Uncategorized

As Recession Noise Grows, Recession Signal Is Fading

As Recession Noise Grows, Recession Signal Is Fading

Authored by Simon White, Bloomberg macro strategist,

The clamor for a US recession has…

Authored by Simon White, Bloomberg macro strategist,

The clamor for a US recession has grown louder in recent weeks, but forward-looking data shows the risk of one is easing not rising.

Despite the abrupt turn in the mood music in recent weeks it is looking increasingly likely the official arbiter of US recessions, the National Bureau of Economic Research, won’t call one, leaving stocks priced for too negative an outcome.

Warning sounds about a US recession have been growing louder. But that has been fueled by principally lagging economic data telling us where the economy’s been, not where it’s going next. Leading data is inflecting higher, suggesting the US may skirt a NBER-recession for most of next year.

Academic disputes are said to matter so much as they mean so little. The same can be said for recession prediction — after all, it’s what the market does that ultimately counts for investors. Nonetheless, the recent flurry of recession chatter deserves a reply, as a close look at the data shows that a slump in the medium term is no longer the base case.

I come at this as a soft-landing skeptic. Multiple reliable data points had been pointing toward a recession, but there is now enough contrary data to sow sufficient doubt.

Before going any further we have to set the terms of reference. It can be argued the US has experienced or is already in a recession, for instance by looking at GDI, manufacturing, goods GDP, or earnings. But with no hard-and-fast definition of an economic contraction (the technical definition of two-consecutive quarters of negative growth is too simplistic), having a referee in the NBER is the best option.

The downside is the NBER doesn’t announce recessions until after they have started, and thus is impractical for investors in real time. The utility instead comes from noting that the times the NBER deems to be recessions are when stocks have experienced their worst downturns — thus trying to figure out ahead of the NBER when there will be a contraction can save investors from considerable losses.

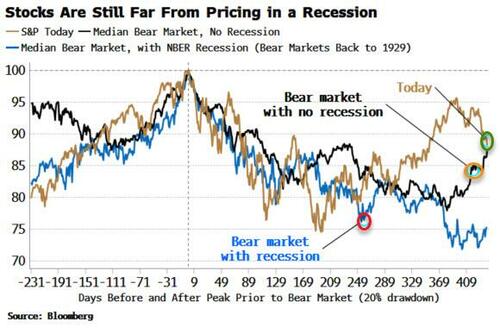

Since March this year, the S&P has been trading as if an NBER-recession will be avoided. Lately stocks have sold off, but they are still a long way above the median S&P in bear markets that had a recession (the blue line in the chart below). That means there is still sizable downside risk today if there is a downturn; but equivalently there is the risk from missed opportunity as stocks could eclipse their recent highs, or more, if a slump is avoided.

NBER recession dating is not an exact science. As the bureau itself puts it, “there are no fixed rules or thresholds that trigger a determination of decline.” But the research body requires a recession be durable, diffuse and deep. It also gives four of the key variables it uses as recession determinants:

-

real personal consumption expenditure (PCE)

-

payrolls

-

industrial production

-

real personal income net of transfer payments

Let’s start there. In the chart below we can see the four series over the last 50+ years. All of them contracted on an annual basis at some point during each NBER recession since 1970, apart from the one in 2001, where real PCE didn’t contract (recessions are vertical gray bars in the chart below).

Zooming in to the present in the next chart, we can see that none of the four indicators are currently contracting. Industrial production is flat-lining around zero, payrolls growth is turning lower from a high level, while real PCE and real personal income are positive and have been rising.

Not only is the NBER very unlikely to call a recession based on the current state of play, leading data shows that is unlikely to change in the next 6-9 months.

All four indicators are coincident-to-lagging, and most of them are released with a delay.

That’s why we must turn to leading data series to pre-empt the NBER. It is increasingly pointing in the direction that the current slowdown won’t last quite long enough (have the duration) or fall hard enough (have the depth) to trigger an NBER recession.

First, there is the recent upturn in the manufacturing ISM, which anticipates that industrial production should soon recover. October’s ISM disappointed to the downside, and if sustained this would cause some concern. But leading data for the ISM, such as the rising new orders-to-inventory ratio and the steepening in the global yield curve (shown below), intimate the ISM has bottomed and should continue its rise.

Second, there is the strong upturn in the US Leading Indicator (composed of leading data series such as building permits), which points to a continued rise in real retail-sales growth, and thus real PCE.

Third, real wage growth has been growing positively, keeping real income less transfer payments supported. However, of the four indicators, real income faces the most downside risk. Leading indicators for wages are rolling over, pointing to lower wage growth next year.

Finally, an inflection lower in the annual growth of unemployment claims points to eventual support for payrolls growth. WARN data (which leads claims) is also now flat again, indicating any claims growth should be contained. The jobs market should continue to slow, but leading data is showing the slowdown may not be of sufficient depth for the NBER to deem it recession worthy.

None of the indicators are screaming recession. The NBER has stated it gives more weight to real income growth and payrolls in its assessment, but even if these two end up contracting, the data is showing that the other series do not look like following them down soon. Remember, the bureau has never called a recession in the last 50 years when fewer than three of the four indicators have been contracting, and then only once.

Instead, the biggest risk to a soft landing come from two other factors: geopolitical, and credit.

I won’t dwell on the first - an unexpected escalation in global hostilities would likely hit sentiment enough to tip the US into recession.

Credit is the biggest endogenous risk facing the economy and the market. Bankruptcy filings and charge-off rates are rising, indicating underlying stress not reflected in credit spreads. Moreover, the opacity in rapidly growing private-credit markets is becoming a greater concern. Credit should be monitored closely as a fast unraveling would swiftly take the economy into recession territory.

Until then an NBER-recession looks less likely than so over the next 6-9 months. Which is not how the situation looked earlier in the summer. Abnormally high fiscal deficits; the asynchronous recovery after the pandemic disrupting the traditional interplay between the goods and services economy; and money illusion to a degree most haven’t experienced before are all factors why this time is not following the usual script.

When the leading data turns sufficiently down, the NBER will make a recession announcement in due course. But we are unlikely to hear from them for a while yet.

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

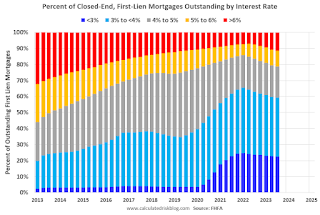

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

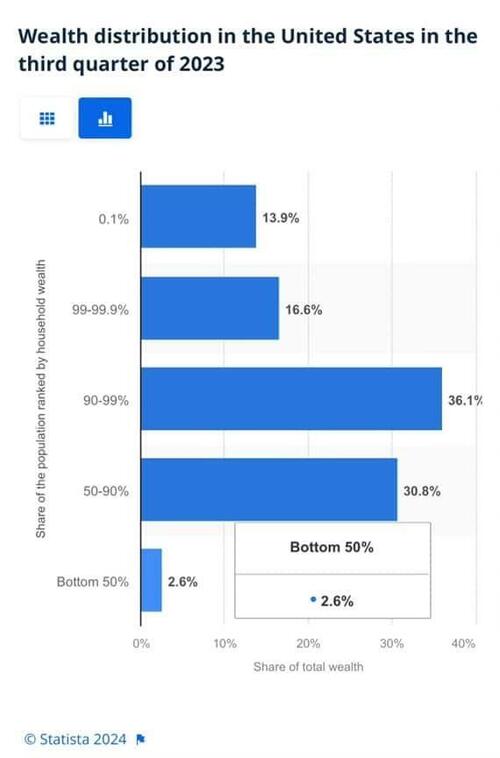

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

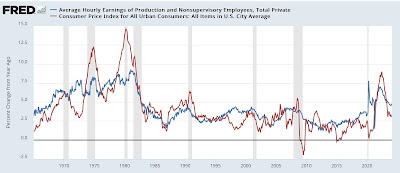

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Uncategorized

The most potent labor market indicator of all is still strongly positive

– by New Deal democratOn Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently…

- by New Deal democrat

On Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently than not indicated a recession was near or underway. But I concluded by noting that this survey has historically been noisy, and I thought it would be resolved away this time. Specifically, there was strong contrary data from the Establishment survey, backed up by yesterday’s inflation report, to the contrary. Today I’ll examine that, looking at two other series.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges