Government

China Unexpectedly Cuts Reserve Ratio For Banks, Injecting $73BN To Stimulate Economy

China Unexpectedly Cuts Reserve Ratio For Banks, Injecting $73BN To Stimulate Economy

Early Friday, China’s central bank surprised by announcing…

Early Friday, China’s central bank surprised by announcing an unexpected cut to the amount that banks set aside for deposits by 25 basis points, vowing to keep ample liquidity in the interbank system and better fund the real economy.

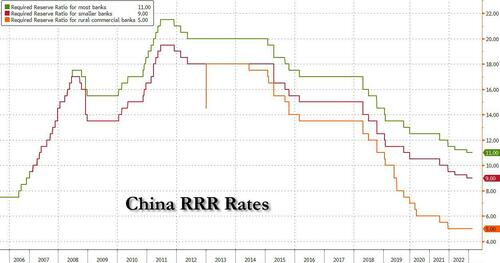

The People’s Bank of China reduced the reserve requirement ratio for almost all banks by 0.25 percentage points, effective from March 27, it said in a statement on Friday. The PBOC last cut the RRR in December, by the same magnitude. The cut, effective March 27, is expected to inject 500 billion yuan ($72.6 billion) worth of liquidity into the market, while the average reserve requirement ratio of Chinese financial institutions will be lowered to 7.6 per cent.

The RRR cut comes just days after China’s new government took office and the freshly inaugurated Premier Li Qiang pledged to achieve an annual economic growth target of around 5% this year.

“The PBOC will keep monetary policy targeted and powerful,” the central bank said in a statement adding that “We’ll provide better support for key areas and weak links, refrain from a big stimulus … and concentrate on pushing for high-quality development.”

Economists said the cut was aimed at ensuring liquidity in the banking system to sustain the rapid pace of lending seen in January and February, yet which led to modest economic results as discussed earlier this week.

China’s consumer spending and investment rebounded in the first two months of the year after pandemic restrictions were dropped in December, according to recent official data. But the recovery remains uncertain, with unemployment still elevated, property investment continuing to contract and falling exports dragging on industrial output.

“It seems that the central bank is not going to slow the pace of credit growth as people feared,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd.

The timing of the cut could be due to concerns that credit growth could slump in April, following the completion of financing for a number of government-led investment projects early this year, Xing added. The yuan pared an advance of as much as 0.6%, trading 0.1% stronger at 6.89 in the onshore market after the PBOC’s move.

Here are some snap reactions by economists and commentators, courtesy of Bloomberg:

Niu Chunbao, a fund manager at Shanghai Wanji Asset Management:

"The decision by the Chinese central bank to cut reserve requirement ratio signals that authorities are focused on supporting growth, not an indication of any problems in the economy. It could also be meant to give the market a boost after the poor performance in growth stocks this year. I don’t feel excited on the news as the main challenge this year is exports, and liquidity isn’t going to help much on that front”

Huang Yuhang, Fund manager at Lanqern Capital

“I don’t think this has much to do with fears about the banking stress, but rather the recovery seems to need a bit of help, judging by the economic figures this week. The key impediment to the recovery is demand still being weak, as confidence for incomes is still fragile, so liquidity hasn’t been the issue for the economic recovery, hence the market may or may not buy it”

Mingze Wu, a FX trader at StoneX Group in Singapore

“Given that global banks are now on defensive and liquidity is at premium, it make sense for PBOC to start getting ready before real problem arise. Likely Chinese banks have been affected by their bond portfolio losses just like the US bank albeit the impact will be lower but nonetheless still significant since you can’t escape US market”

Xiadong Bao, fund manager at Edmond de Rothschild Asset Management

“The Jan-Feb macro data indicates the recovery is well under way, while the early March high frequency data we’ve seen so far showed a certain weakness, which triggered recent market concerns on a weaker-than-expected recovery. This cut shows the strong commitment of PBOC to support the growth recovery in 2023, especially in the backdrop of a complicated exterior environment”

Mitul Kotecha, head of emerging-markets strategy at TD Securities

“The timing of the cut is a little surprising given the strength of recent data but it is consistent with recent comments by PBOC governor Yi Gang when he highlighted that cuts in the RRR would be an effective way to add liquidity. This is unlikely however, to translate into a cut in Loan Prime rates next week in our view but it does add further, albeit limited support to the economy. CNY trimmed gains on the news but overall we expect the currency to track USD gyrations, with some weakness on a trade weighted basis likely”

Fiona Lim, senior foreign exchange strategist at Malayan Banking Bhd. in Singapore

“A RRR cut at this point will not undermine the yuan much given that it is somewhat expected. USD has also been under pressure with a 25bps hike by the Fed already priced to a significant extent. USDCNH pairing is likely to remain within the 6.83-7.00 range barring fresh signs of bank stress in Europe”

Steven Leung, executive director, UOB Kay Hian

“The global banking crisis, even though it’s been stabilized after the major banks injected money into the banking system but still the situation isn’t yet over. So we really need some more liquidity in the global financial markets since China is in a different cycle - they’ve been loosening the policy. And secondly, if you look at the economic data released in February, it didn’t provide any surprise to the markets. So maybe Beijing recognizes the pace of the recovery is not as strong as they expected”

Shen Meng, director, Chanson & Co.

“China’s CPI is still low, which gives room for adjustment in monetary policy. The increase between M2 money supply and social financing is still notable. The 0.25 percentage cut can inject approximately 500 billion of long-term funds in order to support fiscal expenditure, which would fund state-owned enterprises’ investments. And with expectations of the Fed’s continued rate hikes, this move ensures stable market flows”

Sofia Horta E Cots, Bloomberg Analyst

Ah the classic late Friday RRR cut out of China. This is essentially a cash injection into the financial system — or dare we call it a bit of monetary stimulus. The RRR cut is one of the cheapest types of liquidity the People’s Bank of China can offer banks because it’s not a loan and carries no interest rate (unlike like the MLF or reverse repos instruments.) The PBOC, which also repeated a pledge to not flood the market with liquidity, is trying to keep borrowing costs low across the economy to aid the recovery from Covid Zero. It’s trying to do that without engaging in large-scale stimulus because of Beijing’s obsession with financial risks. Inflation, rapid rate hikes and bank failures are not on President Xi Jinping’s wishlist. Chinese banks are looking relatively resilient right now, as I wrote here. So is the PBOC also getting ahead of a potential spillover of financial-sector stress from the US and Europe? You never know with China’s monetary policy, but the timing is certainly interesting

The yuan pared an advance of as much as 0.6%, trading 0.1% stronger at 6.89 in the onshore market after the PBOC’s move. The move also helped push commodities higher.

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire