Government

The $31 Trillion Dollar Question – Can The Fed Afford To Pivot?

The $31 Trillion Dollar Question – Can The Fed Afford To Pivot?

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

In my other role…

Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

In my other role as a secret apologist for Russia and Vladimir Putin, I was contacted yesterday by Sputnik News to comment on the official US debt number surpassing $31 trillion. I’m always grateful for the opportunity to talk about these issues.

I am, after all, a fiscal hawk extraordinaire.

At the same time, I’m completely hip to why Sputnik (and RT) wanted to discuss this issue. They are running their own framing campaign, propaganda if you will. I’m no one’s useful idiot when it comes to these matters.

They may have been looking for a dissident American voice to berate the US for its reckless spending, which fits the Russian media narrative that the US cannot sustain its current pressure campaign against Russia.

This is meant to counter the West’s narrative that Russia can’t sustain its military operations in Ukraine.

Hey, everyone’s got a truth to tell. I get it, it’s a war out there. All I can do is make the best use of the opportunities in front of me and tell my version of those truths. Because talking about things truthfully may actually get us one step back on the path towards peace rather than global war. That said, if I see no upside to the opportunity, the best thing to do is turn it down politely and wait for the next one.

At the same time we all have to realize that Russian media outlets have a hard time booking guests at this point due to the massive political pressure. So, as always, I see the opportunity as a way to talk to everyone to further understanding these things, not just feed one side’s attempt to shift the Overton Window.

In this particular case the US debt is a major issue and part of my general thesis of how the gameboard maps out in real time — faction by fractious faction. So, I was happy to throw my thoughts into the mix.

In short, the US is staring at a massive fiscal decision in the coming months and years. The situation isn’t insolvable but it also isn’t going to be easy for get through. We’re staring at a global recession, at a minimum, as well as a sovereign debt crisis in the West and in some Emerging Markets. Turkey has already been blown up.

However, the US is still a major player in the global financial system and the Federal Reserve the most powerful of these institutions. Understanding the Fed’s role in fixing what is broken is something all sides need to consider.

So, while, I’m sure it pleases my Russian paymasters (sic) that I believe there’s a split at the top of the US political establishment, it may not afford them the opportunities they think that split implies.

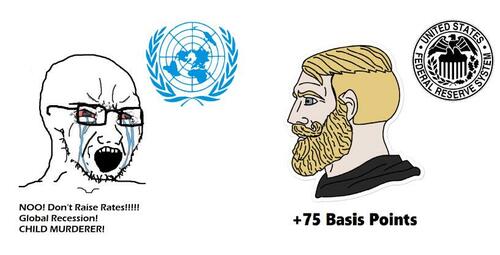

The reality is that the Fed has charted its own path here and this week’s pathetic appeal from the United Nations to urge central banks from raising interest rates is the best evidence I can present to you that my arguments about the Fed are correct.

The UN basically asked the Fed to, “Think of the CHILDREN!” Bail out the world for the common good. Now is not the time for unilateral action. Think globally, act locally.

You know, all the usual bromides to cover the reality that a hawkish Fed gores the wrong people’s oxen.

But the not-so-subtle point I think Sputnik was trying to make is that can the Fed actually do this with the US dealing with a $31 trillion debt overhang.

It is the question of the century.

For me, it’s simple. We won’t ever know if we don’t try. And given that the alternative to a few years of global depression to burn out the excesses of the Davos-controlled Fed during the Bernanke/Yellen years or turning the West over to Klaus Von CommieSchnitzel and his Minority Report future, I don’t think the decision is a difficult one for most people to make.

Here is the full Q&A between myself and Sputnik to ponder.

According to the NYT, the breach of the threshold comes at an inopportune moment, as historically low interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation. What consequences does this policy bring from a mid-term perspective?

There was so much money printed during the COVID-19 period that it’s left the Fed with a massive dilemma. It needs to flush the global economy of excess dollars and shrink its balance sheet without destroying the US economy in the process.

It’s clear that FOMC Chair Jerome Powell is acting with regards only towards the US’s needs. For the first time in decades the world is having to come to grips with the idea that the Fed will not be there to bail them out if they get into trouble.

The medium term will be a period of extreme dollar strength. Because during this loose dollar period, post-2008, the world loaded up on cheap dollar-denominated debt. That is now reversing itself hard. Emerging markets and even developed markets like the UK, Europe and China are vulnerable to this reversal of dollar outflow.

The political problem for the “Biden” administration is that this is making it very difficult for them in this mid-term election cycle. “Biden” wants inflation down but they baked far too much of it into the global economy contain it even with this aggressive rate hike cycle from the Fed.

This sets the Fed and Congress at odds with each other. But it also sets the stage for a political shift after November. If Congress tries to keep spending beyond its means then the US will enter a very ugly inflationary cycle that the Fed is powerless to contain.

Do you see any alternatives to the existing policy?

Yes. Congress needs to rein in spending to previous levels. The Fed is doing its job raising the cost of capital to divert money out of the unsustainable and into the sustainable. Monetary policy can signal entrepreneurs and investors to rebuild what’s degraded and look to where the economy has been neglected.

But it can’t do that if Congress also wants to get in the act spending money that fuels keeping prices too high and crowding out investment where it wants to go, rather than where Congress wants it to go.

This will require a complete 90-degree shift in our political thinking, similar to the Reagan/Volcker years. We have half of the policy in place, Powell acting like fir Arthur Burns and implying he will also be Volcker.

We need the other half of the policy by getting rid of the ruinous and reckless “Biden” politics of envy – eating the rich, fomenting wars, etc.

But, sadly, I see “Biden” and the people he’s aligned with only wanting war to cover the insolvency of national governments.

Who are the losers and winners in this situation?

If the Fed can help force a political rethink in the US, and the national polling seems to suggest that Americans are ready for this, then a more balanced US fiscal and monetary policy coming into the 2024 presidential cycle would make most of the world a winner because it would put an end to the current insanity.

In the short to medium term, however, the pain for much of the world will be intense, including the US. Much of the deflation in certain sectors of the US economy from the Fed’s intense interest rate policy should be offset by capital inflow from those who have lived beyond their means because of the weak dollar in the past.

The prime beneficiaries of this have been Europe and their overly generous entitlement/pension systems, which are teetering on full collapse as we saw in the UK recently, and China with its massive trade surplus with the US.

The winners will be those who produce and export base commodities. Because in broad strokes, assets inflated through easy credit for over a decade, like gov’t bonds, stocks, real estate and mid-to-high end consumer goods, will be deflating. On the flip side, base commodity prices, the main driver of inflation today, will continue rising – oil, gas, gold, metals, food, etc.

In short, the easy money of the post-2008 era fueled stock, bond and real estate booms which will now bust, suppressing investment into base commodities. With the credit cycle reversing so too will this dynamic.

If servicing the debt becomes more expensive, what will it mean, in practical terms, for the country’s economy? How can this situation affect ordinary Americans?

The downside of all of this is that US debt servicing will rise, helping to force Congress into tightening its belt. If “Biden” doesn’t stop trying to spend money in ways that would make drunken sailors think twice, then he’s deliberately trying to destroy the US fiscal position to degrade the country he’s supposed to be leading. It will be evidence of his administration being staffed in all key positions with vandals.

The US has a lot of debt that needs rolling over in 2023. It will have to happen at higher rates. The Fed will likely stop rate hikes in Q1 to help that situation. But a slow down in government spending without the concomitant relaxing of regulations to free up the flow of capital will keep the US economy sputtering for 2023 even with the inflow from overseas.

Even with a GOP win in November, the battle for the future here will be intense. I don’t expect it to go well and it means recession, political paralysis and the possibility of the White House to continue pursuing ruinous policy because Congress abdicated all of its responsibilities towards foreign policy to the president two decades ago after 9/11.

Practically, after the mid-terms, we will all struggle with high energy and food prices, limited good employment options, frozen capital searching for a decent investment while the economy slowly unwinds the ugly situation it is currently in where supply and demand for basic goods and services are completely out of whack, per Powell’s recent statement at Jackson Hole.

My advice to people is the same as it’s been for years. Get and stay out of debt, minimize expenses where you can, and develop strong local communities to assist each other while the geopolitical tensions continue to rise.

p.s. all references to my being a Russian secret agent are pure, unadulterated sarcasm, in case anyone reading this is devoid of a sense of humor, or a Democrat… but I repeat myself

* * *

Join my Patreon if you like big questions

International

The next pandemic? It’s already here for Earth’s wildlife

Bird flu is decimating species already threatened by climate change and habitat loss.

I am a conservation biologist who studies emerging infectious diseases. When people ask me what I think the next pandemic will be I often say that we are in the midst of one – it’s just afflicting a great many species more than ours.

I am referring to the highly pathogenic strain of avian influenza H5N1 (HPAI H5N1), otherwise known as bird flu, which has killed millions of birds and unknown numbers of mammals, particularly during the past three years.

This is the strain that emerged in domestic geese in China in 1997 and quickly jumped to humans in south-east Asia with a mortality rate of around 40-50%. My research group encountered the virus when it killed a mammal, an endangered Owston’s palm civet, in a captive breeding programme in Cuc Phuong National Park Vietnam in 2005.

How these animals caught bird flu was never confirmed. Their diet is mainly earthworms, so they had not been infected by eating diseased poultry like many captive tigers in the region.

This discovery prompted us to collate all confirmed reports of fatal infection with bird flu to assess just how broad a threat to wildlife this virus might pose.

This is how a newly discovered virus in Chinese poultry came to threaten so much of the world’s biodiversity.

The first signs

Until December 2005, most confirmed infections had been found in a few zoos and rescue centres in Thailand and Cambodia. Our analysis in 2006 showed that nearly half (48%) of all the different groups of birds (known to taxonomists as “orders”) contained a species in which a fatal infection of bird flu had been reported. These 13 orders comprised 84% of all bird species.

We reasoned 20 years ago that the strains of H5N1 circulating were probably highly pathogenic to all bird orders. We also showed that the list of confirmed infected species included those that were globally threatened and that important habitats, such as Vietnam’s Mekong delta, lay close to reported poultry outbreaks.

Mammals known to be susceptible to bird flu during the early 2000s included primates, rodents, pigs and rabbits. Large carnivores such as Bengal tigers and clouded leopards were reported to have been killed, as well as domestic cats.

Our 2006 paper showed the ease with which this virus crossed species barriers and suggested it might one day produce a pandemic-scale threat to global biodiversity.

Unfortunately, our warnings were correct.

A roving sickness

Two decades on, bird flu is killing species from the high Arctic to mainland Antarctica.

In the past couple of years, bird flu has spread rapidly across Europe and infiltrated North and South America, killing millions of poultry and a variety of bird and mammal species. A recent paper found that 26 countries have reported at least 48 mammal species that have died from the virus since 2020, when the latest increase in reported infections started.

Not even the ocean is safe. Since 2020, 13 species of aquatic mammal have succumbed, including American sea lions, porpoises and dolphins, often dying in their thousands in South America. A wide range of scavenging and predatory mammals that live on land are now also confirmed to be susceptible, including mountain lions, lynx, brown, black and polar bears.

The UK alone has lost over 75% of its great skuas and seen a 25% decline in northern gannets. Recent declines in sandwich terns (35%) and common terns (42%) were also largely driven by the virus.

Scientists haven’t managed to completely sequence the virus in all affected species. Research and continuous surveillance could tell us how adaptable it ultimately becomes, and whether it can jump to even more species. We know it can already infect humans – one or more genetic mutations may make it more infectious.

At the crossroads

Between January 1 2003 and December 21 2023, 882 cases of human infection with the H5N1 virus were reported from 23 countries, of which 461 (52%) were fatal.

Of these fatal cases, more than half were in Vietnam, China, Cambodia and Laos. Poultry-to-human infections were first recorded in Cambodia in December 2003. Intermittent cases were reported until 2014, followed by a gap until 2023, yielding 41 deaths from 64 cases. The subtype of H5N1 virus responsible has been detected in poultry in Cambodia since 2014. In the early 2000s, the H5N1 virus circulating had a high human mortality rate, so it is worrying that we are now starting to see people dying after contact with poultry again.

It’s not just H5 subtypes of bird flu that concern humans. The H10N1 virus was originally isolated from wild birds in South Korea, but has also been reported in samples from China and Mongolia.

Recent research found that these particular virus subtypes may be able to jump to humans after they were found to be pathogenic in laboratory mice and ferrets. The first person who was confirmed to be infected with H10N5 died in China on January 27 2024, but this patient was also suffering from seasonal flu (H3N2). They had been exposed to live poultry which also tested positive for H10N5.

Species already threatened with extinction are among those which have died due to bird flu in the past three years. The first deaths from the virus in mainland Antarctica have just been confirmed in skuas, highlighting a looming threat to penguin colonies whose eggs and chicks skuas prey on. Humboldt penguins have already been killed by the virus in Chile.

How can we stem this tsunami of H5N1 and other avian influenzas? Completely overhaul poultry production on a global scale. Make farms self-sufficient in rearing eggs and chicks instead of exporting them internationally. The trend towards megafarms containing over a million birds must be stopped in its tracks.

To prevent the worst outcomes for this virus, we must revisit its primary source: the incubator of intensive poultry farms.

Diana Bell does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

genetic pandemic mortality spread deaths south korea south america europe uk chinaInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic franceInternational

As the pandemic turns four, here’s what we need to do for a healthier future

On the fourth anniversary of the pandemic, a public health researcher offers four principles for a healthier future.

Anniversaries are usually festive occasions, marked by celebration and joy. But there’ll be no popping of corks for this one.

March 11 2024 marks four years since the World Health Organization (WHO) declared COVID-19 a pandemic.

Although no longer officially a public health emergency of international concern, the pandemic is still with us, and the virus is still causing serious harm.

Here are three priorities – three Cs – for a healthier future.

Clear guidance

Over the past four years, one of the biggest challenges people faced when trying to follow COVID rules was understanding them.

From a behavioural science perspective, one of the major themes of the last four years has been whether guidance was clear enough or whether people were receiving too many different and confusing messages – something colleagues and I called “alert fatigue”.

With colleagues, I conducted an evidence review of communication during COVID and found that the lack of clarity, as well as a lack of trust in those setting rules, were key barriers to adherence to measures like social distancing.

In future, whether it’s another COVID wave, or another virus or public health emergency, clear communication by trustworthy messengers is going to be key.

Combat complacency

As Maria van Kerkove, COVID technical lead for WHO, puts it there is no acceptable level of death from COVID. COVID complacency is setting in as we have moved out of the emergency phase of the pandemic. But is still much work to be done.

First, we still need to understand this virus better. Four years is not a long time to understand the longer-term effects of COVID. For example, evidence on how the virus affects the brain and cognitive functioning is in its infancy.

The extent, severity and possible treatment of long COVID is another priority that must not be forgotten – not least because it is still causing a lot of long-term sickness and absence.

Culture change

During the pandemic’s first few years, there was a question over how many of our new habits, from elbow bumping (remember that?) to remote working, were here to stay.

Turns out old habits die hard – and in most cases that’s not a bad thing – after all handshaking and hugging can be good for our health.

But there is some pandemic behaviour we could have kept, under certain conditions. I’m pretty sure most people don’t wear masks when they have respiratory symptoms, even though some health authorities, such as the NHS, recommend it.

Masks could still be thought of like umbrellas: we keep one handy for when we need it, for example, when visiting vulnerable people, especially during times when there’s a spike in COVID.

If masks hadn’t been so politicised as a symbol of conformity and oppression so early in the pandemic, then we might arguably have seen people in more countries adopting the behaviour in parts of east Asia, where people continue to wear masks or face coverings when they are sick to avoid spreading it to others.

Although the pandemic led to the growth of remote or hybrid working, presenteeism – going to work when sick – is still a major issue.

Encouraging parents to send children to school when they are unwell is unlikely to help public health, or attendance for that matter. For instance, although one child might recover quickly from a given virus, other children who might catch it from them might be ill for days.

Similarly, a culture of presenteeism that pressures workers to come in when ill is likely to backfire later on, helping infectious disease spread in workplaces.

At the most fundamental level, we need to do more to create a culture of equality. Some groups, especially the most economically deprived, fared much worse than others during the pandemic. Health inequalities have widened as a result. With ongoing pandemic impacts, for example, long COVID rates, also disproportionately affecting those from disadvantaged groups, health inequalities are likely to persist without significant action to address them.

Vaccine inequity is still a problem globally. At a national level, in some wealthier countries like the UK, those from more deprived backgrounds are going to be less able to afford private vaccines.

We may be out of the emergency phase of COVID, but the pandemic is not yet over. As we reflect on the past four years, working to provide clearer public health communication, avoiding COVID complacency and reducing health inequalities are all things that can help prepare for any future waves or, indeed, pandemics.

Simon Nicholas Williams has received funding from Senedd Cymru, Public Health Wales and the Wales Covid Evidence Centre for research on COVID-19, and has consulted for the World Health Organization. However, this article reflects the views of the author only, in his academic capacity at Swansea University, and no funding or organizational bodies were involved in the writing or content of this article.

vaccine treatment pandemic covid-19 spread social distancing uk world health organization-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex