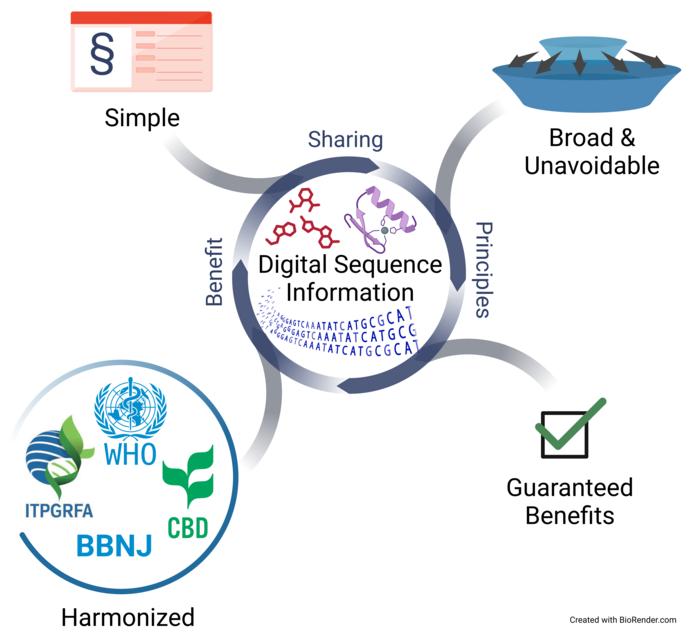

At the 2022 COP-15 meeting, signatories of the Convention on Biological Diversity reached a new agreement called the Kunming-Montreal Global Biodiversity Framework, which contained provisions to establish a separate, multilateral benefit-sharing mechanism for the use of “digital sequence information” (DSI), that is, the biological data associated with, or derived from, genetic resources such as nucleotide sequences and epigenetic, protein, and metabolite data.

In a new Policy Forum analysis published in the journal Science, researchers underscore that the international community has a narrow window of opportunity to develop a DSI benefit-sharing framework that is simple, harmonized, effective, and transformational. The authors recommend that this new framework break with the past ways countries have regulated access and benefit sharing for biological and genetic materials.

Amber Hartman Scholz, head of the science policy department at the Leibniz Institute DSMZ, German Collection of Microorganisms and Cell Cultures in Braunschweig, Germany; and coauthor of the analysis piece, says that fundamentally the benefit-sharing hypothesis seems broken.

“As we develop a new mechanism for digital sequence data, we should focus on ensuring outcomes, reducing avoidance, and simplifying everything,” Scholz says, “As the international policy community builds a new benefit-sharing system for digital sequence information, we have to learn from the past, otherwise, we will fail even more in the digital era.”

Michael Halewood, a researcher at the Alliance of Bioversity International and CIAT; and the CGIAR Genebanks Initiative, agrees.

“The practically free, infinitely reproducible, ubiquitous nature of DSI has brought internationally endorsed access and benefit sharing (ABS) systems to a crossroads, and is threatening to run them into the ditch,” he says, “A new harmonized ABS system for DSI should be built on lessons learned from trying to regulate genetic materials; this new system must be coordinated, simple, universally applicable, and unavoidable.”

Time Marches On

For over 30 years, the international community has been forging and reforging international agreements to require users of biological and genetic material sourced from many different countries to share profits or training opportunities and research collaboration with the providers of those materials, for example, if a new drug is developed in one country using samples from an endemic species from another, then the providing country should “benefit” from that development.

“These efforts have been largely unsuccessful, partly because ABS systems developed so far tend to be dragged down by their own bureaucratic weight, designed as they are to micro-regulate each individual act of access and use of each genetic material in the development of new commercial products, and partly because they are pretty easy to avoid, getting genetic materials from unregulated sources,” Halewood says.

On top of that, the emergence of fast, low-cost genome sequencing technologies coupled with open access infrastructures for sharing digital sequence information make it possible to access and use potentially unlimited ranges of genetic sequences without needing to access (or a highly reduced number, at least) of the underlying genetic materials. Furthermore, artificial intelligence applied to biological datasets has exponentially amplified this potential.

The shift in focus to digital sequence information provides an opportunity to develop a better overall system, one that really delivers on the benefit sharing promises of earlier international agreements.

Confronting The Future

The researchers view the COP-15 decision as recognizing that the current transaction-based–benefit-sharing mechanism is not realistic for DSI. They also note the need for a mechanism compatible with open access to biomolecular data from around the world for all biological data and harmonized across multiple UN agreements.

Scholz notes,

“As policymakers take up negotiations in advance of COP16 and begin to set up this new mechanism, they need to look afresh at their historical negotiation positions, reset them, and focus on the outcomes they want for benefit-sharing. The past shows us a way forward that is broader and bolder than 30 years ago.”

Background Information:

- CBD COP15 – 15/9. Digital sequence information on genetic resources

- KMGBF – Target 13. Fair and equitable sharing of benefits from genetic resources, digital sequence information and associated traditional knowledge

- Digital sequence information will influence who benefits from biodiversity

- DSI Scientific Network – CBD COP15 Outcome Statement

- DSI Scientific Network – Submission of views on issues for further consideration for digital sequence information on genetic resources

About the Alliance of Bioversity International and CIAT

The Alliance of Bioversity International and the International Center for Tropical Agriculture (CIAT) delivers research-based solutions that harness agricultural biodiversity and sustainably transform food systems to improve people’s lives. Alliance solutions address the global crises of malnutrition, climate change, biodiversity loss, and environmental degradation.

With novel partnerships, the Alliance generates evidence and mainstreams innovations to transform food systems and landscapes so that they sustain the planet, drive prosperity, and nourish people in a climate crisis.

The Alliance is part of CGIAR, a global research partnership for a food-secure future. www.alliancebioversityciat.org

About the Leibniz Institute DSMZ

The Leibniz Institute DSMZ-German Collection of Microorganisms and Cell Cultures is the world’s most diverse collection of biological resources (bacteria, archaea, protists, yeasts, fungi, bacteriophages, plant viruses, genomic bacterial DNA as well as human and animal cell lines). Microorganisms and cell cultures are collected, investigated and archived at the DSMZ. As an institution of the Leibniz Association, the DSMZ with its extensive scientific services and biological resources has been a global partner for research, science and industry since 1969. The DSMZ was the first registered collection in Europe (Regulation (EU) No. 511/2014) under the Nagoya Protocol and is certified according to the quality standard ISO 9001:2015. As a patent depository, it is the only place in Germany where biological material can be deposited in accordance with the requirements of the Budapest Treaty. In addition to scientific services, DSMZ is also a research institute located on the Science Campus Braunschweig-Süd. DSMZ safeguards more than 85,000 cultures and biomaterials and has around 220 employees. www.dsmz.de

Journal

Science

DOI

10.1126/science.adj1331

Article Title

New benefit-sharing principles for digital sequence information

Article Publication Date

2-Nov-2023