Government

Bidenomics: why it’s more likely to win the 2024 election than many people think

Recent opinion polls show American are very gloomy on both the economy and Biden.

Joe Biden has come out fighting against perceptions that he is handling the US economy badly. During an address in Maryland, the president contrasted Bidenomics with Trumpian “MAGAnomics” that would involve tax-cutting and spending reductions. He decried trickle-down policies that had, “shipped jobs overseas, hollowed out communities and produced soaring deficits”.

Changing voters’ minds about the economy is one of Biden’s biggest challenges ahead of the 2024 election. Recent polling data suggested 63% of Americans are negative on the US economy, while 45% said their financial situation had deteriorated in the last two years.

Voters are also downbeat about Biden. In a recent CNN poll, almost 75% of respondents were “seriously” concerned about his mental and physical competence. Even 60% of Democratic and Democratic-leaning respondents were “seriously” concerned he would lose in 2024.

This appears a great opportunity for Donald Trump. He’s the clear favourite amongst Republican voters for their nomination, assuming recent indictments don’t thwart his ambitions.

Trump won in 2016 by capitalising on Americans’ economic discontent. Globalisation is estimated to have seen 5.5 million well paid, unionised US manufacturing jobs lost between 2000 and 2017. The “small-government” approach since the days of Ronald Reagan also exacerbated inequality, with only the top 20% of earners seeing their GDP share rise from 1980-2016.

Trump duly promised to retreat from globalisation and prioritise domestic growth and job creation. “Make America Great Again” resonated with many voters, especially in swing manufacturing states such as Pennsylvania, Michigan and Wisconsin. Winning these “rust-belt” states was crucial to Trump’s success.

These will again be key battlegrounds in 2024, but the economic situation is somewhat different now. There may be more cause for Democrat optimism than the latest polls suggest.

What is Bidenomics?

When Biden won in 2020, he too recognised that the neoliberal version of US capitalism was failing ordinary Americans. His answer, repeated in his Maryland speech, is to grow the economy “from the middle out and the bottom up”. To this end, Bidenomics is centred on three key pillars: smarter public investment, growing the middle class and promoting competition.

On investment, Biden’s approach fundamentally challenges the argument by the right that increasing public investment “crowds out” more efficient private investment. Bidenomics argues that targeted public investment will unlock private investment, delivering well paid jobs and growth.

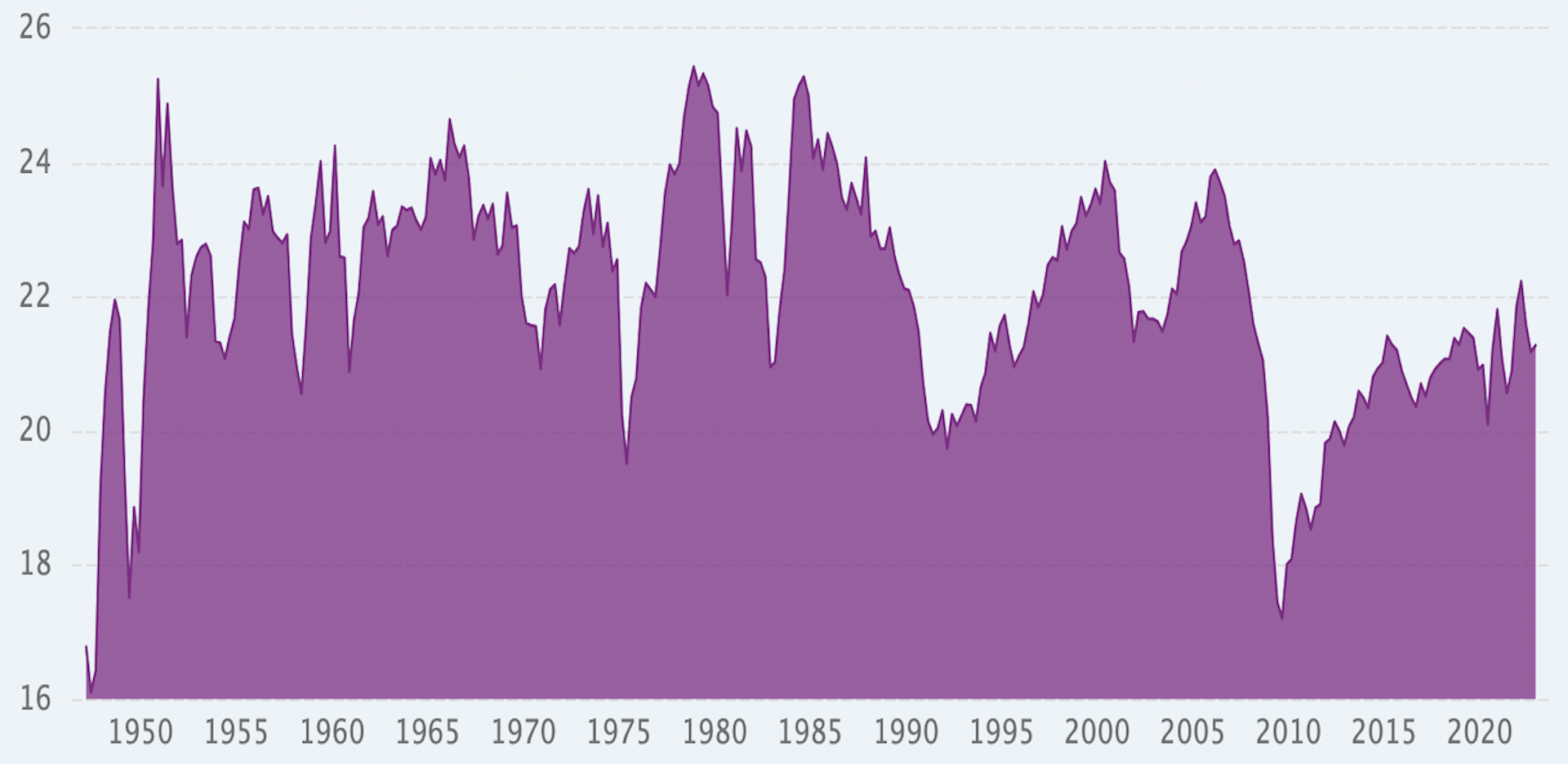

The 2022 Inflation Reduction Act (IRA) has helped raise US capital expenditure nearer its long-term trend, although there’s a way to go. But what is really distinctive is the green-economy focus.

US public investment as a % of GDP

Almost 80% of the US$485 billion (£390 billion) in IRA spending is on energy security and climate change investment, through tax credits, subsidies and incentives. Much of the investments announced into manufacturing electric cars, batteries and solar panels, and mining vital ingredients like cobalt and lithium, are in the rust belt.

Meanwhile, Biden’s 2022 Chips Act is a US$280 billion investment to bolster US independence in semiconductors. With both acts backing domestic investment, the strategy concedes Trump’s point that globalisation failed blue-collar America. This is underpinned by other protectionist measures such as Biden’s “buy American” policy.

A whole series of measures aim to boost the middle classes. These include increasing workers’ ability to collectively bargain, and widening the maximum earning threshold for workers entitled to overtime pay from US$35,000 to US$55,000 – taking in 3.6 million more workers. As for promoting competition, measures include banning employers from using non-compete clauses in employment contacts.

The results so far

It’s too early to judge these policies, but the US economy has been relatively impressive under Biden. Over 13 million new jobs have been created, though much of this can be perhaps attributed to workers resuming employment after COVID. Unemployment is below 4%, a 50-year low, though similar to what Trump achieved pre-COVID.

Total US jobs

The IMF predicts the US economy will grow 1.8% in 2023, the strongest among the G7. The US also has the group’s lowest inflation rate, although it rose in August. On the closely watched core-inflation metric, which excludes food and energy, the US is mid-table, though improving.

The federal deficit, the annual difference between income and outgoings, is heading in the wrong direction. It deteriorated under Trump, ballooned during COVID then partially bounced back, but is forecast to widen in 2023 to 5.9% of GDP or circa US$2 trillion.

Ratings agency Fitch recently downgraded the US credit rating from AAA to AA+. Fitch says the US public finances will worsen over the next three years because GDP will deteriorate and spending rise, and that the endless political battles over the US debt ceiling have eroded confidence.

Nonetheless, the other major ratings agencies have not made similar downgrades, and the widening deficit is mostly not because of Bidenomics. Tax receipts are substantially down because the markets have been less favourable to investors, while surging interest rates have increased US debt interest payments.

Overall, the economics signs are arguably moving in the right direction. An article co-written by business professor Jeffrey Sonnefeld from Yale University in the US, advisor to Democrat and Republican administrations, compares Bidenomics to President Franklin D. Roosevelt’s New Deal. It argues:

The US economy is now pulling off what all the experts said was impossible: strong growth and record employment amidst plummeting inflation … the fruits of economic prosperity are inclusive and broad-based, amidst a renaissance in American manufacturing, investment and productivity.

The Democrats know they must make this case to win in 2024. To compound Biden’s Maryland speech, there are plans for an advertising blitz in key states. Of course, the party may yet back another candidate, if they are thought more likely to win – currently Biden and Trump are neck and neck.

One consolation to the Democrats is that voters’ gloom is partly related to interest rates, which are probably close to peaking. Anyway, recent polling suggesting voters view the economy as the paramount issue is arguably good news: it means that Republican efforts to shift the narrative towards the culture wars are less likely to win an election.

Conor O'Kane does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

unemployment subsidies federal reserve trump gdp interest rates unemploymentGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges