International

A Vicious Stagflationary Environment Awaits

A Vicious Stagflationary Environment Awaits

Authored by Tavi Costa and Kevin Smith via Crescat Capital,

Today’s restrictive Fed policies…

Authored by Tavi Costa and Kevin Smith via Crescat Capital,

Today’s restrictive Fed policies in a rapidly deteriorating economy are the preconditions for a steep recession. Contrary to the unprecedented monetary and fiscal support we had following the last economic downturn, we are currently experiencing a major withdrawal of liquidity at a time when corporate fundamentals are starting to contract. Despite the deepest yield curve inversion in decades, the Fed is raising rates at its fastest pace since 1984 as it prepares to shrink its balance sheet by $90 billion per month, starting next month. Already, in the last three months, M2 money supply also contracted by its largest amount in 63 years!

In the meantime, inflation remains deeply entrenched in the economy. These are arguably the most challenging set of circumstances the Fed has confronted in many decades. Central banks can sacrifice economic growth as long as unemployment rates stay low, which we believe to be highly unlikely.

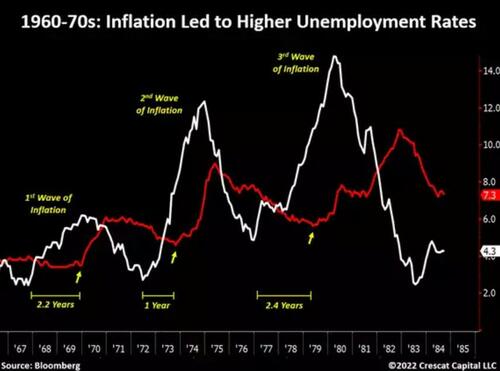

Looking back at the Great Inflation period from the late 1960s to the early 1980s, the rise in consumer prices preceded substantial increases in unemployment rates. On average, after two years of the initial appreciation in inflation rates, labor markets started to falter. Today, it has been exactly two years and three months since CPI rates began to trend higher. With such a level of monetary tightening with already eroding economic conditions, we strongly believe unemployment rates are poised to rise significantly from their current levels.

Inflationary Recession

In 1973-4, it took a decline of 48% in stocks for inflation to start trending lower for the next couple of years. The persistent increase in consumer prices at the time forced the Fed which had to radically tighten financial conditions. As a result, a brutal inflationary recession followed and, outside of precious metals, overall equities and Treasuries collapsed together. A similar macro setup is unfolding today.

In our view, the US and most other developed economies have decisively entered an inflationary regime. Consequently, the role of monetary policy will be much more directed towards price stability which inhibits the backdrop of excessive central bank liquidity that drove overall market prices to today’s unsustainable levels.

We believe January 3rd marked the peak for US stocks and this is just the beginning of a bear market from truly historical overvaluations.

Opportunities Abound

Decades of reckless Fed actions have created one of the most frenzied investment environments in stock market history. Outside of natural resource industries, we are seeing a profusion of unsustainably high valuations across most of the equity market.

Unsurprisingly, today’s consumer discretionary sector is now worth 2.6 times the size of the energy sector, while the latter generates over 5 times more in free cash flow. We believe these price imbalances are true opportunities. In our global macro and long/short hedge funds, we are long undervalued stocks in scarce commodity industries today, including precious and base metal miners, oil and gas E&Ps, and fertilizer producers while we are short a variety of overvalued stocks in a variety of sectors with deliberate over-weighting of short positions in consumer discretionary and information technology, in particular mega-cap tech.

The Fundamental Setup for Mining Stocks

In a similar concept to how historically undervalued energy companies continue to be, other commodity businesses may offer an even stronger value proposition. Mining stocks, for instance, are currently trading at multiples not seen since their historically most depressed levels. This is a function of falling stock prices coupled with strong fundamentals. The P/E ratio for metals and mining stocks in the S&P 500 are now retesting the lows of the 2008 bottom.

Greatest Dividend Yield in Almost a Decade

Gold miners also have the highest dividend yield in almost ten years. While this seems compelling, it is just a supplementary part of our bullish thesis on gold and silver mining stocks. These companies are almost paying more dividends than utility stocks for the first time in the history of the data.

Similarly, energy stocks are paying more dividends than any other sector in the S&P 500 today.

Energy Stocks-to-Oil Ratio on the Rise

Energy stocks have underperformed oil prices for almost six years. Even after most energy commodities reached a bottom in April 2020, exploration and production companies have not kept up with the level of appreciation. It is interesting, however, that in this recent pullback in WTI and Brent oil prices, energy stocks behaved significantly better. We think this is a very bullish sign for the overall industry. It is always important to see the risker parts of a sector leading the way. We believe the energy stocks-to-oil ratio will break out from this key resistance and continue to move higher.

The Resurgence of the Inflation Narrative

None of the structural issues causing inflation have been resolved. Overall CAPEX for commodity producers has gone nowhere and monetary tightening has only reduced capital available for new investments. We believe that the Fed still runs a major risk of prematurely shifting its hawkish stance and re-igniting the inflation narrative. The softer tone we have seen from policy makers recently is likely to drive commodity prices higher again. That has already begun. Look no further than natural gas prices making new highs recently.

Natural Gas Sends Strong Message

The surge in natural gas prices to recent highs is perhaps one of the most important developments unfolding in the macro environment today. It is happening right at a time when the inflation narrative has dissipated due to recession fears. The appreciation of natural gas reminds us that commodity markets are fundamentally linked. Rising energy prices often drive rising agricultural and materials prices.

Natural Gas and Ammonia Prices Are Strongly Correlated

Note the historical correlation between natural gas and ammonia prices. In the past, one has led the other. Higher ammonia prices mean higher fertilizer prices which trigger agricultural commodities to rise leading to higher food prices.

Most Erratic Energy Policy in History

In case one thinks that the selling pressure in oil has been solely driven by recession fears, the US government just sold another 27 million barrels last month. At this pace, the strategic petroleum reserves (SPR) will be zero in 18 months.

Nonetheless, with recent recession fears, the demand deterioration in the Chinese economy, and the US government selling its SPRs, one would think oil would not be trading anywhere close to as high as $90 per barrel. Such strength in the price speaks to the overall supply tightness in the energy market. We believe oil is headed substantially higher.

The Early Innings of a Bear Market

Equity markets are not priced for the vicious stagflationary environment that we envision. Overall, stocks are behaving as if we were still in a secular disinflationary environment which allows the Fed to loosen monetary conditions without causing inflationary pressure. As prices for goods and services continue to increase at historically elevated levels, so will the cost of capital. That is not a positive scenario for growth stocks, particularly relative to value companies. The Russell Growth vs. Value index spread still is near the peak levels reached in the Tech Bubble of 2000. This further supports our view that the decline in the overall equity markets is just the beginning.

Value vs. Growth

The long-term double bottom in the energy-to-tech stocks ratio illustrates how early we are in this upward trend for oil and gas stocks. For over a decade, capital flows have solely focused on growth-related companies and have completely forgotten about businesses that are crucial to the basic functioning of the global economy. We are excited to be able to invest in historically undervalued energy companies at what we believe to be only the beginning of an inflationary era.

Job Openings Collapsing

Maybe it is just a coincidence, but 774 CEOs have left their roles this year in the US alone. That is the highest number in 20 years!

What do these high-profile executives know that investors don’t?

There have been significant changes in labor market indicators recently. Job opening just had their largest 3-month decline in the history of the data, excluding the initial shock of the pandemic. This is probably just the beginning. Fed tightening with PMIs already at levels only seen in the Global Financial Crisis is just one more nail in the coffin for the economy.

Tech Bubble on Steroids

At the height of the Tech Bubble in 2000, the top-10 US market cap tech stocks collectively reached an enterprise value of 30% of GDP. The problem then was the same as it is today. Growth expectations were too high for these companies. Their valuations had simply become too rich relative to the size of the overall economy to justify the growth assumptions.

Furthermore, the spending boom to address the Y2K computer problem made the fundamentals truly unsustainable. Investors were extrapolating high short-term growth rather than realizing that it was a top in both growth and profitability for the business cycle. Over the next two and a half years, the enterprise value of these companies would plunge to just 5% of GDP as the combined revenue, earnings, free cash flow, and stock prices for these companies plummeted and led the entire economy into recession.

Fast forward to year-end 2021, the height of today’s mega-cap-tech-led stock market bubble. The top-10 US market cap tech stocks collectively reached an even higher 56% EV to GDP, 87% higher than it was at the peak of the 2000 tech bubble. The record-breaking fiscal and monetary stimulus during Covid accelerated the move to the cloud and the corresponding IT spending boom, just like Y2K. Once again, investors have extrapolated unsustainable growth and profitability to justify high valuations.

Remarkably, even as the fundamentals are already deteriorating, the further downside risk for these mega-caps remains totally incomprehensible to most market participants today. The common investment narrative remains that these companies have reasonable P/E ratios. Not only is the E coming off unsustainably inflated levels, but the P/E multiple is also too high compared to likely future growth.

The chart below shows the potential further downside risk for the top-10 mega-cap tech stocks today, on an EV-to-GDP basis, if they were to approach the same cyclical low valuation levels that they did in 2002 of 5 times EV to GDP. We are not necessarily calling for a full retest of those multiples, but we believe the market will continue to head in that direction. We are indeed looking for substantially lower stock prices for many of these companies along with continued downward revisions to earnings and free cash flow projections and contracting multiples, all of which should coincide with an economic recession over the next several quarters.

Investors have been buying the dip and continue to get sucked into what we believe has been a mere bear market rally over the last two months, one that is starting to roll over again. The technical analysis of this macro/fundamental chart looks like a monster head-and-shoulders pattern.

Payrolls: Still Partying Like It’s 1999

Nonfarm payrolls recently surprised the markets with a surge of 528,000. Despite what seems to be very positive news, here is a reminder that nonfarm payrolls also surged by almost 500,000 right at the peak of the tech bubble in March 2000. It is important to understand that most labor market gauges are lagging indicators. An extremely low unemployment rate is often a contrarian indicator.

Hardly Even Growth Stocks Anymore

In contrast to what most investors believe, the “FAANG” stocks are starting to show serious signs of weakness in their fundamentals. The median real revenue growth for these companies has officially turned negative for the first time in almost two decades. Interestingly, investors still consider them “growth” stocks despite their meaningful exposure to a cyclical downturn in the economy at large. We think mega-cap tech companies pose a significant risk to the overall equity market. After years of attracting investment flows from capital markets on the back of incredibly successful business models, these stocks are deteriorating fundamentally, and most investors are not even paying attention.

More Buybacks Than Capex

S&P 500 companies are spending more money on share buybacks than they are investing in their businesses. They are doing this at the highest ratio in the history of the data which goes back 25 years. Aggregate annual buybacks are 134% of CAPEX. This trend is likely to crimp productivity growth and innovation for years to come.

Financial Engineering Failure

While many investors believe share buyback programs have been widely successful, the data shows otherwise. Stocks with the highest buyback ratios have underperformed the overall market in the last three years. It gets worse. If we look at the members of the S&P 500 Buyback index, 89% of their cash flow generated in the last 12 months was used to buy back their shares. Managers have been making poor capital allocation decisions, buying back expensive shares, and under-investing in future growth.

Contracting Fundamentals

While we have seen most stocks in the technology sector being re-rated at lower price levels, fundamentals for these businesses continue to weaken, particularly for the smaller players. Aggregate profit margins for the Russell 2000 Technology index members are now at their lowest level since the Global Financial Crisis.

Yield Curve Inversions During Tightening Cycles

In the last 30+ years, every time the yield curve inverted, the Fed was forced to end its tightening cycle as the economy was heading into a recession. Over time, the sharp reversal of these policies, i.e., subsequent easing cycles, are what have fueled the excesses we see in financial asset valuations today.

For every economic downturn we have had since the late 1980s, government and Fed support became progressively larger. Such policy behavior is only achievable in a macroeconomic environment where inflation is not a long-term problem.

In the inflationary late 1960s to early 1980s, in contrast, central banks were much more limited in their ability to deploy liquidity measures during recessions. We think we are entering a similar macro setting today. This potential lack of liquidity is yet to be reflected in the prices of risky assets, which remain near historic high levels. Nonetheless, despite the steep inversion in the US yield curve, we think the Fed will be forced to remain hawkish for longer. In our strong view, the tightening of financial conditions in a fragile economy should be detrimental to equity markets.

Unsustainable Inversion

The 1-year Eurodollar curve is now as inverted as it was at the beginning of the Global Financial Crisis. That just means markets believe the Fed will be forced to cut interest rates in the next 12 months. For us, this inversion reflects how investors continue to bet on the potential for a deflationary outcome.

We believe it is unlikely that the Fed will be able to loosen financial conditions given that long-term inflation expectations are likely to remain well above the 2% target. In this sense, today’s setup reminds us of the 1970s when policy makers will be forced to maintain a hawkish stance for longer. As a result, market liquidity will remain challenged.

China’s Balance Sheet Recession

China is currently facing a full-blown balance sheet recession due to an over-levered banking system and real estate market. The unwinding of its severe macro imbalances has forced the PBOC to loosen monetary conditions not only in an inflationary environment but also with a significantly more restrictive Fed policy. In our strong view, a devaluation of the Chinese yuan is the next wrecking ball that very few investors are positioned for.

Note how China’s imports of steel products are now at the lowest level in 24 years.

The Fed is Tightening While the PBOC is Easing

The PBOC-to-Fed’s interest rate policy spread has consistently led the changes in USDCNY by 6 months.

Such divergence in central banks’ stance is likely to add major pressure on the yuan to depreciate relative to the dollar.

The disconnect between the Chinese yuan and the required deposit reserve ratio for major banks remains one of the most important charts in the current macro environment.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Spread & Containment

‘I couldn’t stand the pain’: the Turkish holiday resort that’s become an emergency dental centre for Britons who can’t get treated at home

The crisis in NHS dentistry is driving increasing numbers abroad for treatment. Here are some of their stories.

It’s a hot summer day in the Turkish city of Antalya, a Mediterranean resort with golden beaches, deep blue sea and vibrant nightlife. The pool area of the all-inclusive resort is crammed with British people on sun loungers – but they aren’t here for a holiday. This hotel is linked to a dental clinic that organises treatment packages, and most of these guests are here to see a dentist.

From Norwich, two women talk about gums and injections. A man from Wales holds a tissue close to his mouth and spits blood – he has just had two molars extracted.

The dental clinic organises everything for these dental “tourists” throughout their treatment, which typically lasts from three to 15 days. The stories I hear of what has caused them to travel to Turkey are strikingly similar: all have struggled to secure dental treatment at home on the NHS.

“The hotel is nice and some days I go to the beach,” says Susan*, a hairdresser in her mid-30s from Norwich. “But really, we aren’t tourists like in a proper holiday. We come here because we have no choice. I couldn’t stand the pain.”

This is Susan’s second visit to Antalya. She explains that her ordeal started two years earlier:

I went to an NHS dentist who told me I had gum disease … She did some cleaning to my teeth and gums but it got worse. When I ate, my teeth were moving … the gums were bleeding and it was very painful. I called to say I was in pain but the clinic was not accepting NHS patients any more.

The only option the dentist offered Susan was to register as a private patient:

I asked how much. They said £50 for x-rays and then if the gum disease got worse, £300 or so for extraction. Four of them were moving – imagine: £1,200 for losing your teeth! Without teeth I’d lose my clients, but I didn’t have the money. I’m a single mum. I called my mum and cried.

Susan’s mother told her about a friend of hers who had been to Turkey for treatment, then together they found a suitable clinic:

The prices are so much cheaper! Tooth extraction, x-rays, consultations – it all comes included. The flight and hotel for seven days cost the same as losing four teeth in Norwich … I had my lower teeth removed here six months ago, now I’ve got implants … £2,800 for everything – hotel, transfer, treatments. I only paid the flights separately.

In the UK, roughly half the adult population suffers from periodontitis – inflammation of the gums caused by plaque bacteria that can lead to irreversible loss of gums, teeth, and bone. Regular reviews by a dentist or hygienist are required to manage this condition. But nine out of ten dental practices cannot offer NHS appointments to new adult patients, while eight in ten are not accepting new child patients.

Some UK dentists argue that Britons who travel abroad for treatment do so mainly for cosmetic procedures. They warn that dental tourism is dangerous, and that if their treatment goes wrong, dentists in the UK will be unable to help because they don’t want to be responsible for further damage. Susan shrugs this off:

Dentists in England say: ‘If you go to Turkey, we won’t touch you [afterwards].’ But I don’t worry because there are no appointments at home anyway. They couldn’t help in the first place, and this is why we are in Turkey.

‘How can we pay all this money?’

As a social anthropologist, I travelled to Turkey a number of times in 2023 to investigate the crisis of NHS dentistry, and the journeys abroad that UK patients are increasingly making as a result. I have relatives in Istanbul and have been researching migration and trading patterns in Turkey’s largest city since 2016.

In August 2023, I visited the resort in Antalya, nearly 400 miles south of Istanbul. As well as Susan, I met a group from a village in Wales who said there was no provision of NHS dentistry back home. They had organised a two-week trip to Turkey: the 12-strong group included a middle-aged couple with two sons in their early 20s, and two couples who were pensioners. By going together, Anya tells me, they could support each other through their different treatments:

I’ve had many cavities since I was little … Before, you could see a dentist regularly – you didn’t even think about it. If you had pain or wanted a regular visit, you phoned and you went … That was in the 1990s, when I went to the dentist maybe every year.

Anya says that once she had children, her family and work commitments meant she had no time to go to the dentist. Then, years later, she started having serious toothache:

Every time I chewed something, it hurt. I ate soups and soft food, and I also lost weight … Even drinking was painful – tea: pain, cold water: pain. I was taking paracetamol all the time! I went to the dentist to fix all this, but there were no appointments.

Anya was told she would have to wait months, or find a dentist elsewhere:

A private clinic gave me a list of things I needed done. Oh my God, almost £6,000. My husband went too – same story. How can we pay all this money? So we decided to come to Turkey. Some people we know had been here, and others in the village wanted to come too. We’ve brought our sons too – they also need to be checked and fixed. Our whole family could be fixed for less than £6,000.

By the time they travelled, Anya’s dental problems had turned into a dental emergency. She says she could not live with the pain anymore, and was relying on paracetamol.

In 2023, about 6 million adults in the UK experienced protracted pain (lasting more than two weeks) caused by toothache. Unintentional paracetamol overdose due to dental pain is a significant cause of admissions to acute medical units. If left untreated, tooth infections can spread to other parts of the body and cause life-threatening complications – and on rare occasions, death.

In February 2024, police were called to manage hundreds of people queuing outside a newly opened dental clinic in Bristol, all hoping to be registered or seen by an NHS dentist. One in ten Britons have admitted to performing “DIY dentistry”, of which 20% did so because they could not find a timely appointment. This includes people pulling out their teeth with pliers and using superglue to repair their teeth.

In the 1990s, dentistry was almost entirely provided through NHS services, with only around 500 solely private dentists registered. Today, NHS dentist numbers in England are at their lowest level in a decade, with 23,577 dentists registered to perform NHS work in 2022-23, down 695 on the previous year. Furthermore, the precise division of NHS and private work that each dentist provides is not measured.

The COVID pandemic created longer waiting lists for NHS treatment in an already stretched public service. In Bridlington, Yorkshire, people are now reportedly having to wait eight-to-nine years to get an NHS dental appointment with the only remaining NHS dentist in the town.

In his book Patients of the State (2012), Argentine sociologist Javier Auyero describes the “indignities of waiting”. It is the poor who are mostly forced to wait, he writes. Queues for state benefits and public services constitute a tangible form of power over the marginalised. There is an ethnic dimension to this story, too. Data suggests that in the UK, patients less likely to be effective in booking an NHS dental appointment are non-white ethnic groups and Gypsy or Irish travellers, and that it is particularly challenging for refugees and asylum-seekers to access dental care.

This article is part of Conversation Insights

The Insights team generates long-form journalism derived from interdisciplinary research. The team is working with academics from different backgrounds who have been engaged in projects aimed at tackling societal and scientific challenges.

In 2022, I experienced my own dental emergency. An infected tooth was causing me debilitating pain, and needed root canal treatment. I was advised this would cost £71 on the NHS, plus £307 for a follow-up crown – but that I would have to wait months for an appointment. The pain became excruciating – I could not sleep, let alone wait for months. In the same clinic, privately, I was quoted £1,300 for the treatment (more than half my monthly income at the time), or £295 for a tooth extraction.

I did not want to lose my tooth because of lack of money. So I bought a flight to Istanbul immediately for the price of the extraction in the UK, and my tooth was treated with root canal therapy by a private dentist there for £80. Including the costs of travelling, the total was a third of what I was quoted to be treated privately in the UK. Two years on, my treated tooth hasn’t given me any more problems.

A better quality of life

Not everyone is in Antalya for emergency procedures. The pensioners from Wales had contacted numerous clinics they found on the internet, comparing prices, treatments and hotel packages at least a year in advance, in a carefully planned trip to get dental implants – artificial replacements for tooth roots that help support dentures, crowns and bridges.

In Turkey, all the dentists I speak to (most of whom cater mainly for foreigners, including UK nationals) consider implants not a cosmetic or luxurious treatment, but a development in dentistry that gives patients who are able to have the procedure a much better quality of life. This procedure is not available on the NHS for most of the UK population, and the patients I meet in Turkey could not afford implants in private clinics back home.

Paul is in Antalya to replace his dentures, which have become uncomfortable and irritating to his gums, with implants. He says he couldn’t find an appointment to see an NHS dentist. His wife Sonia went through a similar procedure the year before and is very satisfied with the results, telling me: “Why have dentures that you need to put in a glass overnight, in the old style? If you can have implants, I say, you’re better off having them.”

Most of the dental tourists I meet in Antalya are white British: this city, known as the Turkish Riviera, has developed an entire economy catering to English-speaking tourists. In 2023, more than 1.3 million people visited the city from the UK, up almost 15% on the previous year.

Read more: NHS dentistry is in crisis – are overseas dentists the answer?

In contrast, the Britons I meet in Istanbul are predominantly from a non-white ethnic background. Omar, a pensioner of Pakistani origin in his early 70s, has come here after waiting “half a year” for an NHS appointment to fix the dental bridge that is causing him pain. Omar’s son had been previously for a hair transplant, and was offered a free dental checkup by the same clinic, so he suggested it to his father. Having worked as a driver for a manufacturing company for two decades in Birmingham, Omar says he feels disappointed to have contributed to the British economy for so long, only to be “let down” by the NHS:

At home, I must wait and wait and wait to get a bridge – and then I had many problems with it. I couldn’t eat because the bridge was uncomfortable and I was in pain, but there were no appointments on the NHS. I asked a private dentist and they recommended implants, but they are far too expensive [in the UK]. I started losing weight, which is not a bad thing at the beginning, but then I was worrying because I couldn’t chew and eat well and was losing more weight … Here in Istanbul, I got dental implants – US$500 each, problem solved! In England, each implant is maybe £2,000 or £3,000.

In the waiting area of another clinic in Istanbul, I meet Mariam, a British woman of Iraqi background in her late 40s, who is making her second visit to the dentist here. Initially, she needed root canal therapy after experiencing severe pain for weeks. Having been quoted £1,200 in a private clinic in outer London, Mariam decided to fly to Istanbul instead, where she was quoted £150 by a dentist she knew through her large family. Even considering the cost of the flight, Mariam says the decision was obvious:

Dentists in England are so expensive and NHS appointments so difficult to find. It’s awful there, isn’t it? Dentists there blamed me for my rotten teeth. They say it’s my fault: I don’t clean or I ate sugar, or this or that. I grew up in a village in Iraq and didn’t go to the dentist – we were very poor. Then we left because of war, so we didn’t go to a dentist … When I arrived in London more than 20 years ago, I didn’t speak English, so I still didn’t go to the dentist … I think when you move from one place to another, you don’t go to the dentist unless you are in real, real pain.

In Istanbul, Mariam has opted not only for the urgent root canal treatment but also a longer and more complex treatment suggested by her consultant, who she says is a renowned doctor from Syria. This will include several extractions and implants of back and front teeth, and when I ask what she thinks of achieving a “Hollywood smile”, Mariam says:

Who doesn’t want a nice smile? I didn’t come here to be a model. I came because I was in pain, but I know this doctor is the best for implants, and my front teeth were rotten anyway.

Dentists in the UK warn about the risks of “overtreatment” abroad, but Mariam appears confident that this is her opportunity to solve all her oral health problems. Two of her sisters have already been through a similar treatment, so they all trust this doctor.

The UK’s ‘dental deserts’

To get a fuller understanding of the NHS dental crisis, I’ve also conducted 20 interviews in the UK with people who have travelled or were considering travelling abroad for dental treatment.

Joan, a 50-year-old woman from Exeter, tells me she considered going to Turkey and could have afforded it, but that her back and knee problems meant she could not brave the trip. She has lost all her lower front teeth due to gum disease and, when I meet her, has been waiting 13 months for an NHS dental appointment. Joan tells me she is living in “shame”, unable to smile.

In the UK, areas with extremely limited provision of NHS dental services – known as as “dental deserts” – include densely populated urban areas such as Portsmouth and Greater Manchester, as well as many rural and coastal areas.

In Felixstowe, the last dentist taking NHS patients went private in 2023, despite the efforts of the activist group Toothless in Suffolk to secure better access to NHS dentists in the area. It’s a similar story in Ripon, Yorkshire, and in Dumfries & Galloway, Scotland, where nearly 25,000 patients have been de-registered from NHS dentists since 2021.

Data shows that 2 million adults must travel at least 40 miles within the UK to access dental care. Branding travel for dental care as “tourism” carries the risk of disguising the elements of duress under which patients move to restore their oral health – nationally and internationally. It also hides the immobility of those who cannot undertake such journeys.

The 90-year-old woman in Dumfries & Galloway who now faces travelling for hours by bus to see an NHS dentist can hardly be considered “tourism” – nor the Ukrainian war refugees who travelled back from West Sussex and Norwich to Ukraine, rather than face the long wait to see an NHS dentist.

Many people I have spoken to cannot afford the cost of transport to attend dental appointments two hours away – or they have care responsibilities that make it impossible. Instead, they are forced to wait in pain, in the hope of one day securing an appointment closer to home.

‘Your crisis is our business’

The indignities of waiting in the UK are having a big impact on the lives of some local and foreign dentists in Turkey. Some neighbourhoods are rapidly changing as dental and other health clinics, usually in luxurious multi-storey glass buildings, mushroom. In the office of one large Istanbul medical complex with sections for hair transplants and dentistry (plus one linked to a hospital for more extensive cosmetic surgery), its Turkish owner and main investor tells me:

Your crisis is our business, but this is a bazaar. There are good clinics and bad clinics, and unfortunately sometimes foreign patients do not know which one to choose. But for us, the business is very good.

This clinic only caters to foreign patients. The owner, an architect by profession who also developed medical clinics in Brazil, describes how COVID had a major impact on his business:

When in Europe you had COVID lockdowns, Turkey allowed foreigners to come. Many people came for ‘medical tourism’ – we had many patients for cosmetic surgery and hair transplants. And that was when the dental business started, because our patients couldn’t see a dentist in Germany or England. Then more and more patients started to come for dental treatments, especially from the UK and Ireland. For them, it’s very, very cheap here.

The reasons include the value of the Turkish lira relative to the British pound, the low cost of labour, the increasing competition among Turkish clinics, and the sheer motivation of dentists here. While most dentists catering to foreign patients are from Turkey, others have arrived seeking refuge from war and violence in Syria, Iraq, Afghanistan, Iran and beyond. They work diligently to rebuild their lives, careers and lost wealth.

Regardless of their origin, all dentists in Turkey must be registered and certified. Hamed, a Syrian dentist and co-owner of a new clinic in Istanbul catering to European and North American patients, tells me:

I know that you say ‘Syrian’ and people think ‘migrant’, ‘refugee’, and maybe think ‘how can this dentist be good?’ – but Syria, before the war, had very good doctors and dentists. Many of us came to Turkey and now I have a Turkish passport. I had to pass the exams to practise dentistry here – I study hard. The exams are in Turkish and they are difficult, so you cannot say that Syrian doctors are stupid.

Hamed talks excitedly about the latest technology that is coming to his profession: “There are always new materials and techniques, and we cannot stop learning.” He is about to travel to Paris to an international conference:

I can say my techniques are very advanced … I bet I put more implants and do more bone grafting and surgeries every week than any dentist you know in England. A good dentist is about practice and hand skills and experience. I work hard, very hard, because more and more patients are arriving to my clinic, because in England they don’t find dentists.

While there is no official data about the number of people travelling from the UK to Turkey for dental treatment, investors and dentists I speak to consider that numbers are rocketing. From all over the world, Turkey received 1.2 million visitors for “medical tourism” in 2022, an increase of 308% on the previous year. Of these, about 250,000 patients went for dentistry. One of the most renowned dental clinics in Istanbul had only 15 British patients in 2019, but that number increased to 2,200 in 2023 and is expected to reach 5,500 in 2024.

Like all forms of medical care, dental treatments carry risks. Most clinics in Turkey offer a ten-year guarantee for treatments and a printed clinical history of procedures carried out, so patients can show this to their local dentists and continue their regular annual care in the UK. Dental treatments, checkups and maintaining a good oral health is a life-time process, not a one-off event.

Many UK patients, however, are caught between a rock and a hard place – criticised for going abroad, yet unable to get affordable dental care in the UK before and after their return. The British Dental Association has called for more action to inform these patients about the risks of getting treated overseas – and has warned UK dentists about the legal implications of treating these patients on their return. But this does not address the difficulties faced by British patients who are being forced to go abroad in search of affordable, often urgent dental care.

A global emergency

The World Health Organization states that the explosion of oral disease around the world is a result of the “negligent attitude” that governments, policymakers and insurance companies have towards including oral healthcare under the umbrella of universal healthcare. It as if the health of our teeth and mouth is optional; somehow less important than treatment to the rest of our body. Yet complications from untreated tooth decay can lead to hospitalisation.

The main causes of oral health diseases are untreated tooth decay, severe gum disease, toothlessness, and cancers of the lip and oral cavity. Cases grew during the pandemic, when little or no attention was paid to oral health. Meanwhile, the global cosmetic dentistry market is predicted to continue growing at an annual rate of 13% for the rest of this decade, confirming the strong relationship between socioeconomic status and access to oral healthcare.

In the UK since 2018, there have been more than 218,000 admissions to hospital for rotting teeth, of which more than 100,000 were children. Some 40% of children in the UK have not seen a dentist in the past 12 months. The role of dentists in prevention of tooth decay and its complications, and in the early detection of mouth cancer, is vital. While there is a 90% survival rate for mouth cancer if spotted early, the lack of access to dental appointments is causing cases to go undetected.

The reasons for the crisis in NHS dentistry are complex, but include: the real-term cuts in funding to NHS dentistry; the challenges of recruitment and retention of dentists in rural and coastal areas; pay inequalities facing dental nurses, most of them women, who are being badly hit by the cost of living crisis; and, in England, the 2006 Dental Contract that does not remunerate dentists in a way that encourages them to continue seeing NHS patients.

The UK is suffering a mass exodus of the public dentistry workforce, with workers leaving the profession entirely or shifting to the private sector, where payments and life-work balance are better, bureaucracy is reduced, and prospects for career development look much better. A survey of general dental practitioners found that around half have reduced their NHS work since the pandemic – with 43% saying they were likely to go fully private, and 42% considering a career change or taking early retirement.

Reversing the UK’s dental crisis requires more commitment to substantial reform and funding than the “recovery plan” announced by Victoria Atkins, the secretary of state for health and social care, on February 7.

The stories I have gathered show that people travelling abroad for dental treatment don’t see themselves as “tourists” or vanity-driven consumers of the “Hollywood smile”. Rather, they have been forced by the crisis in NHS dentistry to seek out a service 1,500 miles away in Turkey that should be a basic, affordable right for all, on their own doorstep.

*Names in this article have been changed to protect the anonymity of the interviewees.

For you: more from our Insights series:

GP crisis: how did things go so wrong, and what needs to change?

Insomnia: how chronic sleep problems can lead to a spiralling decline in mental health

To hear about new Insights articles, join the hundreds of thousands of people who value The Conversation’s evidence-based news. Subscribe to our newsletter.

Diana Ibanez Tirado receives funding from the School of Global Studies, University of Sussex.

pound pandemic treatment therapy spread recovery iran brazil european europe uk germany ukraine world health organizationInternational

Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

The struggling chain has given up the fight and will close hundreds of stores around the world.

It has been a brutal period for several popular retailers. The fallout from the covid pandemic and a challenging economic environment have pushed numerous chains into bankruptcy with Tuesday Morning, Christmas Tree Shops, and Bed Bath & Beyond all moving from Chapter 11 to Chapter 7 bankruptcy liquidation.

In all three of those cases, the companies faced clear financial pressures that led to inventory problems and vendors demanding faster, or even upfront payment. That creates a sort of inevitability.

Related: Beloved retailer finds life after bankruptcy, new famous owner

When a retailer faces financial pressure it sets off a cycle where vendors become wary of selling them items. That leads to barren shelves and no ability for the chain to sell its way out of its financial problems.

Once that happens bankruptcy generally becomes the only option. Sometimes that means a Chapter 11 filing which gives the company a chance to negotiate with its creditors. In some cases, deals can be worked out where vendors extend longer terms or even forgive some debts, and banks offer an extension of loan terms.

In other cases, new funding can be secured which assuages vendor concerns or the company might be taken over by its vendors. Sometimes, as was the case with David's Bridal, a new owner steps in, adds new money, and makes deals with creditors in order to give the company a new lease on life.

It's rare that a retailer moves directly into Chapter 7 bankruptcy and decides to liquidate without trying to find a new source of funding.

Image source: Getty Images

The Body Shop has bad news for customers

The Body Shop has been in a very public fight for survival. Fears began when the company closed half of its locations in the United Kingdom. That was followed by a bankruptcy-style filing in Canada and an abrupt closure of its U.S. stores on March 4.

"The Canadian subsidiary of the global beauty and cosmetics brand announced it has started restructuring proceedings by filing a Notice of Intention (NOI) to Make a Proposal pursuant to the Bankruptcy and Insolvency Act (Canada). In the same release, the company said that, as of March 1, 2024, The Body Shop US Limited has ceased operations," Chain Store Age reported.

A message on the company's U.S. website shared a simple message that does not appear to be the entire story.

"We're currently undergoing planned maintenance, but don't worry we're due to be back online soon."

That same message is still on the company's website, but a new filing makes it clear that the site is not down for maintenance, it's down for good.

The Body Shop files for Chapter 7 bankruptcy

While the future appeared bleak for The Body Shop, fans of the brand held out hope that a savior would step in. That's not going to be the case.

The Body Shop filed for Chapter 7 bankruptcy in the United States.

"The US arm of the ethical cosmetics group has ceased trading at its 50 outlets. On Saturday (March 9), it filed for Chapter 7 insolvency, under which assets are sold off to clear debts, putting about 400 jobs at risk including those in a distribution center that still holds millions of dollars worth of stock," The Guardian reported.

After its closure in the United States, the survival of the brand remains very much in doubt. About half of the chain's stores in the United Kingdom remain open along with its Australian stores.

The future of those stores remains very much in doubt and the chain has shared that it needs new funding in order for them to continue operating.

The Body Shop did not respond to a request for comment from TheStreet.

bankruptcy pandemic canada-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex