Uncategorized

Neuroscience legend Steve Paul retires; Exclusive: GSK hires ex-Innate Pharma CEO for new position

If you’re in neuroscience, you’ve probably heard of him.

Few people have dipped a hand in as many neuroscience biotechs and government research units…

If you’re in neuroscience, you’ve probably heard of him.

Few people have dipped a hand in as many neuroscience biotechs and government research units as Steve Paul, and he’s going out (nearly) on top.

The decadeslong CNS drug discovery and development veteran retired from his post as chief scientific officer and president of R&D at Karuna Therapeutics on Jan. 16, just weeks after inking a $14 billion exit to Bristol Myers Squibb.

Paul will remain on the board at Karuna, a biotech on the verge of becoming the first to market a new type of schizophrenia drug after decades of trying to innovate new approaches to treating the condition. The FDA will decide on Karuna’s candidate, dubbed KarXT, by the end of September. He had also been chair, president and CEO of the biotech from 2018 to 2022.

The Washington University School of Medicine professor originally made his mark during 18 years on the government research side as scientific director of the National Institute of Mental Health before transitioning to industry.

He spent 17 years at Eli Lilly, starting in the early 1990s, and eventually headed up Lilly Research Laboratories as president. Paul would go on to co-found other neuroscience biotechs like Sage Therapeutics and Voyager Therapeutics, where he was also an early CEO.

“His experience and creativity in the field is rare,” ARCH Venture Partners co-founder and managing director Bob Nelsen said of Paul in 2018.

Paul’s legacy will continue to be felt at other biotechs like Rapport Therapeutics, a Janssen neuromedicine spinout that he chairs. He’s also chair of the Foundation for the National Institutes of Health.

With a wave of new startups emerging in neuropsychiatric disorders and neurodegenerative diseases, will any entice Paul enough to quickly emerge from retirement (again)?

— Kyle LaHucik

Mondher Mahjoubi

Mondher Mahjoubi→ GSK is expanding its C-suite with a new position, a spokesperson tells Endpoints News. The pharma giant has selected former Innate Pharma CEO Mondher Mahjoubi as chief patient officer, a role that “will support greater patient and healthcare provider insights, and ensure that these, and patient needs in particular, more strongly inform the development and delivery of our medicines and vaccines,” the spokesperson added.

GSK also made some leadership changes last September to accommodate the split of its research operations into three groups: vaccines and infectious diseases, respiratory and immunology, and oncology. Phil Dormitzer, Kaivan Khavandi and Hesham Abdullah lead the respective teams, while GSK’s former head of research John Lepore left to take the CEO job at Flagship’s ProFound Therapeutics.

Not long after Mahjoubi announced his resignation at Innate Pharma, the FDA lifted the partial clinical hold on an IND for the French biotech’s cancer drug lacutamab.

David Berry

David Berry→ Valo Health CEO David Berry will exit on Feb. 2, and the Flagship company has lined up CFO and chief people officer Graeme Bell as his interim replacement. Ex-Aprea Therapeutics chief Christian Schade has been named executive chairman at Valo Health, which formed a partnership in the cardiometabolic space with Novo Nordisk last September. Bell is the former finance chief at Tmunity and Intellia Therapeutics who spent five of his 22 years with Merck as country CFO, US human health. Valo’s proposed merger with a Khosla Ventures SPAC in 2021 was unsuccessful.

Doug Manion

Doug Manion→ Last year at this time, ex-Arena Pharmaceuticals R&D chief Doug Manion was elevated to CEO at Aclaris Therapeutics. But the Pennsylvania biotech recently ran into trouble when its lead anti-inflammatory drug zunsemetinib flopped in Phase II — investors fled, while layoffs affected nearly half of Aclaris’ employees. Zunsemetinib will stay in the picture as a cancer treatment, but Manion isn’t. With a strategic review in the works, co-founder and chairman Neal Walker is back in the saddle as interim chief. Walker ran Aclaris for a decade before handing the reins to Manion, who joined Aclaris in the summer of 2022 as president and COO.

Michael Martin

Michael Martin→ Michael Martin has succeeded Astellas vet Percival Barretto-Ko as president and CEO of protein degradation player Plexium. Martin spent 12 years at Takeda, where he was global head of the Center for External Innovation. He’s also been president of the Japanese pharma’s VC arm, Takeda Ventures. Chaired by Mike Grey, Plexium’s molecular glues piqued the interest of Amgen and AbbVie in two separate deals.

Andrei Floroiu

Andrei Floroiu→ Andrei Floroiu is out after more than three and a half years as CEO of Vaxart. Chairman Michael Finney has stepped in as interim chief for the South San Francisco vaccine maker, which walked away from its Covid-19 work and dismissed 27% of its staff last year. Instead, Vaxart is focusing on its norovirus program that hit all but one of its primary endpoints in a Phase II challenge study. Wouter Latour had a nine-year run as CEO before Floroiu replaced him in 2020.

→ Michael Dudley retired as CEO of TransCode Therapeutics on Jan. 13, passing the baton to CFO Tom Fitzgerald on an interim basis. Additionally, chief technology officer Zdravka Medarova has been promoted to CSO at TransCode, which is developing RNA therapies for cancer. In a Jan. 4 open letter co-signed by Dudley and executive chairman Philippe Calais, TransCode outlined its plans to restructure, trimming its workforce “from 19 employees at the end of 2022 to 11 at the end of 2023.” The company’s goal is to submit an IND application for its lead asset TTX-MC138 sometime in the first quarter.

Sean McLoughlin

Sean McLoughlin→ Longtime GSK vet Sean McLoughlin has taken over for Aditya Kohli as COO of Takeda spinout HilleVax. Kohli has shifted to the role of business chief. To close out more than two decades at GSK, McLoughlin was the global commercial leader for Arexvy, which has sprinted to such a commanding lead in the RSV race with Pfizer that GSK commercial chief Luke Miels recently said it owns more than 70% of the market share. Earlier, McLoughlin held such roles as US marketing lead for Shingrix and new product strategy lead with the vaccines business unit.

→ According to an SEC filing, Danforth Advisors managing director Stephen DiPalma has stepped in as interim CFO of Foghorn Therapeutics. DiPalma also pinch-hit at Spero Therapeutics until Esther Rajavelu became CFO and CBO in November. Allan Reine stepped down on Jan. 16 and had been Foghorn’s finance chief since 2019.

Annalisa D’Andrea

Annalisa D’Andrea→ Longwood-backed Immunitas Therapeutics has picked up Annalisa D’Andrea as CSO. Since her days at Roche as global head of discovery for immunology and inflammation, D’Andrea handled CSO responsibilities at Kiniksa Pharmaceuticals and was president and CSO of ImmuneID. She’s also a venture partner at Longwood and a board member at Engimmune Therapeutics.

→ Mark Winderlich will replace Katia Schlienger as Hookipa Pharma’s permanent chief development officer on April 1, and until that time, interim medical chief and ex-MorphoSys R&D chief Malte Peters will be a senior clinical advisor. Peters will continue to serve on the board of directors when Winderlich, a MorphoSys vet in his own right, officially takes over. For the past year, Winderlich was in charge of Evotec’s oncology tie-up with Bristol Myers as head of scientific operations, molecular glue discovery & development.

Julie Jordan

Julie Jordan→ Neurogene, the CNS biotech that took Neoleukin’s spot on the Nasdaq when the two companies merged, has recruited Julie Jordan as CMO. Jordan was elevated to the same position at Homology Medicines in January 2023, but she was let go the following July — along with 87% of the staff — when Homology turned out the lights on all their clinical development operations. Homology would combine with Q32 Bio in another reverse merger. Jordan is the former senior director of global clinical development at Cerevel, which AbbVie bought for $8.7 billion in December.

Tatiana Novobrantseva

Tatiana Novobrantseva→ I/O biotech NextPoint Therapeutics has brought in Verseau Therapeutics co-founder Tatiana Novobrantseva as CSO. The ex-scientist at Biogen and Alnylam spent the last year and a half with Moderna as CSO, immuno-oncology research. Dana-Farber and Eli Lilly alum Leena Gandhi took the CMO job at NextPoint last February, and Endpoints News scooped you about its $80 million raise a month earlier.

Joanne Quan

Joanne Quan→ Livmarli maker Mirum Pharmaceuticals has recruited Joanne Quan as CMO and promoted Peter Radovich to president and COO. Peer Review checked in with Quan in August 2022 when she became CMO at Nuvig Therapeutics, and she was succeeded by Alan Glicklich a few months ago. Quan is also the former medical chief at Eiger BioPharmaceuticals and Modis Therapeutics who led clinical development at Arena Pharmaceuticals from 2012-14. Radovich was named COO at Mirum in 2020 and was EVP of operations for Global Blood Therapeutics. The FDA gave the go-ahead to Livmarli in 2021 for cholestatic pruritus in children with Alagille syndrome.

Christopher Bostrom

Christopher Bostrom→ Paratek Pharmaceuticals has promoted Christopher Bostrom to CFO and Jonathan Light to general counsel, corporate secretary and chief compliance officer. Bostrom joined Paratek from Biogen in March 2016 as director, financial planning & analysis, and had been VP of finance since 2020. Light held the role of senior director, executive counsel at Teva before pivoting to Paratek in 2017, starting out as assistant general counsel and vaulting to deputy general counsel in September 2022. Gurnet Point Capital and Novo Holdings teamed up to buy Paratek for $462 million last summer.

→ Joseph Frattaroli is taking a bow as he heads into retirement from his role as CFO of Inhibikase Therapeutics. Frattaroli has served as finance chief since April 2018 and is now handing the reins over to VP for finance Garth Lees-Rolfe — who was formerly finance VP at F-star. Frattaroli founded Flagship Consulting in 2010 and previously was an independent consultant to Danforth Advisors.

Whitney Jones

Whitney Jones→ Whitney Jones has jumped to Vaxcyte as chief people officer after more than three years with the same title at Sangamo Therapeutics. Jones is the former global head of human resources for Novartis Diagnostics, and outside of the biopharma industry, she’s also worked for Gap and Coca-Cola. Vaxcyte pulled off the positive-data-to-public-offering maneuver in impressive fashion last spring with a $500 million raise as it tries to challenge Pfizer’s Prevnar 20 with its pneumococcal vaccine VAX-24.

→ Adial Pharmaceuticals has elected one of its board members, Tony Goodman, as COO. Goodman has served on Adial’s board since 2017 and will remain a member. Earlier in his career, Goodman held a variety of posts at Indivior, culminating in his role as chief business development officer. Goodman is also the founder and managing director of The Keswick Group.

Ana Sousa

Ana Sousa→ San Diego’s Aspen Neuroscience has promoted Ana Sousa to chief regulatory officer. In April 2021, Sousa came to Aspen as SVP of regulatory, quality and product strategy after leading the global regulatory affairs team at Principia Biopharma. Aspen is developing a cell therapy for Parkinson’s called ANPD001, while Bayer’s BlueRock is slightly further ahead with bemdaneprocel.

→ Protein degradation specialist Arvinas has tapped Jared Freedberg as general counsel. We last saw Freedberg in January 2021 when he became general counsel at Intercept Pharmaceuticals, the company that couldn’t punch it into the end zone with NASH and was sold to Alfasigma last fall. Arvinas now has enough cash to last “until 2027” after a $350 million private placement in late November.

Mary Beth DeLena

Mary Beth DeLena→ Getting back on track after the FDA lifted a clinical hold last October, Boston biotech PepGen has now brought on Mary Beth DeLena as general counsel and secretary. DeLena hails from Alnylam, where she was SVP, deputy general counsel and assistant secretary. Before that, she was with Praecis Pharmaceuticals.

Terry-Ann Burrell

Terry-Ann Burrell→ Third Rock’s Rapport Therapeutics has elected Beam Therapeutics CFO Terry-Ann Burrell to the board of directors. Rapport has gained steam as an IPO candidate after its $150 million Series B last August, the neuroscience biotech’s second such megaround in a five-month period.

→ VectorY, the Amsterdam-based neuro biotech that nabbed a $138 million Series A in November, has welcomed Khurem Farooq to the board of directors. Farooq and Anthony Adamis launched Aiolos Bio three months ago, then sold the company to GSK for up to $1.4 billion.

→ Former Acceleron CEO Habib Dable and Gilead oncology clinical development exec Bill Grossman have joined the board of directors at Day One Biopharmaceuticals. Dable is a board member at Blueprint Medicines, Aerovate Therapeutics and PepGen, while Grossman had board seats at Pionyr Immunotherapeutics and Tizona Therapeutics.

nasdaq covid-19 vaccine treatment fda therapy rnaUncategorized

Shipping company files surprise Chapter 7 bankruptcy, liquidation

While demand for trucking has increased, so have costs and competition, which have forced a number of players to close.

The U.S. economy is built on trucks.

As a nation we have relatively limited train assets, and while in recent years planes have played an expanded role in moving goods, trucks still represent the backbone of how everything — food, gasoline, commodities, and pretty much anything else — moves around the country.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

"Trucks moved 61.1% of the tonnage and 64.9% of the value of these shipments. The average shipment by truck was 63 miles compared to an average of 640 miles by rail," according to the U.S. Bureau of Transportation Statistics 2023 numbers.

But running a trucking company has been tricky because the largest players have economies of scale that smaller operators don't. That puts any trucking company that's not a massive player very sensitive to increases in gas prices or drops in freight rates.

And that in turn has led a number of trucking companies, including Yellow Freight, the third-largest less-than-truckload operator; J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics, to close while freight brokerage Convoy shut down in October.

Aside from Convoy, none of these brands are household names. but with the demand for trucking increasing, every company that goes out of business puts more pressure on those that remain, which contributes to increased prices.

Image source: Shutterstock

Another freight company closes and plans to liquidate

Not every bankruptcy filing explains why a company has gone out of business. In the trucking industry, multiple recent Chapter 7 bankruptcies have been tied to lawsuits that pushed otherwise successful companies into insolvency.

In the case of TBL Logistics, a Virginia-based national freight company, its Feb. 29 bankruptcy filing in U.S. Bankruptcy Court for the Western District of Virginia appears to be death by too much debt.

"In its filing, TBL Logistics listed its assets and liabilities as between $1 million and $10 million. The company stated that it has up to 49 creditors and maintains that no funds will be available for unsecured creditors once it pays administrative fees," Freightwaves reported.

The company's owners, Christopher and Melinda Bradner, did not respond to the website's request for comment.

Before it closed, TBL Logistics specialized in refrigerated and oversized loads. The company described its business on its website.

"TBL Logistics is a non-asset-based third-party logistics freight broker company providing reliable and efficient transportation solutions, management, and storage for businesses of all sizes. With our extensive network of carriers and industry expertise, we streamline the shipping process, ensuring your goods reach their destination safely and on time."

The world has a truck-driver shortage

The covid pandemic forced companies to consider their supply chain in ways they never had to before. Increased demand showed the weakness in the trucking industry and drew attention to how difficult life for truck drivers can be.

That was an issue HBO's John Oliver highlighted on his "Last Week Tonight" show in October 2022. In the episode, the host suggested that the U.S. would basically start to starve if the trucking industry shut down for three days.

"Sorry, three days, every produce department in America would go from a fully stocked market to an all-you-can-eat raccoon buffet," he said. "So it’s no wonder trucking’s a huge industry, with more than 3.5 million people in America working as drivers, from port truckers who bring goods off ships to railyards and warehouses, to long-haul truckers who move them across the country, to 'last-mile' drivers, who take care of local delivery."

The show highlighted how many truck drivers face low pay, difficult working conditions and, in many cases, crushing debt.

"Hundreds of thousands of people become truck drivers every year. But hundreds of thousands also quit. Job turnover for truckers averages over 100%, and at some companies it’s as high as 300%, meaning they’re hiring three people for a single job over the course of a year. And when a field this important has a level of job satisfaction that low, it sure seems like there’s a huge problem," Oliver shared.

The truck-driver shortage is not just a U.S. problem; it's a global issue, according to IRU.org.

"IRU’s 2023 driver shortage report has found that over three million truck driver jobs are unfilled, or 7% of total positions, in 36 countries studied," the global transportation trade association reported.

"With the huge gap between young and old drivers growing, it will get much worse over the next five years without significant action."

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic stocks commoditiesUncategorized

Wendy’s has a new deal for daylight savings time haters

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

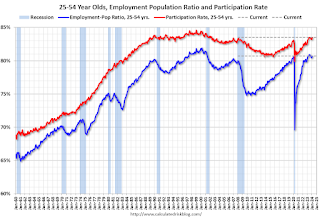

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 hours ago

International3 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex