Week Ahead – Taper Debate in Focus

Country US A blockbuster nonfarm payroll report has moved forward taper expectations and allowed the yield curve to steepen. The labor market recovery is accelerating as temporary layoffs and permanent job losses dramatically improve. Wall Street will…

Country

US

A blockbuster nonfarm payroll report has moved forward taper expectations and allowed the yield curve to steepen. The labor market recovery is accelerating as temporary layoffs and permanent job losses dramatically improve.

Wall Street will pay close attention to Wednesday’s July inflation report which should show prices increased again. Persistent inflation worries are showing some signs of easing, but the peak is still not in place. Friday’s consumer sentiment report along with inflation expectations could prove to be market moving. Inflation expectations are already at a 13-year high and that could help support persistent pricing pressures.

Next week, investors will closely pay attention to Fed speak and any comments over tapering following this impressive nonfarm payroll report. On Monday, Fed’s Bostic and Barkin will speak separately. Tuesday, Fed’s Mester will discuss inflation risks. Wednesday is busy with appearance from Fed’s Logan, Bostic, and George.

EU

A quiet week on the data front for the euro area, with the ZEW data on Tuesday the standout.

The PMIs this week were very encouraging and the vaccine program is continuing to improve, which is promising for the coming months.

UK

The data out of the UK this week has remained strong, albeit with the expected negative points, most notably supply side issues and the “pingdemic”.

The Bank of England remains positive about the outlook, having improved its growth and unemployment forecasts and set out plans for tapering of asset purchases and rate hikes. Neither will happen soon, despite the inflation overshoot, with numerous downside risks remaining including delta and the end of the furlough scheme.

Next week offers mostly tier three data, the one exception being second quarter preliminary GDP.

Emerging Markets

Russia

No major data releases next week.

The central bank recently raised rates to 6.5% and warned that more may follow.

South Africa

Manufacturing and business confidence data next week, both of which are low tier releases.

The central bank previously left interest rates unchanged and signaled a hike may be considered later in the year.

Turkey

A plethora of data over the next week leading up to the central bank meeting and rate decision. With inflation now running just shy of the benchmark interest rate, pressure will be on the CBRT to avoid cutting interest rates despite President Erdogan pushing for cuts after sacking another Governor earlier this year.

Asia Pacific

China

Market sentiment has been dominated by the China government’s crackdown on the tech sector and now the education sector with Mainland and Hong Kong exchanges, as well as US-listed China companies taking a bath this week. Concerns are also rising in the corporate credit sector as S&P became the third major rating agency to downgrade Evergrande debt. This time CCC and other Chinese corporate dollar-denominated debt remain under pressure. Regulatory risk will overshadow another busy data week.

In a more ominous development, delta-variant Covid-19 has appeared in a number of Mainland cities, albeit in small numbers. Readers should pay close attention to these numbers over the weeknd and through next week. China succumbing to the latest virus variant, or having to lock down huge parts of the country, is a game-changer. Apart from China itself, think Asia growth and more supply chain disruption. A deteriorating situation will be a huge negative for China markets, but also regional equities and also developed markets like Australia and the US.

China releases its trade balance this weekend and any number under $50 billion will be a negative, indicating slowing growth. China Inflation released on Monday should be benign but poor trade data will add to the headwinds for China equity markets.

India

The Indian Rupee has recovered over the past week due to lower oil importer buying, with Covid-indced demand still weak. Additionally INR has seen inflows from international investors who have been fleeing China markets and rotating into India and ASEAN markets.The Sensex has risen nearly 3.50% this week, making it one of the regions best performers.

The Reserve Bank of India maintained its suite of policy rates unchanged with no change to the QE programme on Friday, despite stagflationary pressures. Like other Asian central banks, the focus is on the domestic Covid-19 economic recovery. The INR briefly fell but quickly recovered losses and is set to continue rallying next week on further investor inflows.

India releases Inflation, Industrial Production and Exports/Imports at the end of next week, but with the RBI out of the way, all should have low market impact. India’s biggest threat remains a resurgence of the virus. A positive for the currency but negative for equities.

Australia & New Zealand

AUD and NZD trading on Monday could be very choppy with both Singapore and Japan on holiday, severely reducing market liquidity.

Australian markets are showing surprising resilience as lockdown expands to Newcastle, Brisbane and Melbourne once again. Some 60% of Australia’s population is now under some sort of restriction with Sydney virus cases continuing to climb on a daily basis. An unchanged RBA had little market impact and Australian equities seem content to follow Wall Street, with Australia’s commodity export machine still firing on all cylinders judging by trade balance data this week.

NAB Business Confidence on Tuesday and Employment Change on Friday will cause some volatility, especially if the numbers are on the low side, heightening fears of the domestic economy slipping back into a Covid-induced recession. The AUD is most likely to suffer as markets price lower for longer from the RBA, but equities will likely take that as positive news in a zero percent fixed interest world.

Swings in global risk sentiment will continue to influence short-term moves in AUD and NZD.

Huge employment numbers this week saw market prices in the first of three RBNZ rate hikes this year, starting this month. The NZD has performed strongly versus the AUD, USD and other low yielders. I expect NZD/USD to rise through 0.7100 this week on its way to 0.7300. Only the arrival of Covid-19 in the community would change the outlook for NZ. Firm Electronic Retail Card Spending Tuesday makes a rate hike a certainty.

Japan

Japan markets are closed on Monday for a national holiday. Japanese stocks indexes continue to slavishly follow moves in the major US markets, ignoring drivers in other parts of Asia. Japan’s Current Account and PPI are the week’s highlights, but only a huge downside miss on either is likely to shake markets.

Japan expanded its Covid-19 states of emergencies and cases and hospitalizations are spiralling. Markets are for the most part ignoring these situations and only hard lockdowns is likely to be a negative for equities.

USD/JPY has dissolved into a purely US/Japan interest rate differential play and I expect this to continue.

Markets

Oil

Oil prices continue to see risk come off over delta variant fears and a stronger dollar. The oil market heavily remains in deficit, but the short-term hit to demand is weighing on prices. After last week’s surprise increase in US stockpiles, energy traders will closely watch to see if that is becoming a trend.

The focus will shift back to Iran nuclear deal negotiations now that Iran President Raisi has taken office. The supply outlook for crude remains very uncertain, but it seems we could see a more conciliary tone out of Iran which could support the expectation that sanction relief could happen closer to year end.

Gold

Gold prices did not stand a chance following a very strong nonfarm payroll report. This employment report was terrible for gold as it did not support needs for safe-havens and given a good chunk of the wage gains is from low-paying jobs, it did not do much for driving inflation hedges.

Gold could have further downward pressure as Fed tapering bets grow following this strong NFP beat, upward revisions, and strong declines with both temporary layoffs and permanent job losses.

Gold is in the danger zone after breaking below key moving averages, longer-term trendlines, and prior support levels. Gold may find some support from the $1,750 level, but if that breaks prices could tumble towards the psychological $1700 level.

Bitcoin

Bitcoin is once again testing the upper boundaries of its recent trading range. Now back above the $40,000 level and holding up nicely despite a strong dollar, bullish technical buying could accelerate over any fresh endorsements on Wall Street.

It is worth noting that Ethereum momentum is gaining following their latest network upgrade. Ethereum dominance could become the theme over the coming months.

Key Economic Events

Monday, Aug. 9

– Atlanta Fed President Bostic discusses building an inclusive economy at a virtual event hosted by the Greater Fort Lauderdale Alliance Foundation’s Prosperity Partnership.

– Richmond Fed President Barkin speaks to the Roanoke Regional Chamber.

-Bulgarian lawmakers may vote this week on a minority government proposed by ITN, the winner of inconclusive July do-over elections.

-Japan observes the Mountain Day holiday.

Economic data and events:

- China money supply, new yuan loans, PPI, CPI

- Germany Trade

- Indonesia consumer confidence

- Australia foreign reserves

- Mexico CPI

Tuesday, Aug. 10

– Cleveland Fed President Mester discusses inflation risks versus Europe at a virtual event hosted by her bank.

– Poland’s government takes aim at US-owned broadcaster

Economic data and events:

- Australia NAB business confidence

- Germany ZEW survey expectations

- Czech Republic CPI

- Hungary CPI

- Philippines GDP

- Japan bank lending, BoP, bankruptcies

- New Zealand REINZ house sales

- South Africa manufacturing production

Wednesday, Aug. 11

– Atlanta Fed President Bostic discusses the Fed’s role in making the economy more inclusive at a virtual event hosted by the Chautauqua Institution.

– Kansas City Fed President George delivers a keynote address at the virtual annual NABE Economic Measurement Seminar.

– New York Fed EVP Logan speaks at the virtual Financial Crisis Forum, hosted by the Bank for International Settlements and the Yale Program of Financial Stability.

Economic data and events:

- US July CPI M/M: 0.5%E V 0.9% prior; Y/Y: 5.3%e v 5.4% prior

- Germany CPI

- Japan M2 money stock, machine tool orders

- Mexico industrial production

- Singapore GDP

- Australia Westpac consumer confidence

- Russia trade

- EIA Crude Oil Inventory Report

Thursday, Aug. 12

Economic data and events:

- US initial jobless claims, PPI

- USDA World Agricultural Supply and Demand Report (WASDE)

- Eurozone Industrial production

- Turkey Industrial production

- India industrial production, CPI, trade

- Japan PPI

- UK Trade balance

- Mexico Rate decision: Banxico to raise Overnight Rate by 25 basis points

- Turkey Rate decision: CBRT to stick with a tight stance as it holds rates despite surging inflation

- New Zealand food prices, 2-year inflation expectation

- UK industrial production, manufacturing production, GDP

- OPEC monthly report

Friday, Aug. 13

Economic data and events:

- US Aug Prelim University of Michigan consumer sentiment: 81.2e v 81.2 prior

- France unemployment, CPI

- New Zealand Manufacturing PMI

- Russia GDP

- Poland GDP, CPI

- Thailand forward contracts, foreign reserves

- Turkey current account balance

- Czech Republic current account

Sovereign Rating Updates:

– Turkey (Fitch)

– Hungary (S&P)

– Sweden (S&P)

– Ireland (Moody’s)

– Belgium (DBRS)

yield curve covid-19 emerging markets equities stocks bitcoin ethereum euro yuan gold oilUncategorized

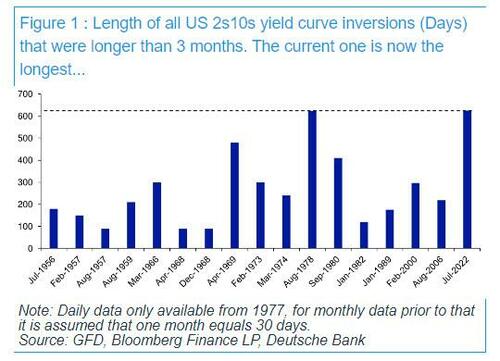

After 625 Days, The Longest Yield Curve Inversion In History

After 625 Days, The Longest Yield Curve Inversion In History

Today is a historic day, as last night – DB’s Jim Reid reminds us – we quietly…

Today is a historic day, as last night - DB's Jim Reid reminds us - we quietly passed the longest continuous US 2s10s inversion in history. After the 2s10s first inverted at the end of March 2022, it has now been continuously inverted for 625 days since July 5th 2022. That exceeds the 624 day inversion from August 1978, which previously held the record.

As regular readers are aware, an inverted yield curve has been the best predictor of a US downturn of any variable through history: the yield curve has always inverted before all of the last 10 US recessions, with a lag that is usually 12-18 months, but some cycles - certainly this one - take longer.... much longer.

In fact, the lack of a recession so far has prompted Red to ask - in his latest Chart of the Day note - if the inverted yield curve recession indicator has failed this cycle?

"Possibly", the DB strategist responds, "but in many ways the yield curve has already accurately predicted many of the drivers that would normally lead to a recession. However, these variables haven't then created recessionary conditions as they normally would have done." He explains:

It led, as it always does, the very sharp deterioration in bank lending standards, and led the declines in bank credit and money supply that are almost unique to this cycle. It was also at the heart of why we had some of the largest bank failures on record with SVB, Signature Bank and First Republic collapsing. A significant part of their failure was a big carry trade that went wrong when the curve inverted.

However, even with the above, a recession - according to the highly political "recession authority" known as the NBER - hasn't materialised. This is perhaps because of the following.

- When lending standards were at their tightest, the borrowing needs of the economy were low relative to previous cycles.

- Excess savings have been unusually high in this cycle (and were revised higher with the GDP revisions last September), so consumers haven't been as exposed to tight credit as they normally are.

- The Fed unveiled a huge series of measures to ensure the regional bank crisis didn't naturally unravel as it would have done in a free market or perhaps in many previous cycles.

- Whilst the Fed’s tightening has been reducing demand, the supply-side of the economy has bounced back strongly from the pandemic disruption, which has further supported growth and made this cycle unique.

So far so good, however, an inverted yield curve should ultimately be a significant headwind for an economy, as capitalism works best when there is a positive return for taking more risk with lending and investments further out the curve. As such, Reid notes, "the rational investor should be prepared to keep more of their money at the front end, or not lend long-term when the curve is inverted" as you are not giving up yield for being able to sleep at night.

So thanks to a historic flood of fiscal stimulus and a daily orgy of new record debt as discussed earlier...

... which means that the US is now running a 6.5% deficit with unemployment near "historical lows", an unheard of event....

... the economy has not succumbed to the inverted yield curve to date, but while it remains inverted the Fed is encouraging more defensive behavior at some point if sentiment changes. As such, the DB strategist concludes that "the quicker we get back to a normal sloping yield curve the safer the system is."

Spread & Containment

Another major retailer cracks down on self-checkout at its stores

The value retailer is discouraging theft at its self-checkout counters by introducing more associate-assisted checkout transactions in its stores.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemicGovernment

CCP-Linked Virologist Fired After Transferring Ebola From Winnipeg To Wuhan Resurfaces In China – And Is Collaborating With Military Scientists

CCP-Linked Virologist Fired After Transferring Ebola From Winnipeg To Wuhan Resurfaces In China – And Is Collaborating With Military Scientists

…

A virologist who had a "clandestine relationship" with Chinese agents and was subsequently fired by the Trudeau government has popped back up in China - where she's conducting research with Chinese military scientists and other virology researchers, including at the Wuhan Institute of Virology, where she's allegedly studying antibodies for coronavirus, as well as the deadly Ebola and Niaph viruses, the Globe and Mail reports.

Xiangguo Qiu and her husband Keding Cheng were fired from the National Microbiology Laboratory in Winnipeg, Canada and stripped of their security clearances in July of 2019.

Declassified documents tabled in the House of Commons on Feb. 28 show the couple had provided confidential scientific information to China and posed a credible security threat to the country, according to the Canadian Security Intelligence Service.

The Globe found that Dr. Qiu’s name appears on four Chinese patent filings since 2020, two with the Wuhan Institute of Virology – whose work on bat coronaviruses has placed it at the centre of concerns that it played a role in the spread of COVID-19 – and two with the University of Science and Technology of China, or USTC. The patents relate to antibodies against Nipah virus and work related to nanobodies, including against coronaviruses. -Globe and Mail

Canadian authorities began questioning the pair's loyalty, as well as the potential for coercion or exploitation by a foreign entity, according to more than 600 pages of documents reported by The Counter Signal.

Highlights (via CTVNews.ca):

- Qiu and Cheng were escorted out of Winnipeg's National Microbiology Laboratory in July 2019 and subsequently fired in January 2021.

- The pair transferred deadly Ebola and Henipah viruses to China's Wuhan Institute of Virology in March 2019.

- The Canadian Security Intelligence Service assessed that Qiu repeatedly lied about the extent of her work with institutions of the Chinese government and refused to admit involvement in various Chinese programs, even when evidence was presented to her.

- [D]espite being given every opportunity in her interviews to describe her association with Chinese entities, "Ms. Qiu continued to make blanket denials, feign ignorance or tell outright lies."

- A November 2020 Public Health Agency of Canada report on Qiu says investigators "weighed the adverse information and are in agreement with the CSIS assessment."

- A Public Health Agency report on Cheng's activities says he allowed restricted visitors to work in laboratories unescorted and on at least two occasions did not prevent the unauthorized removal of laboratory materials.

- Cheng was not forthcoming about his activities and collaborations with people from government agencies "of another country, namely members of the People's Republic of China."

Following their firings, Qiu returned to China despite it being under a pandemic travel lockdown until January, 2023.

"It’s very likely that she received quite preferential treatment in China on the basis that she’s proven herself. She’s done a very good job for the government of China," said Brendan Walker-Munro, senior research fellow at Australia’s University of Queensland Law School. "She’s promoted their interests abroad. She’s returned information that is credibly useful to China and to its ongoing research."

More via the Globe and Mail;

Documents reviewed by The Globe show that Dr. Qiu is most closely aligned with the University of Science and Technology of China (USTC) in Hefei. In March, 2023, a document posted by a Chinese pharmaceutical company listed Dr. Qiu as second amongst “major completion personnel” on a project awarded by the Chinese Preventive Medicine Association for study related to an anti-Ebola virus therapeutic antibody. Most of the other completion personnel were associated with the Chinese People’s Liberation Army.

USTC was founded by the Chinese Academy of Sciences and initially established to build up Chinese scientific expertise useful to the military, which at the time was pursuing technology to build satellites, intercontinental ballistic missiles and atomic bombs. The university has continued to maintain close military ties.

The document says Dr. Qiu works for USTC. Jin Tengchuan, the principal investigator at the Laboratory of Structural Immunology at USTC, lists her as a co-inventor on a patent. Mr. Jin did not respond to requests for comment.

A person who answered the phone at USTC told The Globe, “I don’t have any information about this teacher.”

In 2012, USTC signed a strategic co-operation agreement with the Army Engineering University of the People’s Liberation Army, designed to strengthen research on cutting-edge technology useful for communications, weaponry and other national-defence priorities.

Dr. Qiu is also listed as a 2019 doctoral supervisor for students studying virology at Hebei Medical University.

“Well, that makes me wonder what circumstances she was under when she emigrated to Canada. Why did she come?” asked Earl Brown, a professor emeritus of biochemistry, microbiology and immunology at the University of Ottawa’s faculty of medicine who has worked extensively in China in the past. “People leave for more freedom from China, or to make more money. But China keeps tabs on most people so I am not sure if she came over to infiltrate or whether she came and the infiltration happened later through contact with China.”

It may be impossible to answer that question. Three former colleagues at the National Microbiolgy Lab have indicated that Dr. Qiu and her husband were diligent and pleasant to deal with, but largely kept to themselves outside of work. They say Dr. Qiu was a brilliant scientist with a strong work ethic, although her English was weak. The Globe is not identifying the three who did not want to be named.

Dr. Qiu is a medical doctor from Tianjin, China, who came to Canada for graduate studies in 1996. She started at the University of Manitoba, but began working at the national lab as a research scientist in 2006, working her way up to become head of the vaccine development and antiviral therapies section in the National Microbiology Laboratory’s special pathogens program.

She was also part of the team that helped develop ZMapp, a treatment for the deadly Ebola virus, which killed more than 11,000 people in West Africa between 2014 and 2016.

“My sense is this was part of a larger strategy by China to get access to our innovation system,” said Filippa Lentzos, an associate professor of science and international security at King’s College London. “It was a way for them to to find out what was going on in Canada’s premier lab.”

Initially trained as a medical doctor, Dr. Qiu graduated in 1985 from Hebei University in the coastal city of Tianjin, which lies southeast of Beijing. Dr. Qiu went on to obtain her master of science degree in immunology at Tianjin Medical University in 1990.

Her career at Canada’s top infectious disease lab in Winnipeg began in 2003, only four years after Ottawa opened this biosafety level 4 facility at the Canadian Science Centre for Human and Animal Health.

Over time, she built up a reputation for academic collaboration, particularly with China. It was welcomed by management who felt her work was helping build a name internationally for the National Microbiology Lab.

By the time Canadian officials intervened in 2018 and began investigating, documents show, Dr. Qiu was running 44 separate projects at the Winnipeg lab, an uncommonly large workload.

Her work with former colleague and microbiologist Gary Kobinger vaulted Dr. Qiu into the international spotlight. The pair developed a treatment for Ebola, one that in its first human application led to the full recovery of 27 patients with the infection during a 2014 outbreak in Liberia.

Mr. Kobinger’s career continued to soar and he is now director of the Galveston National Laboratory, a renowned biosafety level 4 facility in Texas. In 2022, he told The Globe that it was “heartbreaking” to see what had happened to his colleague. He declined to speak for this article.

“She had lost a lot of weight with all the stress. She was so convinced that this was all a misunderstanding … and she would go back to her job,” he said in 2022. “ Her career has been destroyed with all this. She was one of the top female Canadian scientists of virology and Canada has lost that.”

Over a period of 13 months, though, the Chinese-Canadian microbiologist and her biologist husband’s lives were turned upside down.

She went from being feted at Ottawa’s Rideau Hall with a Governor-General’s Award in May, 2018, to being locked out of the Winnipeg lab in July, 2019 – the high-security facility where she had made her name as a scientist in Canada. By January, 2021, she and Mr. Cheng were fired.

Last month, after being pressed into explaining what happened, the Canadian government finally disclosed the reasons for this extraordinary dismissal: CSIS found the pair had lied about and hid their co-operation with China from Ottawa.

A big question remains following their departure: Why would Dr. Qiu risk her career, including the stature associated with developing an Ebola treatment, for China?

Read the rest here...

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges