Uncategorized

Automotive 3PL market 2023-2027: A descriptive analysis of five forces model, market dynamics, and segmentation – Technavio

Automotive 3PL market 2023-2027: A descriptive analysis of five forces model, market dynamics, and segmentation – Technavio

PR Newswire

NEW YORK, Jan. 17, 2023

NEW YORK, Jan. 17, 2023 /PRNewswire/ — According to Technavio, the global automotive 3p…

Automotive 3PL market 2023-2027: A descriptive analysis of five forces model, market dynamics, and segmentation - Technavio

PR Newswire

NEW YORK, Jan. 17, 2023

NEW YORK, Jan. 17, 2023 /PRNewswire/ -- According to Technavio, the global automotive 3pl market size is estimated to grow by USD 93.48 billion from 2022 to 2027. The market is expected to grow at a CAGR of 6.6% during the forecast period. Moreover, the growth momentum will accelerate. North America will account for 31% of the market's growth during the forecast period.

For more insights on market size, request a sample report

Global automotive 3PL market - Five forces

The global automotive 3PL market is fragmented, and the five forces analysis covers–

- Bargaining power of buyers

- The threat of new entrants

- Threat of rivalry

- Bargaining power of suppliers

- Threat of substitutes

- Interpretation of porter's five models helps to strategize the business, for entire details – buy the report!

Global automotive 3PL market – Customer landscape

The report includes the market's adoption lifecycle, from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global automotive 3PL market - Segmentation assessment

Segment overview

Technavio has segmented the market based on type (finished vehicle and auto components) and service (transportation, warehousing, distribution, inventory management, and others).

- The finished vehicle segment will grow at a significant rate during the forecast period. Finished vehicle logistics include a series of stages and processes through which cars are safely delivered to end users. This process includes transporting or delivering vehicles from the manufacturer to domestic or international customers. As the global economy is becoming more complex, automotive manufacturers are looking for ways to streamline their supply chains, which has increased the demand for external logistics service providers such as 3PL. In addition, logistics service providers are integrating disruptive technologies such as big data, the Internet of Things (IoT), and connected ships to improve their supply chain management systems. Such factors are expected to fuel the growth of the automotive third-party logistics market during the forecast period.

Geography overview

Based on geography, the global automotive 3pl market is segmented into North America, Europe, APAC, Middle East and Africa, and South America. The report provides actionable insights and estimates the contribution of all regions to the growth of the global automotive 3PL market.

- North America is estimated to account for 31% of the growth of the global market during the forecast period. The demand for logistics is high in the region, especially in countries such as the US, owing to the expansion of regional distribution models. This, in turn, will result in an increase in the demand for warehouses in the region. The US is the second-largest automobile market globally, which plays a key role in imports and exports. It is the third-largest car manufacturer in the world and also the second-largest car importer in the world after the EU. These factors will drive the growth of the market in the region during the forecast period.

Global automotive 3PL market – Market dynamics

Key factor driving market growth

- The increasing auto part manufacturing is driving the market growth.

- The automotive industry is expected to grow at a significant rate owing to improved living standards and increasing purchasing power across the world.

- Moreover, changes in lifestyles have increased car sales in emerging economies.

- Auto parts manufacturing plants require new solutions to ensure constant efficiency and meet consumer demand globally. Collaboration with 3PL providers supports the global expansion of the automotive industry.

- In addition, the aftermarket demand for auto spare parts for vehicles is expected to drive the growth of the market during the forecast period.

Leading trends influencing the market

- Cost reduction in the automotive industry through 3PL is a key trend in the market.

- Manufacturers are building more factories closer to buyers.

- They are collaborating with specialized automotive 3PL providers to find effective solutions and penetrate new markets.

- 3PL providers have an extensive transport network, which includes roadways, railways, and freight cargo, which resulted in better reach and access to transport infrastructure.

- They work with multiple manufacturers to save costs and deliver products from different suppliers.

- Thus, the global automotive third-party logistics market is expected to grow during the forecast period.

Major challenges hindering market growth

- High operation costs are challenging the market growth.

- Fuel prices are one of the main variables influencing transportation expenses.

- As a result of rising fuel prices, transportation expenses are expected to rise.

- Factors such as the high cost of specialized equipment for carrying automobiles, tight regulatory standards governing transportation, and a lack of infrastructure would also restrain the growth of the global automotive 3PL market.

- These factors are expected to restrict market expansion during the forecast period.

What are the key data covered in this automotive 3PL market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the automotive 3PL market between 2023 and 2027

- Precise estimation of the size of the automotive 3PL market and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the automotive 3PL market across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of automotive 3PL market vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Related Reports:

The automotive e-compressor market size is expected to increase by USD 7.45 billion from 2021 to 2026. This report extensively covers market segmentation by application (passenger cars and commercial vehicles) and geography (APAC, North America, Europe, South America, and Middle East and Africa).

The automotive timing belt market size is expected to increase by USD 37.62 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 3.4%. This report extensively covers market segmentation by end-user (OEMs and automotive aftermarket), vehicle type (passenger vehicles and commercial vehicles), and geography (APAC, Europe, North America, South America, and Middle East and Africa).

Automotive 3PL Market Scope | |

Report Coverage | Details |

Page number | 166 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 6.6% |

Market growth 2023-2027 | USD 93.48 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 5.33 |

Regional analysis | North America, Europe, APAC, Middle East and Africa, and South America |

Performing market contribution | North America at 31% |

Key countries | US, China, India, Germany, and UK |

Competitive landscape | Leading vendors, market positioning of vendors, competitive strategies, and industry risks |

Key companies profiled | Agility Public Warehousing Co. K.S.C.P, CMA CGM SA, Deutsche Bahn AG, Deutsche Post AG, DP World, DSV AS, Expeditors International of Washington Inc., FedEx Corp., Flexport Inc., Hellmann Worldwide Logistics SE and Co KG, Kerry Logistics Network Ltd., Kuehne Nagel Management AG, Landstar System Inc., Nippon Express Holdings Inc., PSA International Pte Ltd., ROMEU MULTISERVICES GROUP SL, Rudolph Logistik Gruppe SE and Co. KG, Ryder System Inc, Schneider National Inc., and United Parcel Service Inc. |

Market dynamics | Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Browse for Technavio's consumer discretionary market reports

Table of contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Service

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global automotive 3PL market 2017 - 20221

- Exhibit 18: Historic Market Size – Data Table on Global automotive 3PL market 2017 - 20221 ($ billion)

- 4.2 Type Segment Analysis 2017 - 20221

- Exhibit 19: Historic Market Size – Type Segment 2017 - 20221 ($ billion)

- 4.3 Service Segment Analysis 2017 - 20221

- Exhibit 20: Historic Market Size – Service Segment 2017 - 20221 ($ billion)

- 4.4 Geography Segment Analysis 2017 - 20221

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 20221 ($ billion)

- 4.5 Country Segment Analysis 2017 - 20221

- Exhibit 22: Historic Market Size – Country Segment 2017 - 20221 ($ billion)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Type

- 6.1 Market segments

- Exhibit 30: Chart on Type - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Type - Market share 2022-2027 (%)

- 6.2 Comparison by Type

- Exhibit 32: Chart on Comparison by Type

- Exhibit 33: Data Table on Comparison by Type

- 6.3 Finished vehicle - Market size and forecast 2022-2027

- Exhibit 34: Chart on Finished vehicle - Market size and forecast 2022-2027 ($ billion)

- Exhibit 35: Data Table on Finished vehicle - Market size and forecast 2022-2027 ($ billion)

- Exhibit 36: Chart on Finished vehicle - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Finished vehicle - Year-over-year growth 2022-2027 (%)

- 6.4 Auto components - Market size and forecast 2022-2027

- Exhibit 38: Chart on Auto components - Market size and forecast 2022-2027 ($ billion)

- Exhibit 39: Data Table on Auto components - Market size and forecast 2022-2027 ($ billion)

- Exhibit 40: Chart on Auto components - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Auto components - Year-over-year growth 2022-2027 (%)

- 6.5 Market opportunity by Type

- Exhibit 42: Market opportunity by Type ($ billion)

7 Market Segmentation by Service

- 7.1 Market segments

- Exhibit 43: Chart on Service - Market share 2022-2027 (%)

- Exhibit 44: Data Table on Service - Market share 2022-2027 (%)

- 7.2 Comparison by Service

- Exhibit 45: Chart on Comparison by Service

- Exhibit 46: Data Table on Comparison by Service

- 7.3 Transportation - Market size and forecast 2022-2027

- Exhibit 47: Chart on Transportation - Market size and forecast 2022-2027 ($ billion)

- Exhibit 48: Data Table on Transportation - Market size and forecast 2022-2027 ($ billion)

- Exhibit 49: Chart on Transportation - Year-over-year growth 2022-2027 (%)

- Exhibit 50: Data Table on Transportation - Year-over-year growth 2022-2027 (%)

- 7.4 Warehousing - Market size and forecast 2022-2027

- Exhibit 51: Chart on Warehousing - Market size and forecast 2022-2027 ($ billion)

- Exhibit 52: Data Table on Warehousing - Market size and forecast 2022-2027 ($ billion)

- Exhibit 53: Chart on Warehousing - Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on Warehousing - Year-over-year growth 2022-2027 (%)

- 7.5 Distribution - Market size and forecast 2022-2027

- Exhibit 55: Chart on Distribution - Market size and forecast 2022-2027 ($ billion)

- Exhibit 56: Data Table on Distribution - Market size and forecast 2022-2027 ($ billion)

- Exhibit 57: Chart on Distribution - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on Distribution - Year-over-year growth 2022-2027 (%)

- 7.6 Inventory management - Market size and forecast 2022-2027

- Exhibit 59: Chart on Inventory management - Market size and forecast 2022-2027 ($ billion)

- Exhibit 60: Data Table on Inventory management - Market size and forecast 2022-2027 ($ billion)

- Exhibit 61: Chart on Inventory management - Year-over-year growth 2022-2027 (%)

- Exhibit 62: Data Table on Inventory management - Year-over-year growth 2022-2027 (%)

- 7.7 Others - Market size and forecast 2022-2027

- Exhibit 63: Chart on Others - Market size and forecast 2022-2027 ($ billion)

- Exhibit 64: Data Table on Others - Market size and forecast 2022-2027 ($ billion)

- Exhibit 65: Chart on Others - Year-over-year growth 2022-2027 (%)

- Exhibit 66: Data Table on Others - Year-over-year growth 2022-2027 (%)

- 7.8 Market opportunity by Service

- Exhibit 67: Market opportunity by Service ($ billion)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 68: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 69: Chart on Market share by geography 2022-2027 (%)

- Exhibit 70: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 71: Chart on Geographic comparison

- Exhibit 72: Data Table on Geographic comparison

- 9.3 North America - Market size and forecast 2022-2027

- Exhibit 73: Chart on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 74: Data Table on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 75: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 77: Chart on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 78: Data Table on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 79: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 APAC - Market size and forecast 2022-2027

- Exhibit 81: Chart on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 82: Data Table on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 83: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.6 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 85: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 86: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 87: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.7 South America - Market size and forecast 2022-2027

- Exhibit 89: Chart on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 90: Data Table on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 91: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.8 US - Market size and forecast 2022-2027

- Exhibit 93: Chart on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 94: Data Table on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 95: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.9 China - Market size and forecast 2022-2027

- Exhibit 97: Chart on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 98: Data Table on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 99: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.10 Germany - Market size and forecast 2022-2027

- Exhibit 101: Chart on Germany - Market size and forecast 2022-2027 ($ billion)

- Exhibit 102: Data Table on Germany - Market size and forecast 2022-2027 ($ billion)

- Exhibit 103: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.11 UK - Market size and forecast 2022-2027

- Exhibit 105: Chart on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 106: Data Table on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 107: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 108: Data Table on UK - Year-over-year growth 2022-2027 (%)

- 9.12 India - Market size and forecast 2022-2027

- Exhibit 109: Chart on India - Market size and forecast 2022-2027 ($ billion)

- Exhibit 110: Data Table on India - Market size and forecast 2022-2027 ($ billion)

- Exhibit 111: Chart on India - Year-over-year growth 2022-2027 (%)

- Exhibit 112: Data Table on India - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 113: Market opportunity by geography ($ billion)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 114: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 115: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 116: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 117: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 118: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 119: Matrix on vendor position and classification

- 12.3 Agility Public Warehousing Co. K.S.C.P

- Exhibit 120: Agility Public Warehousing Co. K.S.C.P - Overview

- Exhibit 121: Agility Public Warehousing Co. K.S.C.P - Business segments

- Exhibit 122: Agility Public Warehousing Co. K.S.C.P - Key news

- Exhibit 123: Agility Public Warehousing Co. K.S.C.P - Key offerings

- Exhibit 124: Agility Public Warehousing Co. K.S.C.P - Segment focus

- 12.4 CMA CGM SA

- Exhibit 125: CMA CGM SA - Overview

- Exhibit 126: CMA CGM SA - Business segments

- Exhibit 127: CMA CGM SA - Key news

- Exhibit 128: CMA CGM SA - Key offerings

- Exhibit 129: CMA CGM SA - Segment focus

- 12.5 Deutsche Bahn AG

- Exhibit 130: Deutsche Bahn AG - Overview

- Exhibit 131: Deutsche Bahn AG - Business segments

- Exhibit 132: Deutsche Bahn AG - Key offerings

- Exhibit 133: Deutsche Bahn AG - Segment focus

- 12.6 Deutsche Post AG

- Exhibit 134: Deutsche Post AG - Overview

- Exhibit 135: Deutsche Post AG - Business segments

- Exhibit 136: Deutsche Post AG - Key news

- Exhibit 137: Deutsche Post AG - Key offerings

- Exhibit 138: Deutsche Post AG - Segment focus

- 12.7 DP World

- Exhibit 139: DP World - Overview

- Exhibit 140: DP World - Business segments

- Exhibit 141: DP World - Key news

- Exhibit 142: DP World - Key offerings

- Exhibit 143: DP World - Segment focus

- 12.8 DSV AS

- Exhibit 144: DSV AS - Overview

- Exhibit 145: DSV AS - Business segments

- Exhibit 146: DSV AS - Key offerings

- Exhibit 147: DSV AS - Segment focus

- 12.9 Expeditors International of Washington Inc.

- Exhibit 148: Expeditors International of Washington Inc. - Overview

- Exhibit 149: Expeditors International of Washington Inc. - Business segments

- Exhibit 150: Expeditors International of Washington Inc. - Key offerings

- Exhibit 151: Expeditors International of Washington Inc. - Segment focus

- 12.10 FedEx Corp.

- Exhibit 152: FedEx Corp. - Overview

- Exhibit 153: FedEx Corp. - Business segments

- Exhibit 154: FedEx Corp. - Key offerings

- Exhibit 155: FedEx Corp. - Segment focus

- 12.11 Flexport Inc.

- Exhibit 156: Flexport Inc. - Overview

- Exhibit 157: Flexport Inc. - Product / Service

- Exhibit 158: Flexport Inc. - Key offerings

- 12.12 Hellmann Worldwide Logistics SE and Co KG

- Exhibit 159: Hellmann Worldwide Logistics SE and Co KG - Overview

- Exhibit 160: Hellmann Worldwide Logistics SE and Co KG - Product / Service

- Exhibit 161: Hellmann Worldwide Logistics SE and Co KG - Key offerings

- 12.13 Kerry Logistics Network Ltd.

- Exhibit 162: Kerry Logistics Network Ltd. - Overview

- Exhibit 163: Kerry Logistics Network Ltd. - Business segments

- Exhibit 164: Kerry Logistics Network Ltd. - Key news

- Exhibit 165: Kerry Logistics Network Ltd. - Key offerings

- Exhibit 166: Kerry Logistics Network Ltd. - Segment focus

- 12.14 Kuehne Nagel Management AG

- Exhibit 167: Kuehne Nagel Management AG - Overview

- Exhibit 168: Kuehne Nagel Management AG - Business segments

- Exhibit 169: Kuehne Nagel Management AG - Key offerings

- Exhibit 170: Kuehne Nagel Management AG - Segment focus

- 12.15 Nippon Express Holdings Inc.

- Exhibit 171: Nippon Express Holdings Inc. - Overview

- Exhibit 172: Nippon Express Holdings Inc. - Business segments

- Exhibit 173: Nippon Express Holdings Inc. - Key offerings

- Exhibit 174: Nippon Express Holdings Inc. - Segment focus

- 12.16 PSA International Pte Ltd.

- Exhibit 175: PSA International Pte Ltd. - Overview

- Exhibit 176: PSA International Pte Ltd. - Product / Service

- Exhibit 177: PSA International Pte Ltd. - Key offerings

- 12.17 ROMEU MULTISERVICES GROUP SL

- Exhibit 178: ROMEU MULTISERVICES GROUP SL - Overview

- Exhibit 179: ROMEU MULTISERVICES GROUP SL - Product / Service

- Exhibit 180: ROMEU MULTISERVICES GROUP SL - Key offerings

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 181: Inclusions checklist

- Exhibit 182: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 183: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 184: Research methodology

- Exhibit 185: Validation techniques employed for market sizing

- Exhibit 186: Information sources

- 13.5 List of abbreviations

- Exhibit 187: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/automotive-3pl-market-2023-2027-a-descriptive-analysis-of-five-forces-model-market-dynamics-and-segmentation---technavio-301721146.html

SOURCE Technavio

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

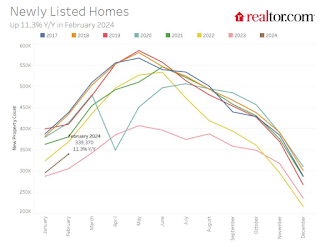

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

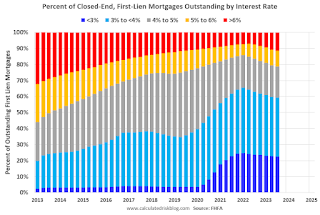

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges