International

The High Cost of Poverty

Politicians and economists seem baffled by low consumer confidence in the midst of low unemployment. One explanation is that rampant inflation is hammering…

Politicians and economists seem baffled as inflation hammers the poor

A recent Wall Street Journal poll found that 83% of respondents describe the state of the economy as “poor or not so good”, with 35% “not satisfied at all” with their personal financial situation. The poll of over a thousand Americans is designed to capture the sentiments of the overall population and has a margin of error of 4%.

With the unemployment rate at 3.6%, it would appear that the labor market is doing well. However, the labor force participation rate, at 62.3%, is still 1.1% below pre-pandemic levels. The disconnect between historically low unemployment and widespread dissatisfaction often appears to baffle economists and politicians.

What’s going on?

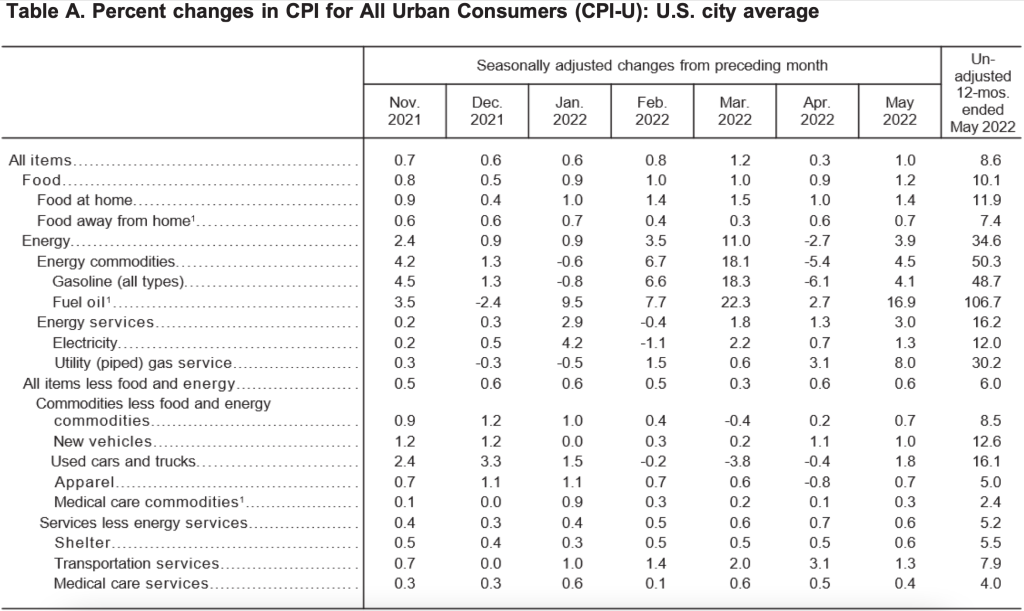

One reason for the sour sentiment among consumers is obviously the high rate of inflation. This morning, the Bureau of Labor Statistics reported its May 2022 data for the Consumer Price Index for all urban consumers (CPI-U). The CPI-U rose by 1% in May on a seasonally adjusted basis and has risen by a whopping 8.6% over the past year. The table shown below provides high level summary data by category:

Lower income Americans spend a large proportion of their income on essential consumption such as food, gasoline, and housing. With the cost of groceries posting annual inflation of over ten percent and the cost of gasoline up nearly fifty percent, people of limited economic means are obviously being hammered by inflation. For many of us, paying higher prices for groceries and gasoline is a manageable annoyance. For someone living paycheck to paycheck, it is far more serious.

Those of us who follow financial news have been reading about wage pressures over the past year, but this has hardly represented some lollapalooza for wage earners because all of the nominal gains in wages and more have been destroyed by inflation. From April 2021 to April 2022, real wages declined by 2.6% according to the Bureau of Labor Statistics.

Aside from food and energy, there is the cost of housing. A glance at the table above shows that the BLS estimates that shelter costs have increased by just 5.5% over the past twelve months. The BLS uses a complex methodology to estimate changes in shelter costs which centers on the concept of owners’ equivalent rent. However, actual rents charged by landlords have hit record highs in several cities and increased by 18% over two years ending in March.

Those of us who were able to secure mortgage rates under 3% during 2021, either through an initial purchase of property or refinancing, benefit from a large part of our housing costs being fixed. In my case, 54% of my monthly cash outflow for housing is the mortgage payment, 29% is the HOA fee, and 17% represents property taxes.

I was recently notified that my HOA fee will increase by 8% in a few months, and I suspect that my property tax will increase by ~10% in 2023. Assuming these increases occur, my monthly cash outflow for housing will increase by ~4% in 2023 because my mortgage payment will remain static for the life of the loan.1

People living in poverty are more likely to rent, and are facing very large increases across the country. But even those who have been able to purchase housing can face far more adverse outcomes in certain circumstances. The Washington Post reported this week that owners of mobile homes are facing ruinous increases in ground rent in several locations throughout the country.

“Mobile” is somewhat of a misnomer because it can cost thousands of dollars to move a mobile home to a different park, if it is possible to move it at all. Most mobile home owners do not own the land underneath their homes. Even if they own their mobile home free and clear, they are subject to rent increases on the ground they occupy. About 20 million Americans live in manufactured housing.

The Washington Post reports that private equity groups have been moving into this space, often using Fannie Mae and Freddie Mac funding:

“When new owners come in, they’re doing infrastructure upgrades, they’re improving the streets and adding amenities, all of which are very important as these communities age,” said Lesli Gooch, chief executive of the Manufactured Housing Institute. “When a community does change hands, often times it’s because of a significant need for improvement and a lack of capital from the existing owners to make such improvements.”

This could very well be true, although several of the individuals interviewed for the article claim that rents went up dramatically as soon as the private equity groups took title. Even if new amenities are introduced, they are obviously unaffordable for many of the people living in these parks.

“In interviews with a dozen mobile home residents around the country, all said their rents had risen this year. Most reported increases of 10 to 25 percent, although some said monthly payments had doubled or tripled. Their options were increasingly limited, too: Many said they had bought trailers after being priced out of apartments, homes and condominiums and were now unsure of where to go next. They had used up their savings or taken on high-interest loans to buy manufactured homes with little resale value. Some were considering moving into motels, crashing with friends or living in their cars until they could find a more permanent arrangement.”

The ground rents in places like Los Angeles have increased to levels that one might think includes actual housing rather than just a plot of land to park a mobile home:

“Christy Andrews thought she was making a sound investment when she scooped up a mobile home for $5,000 in Torrance, Calif., six years ago. But now she says it was a big mistake. Her lot rent — the monthly fee she pays for the plot of land where her trailer is parked — has nearly doubled, to $1,700, in the six years she has lived at Knolls Manor and now takes up nearly all of the $1,900 a month she receives in Social Security disability checks.”

Of course, the cost of apartments or rental homes in coastal regions like Los Angeles are even more costly. Some private equity firms find that it makes sense to convert mobile home parks into more lucrative developments such as condominiums.

Last year, Paul Krugman, who is the 2008 recipient of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, posted a short Twitter thread in which he doesn’t seem to understand how inflation harms the poor.2

In the thread, he states that inflation redistributes wealth from creditors to debtors which is “not exactly a burden on the bottom half of the income distribution.” It is true that unexpected inflation has the effect of helping debtors as the real value of debt melts away in the face of inflation that was not incorporated into the interest rate.

The mortgage I took out last year at 2.75% is melting away on the books of my creditor in real terms, one reason that my personal housing costs are unlikely to rise by more than mid-single digits annually over the next few years.

But the idea that this effect can be the dominant factor when it comes to people living in poverty just seems out of touch with reality.

If you live in a mobile home park in Los Angeles where the rent has skyrocketed by hundreds of dollars per month while you are also paying over 10% more for food and 50% more to fill up your car than you were just a year ago, those are the salient factors that determine your level of confidence.

Consumer price inflation represents an annoyance for me personally and the same is probably true for most of you reading this. But the situation is much worse for people living in poverty, and it does not seem at all surprising that a large majority of Americans believe the economy is on the wrong track.

Americans are no longer fooled by the money illusion of nominal increases in wages that are woefully inadequate to even cover the official increase in the CPI-U, to say nothing of the larger increases in their personal cost of living which is tilted toward items within the CPI that are rising much faster than the overall average indicates.

As Christopher Leonard documented in great detail in The Lords of Easy Money, which I reviewed earlier this year, the Federal Reserve conducted a huge experiment with the American economy over the past decade. As they say, the chickens have now come home to roost.3

Not all economists and politicians are totally clueless, and it seems justifiable to wonder whether they really do not understand what’s happening to cause social unrest today, or if they simply don’t want to understand.

I’m reminded of Family Matters, the 1990s sitcom featuring the lovable, yet clumsy and error prone, Steve Urkel who somehow always caused funny catastrophes, invariably followed by the question, “Did I do that”? Of course, the catastrophes caused by the Federal Reserve and the politicians who failed to exert appropriate oversight of the Fed are anything but funny, as a large number of Americans are now realizing.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

- Of course, part of the mortgage payment represents principal on an amortizing loan, so the entire payment is not an expense. On the other hand, the capital invested in the property has an opportunity cost that is not represented by monthly cash flow.

- h/t to Rudy Havenstein for the Krugman tweet which was included in his recent post, Keynesian Cargo Cult.

- Yes, there are certain factors such as the war between Russia and Ukraine that have made matters worse, but it is disingenuous for politicians to blame inflation principally on the war, as some have implied in recent months. Inflation was clearly gaining momentum for months before the war started.

International

The next pandemic? It’s already here for Earth’s wildlife

Bird flu is decimating species already threatened by climate change and habitat loss.

I am a conservation biologist who studies emerging infectious diseases. When people ask me what I think the next pandemic will be I often say that we are in the midst of one – it’s just afflicting a great many species more than ours.

I am referring to the highly pathogenic strain of avian influenza H5N1 (HPAI H5N1), otherwise known as bird flu, which has killed millions of birds and unknown numbers of mammals, particularly during the past three years.

This is the strain that emerged in domestic geese in China in 1997 and quickly jumped to humans in south-east Asia with a mortality rate of around 40-50%. My research group encountered the virus when it killed a mammal, an endangered Owston’s palm civet, in a captive breeding programme in Cuc Phuong National Park Vietnam in 2005.

How these animals caught bird flu was never confirmed. Their diet is mainly earthworms, so they had not been infected by eating diseased poultry like many captive tigers in the region.

This discovery prompted us to collate all confirmed reports of fatal infection with bird flu to assess just how broad a threat to wildlife this virus might pose.

This is how a newly discovered virus in Chinese poultry came to threaten so much of the world’s biodiversity.

The first signs

Until December 2005, most confirmed infections had been found in a few zoos and rescue centres in Thailand and Cambodia. Our analysis in 2006 showed that nearly half (48%) of all the different groups of birds (known to taxonomists as “orders”) contained a species in which a fatal infection of bird flu had been reported. These 13 orders comprised 84% of all bird species.

We reasoned 20 years ago that the strains of H5N1 circulating were probably highly pathogenic to all bird orders. We also showed that the list of confirmed infected species included those that were globally threatened and that important habitats, such as Vietnam’s Mekong delta, lay close to reported poultry outbreaks.

Mammals known to be susceptible to bird flu during the early 2000s included primates, rodents, pigs and rabbits. Large carnivores such as Bengal tigers and clouded leopards were reported to have been killed, as well as domestic cats.

Our 2006 paper showed the ease with which this virus crossed species barriers and suggested it might one day produce a pandemic-scale threat to global biodiversity.

Unfortunately, our warnings were correct.

A roving sickness

Two decades on, bird flu is killing species from the high Arctic to mainland Antarctica.

In the past couple of years, bird flu has spread rapidly across Europe and infiltrated North and South America, killing millions of poultry and a variety of bird and mammal species. A recent paper found that 26 countries have reported at least 48 mammal species that have died from the virus since 2020, when the latest increase in reported infections started.

Not even the ocean is safe. Since 2020, 13 species of aquatic mammal have succumbed, including American sea lions, porpoises and dolphins, often dying in their thousands in South America. A wide range of scavenging and predatory mammals that live on land are now also confirmed to be susceptible, including mountain lions, lynx, brown, black and polar bears.

The UK alone has lost over 75% of its great skuas and seen a 25% decline in northern gannets. Recent declines in sandwich terns (35%) and common terns (42%) were also largely driven by the virus.

Scientists haven’t managed to completely sequence the virus in all affected species. Research and continuous surveillance could tell us how adaptable it ultimately becomes, and whether it can jump to even more species. We know it can already infect humans – one or more genetic mutations may make it more infectious.

At the crossroads

Between January 1 2003 and December 21 2023, 882 cases of human infection with the H5N1 virus were reported from 23 countries, of which 461 (52%) were fatal.

Of these fatal cases, more than half were in Vietnam, China, Cambodia and Laos. Poultry-to-human infections were first recorded in Cambodia in December 2003. Intermittent cases were reported until 2014, followed by a gap until 2023, yielding 41 deaths from 64 cases. The subtype of H5N1 virus responsible has been detected in poultry in Cambodia since 2014. In the early 2000s, the H5N1 virus circulating had a high human mortality rate, so it is worrying that we are now starting to see people dying after contact with poultry again.

It’s not just H5 subtypes of bird flu that concern humans. The H10N1 virus was originally isolated from wild birds in South Korea, but has also been reported in samples from China and Mongolia.

Recent research found that these particular virus subtypes may be able to jump to humans after they were found to be pathogenic in laboratory mice and ferrets. The first person who was confirmed to be infected with H10N5 died in China on January 27 2024, but this patient was also suffering from seasonal flu (H3N2). They had been exposed to live poultry which also tested positive for H10N5.

Species already threatened with extinction are among those which have died due to bird flu in the past three years. The first deaths from the virus in mainland Antarctica have just been confirmed in skuas, highlighting a looming threat to penguin colonies whose eggs and chicks skuas prey on. Humboldt penguins have already been killed by the virus in Chile.

How can we stem this tsunami of H5N1 and other avian influenzas? Completely overhaul poultry production on a global scale. Make farms self-sufficient in rearing eggs and chicks instead of exporting them internationally. The trend towards megafarms containing over a million birds must be stopped in its tracks.

To prevent the worst outcomes for this virus, we must revisit its primary source: the incubator of intensive poultry farms.

Diana Bell does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

genetic pandemic mortality spread deaths south korea south america europe uk chinaInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic franceInternational

As the pandemic turns four, here’s what we need to do for a healthier future

On the fourth anniversary of the pandemic, a public health researcher offers four principles for a healthier future.

Anniversaries are usually festive occasions, marked by celebration and joy. But there’ll be no popping of corks for this one.

March 11 2024 marks four years since the World Health Organization (WHO) declared COVID-19 a pandemic.

Although no longer officially a public health emergency of international concern, the pandemic is still with us, and the virus is still causing serious harm.

Here are three priorities – three Cs – for a healthier future.

Clear guidance

Over the past four years, one of the biggest challenges people faced when trying to follow COVID rules was understanding them.

From a behavioural science perspective, one of the major themes of the last four years has been whether guidance was clear enough or whether people were receiving too many different and confusing messages – something colleagues and I called “alert fatigue”.

With colleagues, I conducted an evidence review of communication during COVID and found that the lack of clarity, as well as a lack of trust in those setting rules, were key barriers to adherence to measures like social distancing.

In future, whether it’s another COVID wave, or another virus or public health emergency, clear communication by trustworthy messengers is going to be key.

Combat complacency

As Maria van Kerkove, COVID technical lead for WHO, puts it there is no acceptable level of death from COVID. COVID complacency is setting in as we have moved out of the emergency phase of the pandemic. But is still much work to be done.

First, we still need to understand this virus better. Four years is not a long time to understand the longer-term effects of COVID. For example, evidence on how the virus affects the brain and cognitive functioning is in its infancy.

The extent, severity and possible treatment of long COVID is another priority that must not be forgotten – not least because it is still causing a lot of long-term sickness and absence.

Culture change

During the pandemic’s first few years, there was a question over how many of our new habits, from elbow bumping (remember that?) to remote working, were here to stay.

Turns out old habits die hard – and in most cases that’s not a bad thing – after all handshaking and hugging can be good for our health.

But there is some pandemic behaviour we could have kept, under certain conditions. I’m pretty sure most people don’t wear masks when they have respiratory symptoms, even though some health authorities, such as the NHS, recommend it.

Masks could still be thought of like umbrellas: we keep one handy for when we need it, for example, when visiting vulnerable people, especially during times when there’s a spike in COVID.

If masks hadn’t been so politicised as a symbol of conformity and oppression so early in the pandemic, then we might arguably have seen people in more countries adopting the behaviour in parts of east Asia, where people continue to wear masks or face coverings when they are sick to avoid spreading it to others.

Although the pandemic led to the growth of remote or hybrid working, presenteeism – going to work when sick – is still a major issue.

Encouraging parents to send children to school when they are unwell is unlikely to help public health, or attendance for that matter. For instance, although one child might recover quickly from a given virus, other children who might catch it from them might be ill for days.

Similarly, a culture of presenteeism that pressures workers to come in when ill is likely to backfire later on, helping infectious disease spread in workplaces.

At the most fundamental level, we need to do more to create a culture of equality. Some groups, especially the most economically deprived, fared much worse than others during the pandemic. Health inequalities have widened as a result. With ongoing pandemic impacts, for example, long COVID rates, also disproportionately affecting those from disadvantaged groups, health inequalities are likely to persist without significant action to address them.

Vaccine inequity is still a problem globally. At a national level, in some wealthier countries like the UK, those from more deprived backgrounds are going to be less able to afford private vaccines.

We may be out of the emergency phase of COVID, but the pandemic is not yet over. As we reflect on the past four years, working to provide clearer public health communication, avoiding COVID complacency and reducing health inequalities are all things that can help prepare for any future waves or, indeed, pandemics.

Simon Nicholas Williams has received funding from Senedd Cymru, Public Health Wales and the Wales Covid Evidence Centre for research on COVID-19, and has consulted for the World Health Organization. However, this article reflects the views of the author only, in his academic capacity at Swansea University, and no funding or organizational bodies were involved in the writing or content of this article.

vaccine treatment pandemic covid-19 spread social distancing uk world health organization-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex