.177 million in net income and EBITDA of CAD$21.4 million. Yet the market cap is only CAD$32 million.

The Company is a steal at its current valuation. But while most companies/industries are starting to wilt under the burden of rising interest rates and increasingly recessionary conditions, CIBT is expecting its best growth years to be immediately ahead.

CIBT Education is a stable buy-and-hold investment that true “investors” can add to their portfolios.

CIBT Education is a high-growth, recession-proof small cap with a track record of strong performance and its best years still ahead.

The best of both worlds for investors.

When CEO Toby Chu was talking about his recent interactions with investors (in investor road shows and industry events), he remarked to The Market Herald how he was seeing an increasing interest from institutional investors.

Coming up in another full-length feature for The Market Herald, what the Smart Money sees when they look at CIBT – and why they like it.

CIBT.netCIBT corporate presentationFULL DISCLOSURE: This is a paid article by The Market Herald.

The post CIBT Education offers small-cap GROWTH and STABILITY appeared first on The Market Herald.

recession pandemic tsx stocks real estate housing market small-cap otc interest rates small caps stock markets canadaInternational

Acadia’s Nuplazid fails PhIII study due to higher-than-expected placebo effect

After years of trying to expand the market territory for Nuplazid, Acadia Pharmaceuticals might have hit a dead end, with a Phase III fail in schizophrenia…

After years of trying to expand the market territory for Nuplazid, Acadia Pharmaceuticals might have hit a dead end, with a Phase III fail in schizophrenia due to the placebo arm performing better than expected.

Steve Davis

Steve Davis“We will continue to analyze these data with our scientific advisors, but we do not intend to conduct any further clinical trials with pimavanserin,” CEO Steve Davis said in a Monday press release. Acadia’s stock $ACAD dropped by 17.41% before the market opened Tuesday.

Pimavanserin, a serotonin inverse agonist and also a 5-HT2A receptor antagonist, is already in the market with the brand name Nuplazid for Parkinson’s disease psychosis. Efforts to expand into other indications such as Alzheimer’s-related psychosis and major depression have been unsuccessful, and previous trials in schizophrenia have yielded mixed data at best. Its February presentation does not list other pimavanserin studies in progress.

The Phase III ADVANCE-2 trial investigated 34 mg pimavanserin versus placebo in 454 patients who have negative symptoms of schizophrenia. The study used the negative symptom assessment-16 (NSA-16) total score as a primary endpoint and followed participants up to week 26. Study participants have control of positive symptoms due to antipsychotic therapies.

The company said that the change from baseline in this measure for the treatment arm was similar between the Phase II ADVANCE-1 study and ADVANCE-2 at -11.6 and -11.8, respectively. However, the placebo was higher in ADVANCE-2 at -11.1, when this was -8.5 in ADVANCE-1. The p-value in ADVANCE-2 was 0.4825.

In July last year, another Phase III schizophrenia trial — by Sumitomo and Otsuka — also reported negative results due to what the company noted as Covid-19 induced placebo effect.

According to Mizuho Securities analysts, ADVANCE-2 data were disappointing considering the company applied what it learned from ADVANCE-1, such as recruiting patients outside the US to alleviate a high placebo effect. The Phase III recruited participants in Argentina and Europe.

Analysts at Cowen added that the placebo effect has been a “notorious headwind” in US-based trials, which appears to “now extend” to ex-US studies. But they also noted ADVANCE-1 reported a “modest effect” from the drug anyway.

Nonetheless, pimavanserin’s safety profile in the late-stage study “was consistent with previous clinical trials,” with the drug having an adverse event rate of 30.4% versus 40.3% with placebo, the company said. Back in 2018, even with the FDA approval for Parkinson’s psychosis, there was an intense spotlight on Nuplazid’s safety profile.

Acadia previously aimed to get Nuplazid approved for Alzheimer’s-related psychosis but had many hurdles. The drug faced an adcomm in June 2022 that voted 9-3 noting that the drug is unlikely to be effective in this setting, culminating in a CRL a few months later.

As for the company’s next R&D milestones, Mizuho analysts said it won’t be anytime soon: There is the Phase III study for ACP-101 in Prader-Willi syndrome with data expected late next year and a Phase II trial for ACP-204 in Alzheimer’s disease psychosis with results anticipated in 2026.

Acadia collected $549.2 million in full-year 2023 revenues for Nuplazid, with $143.9 million in the fourth quarter.

depression covid-19 treatment fda clinical trials europeInternational

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

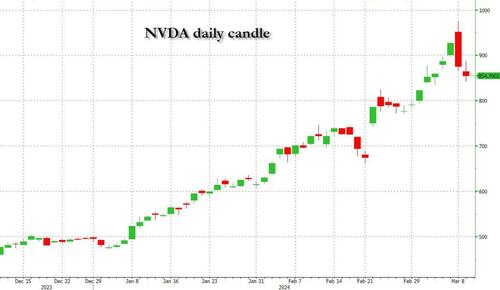

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges