East Hanover, NJ – June 4, 2021 – Modest rises in the economic indicators for people with and without disabilities may be signs of continued economic recovery, according to today’s National Trends in Disability Employment – Monthly Update (nTIDE), issued by Kessler Foundation and the University of New Hampshire’s Institute on Disability (UNH-IOD). As the impact of the pandemic subsides in the U.S. and economic activity increases, improvements in these indicators are likely to continue.

nTIDE COVID Update (month-to-month comparison)

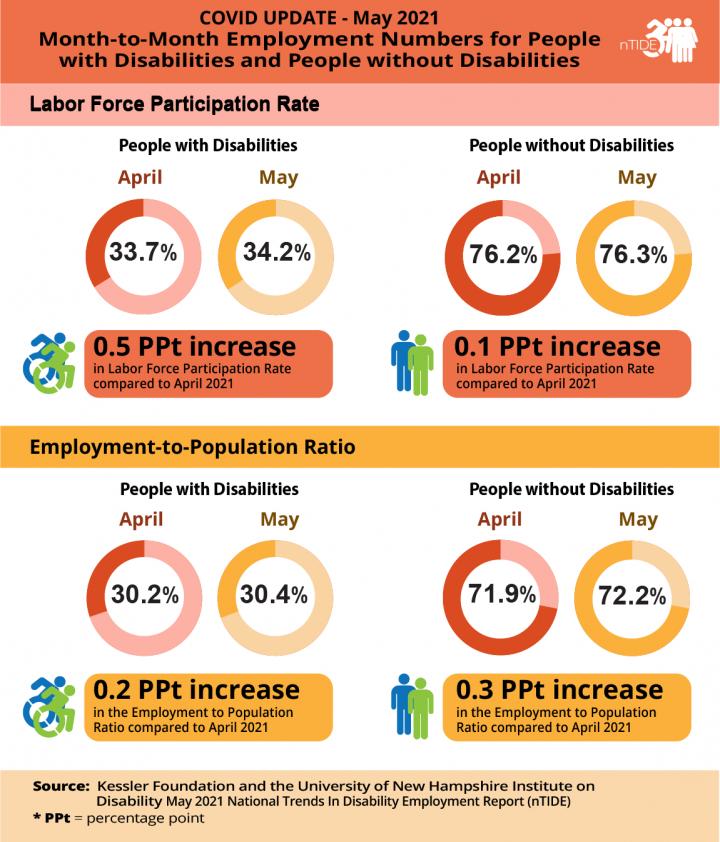

In the Bureau of Labor Statistics (BLS) Jobs Report released Friday, the employment-to-population ratio for working-age people with disabilities increased from 30.2 percent in April to 30.4 percent in May 2021 (up 0.7 percent or 0.2 percentage points). For working-age people without disabilities, the employment-to-population ratio also increased from 71.9 percent in April to 72.2 percent in May 2021 (up 0.4 percent or 0.3 percentage points). The employment-to-population ratio, a key indicator, reflects the percentage of people who are working relative to the total population (the number of people working divided by the number of people in the total population multiplied by 100).

“The modest gains in the employment-to-population ratios over the last three months seem to be signaling a trend back to pre-COVID employment levels for people with and without disabilities,” said John O’Neill, PhD, director of the Center for Employment and Disability Research at Kessler Foundation. “These improvements may be due to more Americans being immunized and feeling safer to return to the workplace,” he added.

The labor force participation rate for working-age people with disabilities increased from 33.7 percent in April to 34.2 percent in May 2021 (up 1.5 percent or 0.5 percentage points). For working-age people without disabilities, the labor force participation rate increased slightly, from 76.2 percent in April to 76.3 percent in May 2021 (up 0.1 percent or 0.1 percentage points). The labor force participation rate is the percentage of the population that is working, not working and on temporary layoff, or not working and actively looking for work.

“It’s interesting to see such little change in the labor force participation of people with disabilities, said economist Andrew Houtenville, PhD, research director of the University of New Hampshire’s Institute on Disability. “This shows the resilience of people with disabilities, who have stayed engaged in the labor market and strived to work throughout the pandemic. This is definitely a bright spot in the economy.”

Year-to-Year nTIDE Numbers (comparison to the same time last year)

The employment-to-population ratio for working-age people with disabilities increased from 27.7 percent in May 2020 to 30.4 percent in May 2021 (up 9.7 percent or 2.7 percentage points). For working-age people without disabilities, the employment-to-population ratio also increased from 65.2 percent in May 2020 to 72.2 percent in May 2021 (up 10.7 percent or 7.0 percentage points).

The labor force participation rate for working-age people with disabilities stayed the same at 34.2 percent. For working-age people without disabilities, the labor force participation rate increased from 74.8 percent in May 2020 to 76.3 percent in May 2021 (up 2 percent or 1.5 percentage points).

In May 2021, among workers ages 16-64, the 4,677,000 workers with disabilities represented 3.3 percent of the total 141,848,000 workers in the U.S.

###

Note: Next nTIDE webinar is Friday, July 2.

No webinar on Friday, June 18 at 12:00 pm Eastern

Due to Juneteenth holiday, no webinar is scheduled for this mid-month update only. However, a news release will be issued comparing the unemployment numbers for people with and without disabilities.

Ask Questions about Disability and Employment

Each nTIDE release is followed by a webinar at noon ET. This live broadcast, hosted via Zoom Webinar, offers attendees Q&A on the latest nTIDE findings, provides news and updates from the field, as well as invited panelists to discuss current disability-related findings and events. On Friday, June 4, at 12:00 pm Eastern, Kathleen West-Evans from the Council of State Administrators of Vocational Rehabilitation (CSAVR) joins Drs. Houtenville and O’Neill, and Denise Rozell, Policy Strategist at AUCD. Join live or watch the recordings at: ResearchonDisability.org/nTIDE.

NOTE: The statistics in the nTIDE are based on Bureau of Labor Statistics numbers but are not identical. They are customized by UNH to combine the statistics for men and women of working age (16 to 64). nTIDE is funded, in part, by grants from the National Institute on Disability, Independent Living and Rehabilitation Research (NIDILRR) (90RT5037) and Kessler Foundation.

About Kessler Foundation

Kessler Foundation, a major nonprofit organization in the field of disability, is a global leader in rehabilitation research that seeks to improve cognition, mobility, and long-term outcomes — including employment — for people with neurological disabilities caused by diseases and injuries of the brain and spinal cord. Kessler Foundation leads the nation in funding innovative programs that expand opportunities for employment for people with disabilities. For more information, visit KesslerFoundation.org.

About the Institute on Disability at the University of New Hampshire

The Institute on Disability (IOD) at the University of New Hampshire (UNH) was established in 1987 to provide a coherent university-based focus for the improvement of knowledge, policies, and practices related to the lives of persons with disabilities and their families. For information on the NIDILRR-funded Employment Policy and Measurement Rehabilitation Research and Training Center, visit ResearchonDisability.org.

For more information, or to interview an expert, contact:

Carolann Murphy, 973.324.8382, CMurphy@KesslerFoundation.org.