Government

Shaping Eurasia: Russia – China Bilateral Trade And Cooperation

Shaping Eurasia: Russia – China Bilateral Trade And Cooperation

Submitted by SouthFront

Relations between Russia and China have gone from strength to strength over the last 10 years. This development is not exclusively due to the increasingly hostile attitude of Western countries, and the US in particularly, to Russia and China, but it has certainly been a major contributing factor. The deepening and diversification of their strategic relationship is apparent in all spheres, but is particularly notable in their economic and military relations.

There are many factors underpinning the expansion and diversification of trade relations and other forms of economic cooperation between Russia and China. The most important ones include the imposition of sanctions on Russia by Western countries in 2014, the economic stagnation that has characterized most European countries for much of the last 10 years while the Chinese economy has continued to grow, symmetry in economic characteristics of both countries (surpluses in one and corresponding shortages in the other in a variety of sectors), US pressure bringing both countries closer together geo-strategically (which has also produced a mutual interest in shifting away from the US dollar in all transactions), and the consolidation and harmonization of the Chinese ‘One Road One Belt’ initiative and the Eurasian Economic Union

After a relatively flat period marked by what could be characterized as benign indifference and neglect, the trade relationship between Russia and China has grown rapidly since 2009 in terms of both imports and exports, although there was a sharp decline during 2014-2015 corresponding to a sharp decline in Russia’s overall GDP and trade volumes.

However, at least as importantly, the growth in trade and other forms of economic cooperation has not just been quantitative but also qualitative, as the governments of both countries have elaborated detailed industrial development strategies and plans over long periods which have channelled both public and private sector investment and production into priority areas.

This is in sharp contrast to the peculiar form of haphazard, opportunistic and hyper-militarized disaster capitalism that has reigned in the US for many years – arguably at least since the 1990s, when US companies began dismantling the US industrial capacity and offshoring production en masse to raise corporate profits, and the US Congress began to dismantle the anti-trust and financial regulatory frameworks that had been established during the Great Depression of the 1930s to limit the volatility and excesses of the financial sector. (It is also approximately the same period that the US began its post Cold War military adventurism in earnest.)

Most recently the Trump administration’s ambitious infrastructure investment fund (which appeared to be yet another corporate and political slush fund to a considerable extent, to be divided amongst political and corporate allies and withheld from opponents or intransigents) to modernize the US’ aging infrastructure never materialized, and the attempt to establish something resembling a coherent industrial policy complemented by a set of tariffs on selected imports to stimulate domestic production degenerated into an ad hoc series of punitive tariffs and charges whose main objective seemed to be to punish China for the US’ own economic and industrial failures.

The only thing the Republicans and Democrats have been able to agree on in recent times, apart from increasing the already astronomical level of military spending, was to establish another disaster capitalism multi-trillion dollar bailout fund (for the Coronavirus this time) for the financial and corporate sectors, which have increasingly fallen under the control of a very limited number of investment funds led by Vanguard and Black Rock.

In contrast, China’s long-running practice of elaborating and updating five year strategic economic development plans which are implemented by a combination of State-owned and private sector enterprises has proven to be a success. After a catastrophic period of experimentation with disaster capitalism under Boris Yeltsin, Russia has also adopted the strategy of developing a hybrid (or ‘mixed’) economy with substantial State and private sector involvement within the overall framework of strategic planning and industrial policies elaborated by the State in accordance with crucial national interests and objectives.

The underlying similarity in approaches and objectives – albeit obscured somewhat by China’s continued strong commitment to communism and Russia’s strong renunciation of the same – has provided a solid basis for both countries’ renewed interest in strengthening bilateral relations and cooperation in all spheres.

While the leadership of both countries have sought to develop and promote a wide range of bilateral trade, investment and R & D projects both by State entities as well as by the private sector, due to their vast scale the bilateral agreements and projects in the energy sector overshadow all others.

This should not however obscure the importance of cooperation in other sectors and the extent to which the different manifestations and forms of cooperation have continued to proliferate. Most Western analysts emphasize the excellent ties that have developed in terms of military cooperation, involving everything from basic R & D of new technologies and weapons systems to military training and exercises, but the bilateral cooperation goes far beyond these high profile sectors to include education, scientific and technical research, agriculture, manufacturing and services more generally.

Macroeconomic Data on the Russian Economy

To contextualize the changes that have taken place in the bilateral economic relations between Russia and China, they are placed against the background of economic developments in Russia more generally. As noted above, Russia’s economy has generally experienced solid if not spectacular growth since the disastrous decade of the 1990s, and although it was significantly impacted by the West’s sanctions imposed in 2014 (as well as by the fall in oil prices that ocurred around the same time) the economy soon stabilized and then recovered quantitative losses on an even more solid fundamental basis given the economy’s increased diversification, self-sufficiency and resistance to external shocks.

Overall Russia has performed at least as well as most Western countries since 2000, though of course China’s economic growth has far exceeded them.

China’s impressive economic growth therefore could explain the steady trend of increasing trade between the two neighbours by and of itself, however as mentioned above bilateral relations have been boosted by external factors (Western hostility and sanctions) and also nurtured and guided by internal factors (strategic economic and industrial planning based on compatible national priorities and objectives, augmented by significant levels of direct State participation in key economic sectors).

Imports and Exports

The growing economic importance of China to Russia has largely been at the expense of Europe, in part due to the imposition of sanctions against Russia but also a natural consequence of China’s continued economic growth and Europe’s economic stagnation, as well as the complementarity that exists between the Russian and Chinese economies, sectors of comparative advantage and resource endowments.

The share of the 28 European Union countries in Russian exports dropped from 52% in 2014 to 45% in 2017, and the corresponding shares in Russian imports fell from 41% to 38%. Over the same period, the share of China in Russian exports increased from 7.5% to 12%, and in imports from 11.5% to 21%. Nonetheless, as of 2017 Russian imports from China (EUR 48bn) remained about half the value of imports from the European Union (EUR 87bn). Thus although trade reorientation away from the West and towards China is steadily increasing, Europe remains an integral trade partner for Russia.

The figures for 2019 were very similar. The top 10 sources of imports were:

China 21% (54 billion US$), Germany 10.1% (25 billion US$), Belarus 5.52% (13.6 billion US$), USA 5.43% (13.4 billion US$), Italy 4.41% (10.9 billion US$), Japan 3.62% (8.96 billion US$), France 3.47% (8.59 billion US$), Korea 3.23% (8 billion US$), Kazakhstan 2.31% (5.71 billion US$), Turkey 2.01% (4.97 billion US$).

The top 10 export destinations for Russian exports in 2019 were:

China 13.4% (57 billion US$), Netherlands 10.4% (44 billion US$), Germany 6.57% (28 billion US$), Belarus 5.08% (21 billion US$), Turkey 4.95% (21 billion US$), Korea 3.83% (16.3 billion US$), Italy 3.36% (14.3 billion US$), Kazakhstan 3.34% (14.2 billion US$), United Kingdom 3.11% (13.2 billion US$), USA 3.09% (13.1 billion US$). Source

The continued importance of Europe to Russia’s economy is particularly evident when the analysis goes beyond the level of trade volumes, to a consideration of the evolution of trade structures by sector, particularly in the case of Russia’s imports. Whereas Russian exports are dominated by mineral fuels in both directions (accounting for more than 76% of exports to the EU and 64% of exports to China), there are important differences in the structure of Russian imports from the EU and China.

“This reflects the fact that, in certain areas, Russia still needs products and equipment that it can only obtain from Western sources. For example, whereas the HS84 category (nuclear reactors, boilers, machinery and mechanical equipment) represents the largest import item from both the EU and China (with shares in total Russian imports of 23% and 28% in 2017, respectively), the second and third most important categories of imports from the EU: HS87 (vehicles, 11% of Russian imports) and HS30 (pharmaceuticals, 9%) are still largely absent in imports from China…

Nevertheless, import structures are also converging: between 2014 and 2017 these structural ‘import gaps’ were substantially reduced – most spectacularly in the above mentioned three largest import items. The structure of Russian imports from China is also becoming more sophisticated: the shares of machinery and electrical equipment are already higher than the corresponding shares in imports from the EU. As the EU-China import gap closes for Russia, one can conclude that China is gradually replacing the EU as an import source, even with respect to structural developments (although there remain gaps at more detailed commodity levels).” LINK

Key Sectors and Major Projects

The negotiation and execution of structural agreements and operational projects and transactions has taken place within the framework of existing strategic planning elements so as to maximize their compatibility with existing projects and activities and contribution to the realization of national priorities and interests. Although Russia’s efforts to increase economic diversification and self-sufficiency in key sectors received a great boost from the imposition of sanctions in 2014, it had already taken substantial steps in this regard. For instance, a ‘food security doctrine’ has been official government policy since 2010, and the doctrine has been a key element of subsequent government programs for the development of the agriculture and fisheries sectors and the regulation of agri-food markets during the period 2013-2020. LINK

In the same way, ambitious infrastructure projects announced in the framework of developing bilateral relations – such as the Moscow-Kazan high speed railway, which will eventually be part of a high speed rail network linking China (and probably even southeast Asia) to Europe – are being laid out within the framework of a broader Russian strategy to overhaul and upgrade infrastructure throughout the country. In April 2019 the Moscow Times reported:

“The Russian government is pursuing a 6.3 trillion ruble ($96 billion) six-year modernization plan to revamp the country’s highways, airports, railways, ports and other transport infrastructure through 2024.

The comprehensive plan is geared toward improving the connectivity of Russian regions, as well as developing strategic routes including the Europe-Western China transport corridor and the Northern Sea Route.

The plan stems from President Vladimir Putin’s ambitious domestic goals outlined after his inauguration last May. Under a presidential decree, a 3.5 trillion ruble investment fund was set up last summer to finance around 170 construction and other projects from 2019 to 2024.”

Of course, both the general plan and specific details have been subject to scepticism by some experts:

“Bloomberg columnist Leonid Bershidsky has argued that the infrastructure plan risks neglecting underdeveloped regions the Kremlin sees as a “social liability.” Economists interviewed by The Christian Science Monitor have said the revitalization plans are geared toward boosting the export potential of big business and are ill-equipped toward future economic development.” LINK

Nonetheless, at least Russia is committed to thinking and acting strategically with the intention of improving the country’s stock of assets and capabilities, and early indications are that most of the projects have been thoroughly evaluated for current and future economic and social utility and that implementation is progressing steadily. What would the detractors of Russia’s efforts in this respect make of the non-existent efforts of the ruling classes in the US to undertake a similar national infrastructure modernization project?

Early on in the preparations for a massive expansion in bilateral ties the underlying financial infrastructure was laid.

Although still heavily reliant on the US dollar for all bilateral transactions at the time, by 2014 around 100 Russian commercial banks were already offering corresponding accounts for settlements in yuan, and in some ordinary depositors could also open an account in yuan. On November 18 Sberbank became the first Russian bank to begin financing letters of credit in Chinese yuan.

The settlement in national currencies between China and Russia in bilateral trade amounted to about 2% in 2013. However, the use of the yuan in mutual settlements between China and Russia increased ninefold in annual terms between January and September 2014, according to the Chinese Ministry of Economic Development, and has continued to rise. LINK

The financial basis for greatly expanded relations has continued to evolve in accordance with progress in other areas.

Thus, in 2015 Sberbank – Russia’s biggest lender – signed a facility agreement with China’s Development Bank to the amount of $966 million.

The goal of the agreement is to develop the “long-term cooperation between Sberbank and China Development Bank in the area of financing foreign trade operations between Russia and China.”

Russia’s state-owned VTB Bank and the Export-Import Bank of China also signed a $483.2 million loan facility agreement to finance trading operations between Russia and China.

The financial architecture has been further consolidated by broader regional frameworks and agreements for mutually beneficial cooperation.

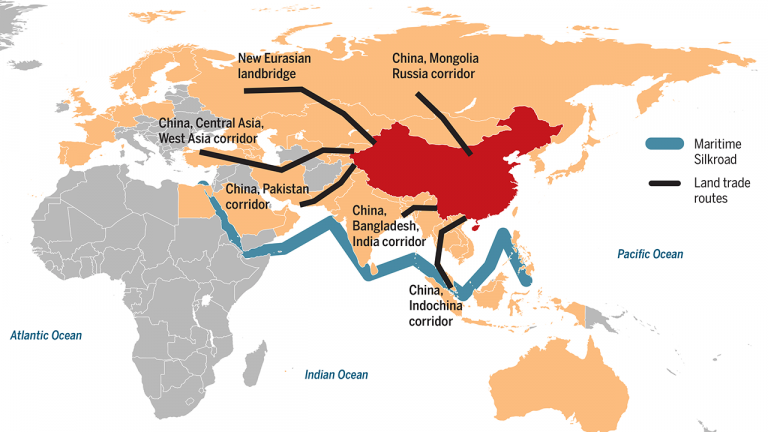

In 2015, Russian President Vladimir Putin and Chinese leader Xi Jinping signed a decree to formalize cooperation in linking the development of the Eurasian Economic Union with the “Silk Road” economic project. The Silk Road project is aimed at connecting China with European and Middle Eastern markets.

“The integration of the Eurasian Economic Union and Silk Road projects means reaching a new level of partnership and actually implies a common economic space on the continent,” Putin said after the meeting with his Chinese counterpart.

Major transport corridors of the Chinese Belt and Road Initiative

Trans-continental railways

Russia’s railway network is steadily undergoing a major program of extension and modernization

Also in 2015, China pledged to invest $5.8 billion in the construction of the Moscow-Kazan High Speed Railway. The railway will be extended to China, connecting the two countries through Kazakhstan. The total cost of the Moscow-Kazan high speed railroad project is $21.4 billion.

An agreement was signed to create a leasing company which will promote the sale of the Russian Sukhoi Superjet-100 passenger planes to the Chinese and South-East Asian markets, and the two countries agreed to develop a new heavy helicopter, called the Advanced Heavy Lift. LINK

The broadening of economic relations spearheaded by high profile State-led industrial projects is underpinned by a range of other initiatives. For example, in September 2018 Russian and Chinese businesses agreed to further develop trade and economic cooperation and increase mutual investments at the Eastern Economic Forum in Vladivostok.

According to a statement from the Russian Direct Investment Fund (RDIF), the sides are considering 73 investment projects worth more than $100 billion in total. The group overseeing the investments is the Russian-Chinese Business Advisory Committee, which includes more than 150 representatives from “leading Russian and Chinese companies.” RDIF said that seven projects worth a total of $4.6 billion have already been implemented as a result of the group’s activities.

The Russia-China Investment Fund was established in 2012 by China’s state-owned China Investment Corporation and RDIF to focus on projects that foster economic cooperation between Moscow and Beijing. LINK

Major China – Russia gas routes

The largest joint project that has been developed is the massive Power of Siberia gas project. In 2014 Gazprom and the China National Petroleum Corporation (CNPC) signed a $400 billion, 30-year framework agreement to deliver 38 billion cubic meters of Russian gas to China annually. According to Russian energy major Gazprom, 119 operational gas wells had been completed by 2017 at the Chayandinskoye field in Yakutia, and the 3,000km of pipelines from Yakutia to the Russian-Chinese border, connected to the Chinese grid via a two-thread underwater crossing of the pipeline across the Amur River, started deliveries as scheduled late in 2019. The deal on the ‘Eastern Route’ took more than a decade to negotiate.

While Western experts are trying to downplay the merits and prospects for the Power of Siberia project – and the bilateral strategic relationship more generally – the project started supplying gas on schedule and at this stage it appears that the claims of the detractors consist of logistical and operational challenges that the Russians have ample experience in confronting or are largely wishful thinking (the terrain is very inhospitable and operating costs and risks are therefore very high, the project will crowd out smaller producers, Russia is locking itself into an arrangement that eliminates other opportunities, Chinese market power means Russia will have to accept unfavourable conditions, the Asian giant will inevitably swallow up its northern neighbour, bilateral relations are founded on a ‘marriage of convenience’, etc.). LINK

As the US has continued to intensify its hostility and associated geopolitical and economic pressure on China and Russia, the two countries have continued to expand their military cooperation as well as a strong high-tech partnership spanning telecommunications, artificial intelligence and robotics, biotechnology and the digital economy based on the exploitation of existing and potential synergies.

The deepening of the bilateral relationship includes more dialogue and exchanges of information, increased academic cooperation and the development of joint industrial science and technology parks. In addition, Russian President Vladimir Putin said Russia would help the Chinese build their own missile early-warning system – a technology that only Russia and the U.S. have successfully implemented so far. LINK

Conclusion

The crucial role of strategic economic and industrial planning and direct State participation in key sectors has been emphasized throughout this report. This is not to suggest that such planning and participation has been perfect; of course, significant errors have been made in both planning and execution, unforeseeable external shocks or factors that could have been predicted but were not taken into account have disrupted progress, as in all other countries.

One area of particular concern is the adverse material impact and effect on morale caused by corruption, which continues to plague both State and private sectors suggesting that the systems of accounting and accountability applying to both require further improvement in both design and implementation. Also, it is arguable that the vision of public forms of economic ownership and participation remains somewhat limited to a strict State/ private company dichotomy and to elitist management structures and procedures within each.

One aspect of this is that more forms of State participation could be considered at the regional and local levels; another is in terms of inclusion of the workforce of each enterprise in the planning, management and accountability structures and decisions of existing State-owned enterprises.

Beyond this, there may be scope for the promotion of other forms of organization, such as producer, professional or community-based cooperatives and collectives that can provide an organizational basis for economic projects and activities in a manner that can incorporate other values and objectives beyond the profit motive.

The basic data for foreign capital flows also suggest a major structural defect which is inherent to the ‘actual existing’ international economy: a vastly disproportionate amount of capital arrives from and departs for small countries that have no clear trade significance or investment capacity of their own, meaning that such capital flows are routed via these jurisdictions either to avoid taxes and other regulations or to deliberately obscure the identity of the owners and beneficiaries of the resources involved.

According to UNCTAD, between 30% and 50% of all ‘foreign direct investment’ worldwide passes through “conduit” countries, making it hard to determine the source.

According to data from the Central Bank of Russia for 2017, Russia receives 36.8% of ‘foreign direct investment’ (or more accurately, international capital flows) from Cyprus, 5.8% from the Bahamas, 7.2% from Bermuda, 0.8% from China, 3.4% from France, 4.1% from Germany, 0.5% from Japan, 0.4% from Korea, 4.4% from Luxembourg, 9.2% from Netherlands, 3.7% from Singapore, 2.9% from Switzerland, 4.2% from the UK, 0.7% from the US and 0.8% from the Ukraine.

According to estimates compiled by UNCTAD, approximately 6.5% of Russia’s ‘FDI’ stock — about $28.7 billion worth based on 2017 data — was actually of Russian origin. The UNCTAD estimates also showed a significantly increased amount of European and US investment. According to the estimates produced, the US is actually the biggest foreign investor in the Russian economy, worth about $39.2 billion.

While such features of international capital flows can be useful to, for example, elude punitive sanctions from hostile states, they greatly restrict efforts to reduce corruption and improve planning and accountability. The Russian government is no doubt well aware of both the potential advantages as well as the drawbacks involved. For example, Bloomberg reported last year:

“For Russia, meanwhile, repatriating the capital that’s recorded as foreign but isn’t remains an important policy goal. In the 2019 World Investment Report, Unctad attributes the 2018 drop in Russia’s investment inflows to the government’s effort to get Russian business owners to redomicile their holdings to the home country.” LINK

While some aspects and consequences of this inimical structural feature of the international economy have been addressed, it remains a major challenge not just for Russia but everywhere.

Overall, however, the available macro-economic data and preliminary results of major joint projects between Russia and China suggest that their approach has been successful as the Russian economy has withstood the external shocks of sanctions imposed by major trading partners as well as large falls in oil and gas prices, and continued on the path of diversification, deepening and constant improvement of existing production capacities to ensure a core level of resilience and self-sufficiency without going to the other extreme of going xenophobic and renouncing foreign trade and cooperation.

Government

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

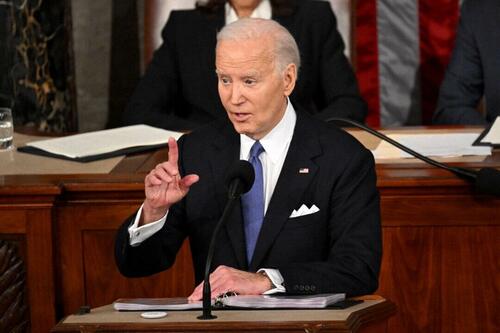

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

International

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico chinaGovernment

Vaccine-skeptical mothers say bad health care experiences made them distrust the medical system

Vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position in the 21st century.

Why would a mother reject safe, potentially lifesaving vaccines for her child?

Popular writing on vaccine skepticism often denigrates white and middle-class mothers who reject some or all recommended vaccines as hysterical, misinformed, zealous or ignorant. Mainstream media and medical providers increasingly dismiss vaccine refusal as a hallmark of American fringe ideology, far-right radicalization or anti-intellectualism.

But vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position.

Pediatric vaccination rates had already fallen sharply before the COVID-19 pandemic, ushering in the return of measles, mumps and chickenpox to the U.S. in 2019. Four years after the pandemic’s onset, a growing number of Americans doubt the safety, efficacy and necessity of routine vaccines. Childhood vaccination rates have declined substantially across the U.S., which public health officials attribute to a “spillover” effect from pandemic-related vaccine skepticism and blame for the recent measles outbreak. Almost half of American mothers rated the risk of side effects from the MMR vaccine as medium or high in a 2023 survey by Pew Research.

Recommended vaccines go through rigorous testing and evaluation, and the most infamous charges of vaccine-induced injury have been thoroughly debunked. How do so many mothers – primary caregivers and health care decision-makers for their families – become wary of U.S. health care and one of its most proven preventive technologies?

I’m a cultural anthropologist who studies the ways feelings and beliefs circulate in American society. To investigate what’s behind mothers’ vaccine skepticism, I interviewed vaccine-skeptical mothers about their perceptions of existing and novel vaccines. What they told me complicates sweeping and overly simplified portrayals of their misgivings by pointing to the U.S. health care system itself. The medical system’s failures and harms against women gave rise to their pervasive vaccine skepticism and generalized medical mistrust.

The seeds of women’s skepticism

I conducted this ethnographic research in Oregon from 2020 to 2021 with predominantly white mothers between the ages of 25 and 60. My findings reveal new insights about the origins of vaccine skepticism among this demographic. These women traced their distrust of vaccines, and of U.S. health care more generally, to ongoing and repeated instances of medical harm they experienced from childhood through childbirth.

As young girls in medical offices, they were touched without consent, yelled at, disbelieved or threatened. One mother, Susan, recalled her pediatrician abruptly lying her down and performing a rectal exam without her consent at the age of 12. Another mother, Luna, shared how a pediatrician once threatened to have her institutionalized when she voiced anxiety at a routine physical.

As women giving birth, they often felt managed, pressured or discounted. One mother, Meryl, told me, “I felt like I was coerced under distress into Pitocin and induction” during labor. Another mother, Hallie, shared, “I really battled with my provider” throughout the childbirth experience.

Together with the convoluted bureaucracy of for-profit health care, experiences of medical harm contributed to “one million little touch points of information,” in one mother’s phrase, that underscored the untrustworthiness and harmful effects of U.S. health care writ large.

A system that doesn’t serve them

Many mothers I interviewed rejected the premise that public health entities such as the Centers for Disease Control and Prevention and the Food and Drug Administration had their children’s best interests at heart. Instead, they tied childhood vaccination and the more recent development of COVID-19 vaccines to a bloated pharmaceutical industry and for-profit health care model. As one mother explained, “The FDA is not looking out for our health. They’re looking out for their wealth.”

After ongoing negative medical encounters, the women I interviewed lost trust not only in providers but the medical system. Frustrating experiences prompted them to “do their own research” in the name of bodily autonomy. Such research often included books, articles and podcasts deeply critical of vaccines, public health care and drug companies.

These materials, which have proliferated since 2020, cast light on past vaccine trials gone awry, broader histories of medical harm and abuse, the rapid growth of the recommended vaccine schedule in the late 20th century and the massive profits reaped from drug development and for-profit health care. They confirmed and hardened women’s suspicions about U.S. health care.

The stories these women told me add nuance to existing academic research into vaccine skepticism. Most studies have considered vaccine skepticism among primarily white and middle-class parents to be an outgrowth of today’s neoliberal parenting and intensive mothering. Researchers have theorized vaccine skepticism among white and well-off mothers to be an outcome of consumer health care and its emphasis on individual choice and risk reduction. Other researchers highlight vaccine skepticism as a collective identity that can provide mothers with a sense of belonging.

Seeing medical care as a threat to health

The perceptions mothers shared are far from isolated or fringe, and they are not unreasonable. Rather, they represent a growing population of Americans who hold the pervasive belief that U.S. health care harms more than it helps.

Data suggests that the number of Americans harmed in the course of treatment remains high, with incidents of medical error in the U.S. outnumbering those in peer countries, despite more money being spent per capita on health care. One 2023 study found that diagnostic error, one kind of medical error, accounted for 371,000 deaths and 424,000 permanent disabilities among Americans every year.

Studies reveal particularly high rates of medical error in the treatment of vulnerable communities, including women, people of color, disabled, poor, LGBTQ+ and gender-nonconforming individuals and the elderly. The number of U.S. women who have died because of pregnancy-related causes has increased substantially in recent years, with maternal death rates doubling between 1999 and 2019.

The prevalence of medical harm points to the relevance of philosopher Ivan Illich’s manifesto against the “disease of medical progress.” In his 1982 book “Medical Nemesis,” he insisted that rather than being incidental, harm flows inevitably from the structure of institutionalized and for-profit health care itself. Illich wrote, “The medical establishment has become a major threat to health,” and has created its own “epidemic” of iatrogenic illness – that is, illness caused by a physician or the health care system itself.

Four decades later, medical mistrust among Americans remains alarmingly high. Only 23% of Americans express high confidence in the medical system. The United States ranks 24th out of 29 peer high-income countries for the level of public trust in medical providers.

For people like the mothers I interviewed, who have experienced real or perceived harm at the hands of medical providers; have felt belittled, dismissed or disbelieved in a doctor’s office; or spent countless hours fighting to pay for, understand or use health benefits, skepticism and distrust are rational responses to lived experience. These attitudes do not emerge solely from ignorance, conspiracy thinking, far-right extremism or hysteria, but rather the historical and ongoing harms endemic to the U.S. health care system itself.

Johanna Richlin does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

disease control extremism pandemic covid-19 vaccine treatment testing fda deaths-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex