‘We’ll see about 200 chains connected through Cosmos’ IBC next year,’ says Tendermint CEO Peng Zhong

In an exclusive interview with Cointelegraph, Peng Zhong, CEO of Tendermint, the core developer of the Cosmos blockchain, discussed recent cutting-edge advancements in the ecosystem.

Ever since the launch of the inter-blockchain…

In an exclusive interview with Cointelegraph, Peng Zhong, CEO of Tendermint, the core developer of the Cosmos blockchain, discussed recent cutting-edge advancements in the ecosystem.

Ever since the launch of the inter-blockchain communications, or IBC, protocol in March, which enabled the communication and transfer of digital assets across different blockchains, development activity seems to have picked up pace on the Cosmos (ATOM) network.

Transaction volumes, the creation of decentralized applications and the number of chains connected via IBC have all been trending upwards in recent months. Speakers at the Cosmoverse Conference, which took place last week, presented many of the latest technologies under development on the blockchain. Its biggest-ever hackathon will also take place in Lisbon tomorrow.

#HackAtomVI is trending in the dev community!

— Cosmos - Internet of Blockchains ⚛️ (@cosmos) November 9, 2021

1000+ Developers Have Already Registered to the Biggest HackAtom in Cosmos History!

Don't miss your chance to win $1M+ in Prize Pool and start your journey in the Internet of Blockchains with a Bang!https://t.co/TqAedC16jn pic.twitter.com/w1hasCxyQo

Tendermint is the core developer behind the Cosmos blockchain and serves as its gateway to the ecosystem. On Wednesday morning, Peng Zhong, the company's CEO, joined Cointelegraph in an exclusive interview to discuss the future of the Cosmos network.

Cointelegraph: What are some of the development highlights surrounding the Cosmos blockchain in terms of the decentralized finance, or DeFi, ecosystem?

Peng Zhong: I think the biggest highlight was early this year when Inter-Blockchain Communications (IBC) launched on the Cosmos hub for the first time. Not much happened after that. People were like, okay, IBC is live, now what do I do? But now, we are seeing 22 blockchains that support IBC. They have all been able to connect to various decentralized exchanges (DEXs) available in the Cosmos ecosystem, such as Osmosis, Gravity DEX. So there's been a lot of cross-chain activity, much more than anyone expected. And we are seeing a very positive growth cycle with IBC enabled.

Total transaction volume on the Cosmos blockchain in the past 30 days. | Source: ATOMSc

CT: Interesting, so where do you see the IBC ecosystem heading, say, five years from now?

PZ: That's very far in the future. I was going to present tomorrow that we are seeing 22 chains today, and next, we'll see about 200 chains connected through IBC next year. I haven't thought about five years out, but my long-term vision running Tendermint and with our focus on bringing more users to Cosmos and a better development experience to the Cosmos Stack. We'll see a million blockchains in the future. Five years from now, I would expect that number to be tens of thousands, if not hundreds of thousands of chains linked through IBC. And that'll be absolutely spectacular, but we have a lot of work to do on the infrastructure side to handle all that encrypted data.

CT: Regarding the recent Cosmosverse, an intriguing development that came up was the concept of liquid staking. Would you mind providing more information on that?

PZ: I believe there are at least three different implementations of liquid staking as presented at Cosmoverse. It was a fantastic conference; I met many people who've been working in this space during the pandemic and never got a chance to see them face to face until now. And then people working at Cosmos for over five years and are still around -- and it speaks to the strength of the ecosystem. So liquid staking at a high level is the ability to allow users to double-dip with their assets. Most commonly, in proof-of-stake (PoS) protocols, you need to stake your tokens to secure the network as a user. And by staking your tokens, you earn yields. For the Cosmos Hub, it's generally between 7% to 20% APY. But then you look at some DeFi protocols, for example, Osmosis or other DEXs built on Cosmos, and you can see that during the launch of these DEXs, they [the developers] want to increase liquidity.

So APYs can be at thousands of percent within a few weeks or hundreds of percent for a few months. And they are much much higher than staking yield. So there is this constant battle, or tug of war, between the incentives for staking, which is to secure the network and is good for everyone, but you earn minimal yield. This is compared to incentives provided by DEXs for acting as liquidity providers, which is very tantalizing. So liquid staking is the ability to allow you as a staker to stake your assets, but at the same time, you get a token that represents your staked position.

So if you stake 100 ATOM, instead of receiving nothing in return other than a steady stream of staking rewards, you would receive [both] staking rewards in ATOM, and you would receive a staked version of your ATOM, let's say sATOM. And that is only IBC-enabled, which means you get to permissionlessly transfer it to DEXs and use that to provide liquidity in pools. That's the general idea of liquid staking —It's a big feature that's coming to multiple blockchains at once.

The version that's coming to the Cosmos hub is more standard, it's where you stake the assets, and you get a token that you can use interchain. The version proposed by Osmosis is called Superfluid staking, which is the ability to provide liquidity in a DEX while being issued liquidity provider tokens (LPs) back, which you can use to stake on the blockchain. So whether you LP first or stake first, you always get the representation you can use across IBC, which is a lot of flexibility and freedom.

However, it adds a lot of added risk because this is now like a second-level derivative of your original token. So if anything breaks down along the way, you might be in trouble. But for those of you who have a big appetite for risk, liquid staking offers more than what you can get off traditional yields.

CT: Is this technology theoretically applicable to all kinds of pools? For example, can I receive a lending token to back deposit into a staking pool to earn yields if I lend out my crypto?

PZ: Exactly, you're on the right track. And there can be many levels of this, and each level gives added risk to your portfolio, so it's a matter of figuring out how much risk you are willing to take. A lot of this [liquid staking] has happened in Ethereum due to the power of ERC-20 tokens, but it's only started to be developed in the Cosmos ecosystem. And of course, in Cosmos, there is an added layer of complexity on top due to the differences in the level of security. So part of the proposed benefit of liquid staking is the ability to share security between multiple chains at once. Which is sort of a looser version of Ethereum where everything is secured by the token.

CT: Another recent development discussed at Cosmoverse is ABCI++ and how it can help improve cross-chain functionality and oracles. Would you mind elaborating more on that?

So the Tendermint Core protocol hasn't been updated in quite a long time in terms of new features. And ABCI++ is a very big new feature. What it does is that it increases the features that Tendermint Core can support. So right now, a function can be run at the end of every single block, which is what all Cosmos blockchains use to do their business logic. At the end of every single block, which on Cosmos, is usually six to seven seconds, some activity can happen. But the Tendermint Core Consensus, while it does create consensus around new blocks, it's not a single-step process; in fact, it's a five-step process of block consensus creation.

There's, in fact, a built-in block explorer in the past, which hasn't been updated much, but actually shows every step of Tendermint block consensus. What ABCI++ is, is that it allows a developer to tap into each one of these five steps. You can imagine them. Instead of just admitting one event for every block that's complete, it admits now five events, and now you can pick and choose which step you want to admit to a consensus that you want to run for that function. And that introduces a lot of potential for more efficient calculations.

The New [v0.35] #TendermintCore Release:

— Tendermint (@tendermintHQ) November 5, 2021

• Prioritized Mempool

• Peer-to-peer Network Makeover

• StateSync Improvements

• Go API Internalization and Stability

…and additional Great Features to discover https://t.co/zXP4t6EBiF pic.twitter.com/zQtV6paZgm

CT: Is Tendermint taking any steps to introduce Cosmos into the Metaverse?

PZ: Yeah, so I think the Metaverse is quite undefined right now. It's everyone building things as Web 3.0. Of course, Facebook can take a claim that they're building the Metaverse, but it's only going to be Facebook's wall garden Metaverse. There's going to be Google's wall garden Metaverse and Apple's version of that. I would assume Steam and Epic Games have their own version. But the version that most of us want today is open-ended and permissionless.

CT: What are some of the highlights of the upcoming hackathon?

PZ: So it's the biggest Cosmos hackathon. And I think Cosmos is the second largest crypto ecosystem in the world, with over $170 billion [of assets] built on the Cosmos infrastructure. It's a very significant event for the world at large. Zooming out a little bit and looking at what happened last year, which was on a much smaller scale. That was when this proof of concept DEX project called Osmosis won the biggest prize. And today, Osmosis is a live blockchain with over $700 million in TVL [total value locked]. Maybe it's a fluke, but I'm hoping to see projects of this caliber this year. This time around, we have far more prize categories — I believe it's seven, each with over $200,000 worth of prizes. This wide array of prizes is our way of making sure people are solving a diverse set of problems. There's so much unbuilt infrastructure, and it doesn't make sense to award only one prize.

Growth of TVL on the Osmosis DEX. | Source: DeFi Llama

CT: Would you like to share any other comments or visions regarding Tendermint and the Cosmos blockchain?

PZ: Yes, I believe that Cosmos is the only ecosystem that tries to democratize access to finance, more so than any other ecosystem. Because in Cosmos, you don't need to buy a token to get involved in the ecosystem. When you build on Cosmos, you don't have to buy anything. You don't have to pay for gas, and that I believe is something very valuable in economies where you can't really afford expensive transactions, and when you don't really have the capital to really experiment with these hybrid ecosystems, like Polkadot or Avalanche or Polkadot or Ethereum, and appealing to people with time. Young people with time but no capital are out of Web 1.0 today, and Cosmos will win Web 3.0. And that's really the core mission of Tendermint, to bring newcomers, make it as easy as possible to build things, and we welcome everyone.

ethereum blockchain crypto pandemic cryptoUncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

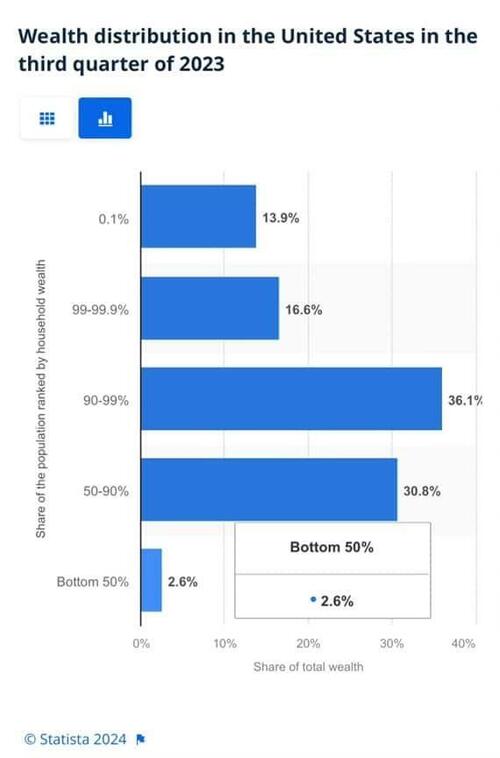

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

International

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges