Uncategorized

Property Tax Expert, Trey Rome, About Texas’ Economy and Housing Market

Property Tax Expert, Trey Rome, About Texas’ Economy and Housing Market

PR Newswire

DALLAS, Jan. 17, 2023

DALLAS, Jan. 17, 2023 /PRNewswire/ — Trey Rome is president of the Texas Property Tax Lienholders Association (TPTLA) and involved in the 202…

Property Tax Expert, Trey Rome, About Texas' Economy and Housing Market

PR Newswire

DALLAS, Jan. 17, 2023

DALLAS, Jan. 17, 2023 /PRNewswire/ -- Trey Rome is president of the Texas Property Tax Lienholders Association (TPTLA) and involved in the 2023 Texas Legislative Session. Rome is founder and CEO of Home Tax Solutions, the largest property loan originator in Texas. Last year he won the "Outstanding Young Alumni Award" from Dallas' SMU Cox School of Business. Below are his opinions about Housing and the Texas Economy.

Texas' Economy

When you look at the past ten years in Texas, we have had a bull market fueled with record-low interest rates. Pandemic-era policies of debt forbearance, PPP loans, and dropping payments on mortgages, student loans, and rent allowed households to become flush with money, leading to record lows in delinquency rates, foreclosures, and bankruptcies. Credit scores improved; asset prices boomed. With all that spending, we are experiencing rapid inflation caused by billions of dollars printed and dumped into circulation. We are now paying the price with inflation (mostly impacting purchasing power of the low-income segment) and are on the quest to reduce record inflation sending prices soaring. The party is over, stimulus and relief programs have ended; now we are dealing with the financial hangover. The Fed shows no signals of slowing future interest rate hikes, the market shows signs that we may be on the precipice of a recession. Savings rates are on the way down and we are starting to see credit defaults from highly leveraged people/companies needing help to maintain the double whammy of increased interest rates and lower revenues/income. Credit card spending and debt are climbing, buying power continues to decrease (especially for low-income earners), and property tax bills substantially increased due to the upsurge in appraised market values (15%-20%) across Texas. In Dallas County, property taxes are up ~ 15% county-wide. Sadly, I believe more Texas property owners will appear on delinquent property tax rolls because of these economic indicators.

Texas' Housing Market

Housing prices and interest rates are high; mortgage rates are approaching 7%. This raises monthly payments which have priced out many buyers who would have easily qualified for the same house last year. It also has started to cool the country's historically hot housing market. However, a unique aspect of the Texas housing market is an enormous amount of people relocating to central Texas, which should keep demand high and supply somewhat tight.

Media Contact:

Francine Wittenberg Cashen

949.735.5641

cashencreative@att.net

View original content:https://www.prnewswire.com/news-releases/property-tax-expert-trey-rome-about-texas-economy-and-housing-market-301721936.html

SOURCE Home Tax Solutions

Uncategorized

Wall Street Bonuses Fall For Second Year To 2019 Lows Amid Capital Markets Freeze

Wall Street Bonuses Fall For Second Year To 2019 Lows Amid Capital Markets Freeze

Wall Street bonuses have declined for two consecutive years,…

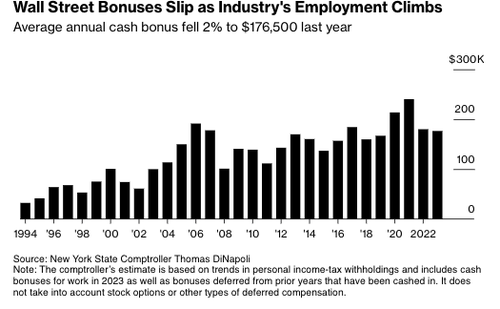

Wall Street bonuses have declined for two consecutive years, falling to levels last seen in 2019, according to the latest yearly figures released by New York State Comptroller Thomas P. DiNapoli. This trend is occurring amidst a multi-year downturn in capital markets due to the Federal Reserve's interest rate hiking cycle.

According to the report, the average Wall Street cash bonus fell 2% to $176,500 in 2023, the lowest level since 2019. The drop was far less than the 25% plunge in 2022. Last year's bonus pool was $33.8 billion, unchanged from the previous year but far less than the $42.7 billion during the stock market mania in 2021.

"Wall Street's average cash bonuses dipped slightly from last year, with continued market volatility and more people joining the securities workforce," DiNapoli said in a news release on Tuesday.

He continued: "While these bonuses affect income tax revenues for the state and city, both budgeted for larger declines so the impact on projected revenues should be limited."

"The securities industry's continued strength should not overshadow the broader economic picture in New York, where we need all sectors to enjoy full recovery from the pandemic," he added.

Despite the slump, the report said Wall Street's profits rose 1.8% last year, "but firms have taken a more cautious approach to compensation, and more employees have joined the securities industry, which accounts for the slight decline in the average bonus."

The report showed the industry employed 198,500 people in 2023, up from 191,600 the prior year. This expansion occurred during a period when US banks laid off 23,000 jobs.

Given that swaps traders and economists at Goldman Sachs Group are forecasting fewer Fed interest-rate cuts this year, a higher-for-longer rates environment will continue to discourage capital-market activity.

There's about a 50% chance of a June cut. Over the last several months, the Fed's interest-rate target implied by overnight index swaps and SOFR futures went from 700bps of cuts to currently 292bps of cuts for the full year.

Any delay in the easing cycle will only mean another year of depressed bonuses for Wall Street.

Uncategorized

Caitlin Clark, Coach Prime, and Linsanity: The Anatomy of a Viewership ‘Craze’

This is a trying time for sports on television as the industry fights the headwinds of cord-cutting and media fragmentation. Television networks and leagues…

This is a trying time for sports on television as the industry fights the headwinds of cord-cutting and media fragmentation. Television networks and leagues have taken measures that just a short time ago would have been considered extreme, desperate, or some combination of the two: an In-Season Tournament in the NBA; MLB in an Iowa cornfield; NASCAR inside the L.A. Coliseum. These efforts have been met with moderate success from a viewership standpoint, but they are not the type of needle-movers that drastically impact viewership in the aggregate. That type of shift requires a unicorn, and the last year has featured two: Caitlin Clark and Deion Sanders.

Clark has spent the past season breaking records on and off the court. Her Iowa Hawkeyes played in two of the four most watched college basketball games this season — regardless of gender. Both her record-breaking game against Ohio State and Big Ten Tournament championship win against Nebraska attracted over three million viewers. Only two men’s games, a Thanksgiving NFL lead-out between Michigan State and Arizona on FOX (5.18m), and a Duke-UNC game on ESPN (3.08m) also eclipsed the three million mark. Clark’s Big Ten Tournament semifinal against Michigan was the most watched women’s sporting event ever measured on Big Ten Network (1.08m). The championship game on CBS was the network’s most watched college basketball game of the year, men’s or women’s (pending results from this past weekend).

Of the six most watched women’s college basketball games this year, Clark played in five. Last year’s LSU-Iowa championship game delivered 9.9m viewers, the most ever for a women’s college game in the Nielsen people-meter era (dates back to 1988). The list could go on.

Deion Sanders — aka Coach Prime — transcended the sport of college football for a moment last fall. On his way to becoming Sports Illustrated Sportsperson of the Year, the Prime-fueled Colorado Buffaloes played in five of the fifteen most-watched regular season games of the year, more than any other school. Through the first five weeks of the season, Colorado played in either the first or second most-watched game of the week. Incredibly, that includes a Week 3 game against Colorado State that averaged 9.3 million viewers on ESPN, despite not kicking off until after 10 PM ET. That game drew four million more viewers than the second-most watched game that week, Georgia-South Carolina in the afternoon window on CBS. All of this for a team that won just one game the previous season.

Such viewership anomalies do not happen in a bubble; they are products of larger, media-driven forces. Think of last summer’s “Barbenheimer” craze for instance. Those two blockbuster films almost single-handedly lifted the box office from its pandemic-era depths. As many Hollywood analysts pointed out, the organic social media trend spurred from the strange juxtaposition of both movies being released on the same day led them to sell more tickets. Established media operations then picked up the story and fed into the trend. Social media isn’t always wagging the tail of traditional media, it can go both ways. The key to a true ‘craze’ however, is breaking through everywhere, no matter the media one consumes.

Maybe the most comparable sports craze in recent memory to the Clark-Sanders charged viewership of this past year is Linsanity. For a few weeks in 2012, New York Knicks guard Jeremy Lin broke out in a series of masterful performances that captured the imagination of the basketball world. Lin helped MSG Network improve its ratings by 82% through mid-February compared to the previous season — an absurd jump. However, Linsanity is perhaps also the most illustrative of another key factor in these viewership crazes: by definition, they are fleeting.

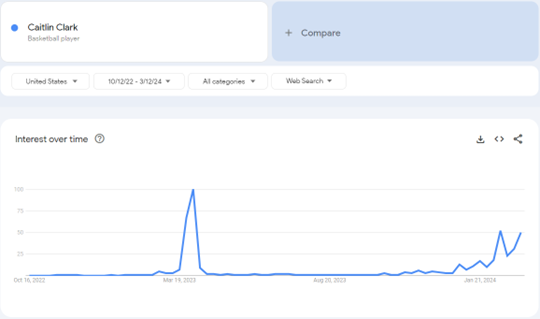

A look at Google search trends (below) puts these anomalies into perspective. Linsanity lasted about three weeks. Prime Time at Colorado was able to break through for about a month. Clark’s 2023 spike held for a few weeks in March, though her spike started much earlier this season, beginning to trend up in January. The lesson here, these massive viewership crazes are nice to have, can potentially raise the floor of a sport on the margins, but cannot be relied on for sustained viewership long term.

Caitlin Clark

Deion Sanders

Jeremy Lin

This isn’t to say these anomalies are without value. Networks have realized that facilitating these crazes help maintain healthy viewership in a difficult television environment. Thus, manufacturing these short-lived spikes could prove to be a key component of network’s strategies into the future. Last year for instance, FOX sent its Big Noon Kickoff show to a Colorado game four of the first five weeks of the season to help jump-start the Deion Sanders media blitz. ESPN’s College GameDay also setup shop in Boulder for the Week 3 game against Colorado State, the same week CBS’s 60 Minutes aired a Deion Sanders story.

As for Clark, ESPN recently announced that for the first time, it will embed a reporter (Holly Rowe) with Iowa for the team’s upcoming NCAA Tournament run. FOX gave Clark special treatment as well. When the network aired Caitlin Clark games this season, they would have her stat line permanently fixed on the scorebug. They livestreamed a “Caitlin Clark Cam” on TikTok. FOX even reportedly offered Clark an NIL package to incentivize her to play in college another year.

Of course, these crazes cannot solely be manufactured by the networks. There must be some truly organic interest in the subject for any of this to be possible. Between Clark and Sanders, there’s evidence to suggest that such crazes are becoming more frequent. Two in one year is notable when the last similar instance was Linsanity in 2012. This is partly due to the networks’ willingness to feed into these stories, though the growing desire in public life for shared experiences should not be discounted either.

Record-setting viewership has become commonplace for sporting events that have found ways to break into the monoculture. To be sure, some of that is because of Nielsen’s changes to out-of-home viewing measurements, though arguably the reason a property like the NFL has been so successful lately is because of its ubiquity in American life. Clark and Sanders have been able to simulate similar far-reaching appeal to generate viewership, albeit for shorter periods of time, and orders of magnitude smaller than the NFL.

A level of cultish personality, elite talent, or both seems prerequisite for a viewership craze to start. The level to which television networks will find ways to capitalize on these circumstances in the future remains to be seen. As traditional media fights for survival, with live sports as a main component, replicating Clark or Sanders-esque media booms may well become a substantial part of the formula. The next few years will be telling about how much influence traditional media still has in its agenda-setting role, and how far they’ll be willing to go to facilitate a media-induced frenzy.

The post Caitlin Clark, Coach Prime, and Linsanity: The Anatomy of a Viewership ‘Craze’ appeared first on Sports Media Watch.

fed pandemic treatmentUncategorized

100 sats would equal $1 if we repeat last cycle’s dollar demise

The inverse of the standard BTC/USD chart gives an interesting perspective on the rise in the purchasing power of Bitcoin over time. The USDT/BTC chart…

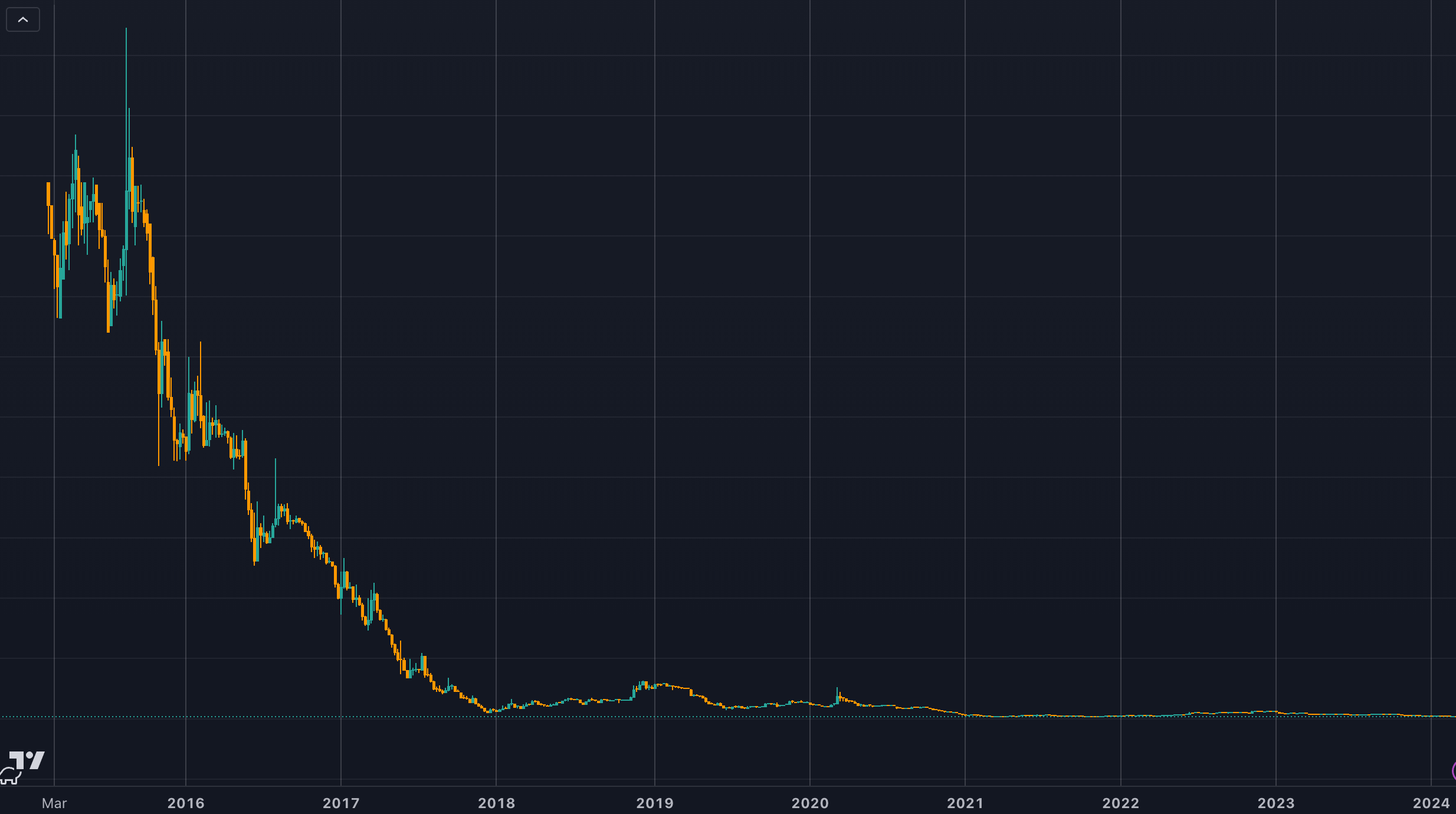

The inverse of the standard BTC/USD chart gives an interesting perspective on the rise in the purchasing power of Bitcoin over time. The USDT/BTC chart below highlights the dollar’s decline against Bitcoin since 2015. From its peak, the dollar has fallen 99.7% against Bitcoin.

When viewed in this form, it’s hard to be bearish on a 13% dip from a new all-time high.

When we look at the chart over a shorter timeframe in a log format, we can better analyze recent data. Since the COVID-19 crash of May 2020, the dollar has fallen 96% against Bitcoin. Currently, $1 equals around 1,580 satoshis (sats.) A further fall of just 36% would bring us to 1,000 per dollar.

Moreover, for 100 sats to equal $1, the dollar would only need to fall another 93.6%, less than the move last cycle. This would make 1 cent akin to 1 sat, bringing nominal parity between Bitcoin and the dollar in unit terms. The Bitcoin to USD increase would be approximately 1,500% to $1 million.

Finally, 10 sats per dollar would require a 99.4% decline, and 1 sat per dollar would total up to 100%. Bitcoin cannot be divided beyond 1 satoshi. Should Bitcoin ever be valued beyond $100 million per coin, we would run out of sufficient notation tools to delineate the exchange rate. However, that would give it a market cap of around $2 quadrillion, over 3 times the value of the world’s current wealth.

The post 100 sats would equal $1 if we repeat last cycle’s dollar demise appeared first on CryptoSlate.

bitcoin btc covid-19-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex