Uncategorized

S&P Futures Hit 2 Month High: 4,200 Looms As Record Bearish Sentiment Leads To Another Meltup

S&P Futures Hit 2 Month High: 4,200 Looms As Record Bearish Sentiment Leads To Another Meltup

We have said previously on more than one…

We have said previously on more than one occasion that the bear market rally just won't end until Wall Street's two bearish cosplayers, Marko Kolanovic and Mike Wilson, throw in the towel and turn bearish...

Rally won't end until Wilson and Marko turn bullish

— zerohedge (@zerohedge) February 7, 2023

... and sure enough, one day after both of these broken records published their latest weekly doom and gloom performance art meant solely to get institutional and retail investors to sell to their flow desks, futures have melted up even more, with spoos now trading a 2+ month high.

US equity futures were set to hold onto Monday’s sharp hour bounce as investors awaited a slew of earnings: contracts on the S&P 500 rose 0.4% by 7:00a.m. in ET while Nasdaq 100 contracts outperformed, rising 0.7%. Johnson & Johnson, Goldman Sachs Group Inc. and Netflix Inc. are among those reporting later.

In premarket trading, Riot Platforms led fellow cryptocurrency-exposed stocks higher in US premarket trading as Bitcoin rebounded to inch closer to the $30,000 mark. Here are some other notable premarket movers:

- Bank of America rose 2% after reporting solid earnings which beat on the top and bottom line.

- Alibaba shares rise in US premarket trading after Reuters reported that Chinese regulators are expected to cut a fine on Ant Group to $700 million from an initially planned amount of more than $1 billion.

- Gamida Cell rose as much as 81% in premarket trading on Tuesday, poised to set a second consecutive intraday record, after the FDA approved its cell therapy Omisirge for patients with blood cancers to reduce the risk of infection following stem cell transplantation.

The irony is that it is not just Marko and Mike that are dodecatupling down on bearishness as stocks melt up: so is everyone else. As Bloomberg notes, traders are "scaling the towering monolith of skepticism that currently comprises Wall Street’s view of markets takes uncommon courage" and the more the S&P 500 goes up — and it’s risen 6% in a month — the less people trust it. Hedge funds have been loading up bets against US stocks, and a model kept by Goldman Sachs shows mutual fund and futures-market outflows suggest that rather than rise, the index should have been down 3% over the past three months.

“Being bullish today is a very lonely proposition,” said Eric Diton, president and managing director of the Wealth Alliance. It is, also, very profitable and as we have repeatedly warned readers, positioning is so bearish that stocks have no choice but to melt up. Moreover, investor allocation to equities relative to bonds has dropped to its lowest level since the global financial crisis as worries about a recession take hold, according to Bank of America Corp.’s global fund manager survey.

And that's why futures at 4,200 are a lock: because with everyone bearish, and nobody left to sell - or short - what comes next is another rolling short squeeze.

Traders are also anticipating the end of Federal Reserve policy tightening and are hoping for a milder-than-expected economic slowdown, optimism that has boosted equities this year. “If interest rates go down to the extent that’s priced into the forwards, we’re not going to get on top of inflation,” Euan Munro, chief executive officer at Newton Investment Management, said on Bloomberg Television. “Inflation is going to be quite hard to beat and will require interest rates to be held higher for a lot longer.”

European stocks are ahead with the Stoxx 600 up 0.5%, led by gains in the banks, mining and travel sectors. Here are the most notable European movers:

- Demant rises as much as 8.1% after the Danish company posted first-quarter results ahead of expectations and boosted its FY guidance, with its Hearing Aids unit delivering a strong beat

- Sika shares gain as much as 3.9% after the Swiss builder boosted sentiment by confirming its guidance and giving a positive indication on margin, according to Baader

- Entain shares jump as much as 4.8% after the UK-based gambling company reported an increase in first-quarter net gaming revenue, with most analysts seeing in-line results

- Moneysupermarket shares gain as much as 2.7% as analysts said the trading update from the price-comparison platform was robust, driven by strength for its Insurance segment

- IntegraFin shares rise as much as 6.8%, the most since November, as analysts said the investment platform’s fiscal 2Q results look robust, prompting an upgrade from Numis

- Volex shares rise as much as 19%, the most since April 2022, after the power products producer said its performance has been ahead of expectations

- ALK-Abello falls the most since November 2007, after the Danish allergy medicines maker reported considerably smaller tablet sales in Europe than expected in a preliminary earnings release

- Ericsson shares fall as much as 8.1%, their biggest intraday decline since January, after the 5G networking equipment-maker gave a tepid outlook for the second quarter

- Wise shares fall as much as 16% after the money-transfer firm reported worse-than-expected total payment volume, attributing a drop in volume per customer to slower growth among frequent users

- THG shares slide as much as 18%, the biggest intraday decline since Jan. 17, after the online retailer reported a bigger-than-estimated drop in first-quarter revenue

- TUI shares fall as much as 6.1% in Frankfurt after a take-up of the company’s rights offering that Louis Capital Markets said looks weak at first glance

Earlier in the session, Asian stocks were mixed as investors digested an uneven set of Chinese economic data, which showed further signs of recovery with some patches of weakness. The MSCI Asia Pacific Index was up 0.1% as of 5 p.m. in Hong Kong, with gains in industrial and financial shares offsetting losses in technology stocks. Benchmarks in Japan advanced, while those in Hong Kong, Taiwan and South Korea fell. Chinese shares eked out small gains as the economy grew at a faster pace than expected in the first quarter. The overall market reaction was muted as tepid property investment figures suggested the housing market remains a drag on the economy. A wave of insider selling of shares also weighed on sentiment.

“From the looks of it most of the major numbers beat estimates, especially GDP and retail sales,” said Willer Chen, senior analyst at Forsyth Barr Asia Ltd. “But property investment is still lagging and misses expectations, which echoes with broader concerns that the property market rebound could be a short-lived one as investments are not picking up.” The latest US earnings season has failed to impress investors so far, with an unexpected expansion in New York state manufacturing activity turning the focus to the Federal Reserve’s policy path. Richmond Fed President Thomas Barkin said he wants to see more evidence that US inflation is easing back to the central bank’s goal of 2%. Europe and the US are going into a slight slump, and China is probably seeing growth pick up, Eva Lee, head of Greater China equities at UBS Global Wealth Management, said on Bloomberg Television. It is an ideal scenario for people to “maybe reallocate a little bit more weighting onto China versus last year or last few years,” she said.

Japanese stocks rose for an eighth day, following US peers higher, driven by gains in banks and insurers. A strong start to the US earnings season and better-than-expected New York factory activity continue to boost global investors’ sentiment. The Nikkei advanced 0.5% to 28,658.83 as of the market close in Tokyo, reaching the highest since August 2022. The Topix rose 0.7% to 2,040.89 to the highest since March 9. Nippon Telegraph & Telephone contributed the most to the Topix’s gain, increasing 2%. Out of 2,158 stocks in the index, 1,581 rose and 470 fell, while 107 were unchanged. “Japanese stocks are strong due to easing fears of a worsening US economy and a weaker yen,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management.

Australian stocks declined weighed by declines in energy and consumer staples stocks. The S&P/ASX 200 index fell 0.3% to close at 7,360.20. Most Asian stocks dropped as investors focused on patches of weakness in China’s economic data even as the overall picture was solid. Australia’s central bank discussed the case for raising interest rates by 25 basis points at its April meeting before deciding there was a stronger argument to pause its almost yearlong tightening cycle and wait for more data on the economy’s outlook.

