Authored by Bert Olivier via The Brownstone Institute,

Bernard Stiegler was, until his premature death, probably the most important philosopher of technology of the present. His work on technology has shown us that, far from being exclusively a danger to human existence, it is a pharmakon – a poison as well as a cure – and that, as long as we approach technology as a means to ‘critical intensification,’ it could assist us in promoting the causes of enlightenment and freedom.

It is no exaggeration to say that making believable information and credible analysis available to citizens at present is probably indispensable for resisting the behemoth of lies and betrayal confronting us. This has never been more necessary than it is today, given that we face what is probably the greatest crisis in the history of humanity, with nothing less than our freedom, let alone our lives, at stake.

To be able to secure this freedom against the inhuman forces threatening to shackle it today, one could do no better than to take heed of what Stiegler argues in States of Shock: Stupidity and Knowledge in the 21st Century (2015). Considering what he writes here it is hard to believe that it was not written today (p. 15):

The impression that humanity has fallen under the domination of unreason or madness [déraison] overwhelms our spirit, confronted as we are with systemic collapses, major technological accidents, medical or pharmaceutical scandals, shocking revelations, the unleashing of the drives, and acts of madness of every kind and in every social milieu – not to mention the extreme misery and poverty that now afflict citizens and neighbours both near and far.

While these words are certainly as applicable to our current situation as it was almost 10 years ago, Stiegler was in fact engaged in an interpretive analysis of the role of banks and other institutions – aided and abetted by certain academics – in the establishment of what he terms a ‘literally suicidal financial system’ (p. 1). (Anyone who doubts this can merely view the award-winning documentary film of 2010, Inside Job, by Charles Ferguson, which Stiegler also mentions on p.1.) He explains further as follows (p. 2):

Western universities are in the grip of a deep malaise, and a number of them have found themselves, through some of their faculty, giving consent to – and sometimes considerably compromised by – the implementation of a financial system that, with the establishment of hyper-consumerist, drive-based and ‘addictogenic’ society, leads to economic and political ruin on a global scale. If this has occurred, it is because their goals, their organizations and their means have been put entirely at the service of the destruction of sovereignty. That is, they have been placed in the service of the destruction of sovereignty as conceived by the philosophers of what we call the Enlightenment…

In short, Stiegler was writing about the way in which the world was being prepared, across the board – including the highest levels of education – for what has become far more conspicuous since the advent of the so-called ‘pandemic’ in 2020, namely an all-out attempt to cause the collapse of civilisation as we knew it, at all levels, with the thinly disguised goal in mind of installing a neo-fascist, technocratic, global regime which would exercise power through AI-controlled regimes of obedience. The latter would centre on ubiquitous facial recognition technology, digital identification, and CBDCs (which would replace money in the usual sense).

Given the fact that all of this is happening around us, albeit in a disguised fashion, it is astonishing that relatively few people are conscious of the unfolding catastrophe, let alone being critically engaged in disclosing it to others who still inhabit the land where ignorance is bliss. Not that this is easy. Some of my relatives are still resistant to the idea that the ‘democratic carpet’ is about to be pulled from under their feet. Is this merely a matter of ‘stupidity?’ Stiegler writes about stupidity (p.33):

…knowledge cannot be separated from stupidity. But in my view: (1) this is a pharmacological situation; (2) stupidity is the law of the pharmakon; and (3) the pharmakon is the law of knowledge, and hence a pharmacology for our age must think the pharmakon that I am also calling, today, the shadow.

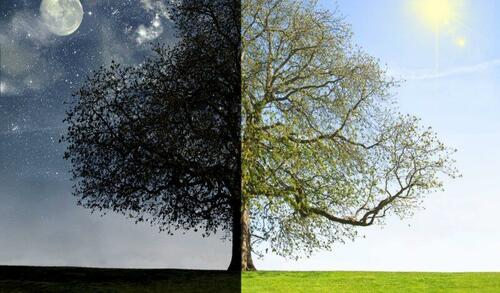

In my previous post I wrote about the media as pharmaka (plural of pharmakon), showing how, on the one hand, there are (mainstream) media which function as ‘poison,’ while on the other there are (alternative) media that play the role of ‘cure.’ Here, by linking the pharmakon with stupidity, Stiegler alerts one to the (metaphorically speaking) ‘pharmacological’ situation, that knowledge is inseparable from stupidity: where there is knowledge, the possibility of stupidity always asserts itself, and vice versa. Or in terms of what he calls ‘the shadow,’ knowledge always casts a shadow, that of stupidity.

Anyone who doubts this may only cast their glance at those ‘stupid’ people who still believe that the Covid ‘vaccines’ are ‘safe and effective,’ or that wearing a mask would protect them against infection by ‘the virus.’ Or, more currently, think of those – the vast majority in America – who routinely fall for the Biden administration’s (lack of an) explanation of its reasons for allowing thousands of people to cross the southern – and more recently also the northern – border. Several alternative sources of news and analysis have lifted the veil on this, revealing that the influx is not only a way of destabilising the fabric of society, but possibly a preparation for civil war in the United States.

There is a different way of explaining this widespread ‘stupidity,’ of course – one that I have used before to explain why most philosophers have failed humanity miserably, by failing to notice the unfolding attempt at a global coup d’etat, or at least, assuming that they did notice it, to speak up against it. These ‘philosophers’ include all the other members of the philosophy department where I work, with the honourable exception of the departmental assistant, who is, to her credit, wide awake to what has been occurring in the world. They also include someone who used to be among my philosophical heroes, to wit, Slavoj Žižek, who fell for the hoax hook, line, and sinker.

In brief, this explanation of philosophers’ stupidity – and by extension that of other people – is twofold. First there is ‘repression’ in the psychoanalytic sense of the term (explained at length in both the papers linked in the previous paragraph), and secondly there is something I did not elaborate on in those papers, namely what is known as ‘cognitive dissonance.’ The latter phenomenon manifests itself in the unease that people exhibit when they are confronted by information and arguments that are not commensurate, or conflict, with what they believe, or which explicitly challenge those beliefs. The usual response is to find standard, or mainstream-approved responses to this disruptive information, brush it under the carpet, and life goes on as usual.

‘Cognitive dissonance’ is actually related to something more fundamental, which is not mentioned in the usual psychological accounts of this unsettling experience. Not many psychologists deign to adduce repression in their explanation of disruptive psychological conditions or problems encountered by their clients these days, and yet it is as relevant as when Freud first employed the concept to account for phenomena such as hysteria or neurosis, recognising, however, that it plays a role in normal psychology too. What is repression?

In The Language of Psychoanalysis (p. 390), Jean Laplanche and Jean-Bertrand Pontalis describe ‘repression’ as follows:

Strictly speaking, an operation whereby the subject attempts to repel, or to confine to the unconscious, representations (thoughts, images, memories) which are bound to an instinct. Repression occurs when to satisfy an instinct – though likely to be pleasurable in itself – would incur the risk of provoking unpleasure because of other requirements.

…It may be looked upon as a universal mental process to so far as it lies at the root of the constitution of the unconscious as a domain separate from the rest of the psyche.

In the case of the majority of philosophers, referred to earlier, who have studiously avoided engaging critically with others on the subject of the (non-)‘pandemic’ and related matters, it is more than likely that repression occurred to satisfy the instinct of self-preservation, regarded by Freud as being equally fundamental as the sexual instinct. Here, the representations (linked to self-preservation) that are confined to the unconscious through repression are those of death and suffering associated with the coronavirus that supposedly causes Covid-19, which are repressed because of being intolerable. The repression of (the satisfaction of) an instinct, mentioned in the second sentence of the first quoted paragraph, above, obviously applies to the sexual instinct, which is subject to certain societal prohibitions. Cognitive dissonance is therefore symptomatic of repression, which is primary.

Returning to Stiegler’s thesis concerning stupidity, it is noteworthy that the manifestations of such inanity are not merely noticeable among the upper echelons of society; worse – there seems to be, by and large, a correlation between those in the upper classes, with college degrees, and stupidity.

In other words, it is not related to intelligence per se. This is apparent, not only in light of the initially surprising phenomenon pertaining to philosophers’ failure to speak up in the face of the evidence, that humanity is under attack, discussed above in terms of repression.

Dr Reiner Fuellmich, one of the first individuals to realise that this was the case, and subsequently brought together a large group of international lawyers and scientists to testify in the ‘court of public opinion’ (see 29 min. 30 sec. into the video) on various aspects of the currently perpetrated ‘crime against humanity,’ has drawn attention to the difference between the taxi drivers he talks to about the globalists’ brazen attempt to enslave humanity, and his learned legal colleagues as far as awareness of this ongoing attempt is concerned. In contrast with the former, who are wide awake in this respect, the latter – ostensibly more intellectually qualified and ‘informed’ – individuals are blissfully unaware that their freedom is slipping away by the day, probably because of cognitive dissonance, and behind that, repression of this scarcely digestible truth.

This is stupidity, or the ‘shadow’ of knowledge, which is recognisable in the sustained effort by those afflicted with it, when confronted with the shocking truth of what is occurring worldwide, to ‘rationalise’ their denial by repeating spurious assurances issued by agencies such as the CDC, that the Covid ‘vaccines’ are ‘safe and effective,’ and that this is backed up by ‘the science.’

Here a lesson from discourse theory is called for. Whether one refers to natural science or to social science in the context of some particular scientific claim – for example, Einstein’s familiar theory of special relativity (e=mc2) under the umbrella of the former, or David Riesman’s sociological theory of ‘inner-’ as opposed to ‘other-directedness’ in social science – one never talks about ‘the science,’ and for good reason. Science is science. The moment one appeals to ‘the science,’ a discourse theorist would smell the proverbial rat.

Why? Because the definite article, ‘the,’ singles out a specific, probably dubious, version of science compared to science as such, which does not need being elevated to special status. In fact, when this is done through the use of ‘the,’ you can bet your bottom dollar it is no longer science in the humble, hard-working, ‘belonging-to-every-person’ sense. If one’s sceptical antennae do not immediately start buzzing when one of the commissars of the CDC starts pontificating about ‘the science,’ one is probably similarly smitten by the stupidity that’s in the air.

Earlier I mentioned the sociologist David Riesman and his distinction between ‘inner-directed’ and ‘other-directed’ people. It takes no genius to realise that, to navigate one’s course through life relatively unscathed by peddlers of corruption, it is preferable to take one’s bearings from ‘inner direction’ by a set of values which promotes honesty and eschews mendacity, than from the ‘direction by others.’ Under present circumstances such other-directedness applies to the maze of lies and misinformation emanating from various government agencies as well as from certain peer groups, which today mostly comprise the vociferously self-righteous purveyors of the mainstream version of events. Inner-directness in the above sense, when constantly renewed, could be an effective guardian against stupidity.

Recall that Stiegler warned against the ‘deep malaise’ at contemporary universities in the context of what he called an ‘addictogenic’ society – that is, a society that engenders addictions of various kinds. Judging by the popularity of the video platform TikTok at schools and colleges, its use had already reached addiction levels by 2019, which raises the question, whether it should be appropriated by teachers as a ‘teaching tool,’ or whether it should, as some people think, be outlawed completely in the classroom.

Recall that, as an instance of video technology, TikTok is an exemplary embodiment of the pharmakon, and that, as Stiegler has emphasised, stupidity is the law of the pharmakon, which is, in turn, the law of knowledge. This is a somewhat confusing way of saying that knowledge and stupidity cannot be separated; where knowledge is encountered, its other, stupidity, lurks in the shadows.

Reflecting on the last sentence, above, it is not difficult to realise that, parallel to Freud’s insight concerning Eros and Thanatos, it is humanly impossible for knowledge to overcome stupidity once and for all. At certain times the one will appear to be dominant, while on different occasions the reverse will apply. Judging by the fight between knowledge and stupidity today, the latter ostensibly still has the upper hand, but as more people are awakening to the titanic struggle between the two, knowledge is in the ascendant. It is up to us to tip the scales in its favour – as long as we realise that it is a never-ending battle.