Uncategorized

Guest Contribution: “The Federal Funds Rate: FOMC Projections, Policy Rule Prescriptions, and Futures Market Probabilities from the March 2024 Meeting”

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer…

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its March 2024 meeting and, in the Summary of Economic Projections (SEP), continued to project a range for the FFR between 4.5 and 4.75 percent by the end of 2024. In contrast with experience through December 2023, futures markets summarized by the CME FedWatch Tool on the day following the meeting were in accord with the FOMC projections and also predicted a range for the FFR between 4.5 – 4.75 percent by the end of 2024.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. In this post, we analyze four policy rules that are relevant for the future path of the FFR, update the policy rule prescriptions through the March 2024 SEP, and include futures market predictions.

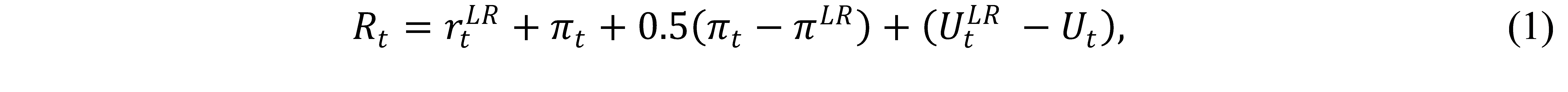

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to March 2024 and the projected FFR for June 2024 to December 2026 from the March 2024 SEP. Figure 1 also depicts policy rule prescriptions. Between September 2020 and March 2024, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between June 2024 and December 2026, we use inflation and unemployment projections from the March 2024 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1: The Federal Funds Rate and Policy Rule Prescriptions. Top panel: Non-Inertial Rules; Bottom panel: Inertial Rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are much higher than the FFR in 2022 and 2023 and are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. In contrast, the policy rule prescriptions for 2024 through 2026 from the March 2024 SEP are consistently lower than the FFR projections. The inertial rules in Panel B prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the March 2024 SEP are very close to the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

It has been widely reported that market participants have been predicting a steeper downward path for the FFR than the FOMC. This is illustrated in Figure 2, which depicts the median predictions from futures markets described in the CME FedWatch Tool on February 1, 2024, the day following the January 2024 FOMC Meeting, through the end of the CME prediction horizon in December 2024. The futures market predictions fall below the projected FFR from June 2024 through December 2024. This is described in more detail in our February 9, 2024, Econbrowser post.

Figure 2: The FFR, CME FedWatch Tool, and Policy Rule Prescriptions in December 2023. Top panel: Taylor Rules; Bottom panel: Balanced Approach.

Futures markets are no longer predicting a steeper downward path for the FFR than the FFR projections. Figure 3 depicts the median predictions from futures markets described in the CME FedWatch Tool on March 21, 2024, the day following the March 2024 FOMC Meeting, through the end of the CME prediction horizon in September 2025. The markets are completely in accord with the FOMC, as the futures market predictions are identical to the FFR projections. The change from December 2023 to March 2024 is entirely due to the change in the CME predictions, as the FFR projections through December 2024 are unchanged. The markets have caught up to the Fed and not vice versa.

We add to this discussion by including prescriptions from policy rules. Figure 3 shows that, for both the Taylor and balanced approach rules, the prescriptions from the inertial policy rules for March 2024 through December 2025 are close to the (identical) FOMC projections and CME predictions. In contrast, the prescriptions from both non-inertial policy rules are considerably below the FOMC projections and CME predictions for the same period. Comparison between futures market predictions and policy rule prescriptions depends on the choice between inertial and non-inertial rules but not on the choice between Taylor and balanced approach rules.

Figure 3: The FFR, CME FedWatch Tool and Policy Rule Prescriptions in March 2024

Top panel: Taylor Rules; Bottom panel: Balanced Approach.

This post written by David Papell and Ruxandra Prodan-Boul.

recession unemployment covid-19 fomc open market committee fed recession unemploymentUncategorized

Penny-pinching buyers are driving down sales of the Big Three’s most profitable segment

Buyers are flocking to more affordable cars amid high prices and interest rates.

Despite the U.S. auto industry celebrating huge sales wins in the first quarter, a key segment containing some of the Detroit Big Three's most profitable nameplates is being left in the dust.

Related: Get ready for $5-a-gallon gasoline

As per a recent report by Automotive News, sales of full-size pickup trucks fell 4% year over year in the period between January and March 2024, with key models reporting reduced sales figures in the double digits.

Stellantis' (STLA) reported that its popular Ram 1500 took a sales hit of 15%, while Ford (F) reported that sales of its bestselling F-series line of pickups took a hit of 10%. On the other hand, General Motors (GM) reported overall sales gains of 2.4% with its Chevrolet Silverado and 2.1% with its GMC Sierra pickups thanks to heavy duty models, but sales of its light duty full-size models are down 1.2%.

Besides GM, Nissan (NSANF) was the only other automaker to sell more pickups this period than the same time in 2023. In total, pickup sales are down 6.4%, including a 31% drop for midsize models like the Ford Ranger and GM's Chevrolet Colorado.

Insiders, analysts and those in the know say that the high prices of cars, as well as high interest rates are causing consumers to cut back on their discretionary spending and explore smaller and cheaper options. As sales of full-size pickups dropped, compact pickups like Ford's hybrid Maverick pickup rose by 82%, while compact and subcompact crossovers rose roughly 25%.

In recent years, automakers like Detroit's Big Three have transformed pickup trucks from utilitarian workhorses into premium machines with MSRPs that rivaled luxury marques like Mercedes-Benz. In a statement to AutoNews, Cox Automotive senior economist Charlie Chesbrough noted that the high prices well equipped pickup's, as well as the slowdown of construction have affected the growth of the segment.

"Pickups have run into two hurdles — interest rates and high prices are having a negative impact directly on affordability and the slowdown in construction is likely impacting demand," Chesbrough told AutoNews. "We don't feel there is much pent-up demand remaining in fleet. Additional growth [in] the full-size pickup segment will be challenging over the near term. Buyers appear to want pickup functionality, but at lower prices."

More Automotive:

- BMW exec says it's the end of the line for a popular option among car enthusiasts

- Mercedes just took a subtle dig at its biggest luxury rival

- Ford is taking away a convenient feature because no one uses it

Additionally, Edmunds head of insights Jessica Caldwell noted that low interest rates during the COVID-19 pandemic allowed for buyers to opt for more expensive vehicles, such as premium trims of pickups like the Ford F-150 Platinum and the Chevrolet Silverado High Country.

She told AutoNews that consumers aren't "stretching their budgets in ways that they would have in the past," and that higher interest rates makes "financing these larger purchases really hard."

According to GlobalData, full-size pickups accounted for 12.4% of new car sales for the first quarter of 2024, compared to 13.7% during the same period in 2023.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic covid-19 interest ratesUncategorized

US Consumer Price Index CPI – USD/JPY Technical Analysis

US Consumer Price Index – CPI The US Consumer Price Index CPI Y/Y overall trend has been steadily declining after reaching its peak of 9.06% in June…

US Consumer Price Index – CPI

The US Consumer Price Index CPI Y/Y overall trend has been steadily declining after reaching its peak of 9.06% in June 2022. A drop in all CPI components, including Energy, Food, and Durable Goods Prices, mainly drove the decline. However, the decline stalled during the last quarter of 2023, and the index has been moving sideways since then as the changes in the Services sector remained almost unchanged throughout the entire time.

Core Services M/M peaked in January 2024 at a one-year high of 0.66%; however, it registered 0.457% for February 2024, a 30% decline. Core Services data M/M may be critical this week as investors will watch whether the declining trend will resume toward the pre-pandemic averages of 0.25%—0.35% or reverse and peak again. The index has been registering higher lows since June 2023. A change in the cost of services can be more meaningful if accompanied by a similar percentage change in other CPI components, such as Durable Goods prices. Oil prices have recently been rising, and it is logical to impact the overall production costs; although the increase in oil prices came slightly after the CPI reporting period, it may still have an impact. On the other hand, a stabilization for CPI data at its current levels can be seen as favorable by market participants as it should add another reason for the FED to consider interest rate cuts sooner rather than later.

Please review the Economic Calendar for all releases and local times.

CME FedWatch Tool

According to the most recent review of the CME FedWatch tool, market participants anticipate two to three rate cuts between March 20th, 2024, and December 31st, 2024. The percentage of participants expecting rates to remain at their current 525-550 range for the meeting on May 1st, 2024, is 94.4%, down from 99.8%. The expectation for a 25-basis points rate cut for the May 1st meeting rose from 0.2% to 5.6%. As for the June 12th, 2024, Fed’s meeting, the percentage of a 25-basis points rate cut fell from 57.2% last week to 46.1%.

USDJPY Technical Analysis – 1 Hour Chart

- Price action continues to trade within a trading range, which began in mid-March 2024.

- Multiple attempts to break above the range upper borders have failed so far; the upper range border intersects with R1 Standard calculations.

- The MACD line crossed below its signal line, and its histogram turned bearish after an extended coiling period.

- Market reaction for Friday, April 5th, 2024: NFP has faded for other currency pairs, such as EURUSD and USDAD; however, for USDJPY, this has not happened, thus adding more weight to the yellow highlighted candle, the candle low intersects with the daily pivot point forming a level of support to follow

- A slight negative divergence can be seen on RSI14 as price action makes higher highs while RSI makes lower highs.

Uncategorized

United Airlines passenger incident triggers quick response

The episode prompted some questions about assumptions travelers have on flights.

Unruly passenger behavior during air travel has been attracting increasing attention in the past few years as unfortunate incidents have happened with more regularity.

And one episode on a recent United Airlines (UAL) flight has prompted some discussion about presumptions people have about each other.

Related: Another National Park just made it more difficult for you to visit

During the Covid-19 pandemic, frustrated travelers — often fueled by overconsumption of alcohol — frequently clashed with flight attendants over compliance with mask-wearing requirements and other matters.

But unruly passenger incidents only increased from 2021 to 2022, after most pandemic rules and restrictions had already been lifted.

On a recent United Airlines airplane, one passenger was removed from a flight after a bizarre confrontation with a woman at a boarding gate in Houston, according to a post in the r/unitedairlines subreddit.

A United Airlines passenger gets aggressive at a boarding gate

A family member had reached United's Global Services status, so they treated their sister and brother-in-law to some first class honeymoon flights.

The writer of the post was able to meet the traveling couple during a layover at George Bush Intercontinental Airport in Houston.

The post, written by Reddit user CanWeBeSure, explained how the incident occurred.

"My sister and her husband don't fly United often, so when the GA (gate agent) started whispering the pre-boarding process and I went up when GS (and 1k at the same time) was called, they followed me, even though they were group 1," CanWeBeSure wrote. "When my sister went to scan her boarding pass, a man behind her said 'you shouldn't be here, I have priority.' She replied with, 'You know, it pays to be kind sometimes.' The man said, 'how's this for being kind?' and proceeded to bump into her, knocking her off balance."

The sister, according to the post, told family members what happened when they got to their seats, because she was behind them when the incident occurred, and they didn't see it.

"A few minutes later, a FA (flight attendant) asked her about what happened and whether she felt safe on the plane with that man on board," the story continued. "She didn't jump to say she felt unsafe, but she gave an honest recount of what happened. The FA said that was all she needed to hear and said she would discuss it with the pilots."

"Shortly after, the GA approached the man a few rows behind us and told him that he could either get off the plane or they would make him get off the plane," the writer continued. "He stood up, grabbed his bag, and walked off as we heard an applause from behind us."

Shutterstock

The United Airlines incident prompts thoughts about travelers' assumptions

Travel writer Gary Leff of the View From the Wing blog considered this episode and recalled a few notes on assumptions people make about other travelers.

First, he remembered reading a trip report years ago where another travel writer, boarding for first class, had a business class passenger shove past him saying "business class."

"The business class passenger mind just couldn't comprehend a young kid flying first (and may not have even known about such a thing as true first class)," Leff wrote.

Leff also recounted how, historically, women were a small minority of first class passengers.

"Young women stood out in a sea of middle aged men — but often received dismissive treatment, including from female flight attendants," Leff wrote.

In the United incident in Houston, one benefit of early boarding is that passengers don't have to gate check their bags, Leff noted. Also, Global Services and 1K passengers do not have to stand in line for long and generally can expect to find overhead bin space near their seat locations.

"The person doing the shoving here was accomplishing both of those things, whether the woman he shoved got on ahead of him or not," Leff wrote. "Shoving was just an act of rage against someone he didn’t feel deserved to get on ahead of him, even though he was disadvantaged in no way at all."

"There's a weird status game going on here that at least most of us avoid turning into physical aggression," Leff continued.

"And as a part of that game we engage in assumptions about the people around us, and about who they are and therefore what they're entitled to — and those assumptions are wrong more than we're programmed to realize."

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic covid-19 treatment-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized6 days ago

Uncategorized6 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 days ago

Uncategorized3 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized15 hours ago

Uncategorized15 hours agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Government2 days ago

Government2 days agoClimate-Con & The Media-Censorship Complex – Part 1