- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

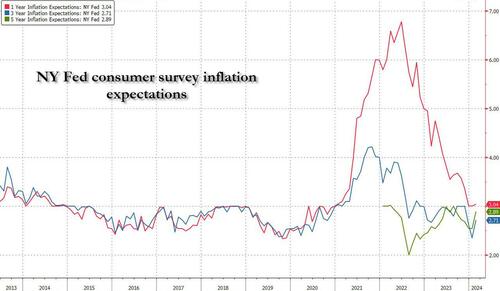

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area |

Best Time to List |

Price Premium |

Dollar Boost |

| United States |

First half of June |

2.3% |

$7,700 |

| New York, NY |

First half of July |

2.4% |

$15,500 |

| Los Angeles, CA |

First half of May |

4.1% |

$39,300 |

| Chicago, IL |

First half of June |

2.8% |

$8,800 |

| Dallas, TX |

First half of June |

2.5% |

$9,200 |

| Houston, TX |

Second half of April |

2.0% |

$6,200 |

| Washington, DC |

Second half of June |

2.2% |

$12,700 |

| Philadelphia, PA |

First half of July |

2.4% |

$8,200 |

| Miami, FL |

First half of June |

2.3% |

$12,900 |

| Atlanta, GA |

Second half of June |

2.3% |

$8,700 |

| Boston, MA |

Second half of May |

3.5% |

$23,600 |

| Phoenix, AZ |

First half of June |

3.2% |

$14,700 |

| San Francisco, CA |

Second half of February |

4.2% |

$50,300 |

| Riverside, CA |

First half of May |

2.7% |

$15,600 |

| Detroit, MI |

First half of July |

3.3% |

$7,900 |

| Seattle, WA |

First half of June |

4.3% |

$31,500 |

| Minneapolis, MN |

Second half of May |

3.7% |

$13,400 |

| San Diego, CA |

Second half of April |

3.1% |

$29,600 |

| Tampa, FL |

Second half of June |

2.1% |

$8,000 |

| Denver, CO |

Second half of May |

2.9% |

$16,900 |

| Baltimore, MD |

First half of July |

2.2% |

$8,200 |

| St. Louis, MO |

First half of June |

2.9% |

$7,000 |

| Orlando, FL |

First half of June |

2.2% |

$8,700 |

| Charlotte, NC |

Second half of May |

3.0% |

$11,000 |

| San Antonio, TX |

First half of June |

1.9% |

$5,400 |

| Portland, OR |

Second half of April |

2.6% |

$14,300 |

| Sacramento, CA |

First half of June |

3.2% |

$17,900 |

| Pittsburgh, PA |

Second half of June |

2.3% |

$4,700 |

| Cincinnati, OH |

Second half of April |

2.7% |

$7,500 |

| Austin, TX |

Second half of May |

2.8% |

$12,600 |

| Las Vegas, NV |

First half of June |

3.4% |

$14,600 |

| Kansas City, MO |

Second half of May |

2.5% |

$7,300 |

| Columbus, OH |

Second half of June |

3.3% |

$10,400 |

| Indianapolis, IN |

First half of July |

3.0% |

$8,100 |

| Cleveland, OH |

First half of July |

3.4% |

$7,400 |

| San Jose, CA |

First half of June |

5.5% |

$88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve

pandemic

home sales

mortgage rates

interest rates

Read More