Spread & Containment

Organoids Stand Out as Stand Ins in Drug Development

Organoids may make the truest tissue models. But what makes the truest organoids? An answer to that question was suggested in a review article that appeared…

Organoids may make the truest tissue models. But what makes the truest organoids? An answer to that question was suggested in a review article that appeared 10 years ago,1 just a few years after organoids began incorporating induced pluripotent stem cells. Today, the review article’s main point is as apt as ever: “Organoids are derived from pluripotent stem cells or isolated organ progenitors that differentiate to form an organ-like tissue exhibiting multiple cell types that self-organize to form a structure not unlike the organ in vivo. … Because organoids can be grown from human stem cells and from patient-derived induced pluripotent stem cells, they have the potential to model human development and disease. Furthermore, they have potential for drug testing and even future organ replacement strategies.”

Organoids of this sort can mirror the genotype and phenotype of real tissues. Indeed, this capability has been demonstrated in the creation of organoids that mimic different tissues, such as tissues of the brain, gut, and lung. Also, there are immune organoids, or lymphoid tissue models. (Alternatively, the term “immune organoids” may refer to tissue models of any type that incorporate a functional immune system.)

Organoid development has been accelerating thanks to the introduction of commercial technologies. For example, there are extracellular matrix gels that, in the words supplied by the review, allow organoids to “self-organize through cell sorting out and stem cell lineage commitment in a spatially defined manner to recapitulate organization of different organ cell types.” Also, there are technologies that combine organoids with microfluidic systems, which can provide sophisticated microenvironments for recapitulating body organs.

Such technologies are enabling the modeling of rare diseases and tumors. Also, they are encouraging developers and regulators to position organoids as alternatives to animal models in drug testing. It should come as no surprise, then, that organoids represent a market with enormous growth potential. According to a market research study issued in 2023 by Insight Partners, the organoid market will register an annual growth rate of 22% in the coming years and reach a value of $12 billion by 2030.

Mini organs on scaffolds

“Organoids have become increasingly popular as tissue models since they can retain the genetic and phenotypic heterogeneity of the original tissue,” reports Hilary Sherman, senior applications scientist, Corning Life Sciences. “This concept has become invaluable for cancer research, where we know that individuals with similar cancers can respond very differently to drugs. Additionally, organoid models can be developed more quickly and cheaply than animal models.”

Sherman notes that organoids can model diseases that are a result of multiple or varied mutations. Indeed, organoids can model complex genetic diseases such as cancer. If organoids incorporate patient-specific mutations, individualized modeling is possible. Such modeling could be used to determine which drugs would be most suitable for individual patients.

Corning Life Sciences

Organoids can be assembled or allowed to self-assemble. In either case, they are typically cultured with specific growth factors and extracellular matrix proteins. This approach was pioneered in 2009, when researchers generated the first 3D organoid culture from adult stem cells.2 They used Corning Matrigel Matrix, a solubilized basement membrane preparation. Rich in extracellular matrix proteins such as laminin and collagen, Matrigel Matrix is used to produce hydrogels that support organ/tissue architectures. Sherman comments, “Corning Matrigel Matrix is considered the gold standard hydrogel for organoid applications.”

Corning also provides the Matribot bioprinter. It is designed to print with temperature-sensitive inks, such as inks containing Matrigel matrix or collagen. “Due to the bioprinter’s temperature-controlled print head, Matrigel Matrix/organoid ink solutions can easily be dispensed into microplates,” Sherman notes. “Often, organoid assays are conducted by dispensing small droplets of Matrigel Matrix/organoid solutions onto microplates.”

“I foresee the continued development of more complex organoid models that will continue to better recapitulate what is happening in vivo,” Sherman declares. “For me, a major accomplishment would be for organoids to completely replace animal testing.”

Multiple modalities

“[Organoids] have been harnessed for a multitude of purposes,” says Dan Rocca, PhD, research leader, Charles River Laboratories. “Brain organoids, for instance, have been used not only to understand early brain development in humans, but also to study how it may have been different in our Neanderthal cousins. Lung organoids have been used to test novel antivirals against SARS-CoV-2 during the pandemic. Tumor organoids, originating from a number of tissue-restricted primary cancers, have been used to help us to reveal how therapeutics impact tumor growth.”

Rocca observes that organoids “better mimic the complexity and heterogeneity of human tumors compared to cell lines isolated from tumor biopsies and support a personalized medicine approach.” Another advantage of organoids, Rocca points out, is that they can be used to help us reduce the number of animals used in drug development.

Charles River Laboratories

However, Rocca says one current challenge is that many organoids represent an early developmental state of an organ and can often form in an inside-out manner that doesn’t always reflect the mature tissue. “They lack vascularization and relevant microenvironments, plus their cross-talk with other organs is limited,” he points out. “These problems need to be carefully considered when interpreting findings from drug screens,

for example.”

Louise Brackenbury, PhD, science director, Charles River Laboratories, indicates that most of the company’s initial organoid focus is on “generating tissue-specific safety/toxicity models to better predict downstream clinical liabilities and de-risk discovery programs early, but they can also be used for mechanism-of-action studies and for efficacy testing.”

Charles River Laboratories

Brackenbury reports that gut organoids are the most developed organoid capability within the company: “They offer better predictivity following infection with enteroviruses and allow efficient and robust screening of antivirals.”

“Alongside this,” she continues, “our immune organoids have proven suitable for testing novel immunomodulators in B-cell recall responses, which we quantify by determining antibody production. Naïve responses to novel antigens, such as Ebola glycoprotein, are detectable in some donors, suggesting it may be a suitable platform in which to determine the immunogenicity of vaccine candidates in a fully ‘human’ system.”

Looking into future possibilities of the technology, Rocca projects, “A measure of great success of the technology would be to use organoids as therapeutic tools, instead of just models. The ability to expand scalable ‘organs’ in vitro and functionally transplant these into patients to ameliorate tissue defects would be a boon for regenerative medicine.”

Large-scale production

“The top three issues I see in organoid R&D today are scalability, reproducibility, and the ability to reflect genetic diversity,” states Shantanu Dhamija, PhD, vice president, strategy and innovation, Molecular Devices, an operating company of Danaher Corporation. He believes that solving these problems will require working in collaboration with others.

Molecular Devices

“Organoid research is a team sport where collaborations are key,” Dhamija stresses. “Under Danaher’s Beacon program, we identify leading innovators in the field to fund product-driven pioneering scientific research. The latest Beacon program with Cincinnati Children’s Hospital Medical Center focuses on preclinical drug safety issues and major causes of drug failure in clinical trials.”

In early February, the organizations launched a multiyear collaboration specifically aiming to improve liver organoid technology as a drug toxicity screening solution. The project will employ technology from Molecular Devices, such as the company’s new CellXpress.ai Automated Cell Culture System. Dhamija says this is “an artificial intelligence–enabled solution for the streamlined, reliable, and reproducible production of organoids at scale.”

Dhamija notes that more than 20% of all clinical trials fail due to liver toxicity. “Despite extensive and multifaceted safety testing for pharmaceuticals, drug-induced liver injury (DILI) remains a major challenge,” he continues. “It is not reliably predicted by current in vitro models, such as immortalized cell lines or primary cells. However, liver organoids represent more highly complex, multicellular, and physiologically relevant models capable of predicting individual patient reactions to therapeutics.”

Large-scale production has been a major challenge impeding the advance of organoids into this arena. “Due to their complexity, liver organoids have been harder to produce at scale with sufficient genetic diversity for accurate analyses,” Dhamija explains. “With our new systems, we can enable the creation of more diverse liver organoids at scale. This allows better patient stratification and higher reproducibility in clinical trials.”

Better together

Cellular models often can lack the complexity and sophistication necessary for accurate translation to human physiology and disease. Emulate places combinations of human organoids and/or other cell subsets on a chip to mirror organ responses more exactly. “The chips are agnostic to the cell,” says Lorna Ewart, PhD, the company’s CSO. Cell subsets can be organoids, cell lines, primary cells, or stem cells. “The benefit of an organoid,” she note, “is that it recapitulates epithelial biology.”

Emulate

Emulate’s chip system includes an upper and a lower channel separated by a porous membrane coated with a tissue-specific extracellular matrix. To create the intestinal chip, the company begins by establishing epithelial-like organoids from endoscopic biopsies of healthy adults. These are then dissociated and seeded into the chip’s top channel. Primary microvascular endothelial cells are added to the bottom channel.

“We include an endothelial cell because communication between the epithelium and endothelium is very important,” Ewart elaborates. “We also include a cyclic stretch to emulate in vivo peristaltic motions.” Two examples of the company’s Organ-Chips that employ organoids are the Colon Intestine-Chip and the Duodenum Intestine-Chip.

Ewart reports, “We have found that when tissue-specific microenvironments are recreated, biological processes related to intestinal maturation are enhanced.” Following growth and differentiation of the cells, the intestinal chip can be utilized for drug testing, studies of inflammation, studies of tumor invasion, and other applications.

The combination of organoids and organ chips can provide the best of both worlds. “The organoid cell cultures are more complex because they have the epithelial cells, and the cell communication avenues and microenvironments allow the cells to behave as if they were inside the human body,” Ewart says. “We are leveraging the strength of both technologies.”

Emulate is also engaged in a broader narrative of building a framework to help people understand the predictive value that Organ-Chip models can generate. “More published examples of Organ-Chip characterization are required to drive wider adoption in the pharmaceutical industry and to gain acceptance by regulatory bodies,” Ewart notes.

To that end, Ewart and Daniel Levner, PhD, Emulate’s CTO, co-authored a paper that detailed workflows for the practical use of the company’s Liver-Chip.3 In another paper, Ewart and colleagues discussed the Liver-Chip’s value in predictive toxicology.4 They argued that the platform would allow manufacturers to bring safer, more effective medicines to market in less time and at lower costs.

Ewart notes that the predictive toxicology paper ranks in the top 1% of research articles of a similar age in the field. “For a scientist, that is tremendous,” she declares. “It indicates that the information is well received, widely read, and frequently referenced!”

Ewart says that Emulate’s work is particularly relevant in light of the FDA Modernization Act 2.0. Passed in 2022, the act eliminates the requirement for mandatory animal testing before a drug can begin Phase I trials. Alternatives such as cell-based assays are now acceptable, paving the way for the use of organoids. Additionally, a further update, version 3.0, is currently being considered.

Future directions

Finally, it just may be true that the future of organoid R&D is out of this world! NASA’s Expedition 71 astronauts will be conducting organoid research aboard the International Space Station’s microgravity laboratory. Although organoids have been examined in space before, the organoids that will be part of Expedition 71 will be the first organoids in space to incorporate induced pluripotent stem cells from Alzheimer’s patients. Experiments with these organoids may provide insights into mechanisms of aging, potentially identify new targets involved in neurodegenerative diseases, and help accelerate drug discovery.

Summing up the potential of the field, Hans Clevers, MD, PhD, a pioneer in organoid research and head of Roche’s Pharma Research and Early Development (pRED) notes in a blog post5 that “One can implement human organoids at every step of the way—from target identification and target validation through preclinical safety and efficacy to stratification in clinical trials.” He foresees that organoid technology “might not only revolutionize the way we do research and develop medicines, but also [enable the discovery of] completely new molecules for devastating diseases.”

References

1. Lancaster MA, Knoblich JA. Organogenesis in a dish: Modeling development and disease using organoid technologies. Science 2014; 345(6194): 1247125.

2. Sato T, Vries RG, Snippert HJ, et al. Single Lgr5 stem cells build crypt-villus structures in vitro without a mesenchymal niche. Nature 2009; 459(7244): 262–265.

3. Levner D, Ewart L. Integrating Liver-Chip data into pharmaceutical decision-making processes. Expert Opin. Drug Discov. 2023; 18(12): 1313–1320.

4. Ewart L, Athanasia Apostolou A, Briggs SA, et al. Performance assessment and economic analysis of a human Liver-Chip for predictive toxicology. Commun. Med. 2022; 2(154): 1–16.

5. Roche launches the Institute of Human Biology to pioneer new approaches for drug discovery and development. Modeling the Future blog. Published May 4, 2023. Accessed March 1, 2024.

The post Organoids Stand Out as Stand Ins in Drug Development appeared first on GEN - Genetic Engineering and Biotechnology News.

vaccine treatment testing fda clinical trials preclinical genetic pandemic goldSpread & Containment

FDA Finally Takes Down Ivermectin Posts After Settlement

FDA Finally Takes Down Ivermectin Posts After Settlement

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Social media posts…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Social media posts urging people not to take ivermectin as a treatment for COVID-19 have been taken down by the U.S. Food and Drug Administration (FDA).

The FDA removed posts from X (formerly Twitter), Facebook, Instagram, and LinkedIn that stated: “You are not a horse. You are not a cow. Seriously y'all. Stop it.”

The posts had remained up even after the regulatory agency agreed to take them down as part of a settlement in a legal case brought by doctors who said the posts wrongly interfered with their practice of medicine.

The March 21 settlement said the FDA would take down specific posts within 21 days. The posts were made in August 2021.

The FDA has also deleted the following posts:

-

An Aug. 21, 2021, Instagram post that said: “You are not a horse. Stop it with the #ivermectin. It’s not authorized for treating #COVID.”

-

An April 26, 2022, Twitter post that said: “Hold your horses ya'll. Ivermectin may be trending, but it still isn’t authorized or approved to treat COVID-19.”

The posts directed people to an FDA webpage titled, “Why You Should Not Use Ivermectin to Treat or Prevent COVID-19.” The page itself acknowledged that the FDA has approved ivermectin for some uses but said “taking a drug for an unapproved use can be very dangerous” and “currently available data do not show ivermectin is effective against COVID-19.”

The agency pointed to a database of clinical trials testing ivermectin against COVID-19; some of the trials showed the drug works against the illness.

Doctors commonly prescribe FDA-approved drugs for a range of purposes, including some outside the scope of approval. The practice is known as off-label prescription.

The FDA’s ivermectin posts gained tremendous traction across social media and news outlets, prompting internal excitement, emails obtained by The Epoch Times showed. Millions of people saw the posts. “That was great! Even I saw it!” Dr. Janet Woodcock, the agency’s acting commissioner at the time, said in one missive.

The FDA has not alerted its followers on social media that it removed the posts.

2022, celebrated the development.

The case “sets an important legal precedent which should deter them from attempting this stunt again anytime soon,” she wrote on X. In another post, she said that “the terms we were asking for were met when we agreed to settle” and “we were not optimistic about what we would get in discovery.”

But while the posts and page have been removed, the FDA has created a new page about ivermectin and COVID-19.

Published on April 5, it states: “One of the U.S. Food and Drug Administration’s jobs is to carefully evaluate the scientific data on a drug to be sure that it is both safe and effective for a particular use. There continues to be interest in a drug called ivermectin for the prevention or treatment of COVID-19 in humans. The FDA has not authorized or approved ivermectin for use in preventing or treating COVID-19 in humans or animals.”

The page repeats the statement that “the FDA has determined that currently available clinical trial data do not demonstrate that ivermectin is effective against COVID 19 in humans,” but lacks the link to the database showing mixed results from trials.

The page also says that “health care professionals may choose to prescribe or use an approved human drug for an unapproved use when they judge that the unapproved use is medically appropriate for an individual patient.”

An FDA spokesperson previously told The Epoch Times that the settlement was not an admission of a violation of law or any other wrongdoing.

“FDA has not changed its position that currently available clinical trial data do not demonstrate that ivermectin is effective against COVID-19,“ the spokesperson said. ”The agency has not authorized or approved ivermectin for use in preventing or treating COVID-19.”

Spread & Containment

Here’s Why “America Is Broken” And People Are Worried

Here’s Why "America Is Broken" And People Are Worried

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open…

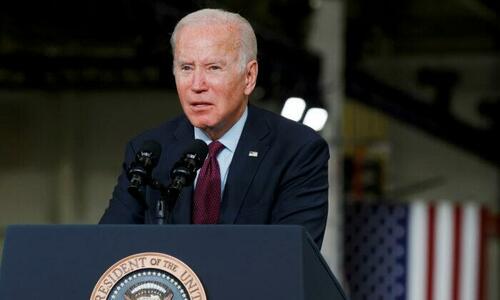

The NY Times on Monday published an opinion piece by UPenn senior lecturer and Open Society Project senior fellow (!) Damon Linker titled "Why Is Biden Struggling? Because America Is Broken."

And while it's more or less a recap of what ZeroHedge readers have known for years, the essay provides a sobering dose of reality for the "You should really watch Rachel Maddow" types.

Seven months away from a rematch election pitting President Biden against former President Donald Trump, the incumbent is struggling. Mr. Biden suffers from persistently low approval ratings, he barely manages to tie Mr. Trump in national head-to-head polls and he lags behind the former president in most of the swing states where the election will be decided (despite some recent modestly encouraging movement in his direction).

The question is why. -NY Times

Biden's defenders, and the administration itself, has chalked the president's unpopularity up to "a failure of communication," however Linker instead suggests "It's usually wiser to listen to what voters are saying" (beyond the obvious concerns about the president's age).

'Too Numerous to List'

Citing a January 2021 essay in Tablet titled "Everything Is Broken," and a follow-up essay by the same author, Alana Newhsouse, who wrote that "whole parts of American society were breaking down before our eyes," Linker encapsulates why Americans are so pissed (h/t Dean Baker):

The examples are almost too numerous to list: a disastrous war in Iraq; a ruinous financial crisis followed by a decade of anemic growth when most of the new wealth went to those who were already well off; a shambolic response to the deadliest pandemic in a century; a humiliating withdrawal from Afghanistan; rising prices and interest rates; skyrocketing levels of public and private debt; surging rates of homelessness and the spread of tent encampments in American cities; undocumented migrants streaming over the southern border; spiking rates of gun violence, mental illness, depression, addiction, suicide, chronic illness and obesity, coupled with a decline in life expectancy.

That’s an awful lot of failure over the past 20-odd years. Yet for the most part, the people who run our institutions have done very little to acknowledge or take responsibility for any of it, let alone undertake reforms that aim to fix what’s broken. -NYT

Linker then writes that the above is why "angry anti-establishment populism has become so prominent in our politics over the past decade," which both Donald Trump and Bernie Sanders have capitalized on.

And Biden, a career politician, has been part of the problem (and therefore implicated in these abject societal failures), and is "badly out of step with the national mood, speaking a language very far removed from the talk of a broken country that suffuses Mr. Trump’s meandering and often unhinged remarks on the subject." (gotta get that shot in!)

That leaves Mr. Biden as the lone institutionalist defender of the status quo surrounded by a small army of brokenists looking for support from an electorate primed to respond to their more downcast message.

Linker suggests that in order to recover, Biden 'stop being so upbeat' - about the economy in particular, and stop making the election about how awful Trump is. Biden "should admit Washington has gotten a lot of things wrong over the past two decades and sound unhappy about and humbled by it."

Further, Biden "could make the argument that all governments make mistakes because they are run by fallible human beings — but also point out that elected representatives in a democracy should be up front about error and resolve to learn from mistakes so that they avoid them in the future."

"Just acknowledging how much in America is broken could generate a lot of good will from otherwise skeptical and dismissive voters," Linker suggests.

Let's see how that goes.

Spread & Containment

The 5 most startling retailer bankruptcies since 2020

The pandemic sent waves through the economy, and since its onset, many businesses have filed for Chapter 11 bankruptcy. These are five of the most surprising…

When a business files Chapter 11 bankruptcy, that doesn’t mean it has declared itself kaput — far from it.

Filing Chapter 11 is like sending out a SOS signal: It allows the business to keep operating while attempting to restructure operations and pay down its debts (unlike a Chapter 7 bankruptcy filing, which closes the company and liquidates its assets). The recovery rate of a business filing Chapter 11 is said to be anywhere between 10% and 40%.

But no two Chapter 11 bankruptcies are alike. You might be surprised to hear that some of the world’s largest companies — such as American Airlines, Marvel Entertainment, and General Motors — have filed Chapter 11 at one point, but through mergers, new revenue streams, or simply by operating smarter, all managed to crawl back to profitability.

Other big names weren’t as fortunate: Funeral rites were observed for Lehman Brothers and WorldCom, for example, because they had been operating fraudulently — even though some argued, in the case of Lehman, that they were “too big to fail.”

Related: Boeing's turbulent descent: The company’s scandals & mishaps explained

How many businesses have filed Chapter 11 since the COVID-19 pandemic?

The COVID-19 pandemic, caused by the SARS-CoV-2 virus, not only made millions of people very sick; it also had a profound impact on the way we live, work, and shop. At the onset of 2020's stay-at-home-orders, hundreds of restaurants shuttered, including household names like Ruby Tuesday, California Pizza Kitchen, and Sizzler.

According to U.S. Federal Courts, business Chapter 11 filings spiked in 2020 while Chapter 7 filings actually decreased. But as vaccines were developed and people returned to work and school, they also resumed their former shopping habits — in fact, mall traffic in 2023 was down only 5.8% compared to 2019, which is much better than it was in 2021, when it was off 15%.

Yet more turbulence was felt in the years following the pandemic, as government stimulus from the CARES Act, which had helped many businesses make payroll and meet other operating expenses, expired in 2021.

Bankruptcy filings by chapter 2019–2023

| Year | Chapter 7 | Chapter 11 |

|---|---|---|

2023 | 261,277 | 7,456 |

2022 | 225,455 | 4,918 |

2021 | 288,327 | 4,836 |

2019 | 480,201 | 7,020 |

Through such choppy waters, we examine a few of the biggest-name retailers that went belly up — and which ones have risen from the ashes under new management.

5 big-name Chapter 11 bankruptcies in retail

FREDERIC J. BROWN/AFP via Getty Images

Rite Aid

It was the country’s third-largest drugstore chain — only Walgreens and CVS were bigger — but thanks to sluggish sales, mounting debt, and federal investigations into whether it illegally filled prescriptions during the opioid crisis, Rite Aid filed Chapter 11 in October 2023.

Earlier in the year, the chain had reported a $241 million quarterly loss due in part to a reduction in revenue from COVID-19 vaccines and rapid tests. Rite Aid simply couldn’t keep up with the convenience of shopping at the pharmacies at big-box stores like Walmart, Target, and Costco.

As part of its Chapter 11 agreement, the company secured $3.5 billion in financing and appointed a new chief executive, Jeff Stein, to lead its corporate reorganization. Rite Aid also planned to close 200 stores in 2024 but not before transferring customer prescriptions to nearby pharmacies. In addition, it gave its 45,000 employees the option to transfer to other stores “when possible.”

Related: How much does Walgreens pay? Entry-level positions, benefits & more

Bed Bath & Beyond

Many people thought Bed Bath & Beyond’s days were numbered when it filed Chapter 11 in April 2023 — after all, it closed all 376 stores across the U.S., and its stock was terminated from the over-the-counter trading market. This came after reporting a quarterly loss of $393 million and on the heels of several years of declining sales, competition from online home goods retailers like Wayfair, and a snarled COVID-19-related supply chain.

Plus, who could forget BBBY’s meme stock trading frenzy in January 2021, when Reddit contributors drove up prices 99%, only to come crashing back down? When the dust settled, Overstock bought the business for a blue-light special of $21.5 million in June 2023, then took its name and merged businesses.

Bed, Bath & Beyond now sells kitchen, bath, and furniture completely online and has added more than 600,000 new products to its inventory.

J. Crew

The first big retailer to capsize during the pandemic, J. Crew filed Chapter 11 in May 2020. But it wasn’t only the fact that retail sales in general withered at the start of COVID-19 — the Commerce Department reported a 50% decline in sales in March 2020 alone — J. Crew had also been saddled with $1.7 billion (that’s with a b) in long-term debt, which weighed heavily on its balance sheet even while its operations were profitable.

The upscale lifestyle apparel seller received a $400 million line of credit from hedge fund Anchorage Capital Management, which became majority owner and, combined with additional loans from Davidson Kempner Capital Management LP and Bank of America, managed to convert its debt into equity, exiting bankruptcy proceedings that August.

But J. Crew is not out of the woods. Ever since creative director Jenna Lyons left in 2017, it has yet to come out with a line of clothing consumers want to pay full price for, and Standard & Poor’s downgrade of parent company Chinos Intermediate 2 LLC from “stable” to “negative” in the third quarter of 2023 raised alarm bells.

However, the preppy chain posted a 9% sales increase for its fiscal year ending February 1, 2024, due in part to holiday sales, which slashed apparel prices by as much as 75%. Paradoxically, J. Crew just might now be one of the best stores to shop at for discounts.

Related: A pre-IPO History of Reddit: From “front page of the internet” to billion-dollar valuation

Justin Sullivan/Getty Images

JCPenney

You’d think a company that survived two World Wars and made a cameo in "Back to the Future" could stand the test of time — and it just well might. Founded in 1902 by James Cash Penney as a dry goods store in Kemmerer, Wyoming, the chain expanded throughout the American West before introducing clothing to its lineup in the 1960s.

Wisely venturing into the pharmacy business, launching a mail order catalog, and offering customers the option to make their purchases through credit paid off in spades, Penney’s peaked in the 1970s with more than 2,000 stores worldwide. But after decades of declining sales, accumulating a boatload of debt during the 2007-2008 financial crisis, and losing customers in droves to Target and Walmart (a familiar refrain), the COVID-19-related closure of Penney’s 800 remaining stores in early 2020 seemed like the final nail in the aging retailer's coffin.

JCPenney filed Chapter 11 that May, only to emerge, phoenix-like, eight months later. The brand permanently closed 200 stores, restructured its $4 billion debt, and took on two new owners — they just happened to be the country’s largest shopping mall owners, Simon Properties and Brookfield Asset Management, thus ensconcing Penney’s place as a retail “anchor.”

In 2021, Mark Rosen, formerly of Levi Strauss & Co., became CEO, and in 2023, he announced $1 billion worth of upgrades to the JCPenney website and app, as well as renovations of its brick-and-mortar stores. Here’s the cincher: Doing so wouldn’t require taking on any more debt. “We’re in a really strong financial position right now,” Rosen said.

AaronP/Bauer-Griffin/GC Images

Guitar Center

It’s hard to believe this mecca for rock n’ roll musicians was originally called Organ Center and sold church organs and small appliances. That all changed in 1964, shortly after The Beatles came to America, when one of owner Wayne Mitchell's vendors told him that he needed to buy Vox amplifiers in order to continue purchasing organs.

Mitchell figured that if he was selling amps, why not stock a few guitars, too? They quickly sold out; Mitchell changed his store’s name, and the rest was history. Riding the hair metal craze of the 1980s that glorified guitar virtuosos like Eddie Van Halen, Guitar Center expanded into 30 locations by the 1990s. It also diversified its portfolio with acquisitions of Musician’s Friend, a mail-order musical instrument company; Music & Arts, which provided in-store music lessons; and in the early 2000s, partnered with Activision, the video gaming giant, on its smash hit “Guitar Hero.”

But the good times and rock & roll didn’t last forever. Over the next decade, Guitar Center underwent a series of leveraged buyouts from private equity firms, each time saddling it with more debt. It tried cutting costs by stocking fewer name brands and laying off staff — many of whom had decades of experience that justified their salaries.

Customers noticed the changes and simply stopped coming, shopping online instead. But right before the pandemic, Guitar Center staged a comeback, posting 10 straight months of sales growth, but while new audiences were found for guitars and online lessons during the COVID-19 lockdown, Guitar Center faced the double whammy of seeing $1 billion in debt come due and the closure of its brick-and-mortar stores.

It entered Chapter 11 in November 2020, although its management team already had a strategy in place. It invested $165 million in the company while eliminating most of its debt. Guitar Center also issued $375 million in senior secured bonds and exited Chapter 11 that December.

Related: Is shrinkflation a big deal? Definition, examples & impact on headline inflation

bankruptcy bankruptcies pandemic covid-19 stimulus bonds lockdown recovery stimulus-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment13 hours ago

Spread & Containment13 hours agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Government3 days ago

Government3 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized4 days ago

Uncategorized4 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.