The Irrational Tax Trap

The Irrational Tax Trap

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

— Benjamin Franklin

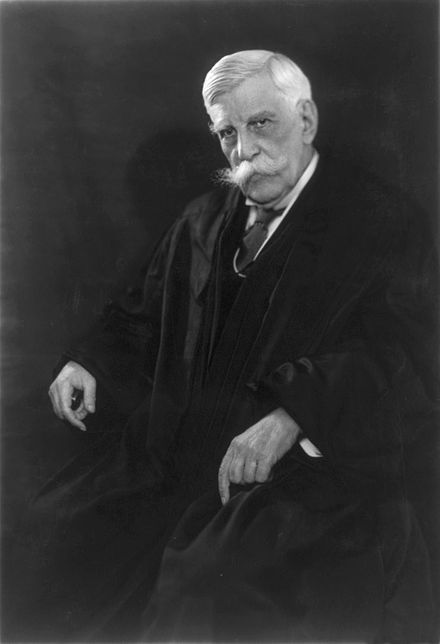

Oliver Wendall Holmes famously said that “taxes are what we pay for a civilized society.” As a widely admired Supreme Court Justice, such words carried a great deal of weight for many citizens and his statement is frequently quoted to this day. Holmes was not a mere virtue signaler when it came to the necessity of funding the government. He voluntarily paid a very high “tax rate” when he left his estate to the United States upon his death in 1935. There is no doubt that Holmes was correct regarding the fact that some level of taxation is required for government to function and that some level of government is required for any large and complex civilization to flourish.

But the devil is in the details.

It might be possible to get over ninety percent of the people to agree that some level of taxation is necessary. But it is difficult to get even a bare majority to agree on the overall level of taxation that is appropriate to say nothing of which level of government — federal, state, or local — should be levying the tax. Even if you can achieve a consensus regarding the overall level of taxation and at what level to levy the tax, the question of who should pay the bulk of the taxes will be controversial.

Taxes are inherently emotional for many people and it is very easy to make serious errors in a state of mind that is not grounded in facts and reason. Those who generally disapprove of the size and scope of government are more likely to view taxes negatively and to seek ways to minimize their personal tax burden. However, even people who approve of a strong and forceful government rarely enjoy paying taxes themselves and will usually not pass up opportunities to reduce their payments. It is important to note that I am referring to legal methods of tax planning here rather than tax evasion.

Regardless of your views regarding the role of government, the level of taxation, or who should bear the brunt of the tax burden, it seems clear that viewing the subject of taxation in a rational manner is desirable. When it comes to making investment decisions, it is critical to keep the issue of taxes in mind but to not allow taxes to be the primary driver of decisions. The old Wall Street quip that one should not let the “tax tail wag the investment dog” is worth keeping in mind because it is all too common for tax driven decision making to lead to serious errors in the long run. Taxes should be viewed as just one of many factors feeding into a coherent decision making process.

The Proof is in the Pudding

As an investor, are you making rational decisions when it comes to taxes?

Everyone obviously likes to think that they are rational, but it is quite likely that tax considerations have hurt your results over time. However, hindsight bias and a human tendency to remember triumphs while relegating errors to the deep recesses of memory makes it likely that we have forgotten cases where tax considerations hurt us.

So, forget about theory and take a look at your results.

If you are like many investors based in the United States, you probably have accounts that enjoy tax free or tax deferred status along with accounts that are fully subject to current income taxes. In my case, I have both traditional and Roth IRA accounts as well as my taxable investment account. Both the traditional and Roth IRA do not incur any current-year tax based on decisions to buy or sell securities, or decisions to invest in securities that pay dividends. The Roth IRA has the additional benefit of offering tax free distributions for people over the age of 59 1/2. My regular investment account has no such tax benefit. Dividends, interest, and capital gains taxes are due on an annual basis.

If my decision making is rational with respect to taxes, then it would follow that the pre-tax results of my IRA accounts and my regular taxable account should not be very different. However, to my surprise, a few years ago when I examined my returns based on the tax status of the account, I found that my IRA accounts had significantly outperformed my taxable account on a pre-tax basis! The difference was not insignificant and because my taxable account is significantly larger than my IRAs, the aggregate lag in dollar terms was very large.

A thorough examination of my transaction activity revealed that I was more likely to sell securities in my IRA accounts than in my taxable account. Although turnover in the IRA accounts was not particularly high, it was materially higher than in my taxable account. I was far more willing to take capital gains in my IRA accounts knowing that I could reinvest the full proceeds of the sale in a new investment without facing the prospect of paying the capital gains tax. As a result, when securities held within my IRA accounts approached my assessment of intrinsic value, I was more likely to at least trim back on the position or sell it entirely when more attractive opportunities existed for reinvestment.

In contrast, a review of my taxable account revealed that I would tend to hold securities in that account even as they approached or exceeded my assessment of intrinsic value. Make no mistake about it, a buy-and-hold approach is usually a good one provided that the companies in a portfolio are steadily growing intrinsic value over time. Owning a security that trades at intrinsic value, or even slightly above it, can be perfectly fine if the intrinsic value of the security is also growing at a nice clip. But the fact is that not all companies fall into this category and usually there are opportunities to reinvest capital in undervalued opportunities. The requirement to take advantage of such opportunities, when fully invested, is to sell a security that is trading at or above intrinsic value. But you have to be willing to do it even if it involves paying taxes.

The Lure of Tax Deferred Compounding

Let us step back for a minute to consider the power of tax deferred compounding and why the prospect of it lures so many investors into making poor decisions.

In a taxable account, a legitimate goal should be to hold securities that will successfully compound intrinsic value over long periods of time, preferably without paying out much in the way of taxable dividends. If you can find a company that can compound capital internally at an attractive rate, your results will be superior to what you would get if you had to identify a different company offering the same rate of return every year. In addition to not having to pay capital gains taxes until you eventually sell, holding a stock for a long period of time relieves the investor of making multiple decisions and the work required to do so successfully.

A simple example should illustrate this point. Investing in a company that can compound intrinsic value at 8 percent per year for twenty years will result in turning a $100,000 investment into over $466,000 prior to paying taxes. If the capital gains tax is 20 percent at the end of this period, the investor will be left with nearly $373,000 after paying the tax.

In contrast, if an investor must change companies every year to earn a 8 percent return, paying a 20 percent capital gains tax along the way, the effective rate of compounding is reduced from 8 percent to 6.4 percent. This investor’s initial $100,000 investment will turn into just under $346,000 at the end of twenty years. In this example, we assume that each of the twenty investments were held for at least one year to qualify for long term capital gains tax treatment. If the holding period was under a year, the lag would be worse.

So, identifying a “compounding machine” that allows for a twenty year holding period produces a difference in the ending balance of $27,000 which is not an insignificant sum relative to the initial $100,000 investment. However, the key caveat is that the single stock must be able to deliver performance over a long period of time. Additionally, the investor would have to forego opportunities to sell and reinvest in better opportunities along the way.

Have I Learned Anything?

In my case, the reason my IRA accounts outperformed my taxable accounts is because I stubbornly refused to sell securities in my taxable account that would incur current year capital gains taxes. I often held the same securities in my IRAs and did sell those shares in order to reinvest in more attractive opportunities. My refusal to pay capital gains taxes resulted in long term underperformance of my taxable account relative to what I know my investment skill was capable of producing, as shown in the results of my IRAs. I would have been far better off making identical decisions in my taxable account and my IRAs, paying the taxes, and reinvesting.

I conducted this analysis of my accounts a few years ago. Have I learned anything from my mistakes?

Apparently I have not learned much given my behavior early this year.

I had held shares of a company in both my IRA and taxable accounts since 2018 that appreciated sharply during the course of 2019. By February 2020, the shares traded materially above my assessment of intrinsic value. I sold the shares that were held in my IRA accounts and redeployed the funds. But in my taxable account, I stubbornly refused to sell more than a token number of shares because doing so would have resulted in a very steep capital gains tax and the loss of other tax benefits.

Fast forward to April 2020. The COVID-19 crisis not only brought the shares of the company in question down to earth, but the fundamental business conditions facing that company had deteriorated to the point where my intrinsic value estimate had declined significantly and the level of risk involved had increased. The range of potential outcomes for the business widened to the point where I was no longer comfortable that a reasonable margin of safety existed. I sold the shares in my taxable account. I still realized a gain on my sale but the large amount of outperformance relative to the S&P 500 that I would have locked in back in February was almost entirely given up. My IRA again outperformed my taxable account due to aversion to realizing taxable income.

Combatting Psychological Pitfalls

It is not possible to change the past and self-recriminations serve no useful purpose. However, we should always try to learn from past mistakes and avoid repeating these errors in the future. The irrational aversion to taxes is a problem facing many investors but perhaps there are ways to frame the problem in a way that is likely to lead to better decisions.

One approach is to reframe how we think about taxes. Those of us who believe that the government wastes a great deal of money are prone to dislike paying taxes because we believe that our money will be wasted. Rather than thinking about our tax money as going into a large void, however, we can reframe the situation. Let’s say that you have realized a $100,000 capital gain and now face a $20,000 federal tax as a result. Rather than framing that $20,000 as going into the government’s general fund, there is no reason that we cannot think of it as funding a specific relative’s social security or Medicare benefits for the year. Alternatively, you can pick any other program and think of your money as funding that program.

If that idea sounds naive, and it might be a stretch for many people to think of taxes in that way, consider a change to how you track your net worth. The reality is that when we refuse to sell an appreciated security to avoid paying current-year taxes, we are not avoiding the eventual tax on the gain. We are only deferring it. If a company, such as Berkshire Hathaway, holds appreciated securities, accounting statements are required to account for a deferred tax liability that recognizes the amount of tax that would be due on the security if the gain was realized immediately.

Individuals should be doing the same for their holdings and recognizing deferred tax liabilities. If you purchased a security years ago for $100,000 and today it is worth $1 million, I am sorry to tell you that you have a silent partner and that entire $1 million is not yours. You have a $900,000 capital gain. And your “partner”, Uncle Sam, “owns” about $180,000 of that $1 million position. You should be carrying a $180,000 deferred tax liability against that $1 million position.

From a mental accounting perspective, if you are carrying a deferred tax liability and thinking of your net worth net of that liability, you are far more likely to be willing to recognize the capital gain and actually pay the tax than if you pretend that the liability does not exist. It is easier from a psychological perspective and leads to more rational decision making outcomes.

Conclusion

Investors should attempt to find companies that are capable of compounding intrinsic value at satisfactory rates for long periods of time without paying taxable distributions to shareholders. Finding such companies, however, is difficult because it is rare for a company to be able to redeploy capital at a high incremental return on equity unless they have and maintain significant moats. Every investor is looking for companies with moats that will protect attractive returns from being competed away. So the valuation of companies that have obvious reinvestment opportunities tends to be high.

If we take Warren Buffett’s approach to heart and view owning shares of a company as owning an interest in the underlying business, we should not have a hair trigger when it comes to selling. The instinct to buy and hold securities of great companies is a good one, but we need to face up to the fact that holding even a great business through periods of significant overvaluation can result in unsatisfactory returns.

When a company gets significantly overvalued, it makes sense to take profits if there are other opportunities that offer brighter prospects going forward. Even Warren Buffett expressed regret in his 2004 letter to shareholders regarding his decision to not sell shares of stock he considered overvalued during the bubble years of the late 1990s.

Those of us who have made serious errors related to irrational tax aversion can take some comfort in knowing that the greatest investor of the past seventy years has grappled with the same problem.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges