Through the eyes of the single-family rental lobby

The National Rental Home Council, a lobby for institutional investors of single-family real estate, says its members have a tiny impact on America’s housing shortage

The post Through the eyes of the single-family rental lobby appeared first on Hous…

First thing’s first. There’s a problem with the U.S. single-family housing market.

“U.S. housing supply is dwindling once again as homes continue to fly off the market at record prices,” said Jeremy Sicklick, CEO of real estate data analytics firm HouseCanary. “For homebuyers, across the country we expect the shortage of homes for sale to extend well into 2022.”

In assessing blame for a high-demand, low inventory housing market, one finger is pointed at companies that purchase single-family homes as an investment.

“Selling out: America’s local landlords. Moving in: Big investors,” reads a Reuter’s headline from this July. “A $60 billion housing grab by Wall Street,” trumpets an October New York Times magazine story.

Last month, Zillow said it was winding down its iBuying division, and courting corporate investors to buy its 18,000 homes remaining in inventory. Meanwhile, Redfin released a report with the headline: “Investors bought a record 18% of U.S. homes that sold in the third quarter.”

But despite these headlines and recent developments, big investors and Wall Street play a small role in the U.S. single-family home market.

Take the Redfin report. The report’s methodology is a keyword search from counties with publicly available deed records, using the keywords “LLC” “Inc” “Trust” “Corp” and “Homes.”

An “LLC” can be used by individual homebuyers to shroud their identity, and “Anyone with a living trust is supposed to buy the home in their trust’s name,” said John Burns, at John Burns Real Estate Consulting.

Added Burns, “I would ignore this study completely.”

Sheharyar Bokhari of Redfin, who co-authored the study, acknowledged it is “Very hard to figure out which homeowners are really Wall Street firms and which ones are mom-and-pop landlords.”

The report should be read for what it is, Bokhari said, the universe of possible “investors” who do not use their home as a primary residence. This includes institutional investor Invitation Homes, or a person who buys a property and then rents it out on Airbnb.

It’s this latter group – which also includes owners of a summer home, timeshare participants, and people who hold on to the abode of a deceased relative – who predominate non-owner-occupied single-family homes in America.

As HousingWire reported last month, an Amherst Pierpont study found that 85% of single-family U.S. rentals are owned by investors who own 10 or fewer properties. Institutional investors – companies with a multistate presence and the capital to buy dozens of homes at once – own 2% of single-family rental homes, or less than 300,000, the study found.

The National Rental Home Council – a Washington, D.C. group that lobbies for Invitation Homes, American Homes 4 Rent and most other corporate single-family landlords – puts the number at 261,000 homes owned by their members.

That’s 1.1% of all single-family rental units in the country. It’s 0.2% of all housing units in the country. Burns, the real estate consultant who produces his own data on single-family home investors, said he believes the trade group’s numbers to be accurate.

The National Rental Home Council data raises questions about why corporate single-family home ownership is a focus for some real estate agents, and, well, journalists in diagnosing the housing market’s ills. Still, the overall number does not end the possibility that institutional investors may impact particular geographic areas or niche housing economy sectors, including iBuying.

HousingWire recently had an extended discussion with David Howard, who is the executive director of the National Rental Home Council. Howard is, as they say, inside the beltway, having worked in Washington on behalf of various housing organizations for the last 22 years. This includes time with the National Association of Real Estate Investments Trust and the Urban Land Institute.

Howard discussed what his organization does, and the contention that, regardless of their exact reach, the impact of big investors in single-family homes is harmful.

Here’s an edited version of that conversation.

HousingWire: What’s the National Rental Home Council’s objective?

David Howard: We are a trade association that represents the single-family rental industry. We do a good bit of legislative and regulator work.

We are a relatively young organization (founded in 2014), which reflects the fact that the single-family rental industry is relatively young.

In the past 12-18 months, we have also focused on issues that were borne out of the Covid crisis including moratoria on evictions, rent control, and rental assistance. Lately, we’ve been working with various legislators in our offices in D.C. on issues of home ownership and affordability.

HW: You say it’s a relatively young industry. Is it true to say that the single-family rental industry got its start after the housing bubble burst in 2008?

DH: The business of single-family rental has been around as long as I can remember. Certainly, the great financial crisis accelerated the growth and development of the single-family home industry.

From 2007 to 2014, institutions accounted for about 2% of homes that were purchased out of foreclosures and short sales, which is out of five million-plus homes. That period of time did jumpstart things for the industry. There were very few people actually purchasing homes, and home prices started falling. Investors came in, and I think we created a floor for the housing market.

HW: How did you arrive at the figure that your members own 261,000 single-family homes?

DH: At the end of the year, we ask our members to provide a count of properties owned by state. We already have prior statistics and have a pretty good sense of the inventory of some companies who are publicly traded. When companies join, they do commit in writing that they will accurately self-report. I have no concern about the validity of the data.

HW: Any major institutional investors that are not members?

DH: Yes, Amherst Properties and they have a portfolio of about 35,000 properties nationally.

HW: Okay, that’s a small part of the market, but your members might be making a significant dent in some areas including iBuying.

You have said before that iBuyers sold “less than 4,000” homes to institutional investors in the first nine months of this year. But, if you add up all the homes that Zillow, Opendoor, and Offerpad – the three main iBuyers that are publicly traded – report selling in the first nine months of 2021, the total is 22,964.

Now, that doesn’t include the universe of iBuying. There’s Redfin (which said it does not resell properties directly to corporate investors) and Keller Williams has an iBuying program, for example. But 4,000 is 17% of 23,000 – arguably significant. And it doesn’t include Zillow selling 2,000 homes to Pretium Partners, and additional sales to corporate investors they might undertake while winding down iBuying.

It also jibes with Offerpad publicly acknowledging that sales to institutional investors fluctuate around 10-20% of total sales per quarter.

So, when institutional investors are looking to buy, do they often turn to iBuyers?

DH: I wouldn’t say that we’ve really seen that in the first three quarters of 2021.

Most of the iBuying that our members engage in comes directly through the MLS [Multiple Listings Services, largely owned by local realtor associations and aggregated to the public by Zillow and other listings websites]. That’s really because the companies need to directly understand the market. They really need to be part of communities.

Our companies are very methodical in their iBuying. They are finding local real estate brokers and using them over and over again in purchasing new homes. Companies have found that is the most efficient new way of expanding their portfolio.

HW: Another area where your members arguably a larger impact have is certain states and cities. These tend to never be Northeast cities, rarely Midwest or west coast cities, and usually Arizona, Texas, or the Southeast

Why these disparities in where single-family rentals are?

DH: We have expanded in places like Charlotte, Raleigh [North Carolina] and Atlanta has been a good market, as has Texas. If you look at the economic and demographic trends in those markets, it’s been population growth and millennials moving into those markets.

And, so, oftentimes when someone moves into the city the first thing you do is rent. Intuitively, it makes more sense to rent first. Companies are not buying homes in market where there’s no demand. Companies are not creating the demand, migration patterns are.

HW: The National Home Rental Council seems to walk a fine line, because as much as extolling the virtues of your members, you seem to be minimizing their role. I first learned about your group from a report you did downplaying the number of single-family rentals. Why such an emphasis on seemingly your group’s lack of impact?

DH: Recent headlines have suggested that large companies have come into the single-family housing market. And some of the stories have really been sensational. So, we decided that we needed to be more transparent.

It was important to point out what was out of context. The fact is that there are 23 states in our country where our members don’t own one home. I recently talked with one U.S. Senator, who I won’t name, and she was concerned about the home buying activities of corporations in her state. I had to tell her that our members don’t own a single property in her state.

HW: Well, I think there’s a concern that corporations already own a sizable chunk of the multifamily market and are now moving into single-family, though I can see your frustrations with articles that exaggerate your member’s inventory.

Still, what about the argument that any inventory owned by your members contributes to the inventory crisis in real estate?

DH: There seems to be an assumption that everyone in the country wants or needs to buy a home.

Our members do help put people on the path to homeownership. For example, we provide formal credit counseling programs. Living in a single-family rental does not set you up to be a lifetime renter.

Also, supply is as much a challenge in the rental housing market as it is in the owner-occupied market. The Census Bureau produces data that shows how much housing is owner occupants versus renters. In the last five years it showed that the amount of owner-occupied housing has increased 10% while renter increased has grown 1%. The overall amount of owner-occupied housing dwarfs rental housing. (As of the third quarter, there were 140.9 million housing units in the U.S., according to the Census Bureau and 126.7 million homes were occupied. The Census reports that 85.4 million units were owner occupied and 41.2 million units lived in by renters.)

There’s as much a challenge with rental housing inventory as there is with owner-occupied.

HW: Let’s finish where you started, which is your group’s legislative agenda. You mentioned the eviction moratoria. Did the National Rental Home Council lobby to let evictions continue amid the pandemic?

DH: No, we never came out publicly against eviction moratoria even though it was very difficult for small homeowners. But it has been such an unusually difficult time for many people.

The post Through the eyes of the single-family rental lobby appeared first on HousingWire.

real estate housing market pandemicUncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

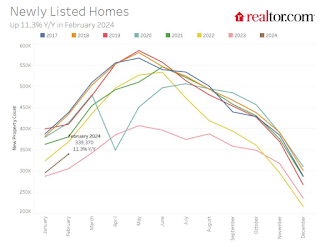

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Government

RFK Jr. Reveals Vice President Contenders

RFK Jr. Reveals Vice President Contenders

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former…

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former Minnesota governor and professional wrestler Jesse Ventura are among the potential running mates for independent presidential candidate Robert F. Kennedy Jr., the New York Times reported on March 12.

Citing “two people familiar with the discussions,” the New York Times wrote that Mr. Kennedy “recently approached” Mr. Rodgers and Mr. Ventura about the vice president’s role, “and both have welcomed the overtures.”

Mr. Kennedy has talked to Mr. Rodgers “pretty continuously” over the last month, according to the story. The candidate has kept in touch with Mr. Ventura since the former governor introduced him at a February voter rally in Tucson, Arizona.

Stefanie Spear, who is the campaign press secretary, told The Epoch Times on March 12 that “Mr. Kennedy did share with the New York Times that he’s considering Aaron Rodgers and Jesse Ventura as running mates along with others on a short list.”

Ms. Spear added that Mr. Kennedy will name his running mate in the upcoming weeks.

Former Democrat presidential candidates Andrew Yang and Tulsi Gabbard declined the opportunity to join Mr. Kennedy’s ticket, according to the New York Times.

Mr. Kennedy has also reportedly talked to Sen. Rand Paul (R-Ky.) about becoming his running mate.

Last week, Mr. Kennedy endorsed Mr. Paul to replace Sen. Mitch McConnell (R-Ky.) as the Senate Minority Leader after Mr. McConnell announced he would step down from the post at the end of the year.

CNN reported early on March 13 that Mr. Kennedy’s shortlist also includes motivational speaker Tony Robbins, Discovery Channel Host Mike Rowe, and civil rights attorney Tricia Lindsay. The Washington Post included the aforementioned names plus former Republican Massachusetts senator and U.S. Ambassador to New Zealand and Samoa, Scott Brown.

In April 2023, Mr. Kennedy entered the Democrat presidential primary to challenge President Joe Biden for the party’s 2024 nomination. Claiming that the Democrat National Committee was “rigging the primary” to stop candidates from opposing President Biden, Mr. Kennedy said last October that he would run as an independent.

This year, Mr. Kennedy’s campaign has shifted its focus to ballot access. He currently has qualified for the ballot as an independent in New Hampshire, Utah, and Nevada.

Mr. Kennedy also qualified for the ballot in Hawaii under the “We the People” party.

In January, Mr. Kennedy’s campaign said it had filed paperwork in six states to create a political party. The move was made to get his name on the ballots with fewer voter signatures than those states require for candidates not affiliated with a party.

The “We the People” party was established in five states: California, Delaware, Hawaii, Mississippi, and North Carolina. The “Texas Independent Party” was also formed.

A statement by Mr. Kennedy’s campaign reported that filing for political party status in the six states reduced the number of signatures required for him to gain ballot access by about 330,000.

Ballot access guidelines have created a sense of urgency to name a running mate. More than 20 states require independent and third-party candidates to have a vice presidential pick before collecting and submitting signatures.

Like Mr. Kennedy, Mr. Ventura is an outspoken critic of COVID-19 vaccine mandates and safety.

Mr. Ventura, 72, gained acclaim in the 1970s and 1980s as a professional wrestler known as Jesse “the Body” Ventura. He appeared in movies and television shows before entering the Minnesota gubernatorial race as a Reform Party headliner. He was a longshot candidate but prevailed and served one term.

Former pro wrestler Jesse Ventura in Washington on Oct. 4, 2013. (Brendan Smialowski/AFP via Getty Images)

In an interview on a YouTube podcast last December, Mr. Ventura was asked if he would accept an offer to run on Mr. Kennedy’s ticket.

“I would give it serious consideration. I won’t tell you yes or no. It will depend on my personal life. Would I want to commit myself at 72 for one year of hell (campaigning) and then four years (in office)?” Mr. Ventura said with a grin.

Mr. Rodgers, who spent his entire career as a quarterback for the Green Bay Packers before joining the New York Jets last season, remains under contract with the Jets. He has not publicly commented about joining Mr. Kennedy’s ticket, but the four-time NFL MVP endorsed him earlier this year and has stumped for him on podcasts.

The 40-year-old Rodgers is still under contract with the Jets after tearing his Achilles tendon in the 2023 season opener and being sidelined the rest of the year. The Jets are owned by Woody Johnson, a prominent donor to former President Donald Trump who served as U.S. Ambassador to Britain under President Trump.

Since the COVID-19 vaccine was introduced, Mr. Rodgers has been outspoken about health issues that can result from taking the shot. He told podcaster Joe Rogan that he has lost friends and sponsorship deals because of his decision not to get vaccinated.

Quarterback Aaron Rodgers of the New York Jets talks to reporters after training camp at Atlantic Health Jets Training Center in Florham Park, N.J., on July 26, 2023. (Rich Schultz/Getty Images)

Earlier this year, Mr. Rodgers challenged Kansas City Chiefs tight end Travis Kelce and Dr. Anthony Fauci to a debate.

Mr. Rodgers referred to Mr. Kelce, who signed an endorsement deal with vaccine manufacturer Pfizer, as “Mr. Pfizer.”

Dr. Fauci served as director of the National Institute of Allergy and Infectious Diseases from 1984 to 2022 and was chief medical adviser to the president from 2021 to 2022.

When Mr. Kennedy announces his running mate, it will mark another challenge met to help gain ballot access.

“In some states, the signature gathering window is not open. New York is one of those and is one of the most difficult with ballot access requirements,” Ms. Spear told The Epoch Times.

“We need our VP pick and our electors, and we have to gather 45,000 valid signatures. That means we will collect 72,000 since we have a 60 percent buffer in every state,” she added.

The window for gathering signatures in New York opens on April 16 and closes on May 28, Ms. Spear noted.

“Mississippi, North Carolina, and Oklahoma are the next three states we will most likely check off our list,” Ms. Spear added. “We are confident that Mr. Kennedy will be on the ballot in all 50 states and the District of Columbia. We have a strategist, petitioners, attorneys, and the overall momentum of the campaign.”

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges