Uncategorized

Warren Buffett’s Advice on Stocks vs. Bonds

In October 2010, Warren Buffett thought that stocks were far more attractive than bonds, a prediction that proved to be accurate.

“It’s quite clear that stocks are cheaper than bonds. I can’t imagine anybody having bonds in their portfolio when they can own equities, a diversified group of equities. But people do because they, the lack of confidence. But that’s what makes for the attractive prices. If they had their confidence back, they wouldn’t be selling at these prices. And believe me, it will come back over time.”

— Warren Buffett, October 5, 2010

From our perspective in mid-2023, Warren Buffett’s advice in late 2010 seems obvious, but it was not self-evident at the time. The United States had recently emerged from a financial crisis and it took years for investors to regain confidence. In retrospect, most of the fluctuations that seemed meaningful to us on a day-to-day basis have receded into mere noise when we zoom out and look at markets over a period of many years.

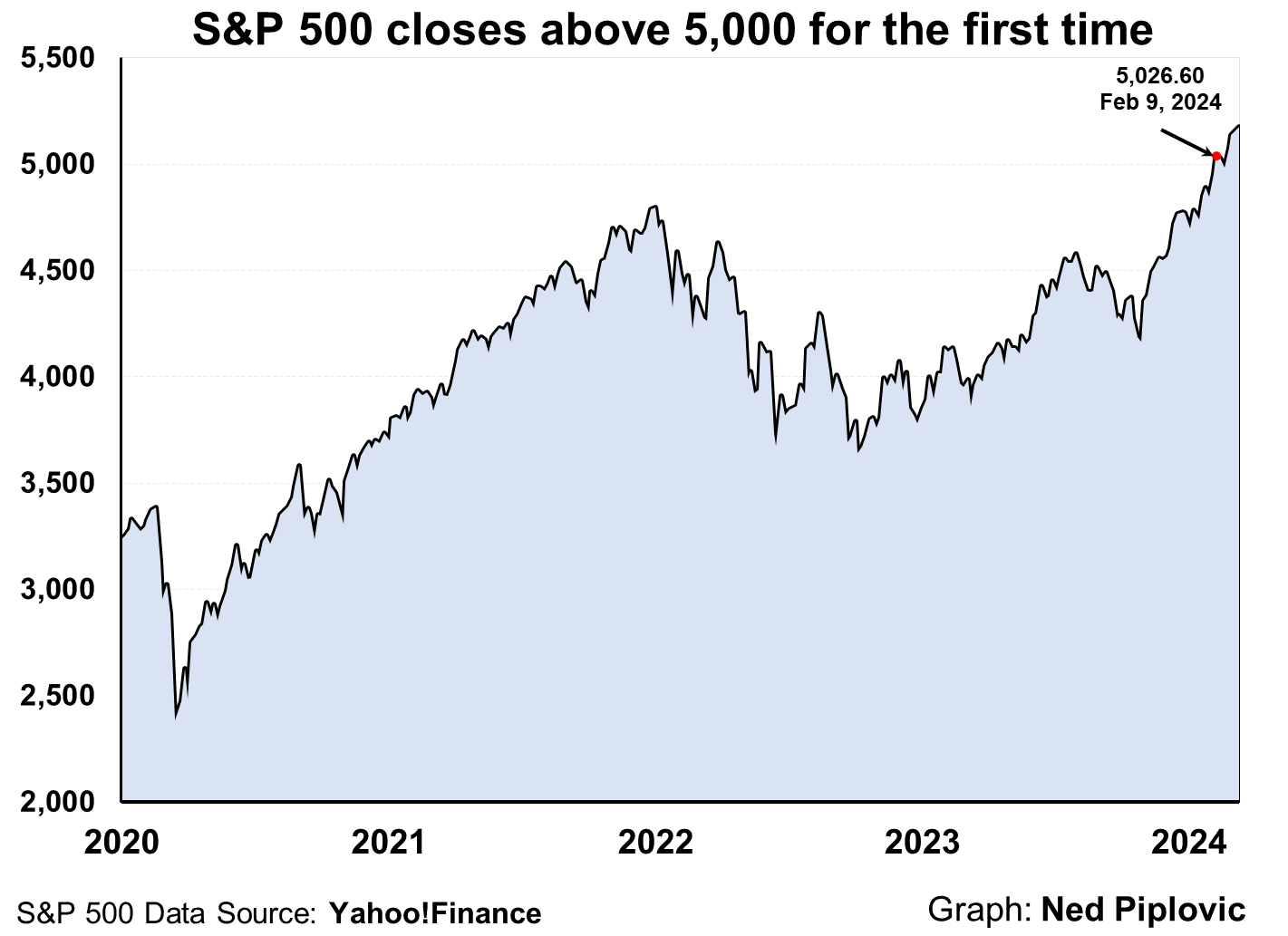

With the benefit of hindsight, Mr. Buffett’s observations nearly thirteen years ago were exactly on target. From October 2010 to May 2023, the S&P 500 posted an annualized return of 10.7%. Those who reinvested dividends would have achieved a 12.7% annualized return over that timeframe. Berkshire Hathaway Class A shares have compounded at an annualized rate of 11.8% since October 4, 2010.

Stocks have done very well indeed, just as Mr. Buffett predicted. How does this compare to the experience of bond investors over the same timeframe?

When I listen to Mr. Buffett comment on bonds, I usually think of treasury securities because Berkshire Hathaway tends to concentrate its fixed maturity investments in treasuries rather than accept credit risk. The occasional drama over the debt ceiling notwithstanding, treasury securities are considered very safe when it comes to credit risk. This lack of credit risk usually comes at the cost of relatively low returns.

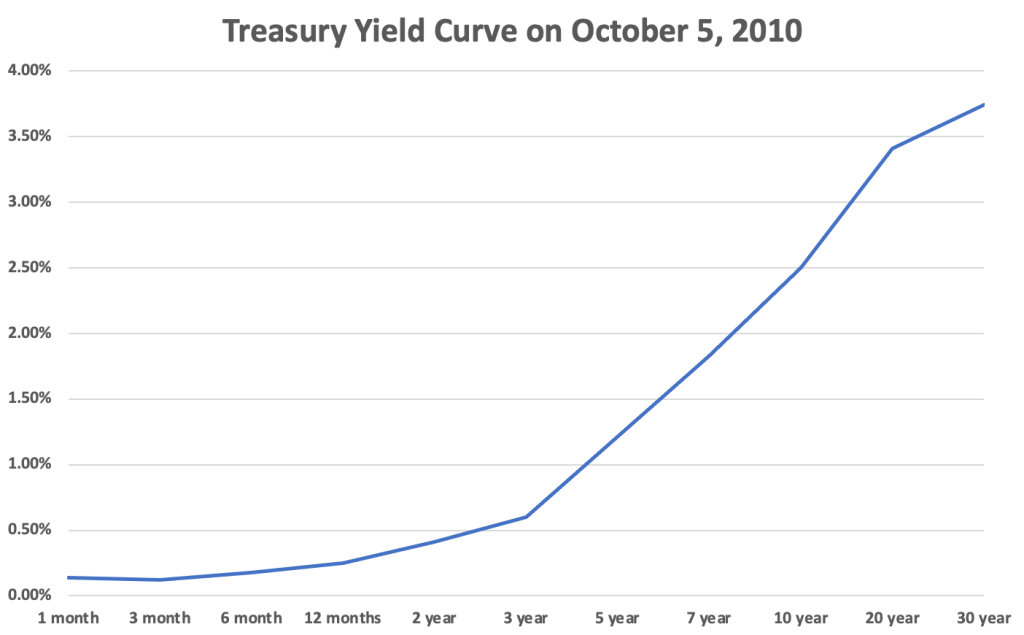

On October 5, 2010, the following yields were available on treasury securities:

Although no one knew it at the time, treasuries were at the beginning of a very long period of extremely low returns. In 2010, the Federal Reserve did not yet have an explicit inflation target, but Chairman Ben Bernanke would soon announce a 2% target. Investing at the short end of the yield curve was a near guarantee of loss of purchasing power of time. A yield in excess of inflation expectations at the time could be obtained in treasuries, but only by purchasing a maturity of ten years or more which involves taking considerable duration risk.

In 2010, fixed income investors might have waited on the sidelines in short term treasury bills expecting that long term treasuries would eventually provide more attractive yields as the economy recovered. While the ten year treasury did offer better yields occasionally, the story of the past thirteen years has been one of consistently low long term yields, as we can see from the chart of the ten year treasury note:

According to the inflation calculator provided by the Bureau of Labor Statistics, the consumer price index compounded at approximately 2.7% from October 2010 to April 2023. Investors in the S&P 500 or Berkshire Hathaway have compounded their wealth far in excess of inflation while an investor in longer term treasury securities would have been lucky to achieve any real return after inflation and taxes.

What if a skittish investor worried about the risk of investing in stocks but found the yields offered on ordinary treasuries unappealing because of the risk of inflation?

Since 1997, the United States Treasury has offered Treasury Inflation Protected Securities (TIPS) which are meant to provide investors with a real return adjusted for inflation. Just as we have a yield curve for regular treasury securities, we also have a yield curve for TIPS. This is what TIPS yields looked like on October 5, 2010:

Unlike regular treasury securities, TIPS are only offered as longer term securities at auction, although one can purchase TIPS on the secondary market for shorter maturities. For purposes of this discussion, I have displayed TIPS yields for five to thirty year maturities in the chart above. Note that the yields are expressed in real terms. In addition to the real yield, investors receive an adjustment for inflation.

At the time, the yield curve was upward sloping for TIPS, with the five year offering a real yield of negative 0.19% and the thirty year security offering a real yield of 1.54%.

It is interesting to note the difference between the yield on the regular ten year treasury of 2.5% and the yield on the ten year TIPS of 0.65% which implies that the market expected the inflation rate to be approximately 1.85% over the ten year period. This means that the choice of investing in the regular ten year treasury or the ten year TIPS would depend on the investor’s expectation of inflation. The investor who expected inflation higher than 1.85% would opt for the TIPS over the regular treasury.

Just as the interest rate for regular treasury securities fluctuates over time, TIPS real yields also fluctuate. The following chart shows how the real yield on the ten year TIPS has varied over the past thirteen years:

We should note that the real yield on longer term TIPS can become negative, as we can see from the exhibit above. This happened early in the thirteen year period and, in a more extreme way, during the period following the pandemic. As of mid-2023, real yields on TIPS are back in positive territory again.

The other option for risk averse small investors in October 2010 would have been to buy I Series U.S. Savings Bonds, also known as I Bonds. However, at the time, the I Bond offered a real yield of 0%, lower than the yields available on TIPS.

The bottom line is that unless an investor in October 2010 was willing to take credit risk in bonds and had a high degree of skill, it is almost certain that stocks provided far higher returns. A long-term investor who took Warren Buffett’s advice to heart would have achieved returns well in excess of inflation. In the bond world, an investor would have struggled to keep his head above water in real purchasing power terms.

This raises the question of whether it ever makes sense to invest in bonds over long periods of time, especially during periods of inflation. The answer depends on the yields offered on bonds, the likely level of inflation in the future, and the current valuation of a broad-based index of U.S. stocks.

I recently wrote an article about the role of TIPS in a fixed income portfolio, but this was in the context of a five year cash flow ladder rather than a long term investment. However, the fact is that the majority of investors will want to allocate a portion of their assets to bonds, especially those who are approaching their retirement years. A bond allocation usually provides a baseline level of perceived stability which permits many investors to view stock price fluctuations with greater equanimity, avoiding panic during the inevitable periods when stocks are declining.

For U.S. based investors who are unwilling to take credit risk, it makes sense to focus on securities backed by the United States government. Both marketable treasury securities and savings bonds have no credit risk, although all marketable securities, including regular treasuries and TIPS, have duration risk if sold prior to maturity.

Anyone investing in bonds needs to be aware of the risk of inflation, the topic of an article published yesterday. TIPS and I Bonds are both viable options that can provide limited inflation protection. In my next article, I will provide a detailed comparison of how TIPS and I Bonds work along with my opinion on how they might be used for various investment goals based on the interest rates that currently prevail.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

treasury securities bonds yield curve pandemic sp 500 equities stocks fed federal reserve interest ratesUncategorized

Your financial plan may be riskier without bitcoin

It might actually be riskier to not have bitcoin in your portfolio than it is to have a small allocation.

This article originally appeared in the Sound Advisory blog. Sound Advisory provide financial advisory services and are specialize in educating and guiding clients to thrive financially in a bitcoin-powered world. Click here to learn more.

“Belief is a wise wager. Granted that faith cannot be proved, what harm will come to you if you gamble on its truth and it proves false? If you gain, you gain all; if you lose, you lose nothing. Wager, then, without hesitation, that He exists.”

- Blaise Pascal

Blaise Pascal only lived to age 39 but became world-famous for many contributions in the fields of mathematics, physics, and theology. The above quote encapsulates Pascal’s wager—a philosophical argument for the Christian belief in the existence of God.

The argument's conclusion states that a rational person should live as though God exists. Even if the probability is low, the reward is worth the risk.

Pascal’s wager as a justification for bitcoin? Yes, I’m aware of the fallacies: false dichotomy, appeal to emotion, begging the question, etc. That is not the point. The point is that binary outcomes instigate extreme results, and the game theory of money suggests that it’s a winner-take-all game.

The Pascalian investor: A rational approach to bitcoin

Humanity’s adoption of “the best money over time” mimics a series of binary outcomes—A/B tests.

Throughout history, inferior forms of money have faded as better alternatives emerged (see India’s failed transition to a gold standard). And if bitcoin is trying to be the premier money of the future, it will either succeed or it won’t.

“If you ain’t first, you’re last.” -Ricky Bobby, Talladega Nights, on which monies succeed over time.

So, we can look at bitcoin success similarly to Pascal’s wager—let’s call it Satoshi’s wager. The translated points would go something like this:

- If you own bitcoin early and it becomes a globally valuable money, you gain immensely. ????

- If you own bitcoin and it fails, you’ve lost that value. ????

- If you don’t own bitcoin and it goes to zero, no pain and no gain. ????

- If you don’t own bitcoin and it succeeds, you will have missed out on the significant financial revolution of our lifetimes and fall comparatively behind. ????

If bitcoin is successful, it will be worth far more than it is today and have a massive impact on your financial future. If it fails, the losses are only limited to your exposure. The most that you could lose is the money that you invested.

It is hypothetically possible that bitcoin could be worth 100x more than it is today, but it can only possibly lose 1x its value as it goes to zero. The concept we’re discussing here is asymmetric upside - significant gains with relatively limited downside. In other words, the potential rewards of the investment outweigh the potential risks.

Bitcoin offers an asymmetric upside that makes it a wise investment for most portfolios. Even a small allocation provides potential protection against extreme currency debasement.

Salt, gasoline, and insurance

“Don’t over salt your steak, pour too much gas on the fire, or buy too much insurance.”

A little bit goes a long way, and you can easily overdo it. The same applies when looking at bitcoin in the context of a financial plan.

Bitcoin’s asymmetric upside gives it “insurance-like” qualities, and that insurance pays off very well in times of money printing. This was exemplified in 2020 when bitcoin's value increased over 300% in response to pandemic money printing, far outpacing stocks, gold, and bonds.

Bitcoin offers a similar asymmetric upside today. Bitcoin's supply is capped at 21 million coins, making it resistant to inflationary debasement. In contrast, the dollar's purchasing power consistently declines through unrestrained money printing. History has shown that societies prefer money that is hard to inflate.

If recent rampant inflation is uncontainable and the dollar system falters, bitcoin is well-positioned as a successor. This global monetary A/B test is still early, but given their respective sizes, a little bitcoin can go a long way. If it succeeds, early adopters will benefit enormously compared to latecomers. Of course, there are no guarantees, but the potential reward justifies reasonable exposure despite the risks.

Let’s imagine Nervous Nancy, an extremely conservative investor. She wants to invest but also take the least risk possible. She invests 100% of her money in short-term cash equivalents (short-term treasuries, money markets, CDs, maybe some cash in the coffee can). With this investment allocation, she’s nearly certain to get her initial investment back and receive a modest amount of interest as a gain. However, she has no guarantees that the investment returned to her will purchase the same amount as it used to. Inflation and money printing cause each dollar to be able to purchase less and less over time. Depending on the severity of the inflation, it might not buy anything at all. In other words, she didn’t lose any dollars, but the dollar lost purchasing power.

Now, let’s salt her portfolio with bitcoin.

99% short-term treasuries. 1% bitcoin.

With a 1% allocation, if bitcoin goes to zero overnight, she’ll have only lost a penny on the dollar, and her treasury interest will quickly fill the gap. Not at all catastrophic to her financial future.

However, if the hypothetical hyperinflationary scenario from above plays out and bitcoin grows 100x in purchasing power, she’s saved everything. Metaphorically, her entire dollar house burned down, and “bitcoin insurance” made her whole. Powerful. A little bitcoin salt goes a long way.

(When protecting against the existing system, it’s important to remember that you need to get your bitcoin out of the system. Keeping bitcoin on an exchange or with a counterparty will do you no good if that entity fails. If you view bitcoin as insurance, it’s essential to keep your bitcoin in cold storage and hold your keys. Otherwise, it’s someone else’s insurance.)

When all you have a hammer, everything looks like a…

A construction joke:

There are only three rules to construction: 1.) Always use the right tool for the job! 2.) A hammer is always the right tool! 3.) Anything can be a hammer!

Yeah. That’s what I thought, too. Slightly funny and mostly useless.

But if you spend enough time swinging a hammer, you’ll eventually realize it can be more than it first appears. Not everything is a nail. A hammer can tear down walls, break concrete, tap objects into place, and wiggle other things out. A hammer can create and destroy; it builds tall towers and humbles novice fingers. The use cases expand with the skill of the carpenter.

Like hammers, bitcoin is a monetary tool. And a 1-5% allocator to the asset typically sees a “speculative insurance” use case - valid. Bitcoin is speculative insurance, but it is not only speculative insurance. People invest and save in bitcoin for many different reasons.

I’ve seen people use bitcoin to pursue all of the following use cases:

- Hedging against a financial collapse (speculative insurance)

- Saving for family and future (long-term general savings and safety net)

- Growing a downpayment for a house (medium-term specific savings)

- Shooting for the moon in a manner equivalent to winning the lottery (gambling)

- Opting out of government-run, bank-controlled financial systems (financial optionality)

- Making a quick buck (short-term trading)

- Escaping a hostile country (wealth evacuation)

- Locking away wealth that can’t be confiscated (wealth preservation)

- As a means to influence opinions and gain followers (social status)

- Fix the money and fix the world (mission and purpose)

Keep this in mind when taking other people’s financial advice. They are often playing a different game than you. They have different goals, upbringings, worldviews, family dynamics, and circumstances. Even though they might use the same hammer as you, it could be for a completely different job.

Wrapping Up

A massive allocation to bitcoin may seem crazy to some people, yet perfectly reasonable to others. The same goes for having a 1% allocation.

But, given today’s macroeconomic environment and bitcoin’s trajectory, I find very few use cases where 0% bitcoin makes sense. By not owning bitcoin, you implicitly say that you are 100% certain it will fail and go to zero. Given its 14-year history so far, I’d recommend reducing your confidence. Nobody is 100% right forever. A little salt goes a long way. Your financial plan may be riskier without bitcoin. Diversify accordingly.

“We must learn our limits. We are all something, but none of us are everything.” - Blaise Pascal.

bonds pandemic stocks bitcoin link goldContact

Office: (208)-254-0142

Ste. 205

Eagle, ID 83616

Check the background of your financial professional on FINRA's BrokerCheck.The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2024 FMG Suite.

Sound Advisory, LLC (“SA”) is a registered investment advisor offering advisory services in the State of Idaho and in other jurisdictions where exempt. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment-making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site.

The information on this site is provided “AS IS” and without warranties of any kind, either express or implied. To the fullest extent permissible pursuant to applicable laws, Sound Advisory LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

SA does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall SA be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if SA or an SA authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Uncategorized

The Question You Should Ask Whenever You’re Wrong

“Never bet on the end of the world. It only comes once, which is pretty long odds.” — Arthur Cashin, New York Stock Exchange Floor Manager (“Maxims…

“Never bet on the end of the world. It only comes once, which is pretty long odds.” — Arthur Cashin, New York Stock Exchange Floor Manager (“Maxims of Wall Street,” p. 110)

Since Joe Biden gave his State of the Union (or shall we say “Disunion”) speech last week, I’ve encountered a plethora of negative comments about the future of America.

Is the American Dream Over?

“If Biden is re-elected, it will be the end of the American Dream as we know it,” said one pundit on Fox News.

The critics are out in force. Supply-side economist Steve Moore writes, “Biden is intentionally trying to dismantle the American economy with his imbecile energy, climate change, crime, border, inflation, debt and high tax policies.”

Glenn Beck, the host of Blaze TV, recently warned that America may face multiple terrorist attacks in one day, similar to 9/11, given the open borders policy of the Biden Administration.

Recently, I attended a private meeting of political leaders and pundits who thought that President Biden’s address was the most polemical, shrill and divisive talk they had ever heard.

I’ve been watching State of the Union addresses all my adult life, by both Republicans and Democrats, and in many ways they are always polemical and divisive. What was amazing to me is how “sleepy” Joe Biden performed. He must have been well rested and jacked up with some pretty incredible drugs to do as well as he did.

President Biden did say some things that were crazy, such as when he asserted that voting for former president Donald Trump is a “vote against democracy.”

Hey, wasn’t it the Democrats who want to remove Trump from the November ballot in Colorado and other states? Talk about anti-democratic! I was glad to see the Supreme Court ruled 9-0 against the Colorado decision. Let the people decide. Isn’t that what democracy is all about?

Why Then Is the Stock Market at an All-Time High?

Kevin Roberts, the new president of the Heritage Foundation, recently declared, “The American Dream is being threatened as never before!”

If that is true, why is the stock market at or near an all-time high? What are the prophets of doom and gloom missing?

That’s the question I always ask when I’m wrong about something:

“What am I missing?”

Wall Street is a good bellwether of what is going on the country. So far, the benefits outweigh the costs. The economy is recovering from the Covid pandemic, inflation is coming down, corporate profits are strong, new technologies are being introduced and there’s a strong movement to reverse the “cancel” and “woke” culture in the United States.

We have gridlock on Capitol Hill that is keeping a lot of bad legislation from becoming law. The Supreme Court has reversed many bad decisions by the lower courts.

We Remain Fully Invested

So, all is not lost after all. In my newsletter, Forecasts & Strategies, we remain fully invested, despite occasional corrections in the market.

We are also well diversified in some “contrarian” investments such as Bitcoin and gold, both of which continue to outperform and offset any selloffs in the stock market.

By remaining positive and fully invested, we have made good money in 2024.

The American Obituary Has Been Written Many Times

The American economy has been left for dead many times, only to be resuscitated with renewed vigor. We have survived civil and world wars, the Great Depression, the inflationary 1970s, terrorist attacks and more.

As J.P. Morgan once said, “The man who is a bear on the United States will eventually go broke” (“Maxims,” p. 111).

I encourage you to read my favorite J.P. Morgan story found on pp. 218-219 in “The Maxims of Wall Street.” See www.skousenbooks.com.

American exceptionalism is alive and well. We are still the Promised Land with millions wanting to live and work here.

Solving Our Unfunded Liability Problem: Look to Canada!

One serious problem in America is the irresponsible, out-of-control deficit spending and national debt, created by both Republican and Democratic leaders over the years. The trouble is getting worse, with rising interest rates to pay the debt and the growing unfunded liabilities from Social Security and Medicare.

Robert Poole of the Reason Foundation warns:

“The Congressional Budget Office (CBO)’s latest 10-year projection is frightening. CBO projects annual federal budget deficits to increase steadily, exceeding $2.5 trillion by 2034, assuming current policies continue… The federal government is projected to borrow an additional $20 trillion over the next decade, the CBO estimates.

“One driving factor is the impact of higher interest rates on the current $34 trillion (and growing) national debt… By 2034, annual interest expense is projected to be $1.6 trillion — more than one-fourth of all federal tax revenue.

“The Penn Wharton Budget Model suggests that the United States has about 20 years to fix this debt/deficit problem — ‘after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.’

“On August 2, 2023, Fitch Ratings downgraded the federal government’s long-term debt rating from AAA to AA+. And on November 10, 2023, Moody’s Investors Service reduced its outlook on the U.S. credit rating from ‘stable’ to ‘negative.’ Standard & Poor’s did its downgrade in 2011. These are warning shots across the ship of state’s bow.”

Sounds ominous. What to do?

Canada faced a similar problem back in the mid-1990s. Deficits were getting out of hand, and the Canadian dollar was sinking. The Conservative Party and the Liberty Party of Canada worked together and resolved to cut government spending, lay off federal workers and then went on a supply-side tax-cutting program that resulted in economic growth and deficit reduction.

What about the unfunded liability problem, which causes national bankruptcy? Again, Canada offers an incredible example of solving the issue.

Last week, Andy Puzder and Terrence Keeley wrote an op-ed in The Wall Street Journal on the success of the Canadian social security system, which has earned a 9.3% annualized return over the past 10 years (versus almost zero return in our Social Security Trust Fund). They wrote:

“The Canada Pension Plan’s superiority stems from its asset allocation. The fund invests about 57% of its assets in equities and 12% in bonds; the rest is divided among real estate, infrastructure and credit. Over the past 10 years, the Canada Pension Plan has realized a 9.3% annualized net return. Similarly to how Social Security works, Canadian citizens pay into the program and are guaranteed lifetime benefits.”

At some point, the United States will need to imitate the Canadian model. Here is a chart on the difference between the two:

In sum, there are solutions to all of our problems — if we know where to look and remain optimistic.

Sound Advice from the ‘Investment Bible’

In my home, I have a whole section of my library devoted to dozens of books written by doomsayers and Cassandras, such as “The Coming Deflation”…. “How to Prosper During the Coming Bad Years”… “Bankruptcy 1995”… “The End of Inflation” and so on.

I’ve also collected a bunch of quotes on doomsayers and Cassandras in “The Maxims of Wall Street.”

Jim Woods, my colleague at Eagle Publishing, is a big fan.

Jim states, “I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better ‘how to’ anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen. The ‘Maxims of Wall Street’ is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection. Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.”

If you don’t have an autographed copy of my collection of quotes, stories and wisdom of the world’s top traders and investors, please order a copy now.

It is in its 10th edition, having sold nearly 50,000 copies. It has been endorsed by Warren Buffett, Kevin O’Leary, Jack Bogle, Kim Githler, Bert Dohmen, Richard Band and Gene Epstein in Barron’s.

I offer it cheaply to my Skousen CAFÉ readers: Only $21 for the first copy, and all additional copies are $11 each (they make a great gift to clients, friends, relatives and your favorite broker or money manager). I sign and number each one, then mail it at no extra charge if you live in the United States. If you order an entire box (32 copies), the price is only $327. As Hetty Green, the first female millionaire, once said, “When I see a good thing going cheap, I buy a lot of it!”

To order, go to www.skousenbooks.com.

You Nailed it!

Friedrich Hayek Won the Nobel Prize 50 Years Ago

“Mises and Hayek articulated and vastly enriched the principles of Adam Smith at a crucial time in this century.” — Vernon Smith (2002 Nobel prize in economics)

March 23 is the anniversary of the passing of a giant in economics — the Austrian economist Friedrich Hayek (1899-1992).

He is most famous for his bestselling book “The Road to Serfdom,” written near the end of World War II, an admittedly a pessimistic book, warning the West that its move toward socialism, fascism and communism was indeed a “road to serfdom.”

Then, when he won the Nobel prize in economics in 1974, he warned again of the dangers of “accelerating inflation,” which he said, were “brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.”

Fortunately, we have moved away from the road to serfdom, especially after the collapse of the Berlin Wall and the Soviet socialist central planning model.

But the road to freedom has been a checkered one, and we must always be alert to losing our liberties in the name of inequality, fairness and social justice.

Last month, Tom Woods interviewed me in honor of the 50th anniversary of Hayek’s winning the Nobel prize. Watch the interview here.

Mark Skousen, Friedrich Hayek and Gary North in Austria, 1985

I had the pleasure of interviewing Hayek for three hours in the Austrian alps in 1985. He was especially happy to hear I resurrected his macroeconomic model in developing gross output (GO). See www.grossoutput.com, a measure of Hayek’s triangles.

This week, Larry Reed, former president of the Foundation for Economic Education, wrote this wonderful tribute to Hayek.

Highly recommended.

Good investing, AEIOU,

Mark Skousen

The post The Question You Should Ask Whenever You’re Wrong appeared first on Stock Investor.

bonds pandemic equities bitcoin real estate canadian dollar goldUncategorized

Walmart and Target make key self-checkout changes to fight theft

Both chains are making changes customers may not like, but self-checkout isn’t going anywhere, according to one industry expert.

In parts of the world, public bathrooms come with a charge, but people pay on the honor system. The money charged allows for better upkeep of the facilities and most people don't mind dropping a small bill or some coins into a lockbox and many of the people who don't are likely dealing with larger problems.

The honor system, however, requires honor. It's based on the idea that most people are trustworthy and that they will pay their fair share.

Related: Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

In the case of a bathroom, people cheating the system are only stealing a low-value service. In the case of self-checkout, a variation on the honor system, people looking to steal by "forgetting" to scan an item can be a very expensive problem.

That has led retailers including Target, Walmart, and Dollar General to make changes. Target has limited the amount of items you can scan at self-checkout at some stores while Dollar General has literally eliminated it in some locations.

Walmart, like Target, has experimented with item limits and limiting the hours of operation for self-checkout. Now, in some stores, the chain has decided to designate some of its self-checkout stations for Walmart+ members and delivery drivers using the Spark app.

Advantage Solutions General Manager Andy Keenan answered some questions about Walmart, self-checkout, and theft from TheStreet via email.

Image source: John Smith/VIEWpress.

What Walmart's self-checkout changes mean

TheStreet: What are the benefits of reserving self-checkout registers for Spark drivers and Walmart+ customers?

Keenan: The benefits include exclusivity and perks of membership, speed, and convenience when shopping.

TheStreet: If this rolls out more broadly, what do you anticipate being the impact on non-Walmart+ customers?

Keenan: There is the potential for non-Walmart+ customers to become agitated, they are losing convenience because they are not enrolled. Customers who are looking for convenience will have fewer options for speed to check out.

TheStreet: Do lane restrictions like limiting lanes to 10 items or fewer help reduce time spent waiting in lines?

Keenan: Yes, but retailers must have a diverse amount of check lane options including 10 items or fewer to ensure that the speed of checkout actually transpires.

TheStreet: Do you believe self-checkout is leading to partial shrink? If so, do you think that this move to shut off self-checkout lanes will help prevent theft in the future?

Keenan: Yes, self-checkout is leading to partial shrink. We believe this tends to be more due to errors in scanning and intentional theft.

There are already front-end transformation tests going on in stores, reducing the number of self-checkouts and shifting back to cashier checkouts in order to measure the reduction in shrink. Early indicators show that a move back to cashier checkouts combined with other shrink initiatives will help prevent theft.

Self-checkout is not going away

While changes are ongoing, Keenan believes self-checkout is here to stay.

“Self-checkout is not, as one recent article called it, a failed experiment. It’s actually part of the next evolution of the retail customer experience, and evolutions take time,” Keenan said in a web post about the findings of the 2024 Advantage Shopper Outlook survey.

He makes it clear that rising labor costs and struggles to find workers make some for of self-checkout inevitable.

“Since the pandemic, there’s been a revolution on hourly labor,” Keenan said. “Labor in certain markets that would cost you $16 an hour now costs you $19 or $20 an hour, and it’s a gig economy. The people who once stood at a checkout stand in the front of a store are now driving for Instacart or DoorDash because the hours are more flexible. They want to make their own schedule, and it’s varied work. Today, most retailers can’t offer that.”

Basically, while there are kinks to work out, self-checkout simply makes sense for retailers.

“The notion that we’re going to pivot away from technology that helps offset labor needs and will ultimately continue to improve customer experience because of some challenges is far-fetched. We need to continue to embrace the technology and realize that it may always be imperfect, but it will always be evolving. The noise that, ‘Oh, self-checkout might not be working,’ that’s just a moment in time,” he added.

bankruptcy pandemic-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges