Uncategorized

Futures Trim Losses As Focus Turns To Earnings

Futures Trim Losses As Focus Turns To Earnings

US stock futures slipped for a second day as investors braced for a busy week of parsing earnings…

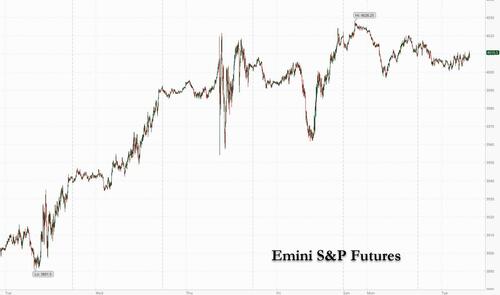

US stock futures slipped for a second day as investors braced for a busy week of parsing earnings reports for signs of an earnings recession, falling profitability and an economic slowdown. Contracts on the S&P 500 fell 0.2% at 7:10 a.m. ET, recovering from a -0.5% drop earlier, while Nasdaq 100 futures dropped 0.3% after trading in the cash market was closed on Monday for a holiday. The dollar was flat after rebounding from an 8 month low on Monday while the US 10-year Treasury yield rises to top about 3.55%.

In premarket trading, shares of Chinese electric-vehicle makers like XPeng Inc. retreated amid worries over demand and competition after the company slashed prices on its models in China. Bank stocks were also lower as Goldman Sachs and Morgan Stanley were set to report their fourth-quarter results before the bell. In corporate news, Bank of America shares got their only sell-equivalent rating after the company flagged a slowdown in lending last week. Whirlpool fell 6% in early New York trading after reporting fourth-quarter net sales of $4.90 billion, compared with forecasts for $5.15 billion. Freeport McMoRan slid 2.6%. Bloomberg Intelligence analysts predict copper could fall to $8,000 a ton from more than $9,000 now as physical demand indicators are weakening. Here are some other notable premarket movers:

- Pfizer (PFE US) stock slides 1.5% after it was cut to equal-weight from overweight at Wells Fargo, which sees an earnings downgrade cycle on the horizon for the pharma giant.

- Cryptocurrency-related stocks rally, as Bitcoin extends its winning streak into a 14th day and trades above the $21,000 level. Coinbase +6%, Riot Platforms +8.3%, Bakkt +10%, Marathon Digital +9.4%

- MGO Global rises 43% to $6.65 in premarket trading, reversing losses from a volatile initial trading session in which the stock more than tripled before closing lower, the latest in a series of wild debuts for US small-cap listings.

- Keep an eye on Tesla after Jefferies cut its target for the stock to $180 from $350, as the brokerage slashed sales and earnings estimates for the electric-car maker. The company last week cut prices across its lineup in an effort to stoke demand after several quarters of disappointing deliveries.

- Watch Wells Fargo stock as it was cut to hold from buy at Jefferies with the risk-reward on the US lender now looking more balanced.

- Keep an eye on utilities as KeyBanc Capital Markets turned more negative on the outlook for the sector into 2023, downgrading CenterPoint Energy and Southern Co to sector weight.

- Watch Global Payments stock as it was upgraded to overweight at Morgan Stanley, which says that fintech and payments sector offers “increasingly compelling” valuations from a more favorable backdrop.

- Piper Sandler downgrades Bandwidth (BAND US), DigitalOcean (DOCN US) and RingCentral (RNG US) to neutral as it tweaks its cloud automation software ratings, with Nice (NICE US) upgraded to overweight and Nutanix (NTNX US) its top pick.

- Morgan Stanley is guarded on hardline, broadline and food retail coverage to start 2023 as it sees more headwinds than tailwinds, with the magnitude of the headwinds outweighing the tailwinds. Wayfair (W US) and Kroger (KR US) upgraded to equal-weight from underweight; National Vision (EYE US) downgraded to equal-weight from overweight.

Bank stocks reversed losses to trade higher on Friday, even after JPM CEO Jamie Dimon and BofA's Brian Moynihan warned of an uncertain economic environment as four of the six biggest US lenders reported their fourth-quarter results. Lenders Goldman Sachs Group Inc. and Morgan Stanley report earnings on Tuesday. Investors will dissect results for the impact of the Federal Reserve’s interest rate hikes and signs of consumer spending slowdown.

“The spread between our earnings model and consensus forecasts is nearly as wide as it’s ever been and suggests a drawdown in stocks for which most are not prepared,” Morgan Stanley’s Michael Wilson wrote in his latest gloomy note. “The main culprit is the elevated and volatile inflationary environment which is likely to play havoc with profitability.”

Meanwhile, according to Bank of America’s latest global fund manager survey, investors are the most underweight on US equities since 2005 as improving market sentiment sends them flocking toward cheaper regions. Allocation to US equities “collapsed” during the first month of 2023, with investors a net 39% underweight the asset class, they said, exceeding even the UK’s 15%. At the same time, participants in the January poll were “a lot less bearish” than in the fourth quarter, sparking a rotation to emerging markets, Europe and cyclical stocks, and away from pharmaceuticals, technology and the US, strategists led by Michael Hartnett wrote in a note.

Investors had their expectations for a pause in central-bank tightening damped by ECB Chief Economist Philip Lane, who said interest rates will have to move into restrictive territory to bring inflation back to target. BlackRock Inc. Vice Chairman Philipp Hildebrand said he saw no chance of policy easing this year. Data including a record increase in UK wages signaled further rate hikes are necessary.

“We’ve just hit pause and I am sure there’s some profit taking,” said James Athey, investment director at Edinburgh-based abrdn. “We‘re into the earnings season which likely brings with it risks and volatility. If you run a risk-parity or 60/40 book, you’ve done brilliantly already this year. It seems prudent to trim some risk.”

US corporate earnings may set the tone for traders this week as the reporting season moves up a gear. Of the 30 companies on the S&P 500 that have posted earnings so far, 24 have beaten analysts’ expectations. However, UBS Wealth Management expects “quite a bit of downside here on the earnings” in the US, according to Hartmut Issel, head of Asia Pacific equities.

European stocks and bonds are both in the red as investors contemplated the prospect of ongoing monetary tightening after ECB Chief Economist Lane said rates will have to move into restrictive territory. The BOE are also facing pressure to continue hiking after UK wages rose at their fastest rate on record, excluding the pandemic. The Stoxx 600 was down 0.2% and on course to snap a four-day winning streak with technology, real estate and autos leading declines. Here are some of the most notable European movers:

- ABB shares rise as much as 1.9% after Redburn upgrades stock to buy from sell, saying recent business exits could mean the Swiss industrial group can grow faster than earlier expected

- Wacker Chemie, one of Europe’s largest producers of polysilicon, rose as much as 3.7% after prices of the material used in solar panels surged in China

- Infineon shares rise as much as 2.4% after Barclays starts coverage of European semiconductor stocks with a preference for Infineon and STMicro, rating both overweight

- Alten shares rise as much as 4.5% after Kepler Cheuvreux raised its recommendation for the French engineering company to buy from hold, citing its ability to deliver strong growth

- Lindt shares rise as much as 1.1% after the Swiss chocolate maker delivered estimate-beating organic sales growth, Vontobel says, with FY23 guidance in line with mid-term targets

- Wise shares fall as much as 7.1% after the UK money-transfer firm’s volume growth slowed, coming in below analyst expectations in the fiscal third quarter

- Ocado Group shares decline as much as 11% after the online grocer reported 4Q retail sales that missed analyst estimates. Morgan Stanley said period performance was “disappointing”

- Philips falls as much as 5.6% after UBS cut the Dutch medical technology group to sell, describing a recent month-long rally as “unjustified,” and flagging downside risks to earnings

- Hugo Boss drops as much as 2.7% as Deustche Bank said a “mild” beat of 4Q consensus estimates failed to impress investors

Asian stocks were mixed as investors assessed data on China’s economic growth and braced for the Bank of Japan’s key policy decision due Wednesday. The MSCI Asia Pacific Index was little changed as of 4:30p.m. Hong Kong time, as losses in financial shares offset an advance in consumer discretionary stocks. Hong Kong’s Hang Seng Index fell 0.8%, ending a four-day rally. Alibaba gained 1% after news that billionaire-investor Ryan Cohen has acquired a stake worth hundreds of millions of dollars in the second half of last year. China’s CSI 300 Index ended flat after a report showed the nation’s gross domestic product grew 3% in 2022, higher than economists expected. The market took a breather after three days of gains fueled by optimism over reopening and eased tech regulations.

“I believe that the market will welcome such numbers,” said Hao Hong, chief economist at Grow Investment Group, in a Bloomberg TV interview. Still, “if the property sector takes more time to recover, it will affect consumption as well. So this year is actually going to be more challenging than last year.” Investors in Asia will also monitor speeches by several Federal Reserve officials this week, as well as comments by central bankers during the World Economic Forum’s annual meeting in Davos, Switzerland.

Japanese stocks rose, ending a two-day loss, as investors adjusted positions before the Bank of Japan’s policy decision tomorrow. Although almost all economists polled by Bloomberg expect no change at the BOJ on Wednesday, some investors are bracing for more action as the central bank struggles to keep bond yields below its target. The Topix Index rose 0.9% to 1,902.89 as of the market close in Tokyo, while the Nikkei 225 advanced 1.2% to 26,138.68. Toyota Motor contributed the most to the Topix’s gain, increasing 2.5%. Out of 2,161 stocks in the index, 1,570 rose and 474 fell, while 117 were unchanged

Australian stocks dipped: the S&P/ASX 200 index closed slightly lower at 7,386.30, snapping four days of gains, as losses in mining and technology stocks weighed on the gauge. Most markets across Asia fell as traders digested data that showed China’s economy growing at the second slowest pace since the 1970s. In New Zealand, the S&P/NZX 50 index rose 0.6% to 11,881.00

India’s benchmark stock gauge posted its biggest advance in more than a week as Reliance Industries led gains among energy firms amid improving outlook for the sector. The S&P BSE Sensex rose 0.9% to 60,655.72 in Mumbai, its largest single-day jump since Jan. 9. The NSE Nifty 50 Index rallied by a similar measure. All but three of the 20 sector sub-gauges compiled by BSE Ltd. gained, led by capital goods makers. Reliance Industries gained 1.4%, after five-straight declines, to push the oil-and-gas sector gauge to an all-time high after the government lowered windfall tax on locally-produced crude and export of diesel. Outlook for oil and gas companies has been improving as moderating crude prices allow state-run refiners to lower marketing losses while Reliance Industries benefits from higher margins.

The Bloomberg Dollar Index inched up 0.1% as the greenback traded higher against most of its Group-of-10 peers. Scandinavian currencies were the worst performers while the Swiss franc led G-10 gains.

- The pound gained and gilts slumped in the wake of UK labor data that showed wages rose at a near-record pace for the three months through November. Yields rose 5-7bps across the curve and traders also bolstered bets on the BOE’s peak rate

- The euro inched lower, but held above $1.08. Bunds eased across the curve and Italian bonds underperformed. Germany January ZEW investor expectations rose to 16.9 versus estimate -15.0

- Japan’s benchmark yield briefly rose above the central bank’s ceiling for a third day as the Bank of Japan starts a two-day policy meeting. The yen fell for a second day. Most economists expect the BOJ to stand pat although market watchers don’t rule out an adjustment including another widening of the yield band to 0.75 or higher, or a scrapping of the yield curve control

- The Australian and New Zealand dollars reversed an Asia session gain amid broad-based dollar strengthening. Australia’s consumer confidence jumped 5%, the largest monthly gain since April 2021, aided by a temporary respite from interest-rate increase as the Reserve Bank’s board doesn’t meet this month

In rates, the Treasury curve extended bear-steepening move after 30-year yields gap higher from the reopen after Monday’s US holiday. Treasury yields were cheaper by up to 7bp across long-end of the curve with 10-year note futures trading toward bottom of Monday’s range; 10-year yields around 3.56% and cheaper by ~5bp vs Friday’s close. Gilts weaker over London session after UK wages rise faster than forecast while European supply pressures also weigh on core rates. Long-end-led losses in US curve steepen 2s10s, 5s30s cash spreads by 5bp and 4bp vs Friday’s close. UK and German government bonds fall with 10-year borrowing costs rising 6bps and 2bps respectively.

In commodities, rose to session highs after earlier dropping WTI rose 0.65% to trade above $80. Spot gold falls roughly $10 to trade near 1,906/oz.

Bitcoin is essentially unchanged on the session and resides in particularly narrow sub-USD 400 parameters after last week's marked upside.

To the day ahead now, and data releases include UK unemployment for November, the German ZEW survey for January, Canadian CPI for December, and the US Empire State manufacturing survey for January. Central bank speakers include the ECB’s Centeno and the Fed’s Williams. Finally, earnings releases include Goldman Sachs, Morgan Stanley and United Airlines.

Market Snapshot

- S&P 500 futures down 0.3% to 4,007.75

- MXAP little changed at 165.62

- MXAPJ down 0.4% to 544.25

- Nikkei up 1.2% to 26,138.68

- Topix up 0.9% to 1,902.89

- Hang Seng Index down 0.8% to 21,577.64

- Shanghai Composite down 0.1% to 3,224.25

- Sensex up 0.9% to 60,629.94

- Australia S&P/ASX 200 little changed at 7,386.29

- Kospi down 0.9% to 2,379.39

- STOXX Europe 600 down 0.1% to 454.10

- German 10Y yield little changed at 2.19%

- Euro little changed at $1.0822

- Brent Futures up 0.4% to $84.78/bbl

- Gold spot down 0.4% to $1,908.36

- U.S. Dollar Index up 0.17% to 102.38

Top Overnight News from Bloomberg

- ECB Governing Council member Mario Centeno said the euro-area economy is performing better than many anticipated in the face of record inflation and the energy crisis that erupted after Russia attacked Ukraine

- ECB Chief Economist Philip Lane said interest rates will have to move into “restrictive territory” to bring inflation back to target

- Investors are looking to bet against Italy’s peer-beating bond rally, saying the gains have gone too far. They argue the ECB is expected to keep hiking interest rates and is unlikely to stand in the way of a selloff given how narrow the spread over German bunds remains

- Investors are the most underweight on US equities since 2005 as improving market sentiment sends them flocking toward cheaper regions, according to Bank of America’s global fund manager survey

- Some 467,000 working days in the UK were lost to strikes in November, a 10-year high, after a wave of walkouts caused by the most severe cost-of-living crisis in a generation. Days lost over a six-month period reached the highest level since 1989-90

- The BOJ’s policy decision due Wednesday is shaping up to be the biggest risk for the dollar-yen pair since the global financial crisis. The currency pair’s overnight implied volatility jumped as high as 54.4 vol, the highest since November 2008, as traders positioned for another policy tweak following a surprise move in December

- An arbitrage trade that rattled Japan’s bond market last year looks to be back. The spread between the prices on Japanese 10-year debt and similar-maturity futures has swelled in recent weeks, providing room for so-called basis trades that try to take advantage of the difference

- This year is pivotal for the Japanese economy to move away from decades of deflationary thinking toward sustained real wage growth, according to the head of the country’s largest labor union

- While China’s GDP grew 3% last year, the second-slowest pace since the 1970s, fourth- quarter and December data came in better than economists had expected

- China’s population started shrinking in 2022 for the first time in six decades, the latest milestone in a worsening demographic crisis for the world’s second-largest economy

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in which most bourses lacked firm direction in the absence of a lead from the US due to MLK Jr. Day and despite the better-than-expected Chinese economic growth and activity data. ASX 200 was subdued with the index contained after it hit resistance at the 7,400 level, while an improvement in Westpac Consumer Confidence and an increase in Rio Tinto’s quarterly output did little to inspire trade. Nikkei 225 outperformed with strength in the auto sector driving the advances and as the BoJ kicked off its 2-day policy meeting with markets second-guessing what the central bank will decide regarding its ultra-easy policy. Hang Seng and Shanghai Comp were lacklustre despite encouraging data in which Chinese GDP, Industrial Production and Retail Sales figures all topped estimates. Nonetheless, the 3.0% growth for 2022 was much lower than the ‘abandoned’ target of around 5.5% and President Xi’s hint of at least 4.4% growth, while China also noted its population shrunk for the first time since 1961 and the death rate was the highest since 1974.

Top Asian News

- PBoC injected CNY 205bln via 7-day reverse repos with the rate kept at 2.00% and injected CNY 301bln via 14-day reverse repos with the rate kept at 2.15% for a CNY 504bln net injection.

- China's Customs said GDP grew 3.0% Y/Y in 2022 and that China was able to stabilise the economy, but added that the foundation for economic recovery is not solid yet, according to Reuters.

- China's stats bureau stated China's population in 2022 shrunk for the first time since 1961 and the death rate was the highest since 1974, although the stats bureau chief later noted they should not worry about China's population decline and overall labour supply still exceeds demand. The stats bureau chief also said that benign inflation in China will create room for macro policies and that the property sector's drag on economic growth this year will not be larger than in 2022, according to Reuters.

European equities trade marginally lower following a mixed APAC lead, Euro Stoxx 50 -0.3%. Sectors in Europe are now mostly lower with no overall bias, but with Chemicals and Industrials outperforming and Autos and Energy towards the bottom. US equity futures are softer but off worse levels with the ES holding above 4,000 throughout the Tuesday session.

Top European News

- ECB's Centeno says Q4 growth within Europe is likely to be positive.

- European Economy Commissioner Gentiloni says we have to strengthen competitiveness by streamlining state aid rules, have a good EU-US partnership; need to support competitiveness, not begin a subsidy war with the US.

- European Commission President von der Leyen says to avoid fragmenting the EU's single market and to support clean tech across the EU, EU has to step up finding; For medium term will prepare a European sovereignty fund but it will take time.

- Germany's BDI President says mild recessionary tendencies will predominate at the start of the year, sees upward trend; Economy expected to shrink by 0.3% in 2023; sees real 1% increase in export of goods and services this year (vs 1.5% global trade).

FX

- A choppy Tuesday session thus far for the Dollar as the index matched yesterday’s 102.56 peak in APAC hours before waning towards the unchanged mark ahead of the European cash open.

- CNH is softer intraday despite supportive Chinese data overnight, which saw Q4 GDP, IP and Retail Sales top expectations across the board.

- USD/JPY is choppy in a 128.23-129.13 parameter, but within recent ranges, whilst the technical “death cross” is more evident as the 50 DMA (135.60) falls further below the 200 DMA (136.67).

- Mixed trade seen across both the EUR and GBP with the latter leading the way following the UK jobs data following strong wages metrics which subsequently lifted BoE market pricing for a 50bps hike (at the time) to around 72% from 63% pre-release.

- PBoC set USD/CNY mid-point at 6.7222 vs exp. 6.7234 (prev. 6.7135)

Fixed Income

- Core benchmarks are downbeat after UK and German data, with USTs in tandem directionally but with magnitudes more contained ahead of Fed's Williams.

- Bunds and, post-open, Gilts printed session lows of 137.66 and 103.37 respectively post-UK jobs data, with the benchmarks nearing but not retesting these points after a particularly strong ZEW release.

- Following the UK jobs data, we have seen an uptick in BoE pricing for 50bp in February to a 75% probability from circa. 63% pre-release.

Commodities

- WTI and Brent front-month futures diverge intraday on account of the US MLK holiday on Monday which resulted in no WTI settlement.

- WTI Feb holds onto a USD 79/bbl status whilst Brent trades on either side of USD 85/bbl in what has been a choppy session.

- Spot gold has been drifting lower as the Dollar remains firm, with the yellow metal trundling lower from highs of USD 1,919/oz down to around USD 1,905/oz.

- Base metals are softer across the board (but to varying degrees) despite the supportive Chinese data overnight as a firmer Dollar exerts pressure on the complex.

- China's state planner, NDRC is to lower retail prices of gasoline an diesel by CNY 205/tonne and CNY 195/tonne respectively as of January 18th.

- Radio Free Europe's Jozwiak writes "Review underway on the Russian oil price cap. Currently at USD 60 but I understand there is a good chance that it might be lowered a bit in upcoming weeks".

- OPEC Secretary General is very bullish on China, and cautiously optimistic on the global economy; Chinese demand will grow by 500k barrels this year; waiting to see what happens after China's New Year holiday (Jan 21st-29th).

Geopolitics

- Russian Defence Ministry discussed increasing the number of military personnel to 1.5mln (vs ~1.3mln in 2022), according to Tass; says major changes in Russian army will take place from 2023-26.

- Ukrainian President Zelensky said the attack in Dnipro underscores the need for new and faster decisions on weapons supplies, while he added they expect key decisions from partners on arms supplies at the Ramstein meeting.

- Russian-installed Donetsk authorities confirm that Russia has control of Soledar, via Tass.

- Russia deployed an SU-27 fighter plane to escort a German naval aircraft over the Baltic, according to Interfax.

- Russian Kremlin when asked about a potential meeting between the CIA's Burns and Russia spy chief says "this kind of dialogue is beneficial".

- UK is reviewing whether to designate Iran’s Revolutionary Guards as a terrorist organisation, according to FT.

- China's Foreign Ministry spokesperson says they are discussing the details of a visit from US Secretary of State Blinken.

- Iran's IRGC have conducted "major drills" in the Persian Gulf, according to Tasnim; details light.

US Event Calendar

- 08:30: Jan. Empire Manufacturing, est. -8.6, prior -11.2

Central Bank Speakers

- 15:00: Fed’s Williams Gives Welcoming Remarks

DB's Jim Reid concludes the overnight wrap

I hope you are all looking forward to the rest of the year now after Blue Monday was navigated yesterday, which flew hot on the heels of Friday 13th at the end of last week. To be fair markets of late haven't been either depressing or scary. However we took pause for breath yesterday, given the US holiday, with nothing much happening. The main news has instead been overnight, where we’ve just had the release of the Chinese GDP figures for Q4 that covers the December surge in Covid cases. The data was better than expected but still showed the scars from Covid.

Q4 GDP (+2.9%) beat expectations (+1.6%) with the FY at +3% (+2.7% expected and +8.1% in 2021) - the second lowest year since China re-emerged from the economic wilderness in the 1970s. Momentum was much stronger than expected in December though. Retail sales dropped -1.8% y/y in December, much better than -9.0% fall expected by analysts and compared to a -5.9% decline in the prior month. Meanwhile, industrial production grew +1.3% y/y, well above the +0.1% predicted by Bloomberg. At the same time, fixed asset investment for 2022 rose by +5.1%, slightly above the +5% expected by Bloomberg.

Asian markets are lower though led by the Hang Seng (-1.25%) followed by the KOSPI (-0.77%), the Shanghai Composite (-0.27%) and the CSI (-0.16%). Elsewhere, the Nikkei (+1.28%) is bucking the trend this morning, recouping some of the losses from the previous two sessions. In overnight trading, stock futures in the US are indicating a negative opening with contracts on the S&P 500 (-0.32%) and NASDAQ 100 (-0.54%) trading in the red. Meanwhile, yields on 10yr USTs (+2.95 bps) have edged higher to 3.53% after the holiday.

Looking back at yesterday now, it was an incredibly uneventful session for the most part, even adjusting for the impact of the US holiday. For instance, if you look at US futures markets (since spot markets were closed), S&P 500 futures had barely budged by the time Europe went home, with a modest decline of -0.10%. It was a similar story for bonds, where futures also saw little change, perhaps in part since expectations of the Fed’s terminal rate for June moved up by just +0.002bps on the day. That said, despite the lack of excitement, the VIX index of volatility ticked up from its one-year low on Friday, moving up +1.14pts to 19.49pts.

Back in Europe there wasn’t much happening either, but one trend to note was the continued decline in natural gas futures yesterday, which fell back to a 16-month low of €55.45 per megawatt-hour. Although these prices are still well above their historic norms, they’ve now come down by more than half in the last month, so this is a big and positive shock if it ends up being sustained. In turn, that led to a fresh decline in inflation expectations, and the 10yr German breakeven came down a further -2.9bps to a 3-month low of 2.05%.

That greater optimism on the inflation side wasn’t enough to prevent a modest decline in sovereign bonds yesterday, with yields on 10yr bunds (+0.6bps), OATs (+0.6bps) and BTPs (+0.6bps) all seeing a small increase. Gilts were an underperformer, with 10yr yields up +1.8bps rise on the day as UK assets more broadly saw a slight underperformance. That came as BoE Governor Bailey testified before the Treasury Committee of MPs, where he warned that there was a risk that inflation wouldn’t drop as fast as expected. Overall however, there was nothing revelatory on how they’re thinking about the next decision on February 2.

With the positive gas news boosting sentiment more broadly, European equities advanced for the most part. The STOXX 600 rose +0.46%, taking the index up to its highest level since April, with other advances for the FTSE 100 (+0.20%), the DAX (+0.31%) and the CAC 40 (+0.28%). That continues the very positive start to the year for European equities, and means that the YTD returns now stand at +7.00% for the STOXX 600 and +8.69% for the DAX.

Finally, the World Economic Forum’s annual meeting at Davos opened last night, which will continue for the rest of the week. Numerous political and business leaders are gathering there, and today’s speakers include European Commission President Ursula Von der Leyen, Chinese Vice Premier Liu He, Spanish PM Pedro Sánchez and German finance minister Christian Lindner. Separately, it’s not actually a Davos meeting, but we heard yesterday that US Treasury Secretary Yellen and Chinese Vice Premier Liu He would be meeting in Zurich.

To the day ahead now, and data releases include UK unemployment for November, the German ZEW survey for January, Canadian CPI for December, and the US Empire State manufacturing survey for January. Central bank speakers include the ECB’s Centeno and the Fed’s Williams. Finally, earnings releases include Goldman Sachs, Morgan Stanley and United Airlines.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire