Spread & Containment

Popular Paper On Ivermectin And COVID-19 Contains False Information

Popular Paper On Ivermectin And COVID-19 Contains False Information

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A popular…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A popular study that claims ivermectin has shown no effectiveness against all-cause mortality contains false information but remains uncorrected.

The meta-analysis, published in 2021 by the journal Clinical Infectious Diseases, explores how groups in randomized, controlled trials fared after receiving ivermectin compared to control groups.

Among five trials included for the portion on all-cause mortality, none showed an effect for ivermectin, the authors claimed.

Ivermectin “did not reduce all-cause mortality,” they wrote.

But the claim is wrong. One of the five trials was described as finding ivermectin recipients were more likely to die, but actually found that ivermectin recipients were less likely to die. “The risk base estimation ... confirmed that the average mortality obtained in all of ivermectin treated arms was 3.3%, while it was about 18.3% in standard care and placebo arms,” the authors of that paper said.

Dr. Adrian Hernandez, an associate professor at the University of Connecticut’s School of Pharmacy, and other authors of the meta-analysis are aware of the false information. The group released their study as a preprint before the journal published it. The first version included the false information. A corrected version properly portrayed the trial’s results for all-cause mortality in a figure summarizing the results, but still falsely said none of the trials showed a benefit against all-cause mortality.

Dr. Hernandez and Clinical Infectious Diseases did not respond to requests for comment.

The lingering false information is in a paper that has attracted numerous citations in other studies, in the press, and on social media. Altmetric, which tracks engagement, scores it at 5,900. A score of 20 or means a paper is doing “far better than most of its contemporaries,” according to the company.

Morimasa Yagisawa of Kitasato University and other researchers pointed out the issue in a March review of ivermectin trials, saying they were “concerned about the spread of misinformation and/or disinformation” about trial results.

“The articles on systematic reviews and meta-analyses are often erroneous or misleading. This is perhaps because the authors were not involved in the clinical trials or patient care and only searched for and analyzed articles and databases on clinical trial results,” they wrote. The problems are “particularly serious” in the paper for which Dr. Hernandez was the corresponding author, the researchers said.

“Although it was a clear error, the wrong content of the preprint was published as a major article in Clinical Infectious Diseases, the official journal of the Infectious Diseases Society of America, without being changed,” they wrote. “Many comments were made questioning the insight of the reviewers and the Editor-in-Chief for publishing a paper with such inconsistencies, but the paper is still published without correction. Since this is a prestigious journal of a prestigious society, an early corrective action is required.”

“There have been several fraudulent meta-analyses, and this is a striking one,” Dr. Pierre Kory, president and chief officer of the FLCCC Alliance and author of the book The War on Ivermectin, told The Epoch Times in an email.

“In this meta-analysis, they selected only 10 of the 81 controlled trials, 33 of which were randomized, on ivermectin that were available at the time. Eight of the ten they selected involved mild COVID-19. Typically, mild COVID does not lead to death. And here they were looking at death rates and, as expected, saw very few. The inclusion criteria they used were intended to show no effect. And they succeeded. Conflicted researchers have been doing this to hydroxychloroquine and ivermectin since the beginning of the pandemic,” he added.

Issues in other meta-analyses include the improper inclusion of papers that did not describe clinical trial results, Mr. Yagisawa and his co-authors said.

They noted that a number of trials have found ivermectin recipients were better off. That includes trials cited by the U.S. Food and Drug Administration (FDA) in its position that ivermectin is not effective against COVID-19.

The FDA recently settled a lawsuit over that position, agreeing to take down several web pages and social media posts.

Spread & Containment

Early cancer vaccine data breathe new life into the field, but many questions remain: #AACR24

SAN DIEGO — Scientists have long dreamed of creating vaccine-like treatments that could teach the immune system to target tumors. After decades of false…

SAN DIEGO — Scientists have long dreamed of creating vaccine-like treatments that could teach the immune system to target tumors. After decades of false starts, that idea is finally getting closer to reality.

A new generation of experimental cancer vaccines was on center stage at the American Association for Cancer Research conference this week in San Diego, ranging from “off-the-shelf” shots to highly customized injections matching the unique genetic makeup of a patient’s tumor.

“We are seeing a renaissance in the cancer vaccine space,” Peter DeMuth, chief scientific officer of Elicio Therapeutics, told Endpoints News. “We’ve known for a long time that getting T cells that specifically target the tumor is a good thing. And while there are many other things that can augment the T cell response, getting the T cell response in the first place is a natural thing for vaccines to do.”

Elicio was one of a dozen companies or academic groups sharing cancer vaccine program updates during the conference. The new data suggest that the vaccines could delay recurrence of conditions like pancreatic cancer or head and neck cancer in some patients.

And while the trials were too small to determine efficacy, for many researchers it was simply a relief to see that the vaccines often worked as expected. Buoyed by those early successes, a portion of the debate is now turning to how an off-the-shelf product will compare against a customized vaccine built around the unique mutations found in each patient’s tumor.

“There’s no ambiguity anymore that a vaccination approach can drive meaningful responses,” Niranjan Sardesai, the CEO of Geneos Therapeutics — which is developing DNA cancer vaccines — told Endpoints. “Where people are differing is what’s the optimal way to drive that immune response.”

Many routes to a personalized vaccine

Much of the renewed excitement around cancer vaccines is due to promising preliminary data from BioNTech and Moderna, competitors whose personalized injections are based on the same mRNA technologies that powered their Covid-19 shots. Their vaccines encode unique sets of neoantigens, tidbits of genetic code-bearing mutations found in the tumor but not healthy cells.

Niranjan Sardesai

Niranjan SardesaiBioNTech and its partner Genentech had previously reported that 8 out of 16 pancreatic cancer patients who got the vaccine developed T cells that targeted the neoantigens from the vaccine.

On Sunday, the companies provided a three-year update on the small trial, suggesting those neoantigen-targeting T cells were doing their job. Of eight patients who developed an immune response, tumors didn’t return in six, while two relapsed. (In the group that didn’t develop an immune response, all but one relapsed.)

The companies are currently testing the vaccine in a bigger Phase 2 study.

On Monday, Moderna also presented an update to a Phase 1 study testing its vaccine and Merck’s immunotherapy Keytruda in patients with advanced head and neck cancer. Six of 22 patients in one part of the study had complete or partial responses to the vaccine, and the disease was controlled in 14 patients at a median follow-up of 38 weeks.

Moderna has previously presented even stronger data in an early-stage study of advanced melanoma, which spurred CEO Stéphane Bancel to say that the company would double down on its cancer vaccine programs. Phase 3 studies in melanoma and lung cancer are already underway, and on Tuesday the biotech’s stock gained 6.2%.

While the mRNA approach has been in vogue since the pandemic, it’s not the only genetic technology for shuttling a personalized neoantigen vaccine into the body. The Pennsylvania startup Geneos (a spinout of Inovio Pharmaceuticals) is using DNA plasmids, and the longstanding French biotech Transgene is using a modified poxvirus vector.

Geneos said Sunday that 11 of 36 patients with advanced liver cancer responded to its vaccine, roughly double the historical rates for treatment with Keytruda. The vaccine also encodes instructions for making the cytokine IL-12, which promotes a killer T cell response that’s helpful for destroying tumors and was linked to better outcomes.

Sardesai told Endpoints that the company is currently raising a Series B financing and looking to enroll more than 100 patients in a larger study, he added.

On Tuesday, Transgene shared an update from a Phase 1 study of patients with head and neck cancer who had already undergone surgery, radiation and chemotherapy.

In a median of 16 months of follow-up, none of the 17 patients who got the custom vaccine soon after the standard treatment relapsed. All but one developed neoantigen-targeting T cells. In contrast, three of 16 patients in an observation group had vaccine relapsed, at which point they were offered the vaccine.

After years of interest, why now?

The prospect of cancer vaccines has tantalized researchers for decades, but promising ideas have largely flopped in larger clinical trials. Igniting the immune system to attack tumors, which come in nearly infinite forms, turned out to be much harder than making shots that protect against bacteria or viruses. Even when the match was lit, the results were lackluster. The sole FDA-approved cancer vaccine, a T cell-based therapy called Provenge developed by the biotech Dendreon, became a black sheep of the field for its questionable efficacy.

Better drug delivery, more precise targets, combinations with other immunotherapies, and a focus on using the vaccines at the right time during cancer treatment have all helped revive the field.

Modern technologies for delivering the vaccines, such as mRNA or new viral vectors, allow the neoantigens to be made inside the body, which may trigger a stronger immune response. Even Elicio’s vaccines, based on an older peptide approach, have a new twist with an added molecule that shuttles the peptides into lymph nodes — the heart of the immune system.

“The targets are also much better,” said Olivier Lantz, an immunologist at Institut Curie in Paris, who has worked on both off-the-shelf and personalized cancer vaccines. “But one of the issues in the personalized vaccine field is you have hundreds of mutations to choose from.”

BioNTech’s vaccine encodes up to 20 neoantigens, Transgene’s includes 30, and Moderna’s vaccine includes up to 34. Some drugmakers, like Elicio, are using a much smaller number of off-the-shelf approaches. Who is right is up for debate.

Vinod Balachandran

Vinod Balachandran“This remains an unanswered question,” Vinod Balachandran, a surgical oncologist who led the BioNTech study at Memorial Sloan Kettering Cancer Center, said during a press conference at the AACR meeting. While having “maximum coverage” makes sense, whether a smaller number could have similar effects “is not really known,” he said.

Combining the vaccines with immunotherapies that supercharge T cells is also increasingly common. Many of these drugs didn’t exist in the early days of the cancer vaccine field.

Historically, cancer vaccines were tested in patients with large, bulky tumors — a tall order for the immune system to tackle on its own. Many of the new products are being tested in patients who are heavily pretreated with surgery, radiation, and chemo. Others are targeting patients at the earliest stage of disease.

“You are dealing with smaller disease burden and less immunosuppressive mechanisms in the tumor,” DeMuth said, calling use after other treatments one of the most promising areas for the vaccines.

Off-the-shelf approach

While Moderna and BioNTech are designing custom vaccines, Elicio’s lead vaccine targets seven common neoantigens formed by KRAS mutations that are found in almost all pancreatic cancers and roughly a quarter of all cancers.

In January, the company published data showing that 21 of 25 pancreatic and colorectal cancer patients in its Phase 1 study developed T cell responses to the vaccine, and that stronger responses were linked to a lower risk of relapse.

On Monday, the company shared data suggesting that as T cells attack tumors with the KRAS mutations, they learn to recognize other neoantigens from a patient’s cancer, an effect known as antigen spreading.

“As the tumor dies it sheds other antigens, and T cells targeting those antigens can be brought into the response,” DeMuth said. “It’s sort of similar to what the neoantigen personalized space is trying to achieve with vaccines specific to a patient’s tumor. It will be interesting to see if an off-the-shelf vaccine can give you that response too.”

George Prendergast

George PrendergastAnother company presented its own twist of an off-the-shelf approach that stretches the definition of what a vaccine can be.

Syncromune, a small Florida-based biotech that’s raised $30 million, developed an experimental procedure that first freezes a tumor and then blasts it with a cocktail of four immunotherapies. Freezing a portion of the tumor causes it to spill its innards, triggering a patient’s T cells to target the tumors throughout the body.

“This lets the body sort it out, rather than having to figure it out,” George Prendergast, president and CEO of the Lankenau Institute for Medical Research and scientific advisor to Syncromune, told Endpoints.

Of the 13 patients who had received enough rounds of treatments to be evaluated, five had a complete response, six had a partial response, and two had stable disease. Two patients died after the study, the company said on Sunday.

vaccine treatment testing fda clinical trials genetic therapy dna pandemic covid-19Government

“Obviously, This Is Very Bad News For Biden”: Wall Street Reacts To Today’s Red Hot Inflation Print

"Obviously, This Is Very Bad News For Biden": Wall Street Reacts To Today’s Red Hot Inflation Print

Coming into today’s CPI number, which…

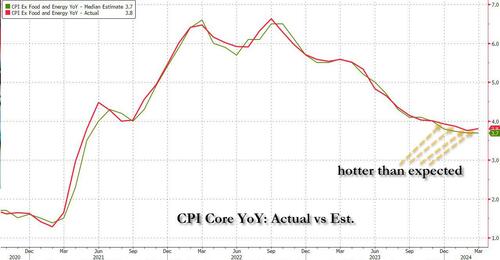

Coming into today's CPI number, which followed three previous red-hot inflation prints, we said that it's time for a "miss" (the first of 2024) not because the data demands it - on the contrary, prices continue to rise at a frightening pace - but because a dovish CPI print today would be the last opportunity for the Fed to set a timetable for a rate cut calendar ahead of November's election.

Well, you can wave goodbye to all that, because we just got the 4th consecutive "inflation beat" in a row...

... with supercore inflation coming in blazing hot...

... thanks to a boiling inflation print which saw every single CPI metric coming in hotter than expected - was a shock, not because it reflected reality, but because it effectively sealed Biden's fate because as Bloomberg's Chris Antsey writes, "obviously, this is very bad news for Joe Biden... we’re approaching the point where high inflation is bound to still be in voters’ minds when they head to the polls, regardless of how the price figures come in over summer."

With that in mind, here is a snapshot of kneejerk reactions by various other Wall Street economists and strategists to today's print courtesy of Bloomberg.

Morgan Stanley economist Ellen Zentner is the first sellside to warn her June rate-cut call is in jeopardy:

“The upside surprise in core CPI is moving the inflation data further away from the convincing evidence the Fed needs to start cutting in June. Dependent on the PPI data tomorrow, this print tilts the Fed toward a later start to the cutting cycle than our current forecast for June.”

Brian Coulton, chief economist at Fitch:

“The so-called ‘Super-core’ CPI measure – services excluding rents – jumped from 3.9% y/y in February to 4.8% in March. This latter metric is heading the wrong way and quite quickly at that.”

David Kelly, Chief Global Strategist at JPMorgan asset management:

“I wish the Federal Reserve would pay more attention to what they do to financial markets with their manipulation of interest rates and not worry too much about what they are doing to the economy. Last decade, we mispriced housing terribly and now a large chunk of younger Americans can’t buy a house.”

Anna Wong, Bloomberg economist:

“March is a month where the CPI enters a seasonal window that’s favorable for disinflation. The fact that core CPI remained the same in March as February — even if it maps to about 0.3% in core PCE inflation terms – is not a good development. This report, more than February’s, is likely to feed Fed concern that progress on disinflation is stalling — even though the core print for the two months was the same.”

Marvin Loh, State Street economist:

“While the rent component shows a strong disinflationary trend, the more important owner’s occupied component is stubbornly unchanged and well above what is needed to get towards a stable 2% level.”

Ira Jersey, Bloomberg rates strategist:

“The 3-month annualized core CPI climbing to 4.5% is going to keep early Fed-cut calls muted coming up. 50 bps of cuts in 2024 currently being priced may not occur until later in the year. The yield curve flattening isn’t surprising as we continue to price out early and deep cuts.”

* * *

“The timing of 2024 rate-cut expectations are front of mind for market participants, with linear markets pricing just below even odds of a first cut in July. Still, the stickiness of ‘supercore’ inflation, now north of 8% on a 3-month annualized basis, may continue to put upward pressure on expectations of the Fed’s terminal floor.”* * *

“A retest of 4.51% is nearly assured with the higher-than-expected CPI. If that doesn’t hold, 4.7% is the next stopping spot for the 10-year yield.”

Seema Shah, economist at Principal Asset Management:

"Today’s print sealed the fate for the June FOMC meeting with a hike now very unlikely. In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to heavily intrude with Fed decision making.”

Priya Misra, JPM rates strategist:

”This was a pivotal report for the market since the last 2 reports were a little high (0.4% mom) and the Fed viewed those readings as a ‘bump in the road’ rather than a change in the trend towards inflation moderation.Rates have risen in the last few weeks as cuts have been priced out but there is more room to go. I also think risk assets will be sensitive to rates if the 10y moves above 4.5%. So far risk assets could ignore the high inflation prints since the Fed was dismissing it. But I think that changes now... Most of the strength in the core explained by firmer motor vehicle insurance costs and medical care -- both of these do not feed into the core PCE deflator in the same way. So incoming Fedspeak will be very important”

Lindsay Rosner, head of multi-sector fixed income investing at Goldman Asset Management:

“To be clear, this number did not eclipse the Fed’s confidence; it did, however, cast a shadow on it. When it comes to spread risk, one hotter CPI print does not derail the bigger story which is the economy is strong, defaults remain benign, and the technicals continue to cast sunshine on spreads maintaining this range.”

Erik Norland, chief economist at the CME Group:

"Given the recent trend in fuel prices, there’s a risk that headline inflation readings on a year-on-year basis surpass 4%. The narrative up to now has been danger of sticky 3% but few are talking about a reacceleration to the 4s.

Florian Ielpo at Lombard Odier Asset Management:

“If the Fed remains committed to its ‘one cut in June’ stance, real interest rates could remain stable while inflation compensation may increase. This would be supportive for equities, as real financing conditions would not tighten further, and profit margins could benefit from higher-than-expected inflation.”

Torsten Slok of Apollo Global

“Easy financial conditions continue to provide a significant tailwind to growth and inflation. As a result, the Fed is not done fighting inflation and rates will stay higher for longer.”

It's about to get even worse: recall today we have a $39 billion 10-year auction which is already being dubbed “sloppy” and a definitive break of 4.5% could easily extend if underwriting dealers are left holding the bag. As it stands, the 10yr has popped above the 4.5% parapet. Ian Lyngen at BMO Capital Markets says:

“We expect the setup to the auction will break 4.50% in 10-year yields with ease.”

And George Goncalves, head of US macro strategy at MUFG, adds:

“Price action tells you two things - positioning wasn’t as concentrated or in line with the mini rally we had heading into the number over the last 24hrs and at same time very little in auction setup either.. . Bottomline if no dip buyers show up this morning, and we keep drifting, the risk is a 4.5% this afternoon.”

* * *

The bottom line, as Bloomberg's Sebatian Boyd writes is the following:

"today’s CPI print adds to the evidence that US monetary policy just isn’t as restrictive as the Federal Reserve thinks it is, and that interest rates will therefore need to stay higher for longer. There are lots of reasons that might be: The great resignation during the pandemic may well have heightened productivity in the US economy as people found new jobs where they’re a better fit. Higher government spending would also push up the neutral rate of interest. But every time we get a hot indicator, the case builds that it has happened and that conventional measures of neutral interest rates are too low. If that is the case, the upshot is higher yields and a flatter curve, because not only would the Fed be able to cut by less than expected in the short term, but yields will need to be higher in the long term too."

Finally, we conclude where we started, and echoing what we said in our CPI preview, namely that the BLS had Biden's fate in its hands, it appears the bureaucrats just voted for Trump. Here is BBG's Chris Antsey:

Obviously, this is very bad news for Joe Biden. It’s still only April, and we’ll have another half-a-year’s worth of inflation reports before the election. But we’re approaching the point where high inflation is bound to still be in voters’ minds when they head to the polls, regardless of how the price figures come in over summer.

To underscore how calamitous today's data is for Biden, here also is BBG's Enda Curran:

Let’s be clear -- today’s data has both economic and political implications. The economics are straight forward: It looks unlikely that the Fed will be cutting rates near term (barring a shock). The political implications are less clear but no less meaningful: Poll after poll has found that voters are grumpy on the economy and news that it could be a while yet before the inflation story is over won’t brighten their mood.

And with Biden's goose now thoroughly cooked, the next question is how long before somebody raises the possibility of a rate hike.

International

‘Bird Flu-Pocalypse’ Forces Hong Kong To Suspend Some Imports Of US Poultry Meat

‘Bird Flu-Pocalypse’ Forces Hong Kong To Suspend Some Imports Of US Poultry Meat

The recent spread of bird flu—also known as highly pathogenic…

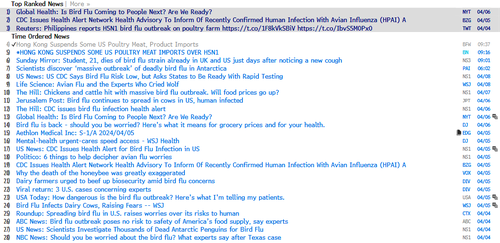

The recent spread of bird flu—also known as highly pathogenic avian influenza, or HPAI— across several US states has been hyped by corporate media. Some journalists are quoting 'experts' who warn the bird flu pandemic could be '100 times worse' than Covid.'

According to Bloomberg data, the story count in corporate media for all things "Bird Flu" last week hit a record high on data going back to 2014.

The context here is crucial. Bird flu is not just a US issue anymore; it's 'going global,' and this is happening just before the US presidential elections in November.

On Tuesday, Hong Kong's food safety authority published a memo stating, "Import of poultry meat and poultry products suspended in some areas of the United States."

Here's the full memo from the Center for Food Safety (CFS) of the Food and Environmental Hygiene Department:

The Center for Food Safety (CFS) of the Food and Environmental Hygiene Department announced today (April 9) that in response to a notification from the World Organization for Animal Health regarding an outbreak of highly pathogenic H5N1 avian influenza in Ionia County, Michigan, and Parmer County, Texas, USA, The CFS immediately instructed the trade to suspend the import of poultry meat and poultry products (including poultry eggs) from the above-mentioned areas to protect public health in Hong Kong.

A spokesman for the CFS said that according to the Census and Statistics Department, Hong Kong imported about 37,770 tonnes of chilled and frozen poultry meat and about 83.84 million poultry eggs from the United States last year.

The spokesman said: "The CFS has contacted the US authorities regarding the incident and will continue to closely monitor information on the outbreak of avian influenza from the World Organization for Animal Health and relevant authorities, and will take appropriate actions in light of the development of the local epidemic."

If it's bird flu or whatever "Disease X" could possibly be, there appears to be a push to "intersect" some type of 'Covid crisis' before the 2024 US elections.

"They will surely try to run their "Disease X" ruse. But they have already lost the trust of the people they made war against in their own country. In which case, expect resistance among the un-sick," James Howard Kunstler penned in a note earlier this month.

-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Government4 days ago

Government4 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment2 days ago

Spread & Containment2 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized5 days ago

Uncategorized5 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.