International

Tesla crash continues as Musk doubles down on ‘blindingly obvious’ strategy

Tesla shares are stuck in a drawdown that has lopped more than $760 billion from its market value since the November 2021 peak.

Tesla shares extended their extraordinary slump Monday and look set to open at the lowest level in more than 15 months, as investors brace for what could be a difficult first-quarter earnings report later this week.

Tesla (TSLA) , which has shed nearly $350 billion in market value this year, is suffering the second-longest drawdown of its share price since it went public in 2010. The slump has lopped more than $760 billion from its market value since the November 2021 peak.

The drop has been triggered in part by aggressive EV price cuts, narrowing profit margins and a strategy shift that looks to prioritize self-driving technologies over traditional car production in the coming years.

Elon Musk is also attempting to win shareholder support for a massive $55.8 billion pay package, first agreed in 2018 but rejected by the Delaware Chancery Court last year, that would see him reclaim a big portion of the ownership stake that he surrendered to raise cash for his $44 billion purchase of Twitter in 2022.

Musk hasn't pinned his future with the group on a successful appeal of the pay award, which was deemed “an unfathomable sum” by Chancery Judge Kathaleen McCormick, but he has said that he'll pursue his artificial-intelligence and robotics ambitions outside the Tesla structure if he isn't able to secure 25% of the company's stock.

His 13% stake makes him Tesla's biggest and most influential shareholder and he carries the full support of the board.

Still, the next few months could prove crucial for both the group's near-term performance as well as Musk's long-term commitment. He's lobbying shareholders to approve his 2018 pay deal, which he hopes will buttress his Delaware court appeal, and is preparing for the long-delayed unveiling of a Tesla robotaxi that could define the group's future.

Tesla pivoting to Full-Self-Driving, AI technologies

A least a portion of the definition was evident in last week's decision to execute the largest round of layoffs in company history. Tesla sacked as many as 14,000, or 10%, of its global staffers in what Musk called preparation for "our next phase of growth."

Musk has long argued that Tesla is a more than a carmaker. Rather, he sees it as a collective of tech-focused startups that he sees as pivotal to his broader ambition of a creating a world packed with self-driving cars powered by his company's AI-led technologies.

Morgan Stanley analyst Adam Jonas has said Tesla's DoJo supercomputer, which is powered by AI technologies, could add more than $500 million to Tesla's market value "through a faster adoption rate in mobility (robotaxis) and network services (software as a service)" over the coming years.

Not quite betting the company, but going balls to the wall for autonomy is a blindingly obvious move.

— Elon Musk (@elonmusk) April 16, 2024

Everything else is like variations on a horse carriage.

That could be why markets are so keenly focused on both the details of its first- quarter earnings report, slated for after the close of trading on April 23, as well as Musk's remarks to investors and analysts on the conference call that follows.

Wedbush analyst Dan Ives, who carries an outperform rating and a $300 price target on Tesla, says the April 23 conference call will be "one of the most important moments in the company's history."

Tesla earnings call in sharp focus

"The miscalculation of demand erosion in China has been a gut punch to the bull thesis, the Model 2 vs. Robotaxi debate has taken on a life of its own, major layoff including key assets for Tesla, and a global EV landscape that has turned Tesla from a Cinderella story to a horror show in the near term," he added.

A focus on robotaxis is likely to require scrapping a lower-priced Tesla model, which investors had expected to launch over the coming years. In turn that likely means a form of surrender to the intensifying competition of China-based rivals such as BYD, Nio and SAIC Motor.

Related: Analyst overhauls Tesla price target amid major strategy shift

It also puts a sharper focus on Tesla's plans to license its driver-assistance technology, which the company calls Full Self-Driving, and its potential to boost profit margins over the near term.

That was called into question over the weekend, however, when Tesla slashed the price of an FSD software subscription by nearly a third, to $8,000 per year.

More Tesla:

- Cathie Wood buys $22 million of battered tech stock

- Analyst revises Tesla stock price target after robotaxi news

- Top analyst reveals new Tesla price target ahead of Q1 earnings

The FSD price cuts were also matched by a series of changes to the cost of its Model Y, Model S and Model X lineup in nearly all its major markets, including China, Germany and the U.S. The changes will further pressure profit margins over the coming quarters.

Margins under more pressure from price cuts

Analysts already estimate that Tesla's first-quarter profit margins narrowed from a year earlier, with LSEG data suggesting a median estimate of 17.2%, with estimates ranging between 14.7% and 20%. That's thanks to aggressive price cuts, a slump in deliveries and ever-expanding inventories.

The EV maker handed over 387,000 new cars to customers over the three months ended in March, a 20% decline from the record 484,000 it notched over the final months of last year and the biggest miss to estimates since Wall Street began compiling data in the mid-2010s.

In terms of overall profit, analysts expect Tesla to post a bottom line of around 53 cents a share, down from 85 cents a share over the year-earlier period. Revenue is pegged to have fallen 5% to $22.15 billion, which would mark its first year-on-year decline since the 2020 pandemic.

Related: Analysts take aim at Tesla stock after Elon Musk makes unpopular decision

"I’m bracing for shares of Tesla to go lower after they report because consensus deliveries for 2024, 2025 and 2026 are likely too high," Deepwater Asset Management's Gene Munster said last week. "My long-term positive view is unchanged."

Tesla shares were marked 4.4% lower in premarket trading to indicate an opening bell price of $140.64 each, the lowest since January 2023 and a move that extends the stock's year-to-date decline to around 44%.

Short interest in the stock remains highly elevated, with data from S3 Partners suggesting it hit a 2024 high of 4.02% of the float outstanding last week. Short interest measures investors' bets that the stock price will drop.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic germany chinaInternational

Parrot fever cases amid a ‘mysterious’ pneumonia outbreak in Argentina – what you need to know about psittacosis

Dozens of people in Argentina are critically ill with ‘atypical’ pneumonia. But this is unlikely to be another pandemic looming.

The term “mysterious pneumonia” has become particularly triggering since early 2020. This is how the yet-to-be-named disease COVID-19 was first described when a cluster of cases was identified in Wuhan, China.

This term is being used again to describe a cluster of “atypical” pneumonia cases in Buenos Aires, Argentina. Some cases of psittacosis, also known as “parrot fever”, have been confirmed within this cluster. Before you start stocking up on toilet paper and masks or taking your parrot back to the pet shop, let me explain what we do and don’t know about this new outbreak. It might save you some money.

Psittacosis, or parrot fever, is caused by bacteria called Chlamydia psittaci, and is a common infection in birds. It is usually transmitted from animal to human via close contact with birds, including parrots and cockatiels, and also poultry such as ducks and turkeys.

The bacteria can be found in faeces and other excretions*excreta?*. So people at higher risk include vets, pet shop workers or those who own birds.

Psittacosis is usually mild but can be a severe infection, especially in vulnerable people such as the elderly or those with weak immune systems.

The Argentina outbreak was first reported on April 17 2024 in ProMED, a widely used site for reporting infectious disease outbreaks around the world. The short post there highlighted there being around 60 cases of “atypical” pneumonia in the previous 30 days, many of them in younger people and several requiring hospitalisation and critical care.

The report to ProMED suggests 20 cases showed evidence of psittacosis, with ten of them confirmed positive by laboratory testing. Many of these cases are reported to have had no obvious contact with birds. The source of the content is also unknown – described merely as “an individual known to ProMED”.

Psittacosis is uncommon, but not unknown. The UK government indicates there are around 25 to 50 cases reported in England and Wales each year.

A 2017 systematic review concluded that around 1% of pneumonia cases not acquired in a hospital may be the result of psittacosis. A World Health Organization situation report dated March 5 2024 describes dozens of human cases across several European countries with five deaths.

WHO advice includes quarantining, frequent handwashing, encouraging people with pet birds to keep cages clean, positioning of cages such that faeces cannot spread between them, and to avoid overcrowding.

One Australian study associated a higher risk of psittacosis with mowing the lawn without using a grass catcher. It is possible that the lawnmower would have run over and “aerosolised” some infected faeces that were subsequently inhaled.

So, how serious is this Argentina outbreak and how concerned should the wider world be? There are often local respiratory infectious disease outbreaks, potentially causing severe pneumonia, and these do not spread more widely or internationally. COVID was very much the exception, rather than the rule.

At the time of writing this article, there is very little information available about the Argentina outbreak. There has been no statement from the public health authorities in Argentina, nor the WHO Pan America Health Organisation.

Among the key pieces of information we really would need to know is the likelihood of human-to-human transmission. For example, if an investigation concludes that all cases were at the same workplace, where potentially they may have been exposed to infected bird faeces, then there most probably has been one source of infection. This makes the public health response more straightforward, with fewer implications for the wider population.

If (hypothetically) the epidemiology tells us that a probable scenario would be multiple cases of human-to-human transmission of psittacosis, this would be much more concerning.

A paper investigating a 2020 outbreak in China concluded that the study data might “represent the first documented report of human-to-human transmission of C. psittaci in China”. But this is rare – and there is currently no clear evidence of this in Argentina.

In its conclusion to the situation report about the 2024 European psittacosis outbreak, the WHO concluded that there is “no indication of this disease being spread by humans nationally or internationally”, and that based on the available information, the risks “posed by this event are low”.

It would be reasonable to apply similar thinking to the Argentina outbreak. But more information is needed to provide proper conclusions.

Psittacosis is one of many infections that can pose a risk to human health in specific circumstances. But there is no indication that “parrot fever” will be the Next Big Thing. This shows the importance of outbreak surveillance and reporting across all parts of the world, with real-time epidemiology and laboratory data being made available to provide up-to-date public information.

Michael Head has previously received funding from the Bill & Melinda Gates Foundation and the UK Department for International Development, and currently receives funding from the UK Medical Research Foundation.

testing covid-19 spread deaths transmission wuhan european uk china world health organizationInternational

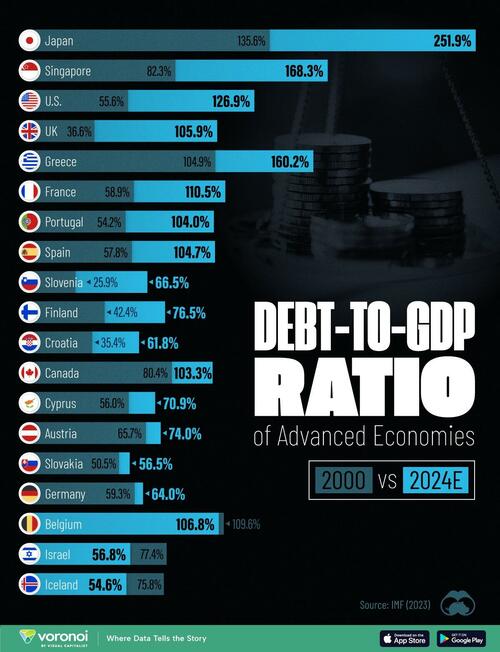

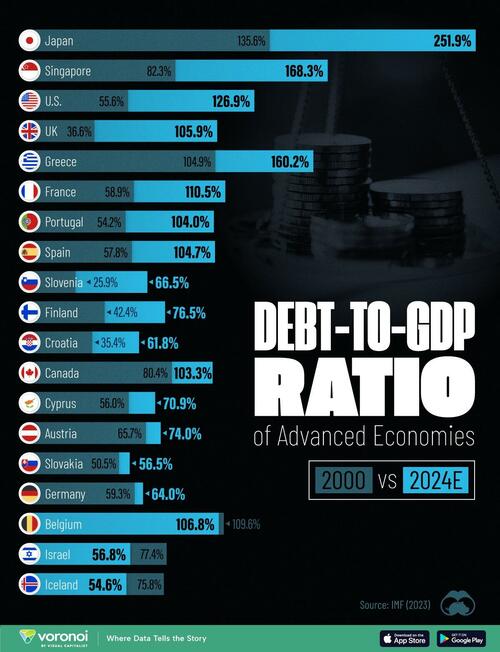

How Debt-to-GDP Ratios Have Changed Around The World Since 2000

How Debt-to-GDP Ratios Have Changed Around The World Since 2000

Government debt levels have grown in most parts of the world since the 2008…

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, Visual Capitalist's Marcu Lu visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

International

How Debt-to-GDP Ratios Have Changed Around The World Since 2000

How Debt-to-GDP Ratios Have Changed Around The World Since 2000

Government debt levels have grown in most parts of the world since the 2008…

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, Visual Capitalist's Marcu Lu visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International1 week ago

International1 week agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

International3 days ago

International3 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?