International

Prices are rising but that isn’t bad for all companies: inflation-busting investment ideas

Prices are going up. There are shortages of raw materials and labour and supply…

The post Prices are rising but that isn’t bad for all companies: inflation-busting investment ideas first appeared on Trading and Investment News.

Prices are going up. There are shortages of raw materials and labour and supply chain issues have also resulted in soaring shipping costs. It’s no secret that if demand remains and supply drops, things get more expensive and that’s exactly what is happening.

If companies have to pay out more in salaries, energy, transport, components and stock there are two possible outcomes. They either absorb those cost increases themselves and profits drop. Or they pass them on to their own customers. Sometimes one approach is taken and sometimes the other.

The consumer goods giant Unilever recently settled investor nerves over the impact of higher costs on margins by announcing they would be maintained this year by passing on rising and volatile raw material and packaging costs to customers.

Most often there is a compromise and companies absorb some of the impact of their costs increasing and pass some of it on to their customers. Usually more is passed forward to the customer as time goes on if costs remain inflated. That in turn, has two possible outcomes. Either the customers absorb the price rises or they buy less or not at all.

The British fast-fashion companies Boohoo and Asos have seen their share prices slide in recent months after warning higher costs would hit their margins. Their highly competitive sector obviously means that, up until a certain point, fast-fashion companies don’t feel they can pass higher costs onto customers and remain competitive.

For companies and their customers, inflation beyond a certain level is a challenge. And it’s one we don’t have much experience of dealing with because the last time inflation rose above 4% was in the early 1990s. That’s causing some confusion now with how to deal with the prospect of rising prices. As Fidelity International portfolio manager Leigh Himsworth states:

“The problem in the City is that people haven’t really seen inflation for a very long time”.

Source: MacroTrends

Other than a very short period at around 3.85% in 2011 when the recovery from the international crisis got a little heated, UK governments and Bank of England governors over the past few decades have had the opposite problem. They’ve tried to keep inflation at the kind of healthy level that is good for the economy when economic headwinds were keeping it pinned down.

Some inflation, the ideal level is generally seen at somewhere around 2% which tends to be the Bank of England’s target, is good. It encourages companies to invest in new products or services for a rising price environment. Almost as economically important as existing but modest inflation is its predictability. When price rises become volatile it is difficult for companies, or anyone else, to plan.

Most companies will feel the impact of rising inflation over the next period and there are conflicting views around how long this period will last. Until recently, a majority of economists believed rising inflation would be a short, sharp spike following the easing of pandemic restrictions – the result of the release of pent-up consumer demand colliding with pandemic-influenced supply chain issues.

There’s now a growing consensus that, while it remains unclear, higher rates of inflation may prove to be longer lasting than initially presumed. A leap in inflation could be a flash in the pan and brought under control quickly with the help of modest interest rate rises that seem likely across many developed economies over the coming weeks and months. Or we could be in for the kind of longer period of higher inflation we haven’t seen since the 1990s.

Investors may well be keen to consider hedging at least some of their portfolios against a longer period of higher inflation. When it comes to equities, that means hunting out the companies who are not only in a strong position to offset higher costs by raising prices without it hurting their competitiveness but could actually benefit from a period of higher inflation.

Here are a few ideas of public companies that look well-positioned for a period of higher inflation, should it transpire to hold over a longer period:

Investment platforms

The most obvious tool central banks have for controlling inflation when it starts to accelerate and become volatile is interest rates. Making borrowing more expensive means there is less money sloshing around in the system to cover higher costs, putting downwards pressure on prices.

Higher interest rates are also a bonus for companies that make money from lending cash. That includes investment platforms like the London-listed Hargreaves Lansdown and AJ Bell in a way that might not be immediately obvious but is influential to their bottom lines.

Lots of investors hold cash in their investment accounts as well as risk-based investments. When investments are sold the cash raised is often not immediately reinvested as investors wait for better market conditions or the right opportunities. Or cash is moved from a bank account and parked in an investment account so it is ready to be invested immediately when the account holder chooses.

Investment platforms like Hargreaves Lansdown, which had £138 billion in assets under management at the end of September, and AJ Bell, with £72.8 billion in assets under management, hold client cash on term deposits with banks. Those terms can range from overnight to longer-term and the cash held with the banks generates interest for the investment platforms.

Over the last year, rock bottom interest rates saw the amount of revenue Hargreaves Lansdown generates that way drop to £50.7 million, a 44% decline on the previous year. Put another way, interest generated on customer cash held on term deposits accounted for 17% of Hargreaves Lansdown’s profits the year before Covid and 8% after as a direct result of lower interest rates.

Interest rates rising to pre-Covid levels would see that income bounce back and any additional rates rises would further boost revenues generated in that way, making listed investment platforms a good option as inflation-hedging stock.

Banks

Banks of course make most of their money through the interest rate paid on lending. There are other factors such as an increase in bad loans that can take some of the shine off the benefits. But as a general rule, banks benefit from higher interest rates. Just watch how their share prices react whenever there is speculation around imminent interest rate rises.

The London Stock Exchange is home to a large number of major domestic and international banks likely to be winners if inflation levels provoke interest rate hikes, including Barclays, Lloyds Banking Group, Nat West and HSBC.

Supermarkets

Tesco chairman John Allan recently warned that spiralling freight, ingredient and wage costs could see food prices in the UK spiral by up to 5% in the lead up to Christmas this year. The UK’s supermarket sector is extremely competitive which means companies will be reluctant to pass higher costs onto consumers. That’s obviously bad for the financial performance of supermarkets but it’s unlikely that all the UK market’s players will be equally affected. As the supermarket with the largest market share in the UK, Tesco will be in the strongest position to negotiate with its suppliers to keep its cost increases under control.

If competitors are forced into fewer promotions to compensate for higher costs there will be more full-price groceries sales across the sector. For supermarkets able to keep their costs down more successfully than competitors, that will present an opportunity to increase margins.

Recruitment companies

A shortage of workers is hitting many sectors, not just trucking. White collar sectors are also experiencing tight labour markets and wage inflation. For recruiters who generate revenue through fees based on a percentage of the salary of the candidates they place, salary inflation is a boost. Both revenues and margins will benefit.

London-listed recruiter Hays is also seeing productivity increase with the net fees the company earns per consultant hitting record levels over the three months to the end of September. If similar levels of tightness remain in the labour market for months to come, Hays and other recruitment companies will happily continue make hay while the sun shines for them.

The post Prices are rising but that isn’t bad for all companies: inflation-busting investment ideas first appeared on Trading and Investment News. equities pandemic recovery interest rates ukInternational

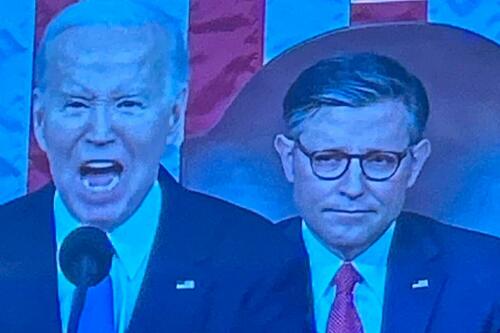

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexico-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International9 hours ago

International9 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex