“[…] CMS121 applicability could be expanded from a geroneuroprotector drug to a metabolic drug […]”

BUFFALO, NY- April 9, 2024 – A new research paper was published in Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 6, entitled, “CMS121: a novel approach to mitigate aging-related obesity and metabolic dysfunction.”

Modulated by differences in genetic and environmental factors, laboratory mice often show progressive weight gain, eventually leading to obesity and metabolic dyshomeostasis. The geroneuroprotector CMS121 has a positive effect on energy metabolism in a mouse model of type 2 diabetes. In this new study, researchers Alcir L. Dafre, Saadia Zahid, Jessica Jorge Probst, Antonio Currais, Jingting Yu, David Schubert, and Pamela Maher from Salk Institute for Biological Studies, National University of Sciences and Technology (NUST) and Federal University of Santa Catarina investigated the potential of CMS121 to counteract the metabolic changes observed during the ageing process of wild type mice.

“This comprehensive analysis aimed to further understand how CMS121 influences the metabolic landscape, paving the way for potential therapeutic applications beyond its established geroneuroprotective benefits.”

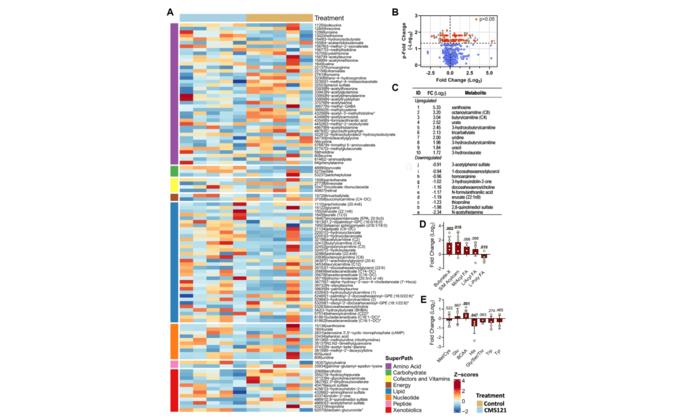

Control or CMS121-containing diets were supplied ad libitum for 6 months, and mice were sacrificed at the age of 7 months. Blood, adipose tissue, and liver were analyzed for glucose, lipids, and protein markers of energy metabolism. The CMS121 diet induced a 40% decrease in body weight gain and improved both glucose and lipid indexes. Lower levels of hepatic caspase 1, caspase 3, and NOX4 were observed with CMS121 indicating a lower liver inflammatory status. Adipose tissue from CMS121-treated mice showed increased levels of the transcription factors Nrf1 and TFAM, as well as markers of mitochondrial electron transport complexes, levels of GLUT4 and a higher resting metabolic rate. Metabolomic analysis revealed elevated plasma concentrations of short chain acylcarnitines and butyrate metabolites in mice treated with CMS121.

“The diminished de novo lipogenesis, which is associated with increased acetyl-CoA, acylcarnitine, and butyrate metabolite levels, could contribute to safeguarding not only the peripheral system but also the aging brain. By mimicking the effects of ketogenic diets, CMS121 holds promise for metabolic diseases such as obesity and diabetes, since these diets are hard to follow over the long term.”

Read the full paper: DOI: https://doi.org/10.18632/aging.205673

Corresponding Authors: Pamela Maher, Alcir L. Dafre

Corresponding Emails: pmaher@salk.edu, alcir.dafre@ufsc.br

Keywords: obesity, diabetes, geroneuroprotection, metabolic disorders, ketogenic diet

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205673

Method of Research

Experimental study

Subject of Research

People

Article Title

CMS121: a novel approach to mitigate aging-related obesity and metabolic dysfunction

Article Publication Date

20-Mar-2024