Uncategorized

Chapter 11, 7 bankruptcy filings claim more beer, brewery brands

It has been a dark time for beer bands and another well-liked brewery appears to be done for good.

It has been a dark period for beer drinkers. First, the Bud Light controversy made beer drinking — something most people associate with fun — political. That has been followed by a general downturn in beer drinking, especially among younger drinkers.

It's not that nobody drinks beer, but the alcoholic beverage has been fighting a number of trends. Hard seltzer and canned cocktails have seen their market share grow significantly.

Related: Iconic retail chain closing roughly half its stores

That has included major players, including Coca-Cola (KO) , entering the market offering a boozy version of its Topo Chico seltzer and partnering with Brown Forman (BFA) to bring Jack Daniels and Coke to market in ready-to-drink (RTD) cans. Shelves have gotten crowded with options that are not beer, which seems to appeal to younger drinkers.

In addition, beer companies have also suffered from a declining market. That's something the Beer Marketing Industry (BMI) shared in its annual report on the state of the industry.

"The report reveals that beer shipments have fallen by 5% in the first three quarters of 2023, and were on track to fall below 200 million barrels for the whole year. As a result, this would be the lowest level of beer consumption in the USA since 1999, and against a 23% population growth since the turn of the Millennium," The Drinks Business reported.

Image source: Shutterstock

Another brewery appears to be gone for good

The downturn in beer sales, along with debt caused by the covid pandemic, has caused a massive problem for the craft beer business. A number of local and regional breweries have shut their doors because they can't service the debt they had to take on when they were shut down for months during the pandemic.

Casualties have included huge names, including San Francisco's Anchor Brewing, a nationally known brewery. A number of other regional favorites of varying sizes, including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing, have also filed for bankruptcy.

It's a sort of beerpocalypse that does not appear to be slowing down as another regional favorite brewery, 7 Mile Brewery of Rio Grande, NJ has filed for Chapter 11 bankruptcy protection. The company, which closed in May, filed for bankruptcy in late -February.

The company did share a goodbye on its Facebook page after its last day of operations in May.

"Well that’s a wrap. Thank you to all that came out this weekend to support us. Thank you to all of you for sharing your memories and sending well wishes. We will miss you all. We would also like to thank all our amazing employees through the years. 7 Mile Brewery was all because of you," the company shared.

7 Mile finally files Chapter 11 bankruptcy

It remains unclear why 7 Mile Brewery waited this long to file as it did not appear to be working toward a plan to reopen. The company reported liabilities of $601,000 and assets of $135,000, which is mainly in brewing equipment.

Filing for Chapter 11 bankruptcy protection might allow the company's owners to work out a plan to keep that equipment. That could, in theory, allow them to open in another location or brew beer to sell to wholesalers.

A local radio station, 92.3 The Buzz shared what it believes to be the reason for the filing.

"The craft brewer closed down its operation in May 2023 but has gone to court seeking protection after landlord threats of on-site auctions to sell the property outright.

7 Mile and the other breweries named above are not the only beer brands and breweries that have gone bankrupt and, in many cases, closed their doors.

Deadwords and Persimmon Hollow, two Florida breweries also filed for Chapter 11 bankruptcy earlier this year. Both of those beer brands are trying to stay open.

Forgotten Boardwalk Brewing in New Jersey was not as lucky, having closed down in February. That was the same fate met by The Alementary Brewing Co., another New Jersey brewery which closed after a bankruptcy filing.

In addition, franchise retail chain Craft Beer Cellar filed for Chapter 7 bankruptcy to liquidate its assets, after suffering from financial distress and failing to sell its business.

bankruptcy pandemic

Uncategorized

The relentless growth of U.S. government debt

I was very lucky to attend the Harvard Business School Owner/ Presidents Management program over the three years to 2006. In my class of 100 mature–age…

I was very lucky to attend the Harvard Business School Owner/ Presidents Management program over the three years to 2006. In my class of 100 mature–age students, around half were from the U.S., and the remainder were from several other countries. I know it is a gross generalisation, but it would be fair to say the U.S. students excelled at any “marketing” related case studies but noticeably under-performed in any case studies related to “accounting”.

It is with that backdrop that I thought it worthwhile analysing the data released from the U.S. Treasury, post the release last week for the month of February, and the fiscal year to date being the five months to February 2024. In short, the data, on an annualised basis, is showing a budget deficit of U.S.$2.0 trillion (which exceeds 8 per cent of gross domestic product (GDP) of U.S.$24.6 trillion), whilst the interest expense component of that deficit is running at U.S.$840 billion, or 42 per cent of the annualised budget deficit.

The U.S. Government Debt is now expected to hit U.S.$35.5 trillion at the end of the fiscal year (30 September 2024), around 144 per cent of GDP, and the trouble is this indebtedness is forecast to grow at a much faster rate than GDP over the medium-term.

The graph above illustrates a 10.4-fold increase in U.S. public debt over 33 years to 2023, with an average annual growth rate exceeding 7 per cent. While various governments may blame COVID-19, the cost of defence, demographics, health, welfare, or net migration, neither U.S. political party has striven for a budget surplus over the past 25 years. The problem associated with the increasing level of government indebtedness means any budget deficit will be starting the new fiscal year at close to U.S.$1 trillion in the red (or around 4 per cent of GDP), assuming reasonably steady interest rates.

Dissipating confidence in the U.S. dollar may be one of the reasons gold and bitcoin are challenging their record highs. And at some stage, “the market” may demand a higher premium over the level of inflationary expectations when lending the U.S. government funds. If the confidence level in U.S. bonds eventually comes under pressure, so logically, there will be many asset valuations.

bonds covid-19 bitcoin goldUncategorized

Major healthcare facilities operator files Chapter 11 bankruptcy

50-year-old nursing home operator files Chapter 11 bankruptcy after defaulting on over $50 million in loans.

Operators of nursing homes and senior living facilities were severely impacted during the Covid-19 pandemic in 2020 as about 40% of residents had or likely had Covid-19 that year and over 1,300 nursing homes had infection rates of 75% or higher during surge periods, the U.S. Department of Health and Human Services Office of the Inspector General reported.

The high infection rates led to severe staffing challenges, including significant loss of staff and substantial difficulties in hiring, training and retraining new staff, according to a February 2024 report. Those staffing challenges, however, continue today, as rising inflation makes it more expensive to compensate these essential workers.

Related: Another discount retailer makes checkout change to fight theft

In addition to staffing challenges, operators have also faced a number of economic issues that have driven some of these companies to file for bankruptcy or, in some cases, shut down facilities. Rising inflation, which affects products, supplies and employee wages, and higher interest rates over the past couple years have severely impacted operators' budgets. On top of those economic issues, operators are battling inadequate Medicare, Medicaid and insurance reimbursements that can lead to capital shortfalls.

Senior care facility bankruptcies rise

Financial hardship has led dozens of operators of senior facilities to file for bankruptcy over the past three years, with 13 companies filing petitions in 2021, 12 debtors filing in 2022 and 15 more in 2023, according to Gibbins Advisors.

Notable Chapter 11 filings over the past year have included Evangelical Retirement Homes of Greater Chicago, which filed Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Illinois in June 2023 to sell its assets at auction. Also, Windsor Terrace Health, an operator of 32 nursing homes in California and three in Arizona, filed its petition in the U.S. Bankruptcy Court for the Central District of California in August 2023 listing $1 million to $10 million in assets and liabilities and unable to pay its debts.

More recently, Magnolia Senior Living, an operator of four facilities in Georgia, filed for Chapter 11 protection on March. 19 in the U.S. Bankruptcy Court for the Northern District of Georgia.

Shutterstock

Loan defaults, ransomware attack force Petersen into bankruptcy

Finally, Petersen Health Care, operator of about 100 nursing homes, assisted-living and long-term care facilities in Illinois, Iowa and Missouri, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware on March 20, suffering financial distress from increased overhead, low reimbursements and a ransomware attack in October 2023 that interrupted the company's efforts to bill patients and insurance companies.

The company's financial problems worsened as it defaulted in on payments on over $50 million in loans that led to 19 of the company's facilities to be placed into receivership.

Petersen asserted in a March 21 statement that it will continue to operate its business as normal, as it is seeking court approval of a $45 million debtor-in-possession financing commitment from lenders to fund post-petition operating expenses and working capital.

“Petersen will operate as usual, and our team remains committed to continuing to provide first-rate care for our residents,” CEO David Campbell said in a statement. “We will emerge from restructuring as a stronger company with a more flexible capital structure. This will enable us to continue as a first-choice care provider and a reliable employer for our staff.”

The Peoria, Ill.,-based company, which was founded in 1974, operates skilled-nursing facilities, assisted/independent living communities, memory care services and homes for the developmentally disabled.

bankruptcy bankruptcies pandemic covid-19 interest ratesUncategorized

Rising insurance costs, ample inventory create a unique market in Southwest Florida

Despite a slower housing market, agents are optimistic about what the spring and summer will bring

Unlike many other metropolitan areas across the country, the housing market in Southwest Florida is comparably flush with for-sale inventory.

“I think one of the major trends we are seeing is that our overall inventory is up 60% year over year compared to 2023,” said PJ Smith, president of the Naples Area Board of Realtors and the broker-owner of Naples Golf to Gulf Real Estate. “We are seeing a healthy increase in inventory, which we really needed.”

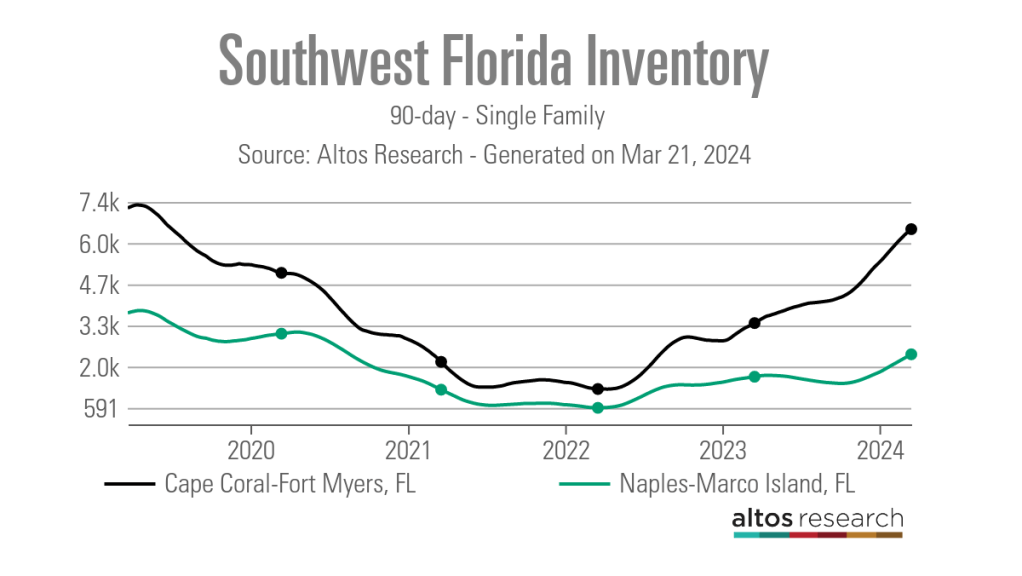

According to data from Altos Research as of March 15, the 90-day average number of single-family active listings in the Naples-Marco Island metro area was 2,362, up from 1,605 one year earlier but down from the 3,760 listings recorded in late March 2019 prior to the COVID-19 pandemic.

In the nearby metro area of Cape Coral-Fort Myers, active single-family inventory over the previous 90 days averaged 6,500 listings as of March 15, above its March 2020 level of 5,044 listings and approaching its March 2019 level of 7,243 listings.

Smith attributes the uptick in inventory to a bump in new listings. The 90-day average number of new listings as of mid-March 2024 was 170 in Naples-Marco Island, and 432 in Cape Coral-Fort Myers). There is also some pent-up desire to sell being released by a steadier interest rate environment and an overall slower market.

“Last year we were still adjusting from the effects of the pandemic market, but now the trends seem to be getting back to our baseline, which is more like our 2019 market,” Smith said. “Days on market is also trending back to what is more normal for our market as well.”

Data from Altos Research shows that the 90-day average median number of days on market in the Naples-Marco Island metro area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022.

While some properties are sitting on the market longer, Smith noted that those in good condition, priced well and in a desirable location are still selling quickly.

“I just sold a property after two days on the market,” Smith said. “We are still seeing properties go pending quickly and some with multiple offers.”

Local real estate professionals attribute the slower market to a variety of factors including higher home prices, which have remained steady despite the slowdown, higher interest rates, and rising costs for homeowners and flood insurance.

“Florida, like many places, is seeing the insurance piece of the component impacting people’s payments in a way that is making it hard to them to navigate the market,” said Cyndee Haydon, a Seminole-based agent for Future Home Realty agent.

According to an analysis by S&P Global, between 2018 and 2023, homeowners insurance rates in Florida have jumped by 43.2%. From 2022 to 2023 alone, rates rose 15%. And data from the Insurance Information Institute shows that Floridian homeowners are paying an average of nearly $6,000 a year in insurance, which is nearly three times what they paid in 2019. In comparison, the average U.S. homeowners insurance policy was roughly $1,700 in 2023.

Compounding the rising insurance costs is the fact that many insurers and reinsurers have made the decision to leave the state. These companies have cited the recent uptick in the number and severity of hurricanes and other weather-related disasters impacting the Sunshine State.

“Florida is seeing notably more hurricanes, so continuous years of poor experience, meaning losses for the insurance carriers, they have no choice but to increase those premiums,” said Sean Kent, the senior vice president of insurance at FirstService Financial.

“Additionally, there are just a few carriers that are willing to participate and insure some of those units, so accessibility to coverage has been reduced significantly.”

These rising costs are understandably impacting the ability or willingness of some buyers to purchase specific properties.

“Insurance is an expense that is expected — but nothing as substantial as we are seeing today,” said Sheryl Houck, a Tampa-based eXp Realty agent. “We are seeing contracts fall through during the due-diligence period because of the sticker shock on insurance costs, so that is definitely a problem.”

Due to this, real estate professionals are bringing insurance partners into their transactions much earlier than before.

“It is definitely a significant concern and issue,” Smith said. “What we recommend is that before you put a property under contract, you consult and get a quote so that you know what your potential insurance costs will be.”

In addition to navigating rising insurance costs with buyers, agents said they have also had to field questions from past clients about the rising premiums, who often need help in finding ways to lower their costs.

“We have instances where clients reach out and ask why they are seeing a 62% jump in their insurance, but we have been able to help them, whether that’s raising their deductible or putting them in touch with some of our other insurance contacts,” Houck said.

Despite rising insurance costs that make homeownership in these markets more costly, local real estate professionals don’t feel that this is behind the recent uptick in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Houck said, ”but it is all relative because we are also seeing a lot of people moving in, because our market is more affordable than New York or California.”

Still, if premiums continue to rise, agents feel like this could become a bigger issue, especially for the area’s large population of retirees.

“When we look at people that are getting closer to retirement or have a fixed income, it becomes more and more of a concern,” Haydon said. “People are really being pinched with affordability.”

But while rising insurance costs are certainly a challenge for owners and buyers in Southwest Florida, Haydon said the slower housing market is good news for a lot of buyers.

“I have negotiated some of the most incredible deals for my buyers that are in the market right now that I have seen since the 2008 housing market crash,” Haydon said. “I had a buyer last month and the property was listed as $475,000, but with the necessary repairs, its value was $410,000 and we were able to negotiate an offer for $410,000.

“Normally, I would tell buyers that if they are 10% off the list price, they are dealing in different realities than the seller.”

Haydon said she has also recently had offers accepted with sale contingencies, closing cost coverages and a variety of other seller concessions.

Although things have slowed from the height of the frenzied post-pandemic market, local agents are optimistic about where the market is headed this spring and summer.

“It is very busy. Literally since Jan. 1, the spigot has turned on,” said Dyan Pithers, co-founder of The Pithers Group, a Tampa-based and Coldwell Banker Realty-brokered firm. “There are a lot of buyers in the market, and we are really focusing on showing value to sellers to get those listings out there so there are homes for buyers to purchase. It is going to be a really strong spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers