Uncategorized

The Digest #182

Passive Investing, Low Trust Societies, Greg Abel in the spotlight, Capital allocation at Berkshire, Better habits for 2024, Amusing CPA stories, Ben Graham,…

Passive vs. Active Investing

Recently, I have been questioning whether it makes sense to continue investing in individual stocks in the future. As I was thinking about this, I decided to post the following on X/Twitter assuming that it would attract just a few responses. However, it attracted quite a bit of attention and the point I made was misunderstood.

Since 2000, when I began investing actively, I have had only two down years (-29% in 2008 and -2.6% in 2015) and I outperformed the S&P 500 in fourteen of twenty-three years. On a weighted cash-flow basis, my returns have clearly outperformed the S&P 500 since 2000. However, my most important investment throughout this period has been Berkshire Hathaway which deserves credit for the vast majority of my unrealized and realized gains in dollar terms. I’m happy with my results but I am not sure active stock picking is worthwhile in the future given my personal circumstances.

Some of the responses assumed that I was either throwing in the towel due to poor performance or that I was trying to chase the “magnificent seven” companies that have dominated market returns this year in the United States. Other responses seemed to assume that I was planning sell my long-held shares of Berkshire, pay taxes on realized capital gains, and reinvest the proceeds in the S&P 500.

I am not currently planning to sell my Berkshire shares, especially not in my taxable account, and I am certainly not motivated by a desire to chase the “magnificent seven” by purchasing an index that these mega-cap tech companies dominate.

The reason I am considering a passive strategy for new investments is because I am not sure that I want to spend the majority of my time on stock research in the future. If I adopt a passive strategy, it will not necessarily track the S&P 500. There are numerous ETFs tracking domestic and foreign markets. It is also possible to track the S&P 500 on an equal-weighted, rather than market-cap, basis through Invesco’s RSP ETF.

I plan to write about passive strategies in 2024 as I investigate what is available. As far as Berkshire is concerned, I have no problem owning this well-run and diversified conglomerate in a concentrated manner for the foreseeable future.

From the Archive: The Paradox of Trust

I’m in the process of migrating hundreds of articles from my website to my newsletter archive on Substack. Occasionally, I will send out an older article that remains timely since the vast majority of current subscribers will not have seen it before. I am also planning to include links to articles from the archive in issues of The Digest.

The Paradox of Trust, October 31, 2019. In retrospect, I wrote this article at a critical inflection point for American society. It was written just three months before the pandemic hit, although obviously I did not know it at the time. I had just returned from a few weeks walking through Spain and immediately noticed the relative lack of trust in the United States compared to what I encountered in rural Spain, where I spent most of my time, as well as in Madrid. My point was that trust in society is critical for anything to work well. In my opinion, the pandemic drastically reduced our already low levels of societal trust and we have yet to recover. In fact, political strife in 2024 could make the situation far worse. (The Rational Walk)

- Related Article: In his recent article, Why the US can’t have nice things, part 2, Chris Arnade made these remarks about social trust after observing conditions on New York City’s subway system: “Social trust is also extraordinary important to maintain, because like a ratchet wheel, once it comes undone, it spins quickly out of control, and getting it wound back is a long, arduous, and complex process, that requires moving it tighter one painful ratchet at a time. Right now in the US, the social trust ratchet wheel has come completely undone.” I recommend reading the full article as well as Dignity: Seeking Respect in Back Row America, Chris Arnade’s excellent book which I briefly described in Holiday Book Recommendations for 2019.

Featured Links

The Man Preparing for a Berkshire Hathaway Without Warren Buffett by Justin Baer, December 23, 2023. This is a profile of Greg Abel who has been Warren Buffett’s designated successor since 2021. From time to time, Mr. Abel has been in the spotlight, but in general he has succeeded in keeping a low profile which is apparently how he likes it. As he goes about his days in Des Moines, he is usually not even recognized. Warren Buffett and Berkshire director Ron Olson are quoted in the article:

- Warren Buffett: “Greg will be more successful than I have been, and if I said otherwise, my nose would grow.”

- Ron Olson: “[Greg] is no Warren Buffett. But neither is anyone else. He’s still a numbers guy and understands the language of business as well as anyone but he loves to learn.”

The death of Charlie Munger has reminded us that Warren Buffett will not be running Berkshire Hathaway forever. This article might raise concerns among shareholders that Mr. Buffett could be planning to step down soon or might have health problems. However, I’m confident that if Mr. Buffett develops problems that could force him to retire, he would be open and candid with shareholders in a timely manner. (WSJ)

Warren Buffett, Teledyne, and the Art of Allocating Capital, December 20, 2023. 35 minutes. Video. Geoff Gannon and Andrew Kuhn discuss capital allocation in general and also comment on Berkshire Hathaway’s potential for reinvesting capital in the years to come. I am in general agreement with their statements regarding the importance of return of capital in the future as well as the comments favoring special dividends over the rigidity of regular dividends. My strong preference is for share repurchases so long as the stock price is not overvalued. (Focused Compounding)

- Thoughts on Share Repurchases and Capital Allocation, July 19, 2018. I wrote this article two days after Berkshire revised its repurchase policy in July 2018. Since the policy was amended, Berkshire has used $72.9 billion to repurchase 199,930 Class A equivalents. Berkshire now has fewer shares outstanding than at any time since prior to the General Re acquisition in 1998. All of the shares that were issued to partially fund the BNSF acquisition in 2010 have been retired, and more. This shrinkage in share count is likely to continue. (The Rational Walk)

When We All Have Pocket Telephones

This is a 97 year old comic strip about what the world would be like in the future when everyone carried around a phone in their pocket. h/t @historyinmemes

Articles

Warren Buffett’s Letters to Shareholders — Searchable Memorex This is a new website that contains all of Warren Buffett’s letters in a searchable format. The site was built by Max Olson who worked with Warren Buffett to publish the first fifty years of Berkshire Hathaway shareholder letters. Last year, I purchased the Kindle version of the letters which is a great deal at just $3.99. I did so in order to be able to search by topic which is something that is now possible on this new website as well.

Charlie Munger Q&A Transcript || University of Michigan (2017) by Kingswell, December 18, 2023. This is the latest in a series of useful transcripts: “On November 30, 2017, Charlie Munger spoke at an alumni event for the University of Michigan’s Ross School of Business held in Los Angeles. For nearly an hour, he expounded on a wide range of topics — from growing up in Omaha during the Great Depression and partnering with Warren Buffett at Berkshire Hathaway to cryptocurrency and China.” (Kingswell)

Ben Graham and His Errant Brothers, December 2023. This is the tenth installment in a series of reminiscences of Benjamin Graham written by his granddaughter. In this article, the author goes into Ben’s childhood years and his often challenging relationship with his brothers. Ben was the youngest of three brothers born in close succession. It is always interesting to read about the early years of someone who later reached the pinnacle of his profession. (Beyond Ben Graham)

How To Have Better Habits in 2024 by Ryan Holiday, December 20, 2023. There’s no shortage of articles on habit building at the end of the year as people get ready to resolve to make a fresh start. . I like this list of suggestions. (RyanHoliday.net)

- Atomic Habits, February 8, 2021. I read James Clear’s book, Atomic Habits, in early 2021 and wrote this review soon after. It is probably the best book on habit building that I have ever read, aside from the stoic classics. (The Rational Walk)

The Writing Mission (is to be curious), a New Covenant, and Twelve Questions by Frederik Gieschen, December 22, 2023. “The best writing feels urgent, emotional, important, and uncomfortable. It feels like a tiny Jerry Stiller is preparing for the ‘airing of grievances’ during Seinfeld’s Festivus, yelling that he’s “got a lot of problems with you people, and now you’re gonna hear about it!” (‘You people’ being society at large, not the readers.) The best writing needs to be spilled out on the page, it cannot be held back. This is a selfish way to write, but the only one I’ve found worth pursuing.” (The Alchemy of Money)

Taxing Our Brains by Dan Smith, December 20, 2023. I got a few laughs out of reading this article written by a retired CPA recounting strangely irrational attitudes among his former clients. A sample: “Years ago, I asked a friend why she hadn’t refinanced her home loan after mortgage rates dropped sharply. Her response? She said she needed the bigger tax deduction. Even after I explained that she only saved 15 cents in tax for every $1 spent on mortgage interest, she still didn’t get it.” (Humble Dollar)

Podcasts

Respect Each Other’s Delusions, December 22, 2023. 9 minutes. This is the podcast version of a recent article. “When you realize that you – the good, noble, well-meaning, even-tempered, fact-driven person that you are – have views of how the world works that are sure to be incomplete if not completely wrong, you should have empathy for others whose deluded beliefs are obvious to you. I am such a fan of Daniel Kahneman’s observation that we are better at spotting other people’s flaws than our own.” (The Morgan Housel Podcast)

Pernod Ricard: Luxury Liquor, December 20, 2023. 47 minutes. Transcript. “Pernod Ricard [is] a business whose history dates back to 1797. Today, the business is the second-largest global producer of wine and spirits with a portfolio of 17 of the top 100 spirits brands, including Absolut vodka, Beefeater gin, Jameson Irish whiskey, and Malibu rum. The portfolio produces north of EUR 12 billion in sales and generates an impressive 60% gross margin and high 20% operating margin.” (Business Breakdowns)

An Extraordinary Introduction to the Birth of Israel and the Arab-Israeli Conflict, December 18, 2023. Transcript. This is one of the best explanations of the conflict I have listened to in recent weeks because it goes back far beyond 1948 to explain the conditions in the nineteenth century that gave rise to the Zionist movement. “We have two topics for today. The first, we’re going to take an historical look at European Jew-hatred, antisemitism, and the second is the current situation here in Israel as the war in Gaza enters its sixth week. And we’ll see some of the ties between those two events.” (Econ Talk)

Jesus, December 24, 2023. 35 minutes. David Senra discusses what he learned from reading Jesus: A Biography from a Believer by Paul Johnson. I found this description of the book on Amazon: “Few figures have had such an influence on the world as Jesus of Nazareth. Paul Johnson’s brilliant and powerful reading of Jesus’ life at once captures his transfiguring message and his historical complexity.” (Founders)

Census at Bethlehem

Pieter Bruegel the Elder painted the scene below in 1566 shortly after of one of the harshest winters on record. The painting portrays Bethlehem as a Flemish village toward the end of the day, with Joseph and Mary approaching the crowd on the left.

Description via Wikipedia:

The painting shows Bethlehem as a Flemish village in winter at sundown. A group of people is gathered at a building on the left, having their details taken down by a scribe. A sign bearing the Habsburg double-headed eagle is visible on the building. Other people are making their way to the same building, including the figures of Joseph and the pregnant Virgin Mary on a donkey. A pig is being slaughtered, though of course such an event would never have occurred in Jewish Bethlehem.

People are going about their daily business in the cold, children are shown playing with toys on the ice and having snowball fights. At the very centre of the painting is a spoked wheel, sometimes interpreted as being a reference to the wheel of fortune.

To the right, a man in a small hut is shown holding a clapper, a warning to keep away from leprosy. Leprosy was endemic in that part of Europe when the painting was created. There is a begging bowl in front of the hut. In the background, men drink at a makeshift bar, and in the distance are a well-kept church and a crumbling castle.

This is a very creative depiction of the scene described in Luke 2:1-5.

For all those who celebrate, Merry Christmas!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

sp 500 stocks pandemic cryptocurrency mortgage rates etfUncategorized

Shipping company files surprise Chapter 7 bankruptcy, liquidation

While demand for trucking has increased, so have costs and competition, which have forced a number of players to close.

The U.S. economy is built on trucks.

As a nation we have relatively limited train assets, and while in recent years planes have played an expanded role in moving goods, trucks still represent the backbone of how everything — food, gasoline, commodities, and pretty much anything else — moves around the country.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

"Trucks moved 61.1% of the tonnage and 64.9% of the value of these shipments. The average shipment by truck was 63 miles compared to an average of 640 miles by rail," according to the U.S. Bureau of Transportation Statistics 2023 numbers.

But running a trucking company has been tricky because the largest players have economies of scale that smaller operators don't. That puts any trucking company that's not a massive player very sensitive to increases in gas prices or drops in freight rates.

And that in turn has led a number of trucking companies, including Yellow Freight, the third-largest less-than-truckload operator; J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics, to close while freight brokerage Convoy shut down in October.

Aside from Convoy, none of these brands are household names. but with the demand for trucking increasing, every company that goes out of business puts more pressure on those that remain, which contributes to increased prices.

Image source: Shutterstock

Another freight company closes and plans to liquidate

Not every bankruptcy filing explains why a company has gone out of business. In the trucking industry, multiple recent Chapter 7 bankruptcies have been tied to lawsuits that pushed otherwise successful companies into insolvency.

In the case of TBL Logistics, a Virginia-based national freight company, its Feb. 29 bankruptcy filing in U.S. Bankruptcy Court for the Western District of Virginia appears to be death by too much debt.

"In its filing, TBL Logistics listed its assets and liabilities as between $1 million and $10 million. The company stated that it has up to 49 creditors and maintains that no funds will be available for unsecured creditors once it pays administrative fees," Freightwaves reported.

The company's owners, Christopher and Melinda Bradner, did not respond to the website's request for comment.

Before it closed, TBL Logistics specialized in refrigerated and oversized loads. The company described its business on its website.

"TBL Logistics is a non-asset-based third-party logistics freight broker company providing reliable and efficient transportation solutions, management, and storage for businesses of all sizes. With our extensive network of carriers and industry expertise, we streamline the shipping process, ensuring your goods reach their destination safely and on time."

The world has a truck-driver shortage

The covid pandemic forced companies to consider their supply chain in ways they never had to before. Increased demand showed the weakness in the trucking industry and drew attention to how difficult life for truck drivers can be.

That was an issue HBO's John Oliver highlighted on his "Last Week Tonight" show in October 2022. In the episode, the host suggested that the U.S. would basically start to starve if the trucking industry shut down for three days.

"Sorry, three days, every produce department in America would go from a fully stocked market to an all-you-can-eat raccoon buffet," he said. "So it’s no wonder trucking’s a huge industry, with more than 3.5 million people in America working as drivers, from port truckers who bring goods off ships to railyards and warehouses, to long-haul truckers who move them across the country, to 'last-mile' drivers, who take care of local delivery."

The show highlighted how many truck drivers face low pay, difficult working conditions and, in many cases, crushing debt.

"Hundreds of thousands of people become truck drivers every year. But hundreds of thousands also quit. Job turnover for truckers averages over 100%, and at some companies it’s as high as 300%, meaning they’re hiring three people for a single job over the course of a year. And when a field this important has a level of job satisfaction that low, it sure seems like there’s a huge problem," Oliver shared.

The truck-driver shortage is not just a U.S. problem; it's a global issue, according to IRU.org.

"IRU’s 2023 driver shortage report has found that over three million truck driver jobs are unfilled, or 7% of total positions, in 36 countries studied," the global transportation trade association reported.

"With the huge gap between young and old drivers growing, it will get much worse over the next five years without significant action."

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic stocks commoditiesUncategorized

Wendy’s has a new deal for daylight savings time haters

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

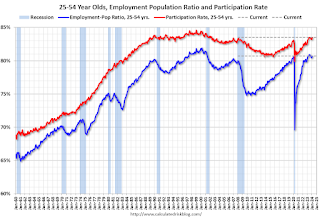

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 hours ago

International2 hours agoWalmart launches clever answer to Target’s new membership program

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex