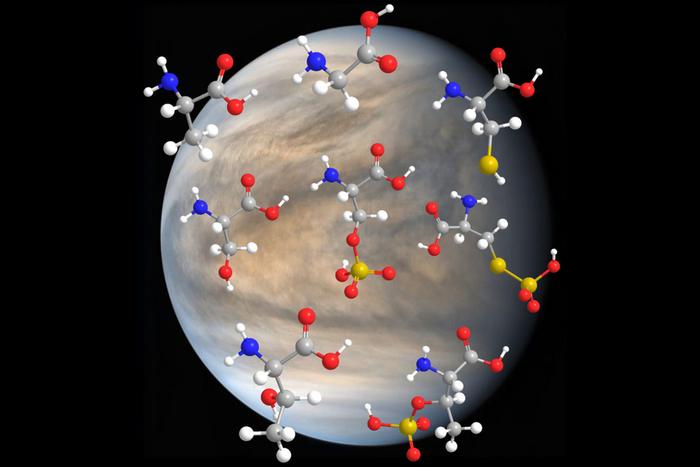

If there is life in the solar system beyond Earth, it might be found in the clouds of Venus. In contrast to the planet’s blisteringly inhospitable surface, Venus’ cloud layer, which extends from 30 to 40 miles above the surface, hosts milder temperatures that could support some extreme forms of life.

If it’s out there, scientists have assumed that any Venusian cloud inhabitant would look very different from life forms on Earth. That’s because the clouds themselves are made from highly toxic droplets of sulfuric acid — an intensely corrosive chemical that is known to dissolve metals and destroy most biological molecules on Earth.

But a new study by MIT researchers may challenge that assumption. Appearing today in the journal Astrobiology, the study reports that, in fact, some key building blocks of life can persist in solutions of concentrated sulfuric acid.

The study’s authors have found that 19 amino acids that are essential to life on Earth are stable for up to four weeks when placed in vials of sulfuric acid at concentrations similar to those in Venus’ clouds. In particular, they found that the molecular “backbone” of all 19 amino acids remained intact in sulfuric acid solutions ranging in concentration from 81 to 98 percent.

“What is absolutely surprising is that concentrated sulfuric acid is not a solvent that is universally hostile to organic chemistry,” says study co-author Janusz Petkowski, a research affiliate in MIT’s Department of Earth, Atmospheric and Planetary Sciences (EAPS).

“We are finding that building blocks of life on Earth are stable in sulfuric acid, and this is very intriguing for the idea of the possibility of life on Venus,” adds study author Sara Seager, MIT’s Class of 1941 Professor of Planetary Sciences in EAPS and a professor in the departments of Physics and of Aeronautics and Astronautics. “It doesn’t mean that life there will be the same as here. In fact, we know it can’t be. But this work advances the notion that Venus’ clouds could support complex chemicals needed for life.”

The study’s co-authors include first author Maxwell Seager, an undergraduate in the Department of Chemistry at Worcester Polytechnic Institute and Seager’s son, and William Bains, a research affiliate at MIT and a scientist at Cardiff University.

Building blocks in acid

The search for life in Venus’ clouds has gained momentum in recent years, spurred in part by a controversial detection of phosphine — a molecule that is considered to be one signature of life — in the planet’s atmosphere. While that detection remains under debate, the news has reinvigorated an old question: Could Earth’s sister planet actually host life?

In search of an answer, scientists are planning several missions to Venus, including the first largely privately funded mission to the planet, backed by California-based launch company Rocket Lab. That mission, on which Seager is the science principal investigator, aims to send a spacecraft through the planet’s clouds to analyze their chemistry for signs of organic molecules.

Ahead of the mission’s January 2025 launch, Seager and her colleagues have been testing various molecules in concentrated sulfuric acid to see what fragments of life on Earth might also be stable in Venus’ clouds, which are estimated to be orders of magnitude more acidic than the most acidic places on Earth.

“People have this perception that concentrated sulfuric acid is an extremely aggressive solvent that will chop everything to pieces,” Petkowski says. “But we are finding this is not necessarily true.”

In fact, the team has previously shown that complex organic molecules such as some fatty acids and nucleic acids remain surprisingly stable in sulfuric acid. The scientists are careful to emphasize, as they do in their current paper, that “complex organic chemistry is of course not life, but there is no life without it.”

In other words, if certain molecules can persist in sulfuric acid, then perhaps the highly acidic clouds of Venus are habitable, if not necessarily inhabited.

In their new study, the team turned their focus on amino acids — molecules that combine to make essential proteins, each with their own specific function. Every living thing on Earth requires amino acids to make proteins that in turn carry out life-sustaining functions, from breaking down food to generating energy, building muscle, and repairing tissue.

“If you consider the four major building blocks of life as nucleic acid bases, amino acids, fatty acids, and carbohydrates, we have demonstrated that some fatty acids can form micelles and vesicles in sulfuric acid, and the nucleic acid bases are stable in sulfuric acid. Carbohydrates have been shown to be highly reactive in sulfuric acid,” Maxwell

Seager explains. “That only left us with amino acids as the last major building block to

study.”

A stable backbone

The scientists began their studies of sulfuric acid during the pandemic, carrying out their experiments in a home laboratory. Since that time, Seager and her son continued work on chemistry in concentrated sulfuric acid. In early 2023, they ordered powder samples of 20 “biogenic” amino acids — those amino acids that are essential to all life on Earth. They dissolved each type of amino acid in vials of sulfuric acid mixed with water, at concentrations of 81 and 98 percent, which represent the range that exists in Venus’ clouds.

The team then let the vials incubate for a day before transporting them to MIT’s Department of Chemistry Instrumentation Facility (DCIF), a shared, 24/7 laboratory that offers a number of automated and manual instruments for MIT scientists to use. For their part, Seager and her team used the lab’s nuclear magnetic resonance (NMR) spectrometer to analyze the structure of amino acids in sulfuric acid.

After analyzing each vial several times over four weeks, the scientists found, to their surprise, that the basic molecular structure, or “backbone” in 19 of the 20 amino acids remained stable and unchanged, even in highly acidic conditions.

“Just showing that this backbone is stable in sulfuric acid doesn’t mean there is life on Venus,” notes Maxwell Seager. “But if we had shown that this backbone was compromised, then there would be no chance of life as we know it.”

The team acknowledges that Venus’ cloud chemistry is likely messier than the study’s “test tube” conditions. For instance, scientists have measured various trace gases, in addition to sulfuric acid, in the planet’s clouds. As such, the team plans to incorporate certain trace gases in future experiments.

“There are only a few groups in the world now that are working on chemistry in sulfuric acid, and they will all agree that no one has intuition,” adds Sara Seager. “I think we are just more happy than anything that this latest result adds one more ‘yes’ for the possibility of life on Venus.”

###

Written by Jennifer Chu, MIT News

Paper: “Stability of 20 Biogenic Amino Acids in Concentrated Sulfuric Acid: Implications for the Habitability of Venus’ Clouds”

https://www.liebertpub.com/doi/10.1089/ast.2023.0082

Journal

Astrobiology

DOI

10.1089/ast.2023.0082

Article Title

“Stability of 20 Biogenic Amino Acids in Concentrated Sulfuric Acid: Implications for the Habitability of Venus’ Clouds”