India’s benchmark indexes dropped for a second straight day on Tuesday while small and midcap gauges extended their winning run as investors rotated allocations from frontline stocks to shares that had trailed their larger peers in recent months. The S&P BSE Sensex fell 0.3% to 59,727.01 in Mumbai, while the NSE Nifty 50 Index declined by a similar measure. Meanwhile, the continued rally in BSE’s small and midcap gauges is the longest run of advances since 2018 and 2014, respectively. Reliance Industries contributed the most to the Sensex’s decline, decreasing 1.1%. The company will be reporting its March quarter earnings after the close of trading on Friday. Out of 30 shares in the Sensex index, 13 rose, while 17 fell

In rates, Treasuries climbed led by the short-end and US stock futures advanced, pointing to a positive cash open. Gilt futures gap lower before extending declines while the British pound is among the best-performing G-10 currencies after data showed UK wages rose more than expected in February. UK two-year yields are up 6bps at 3.67% while cable gains 0.5% as the figures firmed up bets on a 25bps hike by the Bank of England in May. Bunds fall in sympathy with German two-year yields up 1bps at 2.89% while US yields edge lower. US economic data includes housing starts and building permits for March, while Fed’s Bowman discusses digital currencies

In FX, the Bloomberg Dollar Index is down 0.3%. Australia’s dollar rose after minutes of the Reserve Bank’s April meeting showed members discussed a quarter point hike before deciding on a pause. China’s “retail sales and quarterly GDP numbers have both exceeded expectations, hence the small pop higher in AUD even though industrial production and fixed asset investment have somewhat underwhelmed versus expectations,” said Ray Attrill, head of foreign-exchange strategy at National Australia Bank Ltd. in Sydney. The pound was the second best performer among G10 peers after UK wage growth accelerated unexpectedly, fueling inflation concerns.

In commodities, crude futures decline with WTI falling 0.3% to around $80.60. Spot gold rises 0.3% to around $2,002.

Bitcoin is firmer rising 1.2% and at the top-end of the sessions parameters, but is yet to regain the USD 30k mark after eclipsing it and subsequently losing the figure last week.

To the day ahead now, and data releases include UK unemployment for February, the German ZEW survey for April, US housing starts and building permits for March, and Canada’s CPI for March. From central banks, we’ll hear from the Fed’s Bowman, the ECB’s Centeno, and Bank of Canada Governor Macklem. Finally, today’s earnings include Johnson & Johnson, Bank of America, Netflix, Lockheed Martin, Goldman Sachs, BNY Mellon, United Airlines and Western Alliance Bancorp.

Market Snapshot

- S&P 500 futures up 0.1% to 4,183.00

- MXAP little changed at 163.55

- MXAPJ down 0.3% to 528.06

- Nikkei up 0.5% to 28,658.83

- Topix up 0.7% to 2,040.89

- Hang Seng Index down 0.6% to 20,650.51

- Shanghai Composite up 0.2% to 3,393.33

- Sensex down 0.5% to 59,613.52

- Australia S&P/ASX 200 down 0.3% to 7,360.18

- Kospi down 0.2% to 2,571.09

- STOXX Europe 600 up 0.2% to 467.86

- German 10Y yield little changed at 2.49%

- Euro up 0.4% to $1.0974

- Brent Futures down 0.2% to $84.59/bbl

- Gold spot up 0.4% to $2,003.15

- U.S. Dollar Index down 0.37% to 101.72

Top Overnight news from Bloomberg

- China reports bullish Q1 GDP (+4.5% vs. the Street consensus +4% and vs. +2.9% in Q4) and March retail sales (+10.6% Y/Y vs. the Street +7.5%), but March industrial production falls short (+3.9% vs. the Street consensus of +4.4%) and property investment continued to contract. BBG

- Geopolitical rifts caused by rivalry between the US and China could push up inflation by 5 per cent and threaten the leading positions of the dollar and euro, Christine Lagarde has warned. FT

- A Chinese laboratory conducting advanced coronavirus research faced a series of biosafety problems in November 2019 that drew the attention of top Beijing officials and coincided with the Covid pandemic’s emergence, according to a new report being released by Senate Republicans on the pandemic’s origins. The report charts a confluence of unexplained events in that month and concludes the pandemic more likely began from a lab accident than naturally, via an animal infecting humans. WSJ

- Japan will stay the course to reach the central bank's 2% inflation target by continuing monetary easing even though it may take time, Governor Kazuo Ueda said on Tuesday, signaling his stance to maintain loose conditions. RTRS

- Corporate insolvencies rose 16 per cent last month from a year earlier in England and Wales as businesses contended with soaring costs and a weakening economy. Registered company insolvencies climbed to 2,457 in March from the same month a year ago and 83 per cent higher than in February 2020, before the Covid-19 pandemic, the Insolvency Service on Tuesday said. FT

- UK wage growth jumps above expectations in Feb, raising inflation concerns (wages ex-bonus payments rose 6.6% in Feb vs. the Street consensus of +6.2%). BBG

- While the data are still very preliminary, weak tax collections so far in April suggest an increased probability that the debt limit deadline will be reached in the first half of June. We have been projecting that Treasury could operate without a debt limit increase until early August. GIR

- Saudi Arabia and the UAE are buying Russian energy products at depressed prices for domestic consumption and exporting their own oil at market rates. WSJ

- JBHT reported a miss both Q1 EPS and revenue at 1.89/$3.23B (vs. the Street consensus of 2.01/$3.39B) and mgmt. on the call said the economy was in a “freight recession”. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly subdued and failed to benefit from the slew of data from China including stronger GDP growth with the mood tentative across global markets ahead of upcoming earnings releases stateside. ASX 200 was dragged lower by underperformance in energy and consumer stocks, while the RBA Minutes reaffirmed the potential for future rate increases as the central bank noted it is important to be clear that policy may be tightened again to curb inflation in a timely manner and that inflation is still too high. Nikkei 225 was kept afloat following reports that the BoJ is mulling CPI projections for FY25 of between 1.6%-1.9% which would remain below the 2% price goal and support the case for a delayed exit from easy policy. Hang Seng and Shanghai Comp were contained as participants reflected on the somewhat varied data releases from China in which GDP Q/Q matched estimates and Y/Y growth topped forecasts, while Industrial Production and Fixed Asset Investments printed below expectations, but Retail Sales surged by a double-digit percentage.

Top Asian News

- Chinese Finance Ministry official said there are positive changes in the property market but the market is still recovering gradually, while they will accelerate issuance and use of special local government bonds in H2.

- China stats bureau said the international environment is still complex and growth of external demand remains uncertain, while it added that constraints of domestic market demand and insufficient demand still exist but noted that demand for production has basically rebounded, according to Reuters.

- Chinese officers are accused of interfering with dissidents' meetings on US technology platforms

- Citigroup raises its China 2023 GDP forecast to 6.1% (prev. 5.7%).

- RBA Minutes from the April Meeting stated that the board considered a rate hike at the April meeting before deciding to pause, while it agreed there was a stronger case to pause and reassess the need for tightening at future meetings. RBA said it is assessing data on inflation, jobs, consumer spending and business conditions, as well as noted that updated RBA forecasts in May will help assess when and how much more tightening is needed. Furthermore, RBA said it is important to be clear that policy may be tightened again to curb inflation in a timely manner and noted that inflation is still too high.

- BoJ's Ueda says there is no immediate need to review the 2013 joint statement with the government, positive signs are emerging in prices and wage growth. Will achieve inflation target, although it may take time.

- India is weighing a revamp of income tax with a focus on capital gains, according to Bloomberg; could streamline capital gains and income tax rules with law changes in 2024.

European bourses are firmer across the board and were resilient to softer than expected ZEW numbers with earnings in full-focus, Euro Stoxx 50 +0.6%. Sectors have a positive tilt, with Banks, Basic Resources and Travel/Leisure outperforming with the latter assisted by a well-received H1 update from easyJet while Telecoms lag on Ericsson's downside as they expect to remain cautious. Stateside, futures are in the green with the NQ +0.6% outperforming a touch as yields ease off highs while the broader focus is firmly on upcoming bank earnings. Airbus (AIR FP) has informed airlines of delivery delays for the A320neo-family jets slated for delivery in 2024, according to Reuters sources; several hundred jets are set to be postponed by around three months.

Top European News

- EU Commission President von der Leyen says they must be more assertive on trade defense tools, now discussing outbound investment screening.

- French Finance Minister says France will accelerate debt-cutting plans.

FX

- Buck backs off after making a solid start to the week, with the DXY losing grip of 102.000 and sight of 21 DMA at 102.210.

- Aussie outpaces fellow G10s in wake of hawkish RBA minutes, as AUD/USD eyes 200 DMA at 0.6750.

- Kiwi up in slipstream and back on a 0.6200 handle against Greenback pre-NZ CPI.

- Pound perks up on the eve of UK CPI as hot wages put Cable back above 1.24.

- Euro shrugs off weak ZEW metrics amidst a broad Dollar downturn but is facing more decent option expiries at 1.10000.

- PBoC set USD/CNY mid-point at 6.8814 vs exp. 6.8828 (prev. 6.8679)

Fixed Income

- Bunds bounce firmly within 133.49-86 range as the 10-year yield holds around 2.5% and the latest German ZEW survey disappoints in terms of sentiment and expectations.

- Gilts pare some declines between 101.11-56 parameters as the 2053 DMO sale is covered 2.5x.

- T-note idles inside a 114-13/08 band ahead of US housing data, Fed Discount Rate meeting minutes and Bowman.

Commodities

- Crude benchmarks are subdued despite the downbeat USD, firmer tilt to stocks and Chinese data; desks highlight the progress between Iraqi and Kurdish governments in negotiations may be capping any upside.

- Nat Gas prices are contained after the marked rally seen stateside yesterday amid forecasts for colder-than-usual weather.

- Metals remain underpinned by the waning USD with Spot Gold holding at USD 2k/oz, while industrial metals benefit from Chinese GDP though LME Copper is struggling to retain the USD 9k handle.

- Brazil's March oil and gas production fell 11.95% M/M, according to oil regulator ANP cited by Reuters.

- Committee of ministers in Chile approved an environmental permit for Anglo American's (AAL LN) Los Bronces project.

Geopolitics

- G7 Foreign Ministers communique said they condemn in the strongest possible terms Russia's war of aggression against Ukraine which constitutes a serious violation of international law including the UN Charter, while it noted that Russia's irresponsible nuclear rhetoric and threats to deploy nuclear weapons in Belarus are unacceptable. The communique also stated there is no legal basis for China's expansive maritime claims in the South China Sea and they oppose China's militarisation activities in the region, according to Reuters.

- Taiwan is to buy 400 US anti-ship missiles intended to repel China in a deal which is Taiwan's first for land-launched harpoon missiles, according to Bloomberg.

- Russian Defence Ministry said two Russian strategic bombers carried out routine flights over the Okhotsk and Bering Sea, according to Tass.

- Russian Defence Ministry says Russia-Chinese cooperation serves to stabilise the global situation, should help each other in military issues. Remarks which were subsequently echoed by China.

- Russian Kremlin says President visited Kherson and Luhansk regions on Monday; is not aware of any peace plan for Ukraine proposed by France.

- Japan's Defence Ministry has scrambled jet fighters to Russian reconnaissance aircraft over the Seas of Japan

US Event Calendar

- 08:30: March Building Permits MoM, est. -6.5%, prior 13.8%, revised 15.8%

- 08:30: March Building Permits, est. 1.45m, prior 1.52m, revised 1.55m

- 08:30: March Housing Starts MoM, est. -3.5%, prior 9.8%

- 08:30: March Housing Starts, est. 1.4m, prior 1.45m

DB's Craig Nicol concludes the overnight wrap

I was back in the office yesterday after skiing. Was a good trip and one where it felt like the batton was being passed. For the sake of my knees I shouldn’t really ski much anymore (they are sore now) but we did our first family day at the end of the holiday as the twins graduated from a first week of ski school and Maisie could ski again after her hip disease (Perthes). At least I can say I had one day with all of them before I fall apart and retire ungracefully. We will see. Maisie had her latest scan yesterday on our return and relative to the diagnosis we first had nearly 2 years ago she’s made close to the best possible progress she could have made. At the start of the process that ended up with a big operation and 14 months in a wheelchair, they were worried we would have to manage her hip and the pain carefully through childhood and for her to have a hip replacement as soon as she was fully grown. However the scan yesterday showed that the hip ball has now regrown back as normal as it could be given the circumstances. The doctor said she may not now need a hip replacement until she’s nearer 50! She’s not out of the woods yet but it’s gone as well as it could have at this stage and is now worth all the sacrifices. So I may have knee replacements at a younger age than she has her hip done, albeit 40 years apart. Anyway for all the happiness, all I can say is that it's now good to be back and away from all the noise, fights, tears and tantrums.

While I’ve been away it’s clear the story has been a steady recovery back towards, and in some cases better than, pre-SVB levels. For me the script remains the same as it has been for the last couple of years. This is a boom/bust US cycle and we’re getting closer to the bust part. We’ve highlighted H2 2023 as the likely bust part for the past year or so and nothing has really deviated us from that regardless of the good or bad news along the way. However I doubt big banks will be at the epicentre of it as a lot has positively changed in their fundamentals since the GFC. So a retreat from peak financial pessimism makes sense. However things will continue to fall off the wheel in the broader financial system as the lagged impact of tighter monetary policy continues to bite as it does in virtually every hiking cycle. So we’re in the early days of the monetary policy lag still in my opinion.

On a similar note, this morning my credit team have published a strategy update entitled "Squeeze Before The Storm" (link here). The piece suggests that global credit markets may see a continued rally as investors price in a soft-landing. The belief is that March's banking crisis will not accelerate the end of the US or European credit cycle. Hence, we retain our spread targets and believe credit will remain resilient through the spring, especially in €IG. However, the negative impacts of tighter Fed & ECB policy are still in the process of damaging growth, keeping us on track for decompression & material spread widening by the end of 2023. See the piece for more.

While we distance ourselves from the SVB shock, the last 24 hours has continued to see sovereign bonds selling off as investors continue to dial back the chances of rate cuts this year. This got an added kicker yesterday from some solid US data that offered fresh hope of the economy’s resilience. In particular, the Empire State manufacturing survey for April came in at a 9-month high of 10.8 (vs. -18.0 expected), and the new orders subcomponent was at a one-year high of 25.1. In the meantime, the NAHB’s index of homebuilder sentiment rose for a fourth straight month in April, recovering further after a run of declines throughout 2022.

This growing optimism around the economy’s near-term performance means that investors are now almost fully pricing in another Fed rate hike at their meeting on May 3. In fact, futures took the chances up to 88% yesterday, which is their highest since the SVB collapse. And looking further out, the rate priced in by the December meeting rose +7.7bps to 4.56%, which is likewise a post-SVB high. In many respects, what we’ve seen so far is reminiscent of the Fed ‘pivot’ trades over the last 18 months, when investors would dial back the prospect of rate hikes and grow hopeful about a dovish shift in response to some shock, before ratcheting them even higher still as both the economy and inflation proved resilient. Now obviously we’re still some way from the pre-SVB situation, when terminal rate pricing got all the way to 5.69% (vs. 5.10% now), but the direction over the last month has been progressively higher since the turmoil subsided.

Fed speakers have also grown more ambivalent after initial calls for caution shortly after the SVB and Signature bank failures. Yesterday, Richmond Federal Reserve President Barkin (non-voter) said that he wanted “to see more evidence that inflation is settling back to our target,” and that the “labor market has moved from red-hot to merely hot.”

With investors becoming more sceptical that the Fed will cut rates anytime soon, Treasuries sold off most of the day, with the 2yr yield up +9.3bps to 4.189%. That’s their 7th increase over the last 8 sessions, taking yields up to their highest closing level in over a month. The range has been from 5.07% to 3.77% from just before the SVB news hit to now. And the 10yr yield was also up +8.0bps to 3.59% (same range is 4.055% to 3.305%). 10yr yields actually peaked as House Speaker McCarthy was giving a speech on the debt ceiling which we expand on below. Meanwhile in Europe, the direction of travel was the same albeit with smaller moves, as yields on 10yr bunds (+3.3bps), OATs (+1.5bps) and BTPs (+0.7bps) were all higher. One factor influencing that was the perception that 50bps still remained on the table for the ECB’s May meeting, with Latvia’s Kazaks saying that a 50bps move “is not an option that can be ignored.”

Whilst there was a clear movement on the rates side yesterday, equities held fairly steady and the S&P 500 (+0.33%) posted a modest rise. State Street (-9.18%) was the worst performer in the index, which came as they reported more outflows than expected, while competitor Charles Schwab announced outflows that were “as-expected” and rallied +3.94%. Despite State Street’s drop, banks (+2.10%) outperformed along with other cyclicals, while megacap tech stocks saw large declines thanks to the rates moves as the FANG+ Index fell -0.25%. Back in Europe, the STOXX 600 (-0.01%) was just worse than unchanged but broke a run of 5 consecutive gains.

Overnight in Asia, equities in the region are trading mixed following a decent Q1 GDP beat from China. The YoY figure came in at 4.5% (vs 4.0% median estimate on Bloomberg), supported by strong retail sales growth in particular in a sign of a more consumer-led post-covid recovery. However, we also saw soft industrial production (YoY 3.9% vs 4.4% expected) and fixed asset investment data for March, in contrast to a retail sales beat (10.6% vs 7.5%). So this has highlighted an uneven recovery at this stage. Net net this left Chinese stocks roughly flat (CSI 300 +0.08%), putting them ahead of most of the rest of the region, with the Hang Seng (-0.78%) and the Kospi (-0.34%) in the red so far. Japanese equities are the main outperformer, with the Nikkei rising +0.49%. US equity futures are flat (S&P 500 -0.04%) and Treasury yields are down by c -1bps across the curve.

Another important story coming up is with regards to the US debt ceiling, which is something that remains in the backdrop as we come closer to the so-called “X-date” when the government would no longer be able to meet its obligations; potentially over the summer. Today is the deadline for most of the US to file taxes, and so we should have a better idea of what that “X-date” is soon. Those payments will filter down to the Treasury’s operating budget and then attention will turn to another reporting of tax revenue in June. Yesterday saw House Speaker McCarthy give a speech at the New York Stock Exchange, where he said that “a no string-attached debt limit increase will not pass” and called for spending cuts. At the moment, the next step in the process will likely be for the Republicans to vote on a bill that raises the debt ceiling. That isn’t going to pass in the Democratic-controlled Senate, but the logic is to demonstrate what Republicans are prepared to back as McCarthy looks to negotiate an increase in the limit with the White House.

To the day ahead now, and data releases include UK unemployment for February, the German ZEW survey for April, US housing starts and building permits for March, and Canada’s CPI for March. From central banks, we’ll hear from the Fed’s Bowman, the ECB’s Centeno, and Bank of Canada Governor Macklem. Finally, today’s earnings include Johnson & Johnson, Bank of America, Netflix, Lockheed Martin, Goldman Sachs, BNY Mellon, United Airlines and Western Alliance Bancorp.

Uncategorized

Shipping company files surprise Chapter 7 bankruptcy, liquidation

While demand for trucking has increased, so have costs and competition, which have forced a number of players to close.

The U.S. economy is built on trucks.

As a nation we have relatively limited train assets, and while in recent years planes have played an expanded role in moving goods, trucks still represent the backbone of how everything — food, gasoline, commodities, and pretty much anything else — moves around the country.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

"Trucks moved 61.1% of the tonnage and 64.9% of the value of these shipments. The average shipment by truck was 63 miles compared to an average of 640 miles by rail," according to the U.S. Bureau of Transportation Statistics 2023 numbers.

But running a trucking company has been tricky because the largest players have economies of scale that smaller operators don't. That puts any trucking company that's not a massive player very sensitive to increases in gas prices or drops in freight rates.

And that in turn has led a number of trucking companies, including Yellow Freight, the third-largest less-than-truckload operator; J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics, to close while freight brokerage Convoy shut down in October.

Aside from Convoy, none of these brands are household names. but with the demand for trucking increasing, every company that goes out of business puts more pressure on those that remain, which contributes to increased prices.

Image source: Shutterstock

Another freight company closes and plans to liquidate

Not every bankruptcy filing explains why a company has gone out of business. In the trucking industry, multiple recent Chapter 7 bankruptcies have been tied to lawsuits that pushed otherwise successful companies into insolvency.

In the case of TBL Logistics, a Virginia-based national freight company, its Feb. 29 bankruptcy filing in U.S. Bankruptcy Court for the Western District of Virginia appears to be death by too much debt.

"In its filing, TBL Logistics listed its assets and liabilities as between $1 million and $10 million. The company stated that it has up to 49 creditors and maintains that no funds will be available for unsecured creditors once it pays administrative fees," Freightwaves reported.

The company's owners, Christopher and Melinda Bradner, did not respond to the website's request for comment.

Before it closed, TBL Logistics specialized in refrigerated and oversized loads. The company described its business on its website.

"TBL Logistics is a non-asset-based third-party logistics freight broker company providing reliable and efficient transportation solutions, management, and storage for businesses of all sizes. With our extensive network of carriers and industry expertise, we streamline the shipping process, ensuring your goods reach their destination safely and on time."

The world has a truck-driver shortage

The covid pandemic forced companies to consider their supply chain in ways they never had to before. Increased demand showed the weakness in the trucking industry and drew attention to how difficult life for truck drivers can be.

That was an issue HBO's John Oliver highlighted on his "Last Week Tonight" show in October 2022. In the episode, the host suggested that the U.S. would basically start to starve if the trucking industry shut down for three days.

"Sorry, three days, every produce department in America would go from a fully stocked market to an all-you-can-eat raccoon buffet," he said. "So it’s no wonder trucking’s a huge industry, with more than 3.5 million people in America working as drivers, from port truckers who bring goods off ships to railyards and warehouses, to long-haul truckers who move them across the country, to 'last-mile' drivers, who take care of local delivery."

The show highlighted how many truck drivers face low pay, difficult working conditions and, in many cases, crushing debt.

"Hundreds of thousands of people become truck drivers every year. But hundreds of thousands also quit. Job turnover for truckers averages over 100%, and at some companies it’s as high as 300%, meaning they’re hiring three people for a single job over the course of a year. And when a field this important has a level of job satisfaction that low, it sure seems like there’s a huge problem," Oliver shared.

The truck-driver shortage is not just a U.S. problem; it's a global issue, according to IRU.org.

"IRU’s 2023 driver shortage report has found that over three million truck driver jobs are unfilled, or 7% of total positions, in 36 countries studied," the global transportation trade association reported.

"With the huge gap between young and old drivers growing, it will get much worse over the next five years without significant action."

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic stocks commoditiesUncategorized

Wendy’s has a new deal for daylight savings time haters

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

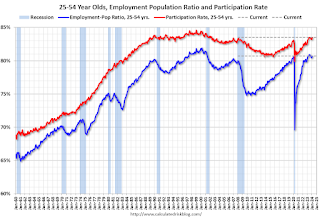

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 hours ago

International3 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex