Spread & Containment

REITs and Bonds Were Havens During Last Week’s Market Losses

US real estate and fixed-securities provided diversification benefits during last week’s widespread selling that weighed on most other markets around the world, based on a set of ETFs through Friday’s close (Dec. 17). Vanguard US Real Estate (VNQ)…

US real estate and fixed-securities provided diversification benefits during last week’s widespread selling that weighed on most other markets around the world, based on a set of ETFs through Friday’s close (Dec. 17).

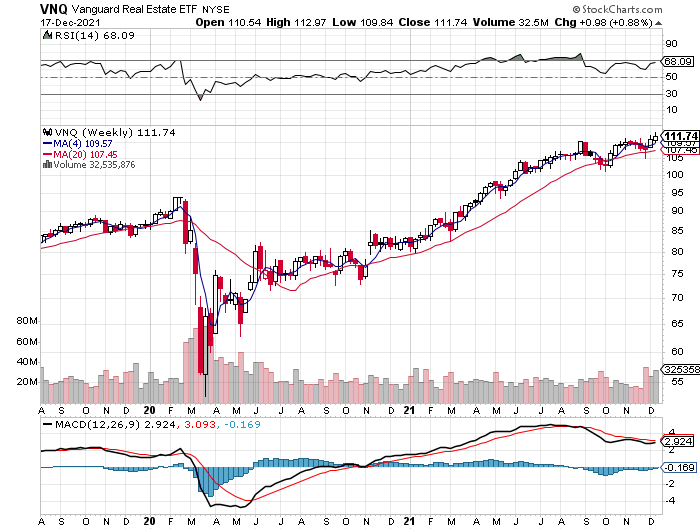

Vanguard US Real Estate (VNQ) – a proxy for US-listed real estate investment trusts (REITs) — posted the leading performance last week for the major asset classes. The fund rallied for a second week, gaining 0.9%. The increase lifted the ETF to just below a record high at the end of the trading week.

A broad measure of US bonds also rose last week. Vanguard Total Bond Market (BND) ticked up 0.4%. Despite the increase, BND continues to trade in range as the market digests the conflicting signals for monetary policy and the economic outlook — factors that are key inputs for bonds.

The Federal Reserve last week signaled that it is pivoting away from the strong monetary stimulus bias it has maintained during the pandemic and shifting, on the margins for now, to a more hawkish outlook to fight elevated inflation. The central bank’s evolving focus comes amid rising uncertainty for the US economy. Although next month’s fourth-quarter GDP report is expected to post a strong rebound from Q3’s weak gain, the bounce is expected to fade in the first half of 2022.

In addition to the potential for stronger economic headwinds due to the spread of the Omicron variant of the coronavirus, new uncertainty over the fate of President Biden’s Build Back Better (BBB) legislation adds another risk to the macro calculus for 2022. Factoring in lower odds that the bill will become law, Goldman Sachs on Sunday cut its forecast for US economic growth in the new year. “A failure to pass BBB has negative growth implications,” the investment bank advises in a report after Sen. Joe Manchin announced he wouldn’t support the bill, which effectively kills the legislation in a closely divided Senate.

Most markets lost ground last week. The biggest loser: stocks in emerging markets. Vanguard FTSE Emerging (VWO) tumbled 2.5%, leaving the ETF at its lowest close since August.

Widespread market losses weighted on the Global Market Index (GMI.F) — an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI.F dropped 1.3% last week. This benchmark has fallen in five of the past six weeks.

US REITs continue to lead for the one-year window by a wide margin. Vanguard US Real Estate (VNQ) is ahead by a strong 33.5% vs. the year-ago level (after factoring in distributions). US stocks are in second place, but VTI’s 23.0% one-year gain remains well behind VNQ’s gain.

Half of the major asset classes are under water for the one-year window. The biggest loser: government bonds in emerging markets via EMLC, which has lost 11.2% over the past 12 months.

GMI.F, by contrast, is up a strong 12.2% for the trailing one-year period.

Most of the major asset classes are posting moderate drawdowns as of Friday’s close, ranging from a trivial 0.3% peak-to-trough decline for US REITs (VNQ) to a bit more than a 9% drawdown for government bonds in developed markets ex-US (BWX).

The three downside outliers: emerging markets stocks (VWO), emerging markets bonds (EMLC) and commodities (GCC), which are currently posting drawdowns in excess of 10% declines.

GMI.F’s current drawdown is -2.9%.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic coronavirus stimulus economic growth bonds government bonds ftse emerging markets stocks monetary policy federal reserve real estate etf senate spread recession gdp stimulus commodities

Spread & Containment

A major cruise line is testing a monthly subscription service

The Cruise Scarlet Summer Season Pass was designed with remote workers in mind.

While going on a cruise once meant disconnecting from the world when between ports because any WiFi available aboard was glitchy and expensive, advances in technology over the last decade have enabled millions to not only stay in touch with home but even work remotely.

With such remote workers and digital nomads in mind, Virgin Voyages has designed a monthly pass that gives those who want to work from the seas a WFH setup on its Scarlet Lady ship — while the latter acronym usually means "work from home," the cruise line is advertising as "work from the helm.”

Related: Royal Caribbean shares a warning with passengers

"Inspired by Richard Branson's belief and track record that brilliant work is best paired with a hearty dose of fun, we're welcoming Sailors on board Scarlet Lady for a full month to help them achieve that perfect work-life balance," Virgin Voyages said in announcing its new promotion. "Take a vacation away from your monotonous work-from-home set up (sorry, but…not sorry) and start taking calls from your private balcony overlooking the Mediterranean sea."

Shutterstock

This is how much it'll cost you to work from a cruise ship for a month

While the single most important feature for successful work at sea — WiFi — is already available for free on Virgin cruises, the new Scarlet Summer Season Pass includes a faster connection, a $10 daily coffee credit, access to a private rooftop, and other member-only areas as well as wash and fold laundry service that Virgin advertises as a perk that will allow one to concentrate on work

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The pass starts at $9,990 for a two-guest cabin and is available for four monthlong cruises departing in June, July, August, and September — each departs from ports such as Barcelona, Marseille, and Palma de Mallorca and spends four weeks touring around the Mediterranean.

Longer cruises are becoming more common, here's why

The new pass is essentially a version of an upgraded cruise package with additional perks but is specifically tailored to those who plan on working from the ship as an opportunity to market to them.

"Stay connected to your work with the fastest at-sea internet in the biz when you want and log-off to let the exquisite landscape of the Mediterranean inspire you when you need," reads the promotional material for the pass.

Amid the rise of remote work post-pandemic, cruise lines have been seeing growing interest in longer journeys in which many of the passengers not just vacation in the traditional sense but work from a mobile office.

In 2023, Turkish cruise line operator Miray even started selling cabins on a three-year tour around the world but the endeavor hit the rocks after one of the engineers declared the MV Gemini ship the company planned to use for the journey "unseaworthy" and the cruise ship line dealt with a PR scandal that ultimately sank the project before it could take off.

While three years at sea would have set a record as the longest cruise journey on the market, companies such as Royal Caribbean (RCL) (both with its namesake brand and its Celebrity Cruises line) have been offering increasingly long cruises that serve as many people’s temporary homes and cross through multiple continents.

stocks pandemic testingSpread & Containment

As the pandemic turns four, here’s what we need to do for a healthier future

On the fourth anniversary of the pandemic, a public health researcher offers four principles for a healthier future.

Anniversaries are usually festive occasions, marked by celebration and joy. But there’ll be no popping of corks for this one.

March 11 2024 marks four years since the World Health Organization (WHO) declared COVID-19 a pandemic.

Although no longer officially a public health emergency of international concern, the pandemic is still with us, and the virus is still causing serious harm.

Here are three priorities – three Cs – for a healthier future.

Clear guidance

Over the past four years, one of the biggest challenges people faced when trying to follow COVID rules was understanding them.

From a behavioural science perspective, one of the major themes of the last four years has been whether guidance was clear enough or whether people were receiving too many different and confusing messages – something colleagues and I called “alert fatigue”.

With colleagues, I conducted an evidence review of communication during COVID and found that the lack of clarity, as well as a lack of trust in those setting rules, were key barriers to adherence to measures like social distancing.

In future, whether it’s another COVID wave, or another virus or public health emergency, clear communication by trustworthy messengers is going to be key.

Combat complacency

As Maria van Kerkove, COVID technical lead for WHO, puts it there is no acceptable level of death from COVID. COVID complacency is setting in as we have moved out of the emergency phase of the pandemic. But is still much work to be done.

First, we still need to understand this virus better. Four years is not a long time to understand the longer-term effects of COVID. For example, evidence on how the virus affects the brain and cognitive functioning is in its infancy.

The extent, severity and possible treatment of long COVID is another priority that must not be forgotten – not least because it is still causing a lot of long-term sickness and absence.

Culture change

During the pandemic’s first few years, there was a question over how many of our new habits, from elbow bumping (remember that?) to remote working, were here to stay.

Turns out old habits die hard – and in most cases that’s not a bad thing – after all handshaking and hugging can be good for our health.

But there is some pandemic behaviour we could have kept, under certain conditions. I’m pretty sure most people don’t wear masks when they have respiratory symptoms, even though some health authorities, such as the NHS, recommend it.

Masks could still be thought of like umbrellas: we keep one handy for when we need it, for example, when visiting vulnerable people, especially during times when there’s a spike in COVID.

If masks hadn’t been so politicised as a symbol of conformity and oppression so early in the pandemic, then we might arguably have seen people in more countries adopting the behaviour in parts of east Asia, where people continue to wear masks or face coverings when they are sick to avoid spreading it to others.

Although the pandemic led to the growth of remote or hybrid working, presenteeism – going to work when sick – is still a major issue.

Encouraging parents to send children to school when they are unwell is unlikely to help public health, or attendance for that matter. For instance, although one child might recover quickly from a given virus, other children who might catch it from them might be ill for days.

Similarly, a culture of presenteeism that pressures workers to come in when ill is likely to backfire later on, helping infectious disease spread in workplaces.

At the most fundamental level, we need to do more to create a culture of equality. Some groups, especially the most economically deprived, fared much worse than others during the pandemic. Health inequalities have widened as a result. With ongoing pandemic impacts, for example, long COVID rates, also disproportionately affecting those from disadvantaged groups, health inequalities are likely to persist without significant action to address them.

Vaccine inequity is still a problem globally. At a national level, in some wealthier countries like the UK, those from more deprived backgrounds are going to be less able to afford private vaccines.

We may be out of the emergency phase of COVID, but the pandemic is not yet over. As we reflect on the past four years, working to provide clearer public health communication, avoiding COVID complacency and reducing health inequalities are all things that can help prepare for any future waves or, indeed, pandemics.

Simon Nicholas Williams has received funding from Senedd Cymru, Public Health Wales and the Wales Covid Evidence Centre for research on COVID-19, and has consulted for the World Health Organization. However, this article reflects the views of the author only, in his academic capacity at Swansea University, and no funding or organizational bodies were involved in the writing or content of this article.

vaccine treatment pandemic covid-19 spread social distancing uk world health organizationInternational

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex