New York, NY—January 18, 2023—Researchers at Columbia Engineering and Columbia University Irving Medical Center have invented a new RNA sequencing method that achieves high-quality results from small volumes of frozen tumor specimens. They demonstrated the success of their technique in two clinical studies that profiled dozens of tumor samples, both those archived and those freshly collected, to understand how they respond to anti-tumor therapy. The paper was published January 9, 2023, by Nature Genetics.

Using RNA sequencing to measure gene expression at the resolution of single cells has been one of the most transformative tools for studying cancer tissues over the past decade. By examining the RNA of individual cells, researchers can better understand the diversity of cells within a tumor, as well as how these tumor cells grow and interact with immune cells. These are important factors for understanding the hallmarks of cancer progression and the resistance of cancer to therapy–both key to the development of new cancer treatments.

Major challenge

A major barrier to the widespread adoption of single-cell RNA sequencing in traditional clinical workflows has been the volume of fresh tissue required–substantially more than what is routinely collected for clinical purposes. And the need for fresh tissue means that samples must be immediately analyzed once collected. These requirements have significantly limited the scientific analyses that can be done on patient samples.

Successful new technique

Focused on overcoming these barriers, the Columbia team created a new sequencing method that delivered top results from a small amount of frozen tumor specimens. Usually collected during clinical trials and stored in biobanks, these specimens may include tissues from rare cancers and patients with unique histories or risk factors. The new technique’s ability to sequence these types of specimens greatly increases the number and variety of tumor samples available for scientific analysis.

“We are very excited about this work and its potential,” said Elham Azizi, assistant professor of biomedical engineering and Herbert and Florence Irving Assistant Professor of Cancer Data Research at the Irving Institute for Cancer Dynamics, who co-supervised this study with Benjamin Izar, assistant professor of medicine at the Herbert Irving Comprehensive Cancer Center.

“The ability to work from frozen samples opens the door to multi-institutional collaborations that will propel the discovery of biomarkers and drug targets. It also gives us the opportunity to apply cutting-edge computational techniques in the analysis and integration of the unlocked clinical data,” Azizi explained.

Izar added “And because our method requires only a minute amount of tissue, the remainder of the sample may be used for additional studies. This really is a win-win for researchers, clinicians, and, most importantly, our patients.”

Study’s results broaden understanding of cancer progression

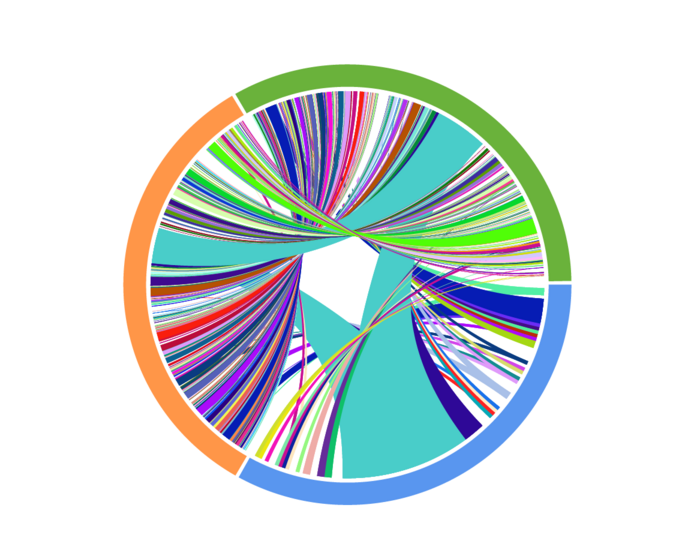

The new study led by Yiping Wang, Joy Fan, and Johannes Melms, trainees in the Izar and Azizi Labs, generated results from single-cell RNA sequencing, single-cell T-cell receptor sequencing, whole genome sequencing, and spatial RNA-sequencing (an innovative RNA-sequencing method that preserves the tumor architecture in situ)–all performed on the same samples. With the ability to bridge multiple modalities of cancer data, the researchers provided a comprehensive view of the genetic alterations, cellular functions, immune cell dynamics, and spatial localization of cells in the context of the patient tissue. These improvements significantly broadened their understanding of cancer progression and resistance mechanisms.

Next steps

The team is now applying their novel experimental and computational techniques to analyze larger clinical cohorts. The data enables them to better study disease progression and examine the impact of therapies in clinical trials in melanoma as well as other cancer types.

ECHIDNA, a new computational tool

In parallel, the researchers are also developing an innovative computational tool for systematic integrative analysis of whole genome data and single-cell RNA sequencing, named ECHIDNA. They expect this machine learning algorithm to be key in understanding the relationship between genetic alterations (genotype) and cellular function (phenotype) in tumor cells and will apply it to a larger cohort of melanoma patients in order to characterize diverse mechanisms of treatment resistance. Future work will also include building new computational methods for integrating these data within the spatial context of the histology slice in order to characterize the spatial dynamics of tumor-immune cell interactions.

Izar noted, “In addition to understanding cancer tissue, our method also enables studying tissue response and tissue immunology in other diseases. In the past, we used an earlier version of the method presented here to study the tissue response to lethal COVID-19 infection across multiple organs. This demonstrates an example of developments originating in cancer research that can propel life science research at large.”

###

About the Study

JOURNAL: Nature Genetics

STUDY: “Multi-modal single-cell and whole-genome sequencing of small, frozen clinical specimens.”

AUTHORS: Yiping Wang1,2*, Joy Linyue Fan3*, Johannes C. Melms1,4*, Amit Dipak Amin1,4, Yohanna Georgis5, Irving Barrera6, Patricia Ho1,4, Somnath Tagore1,7, Gabriel Abril-Rodríguez8, Siyu He3, Yinuo Jin3, Jana Biermann1,2, Matan Hofree6, Lindsay Caprio1,4, Simon Berhe4, Shaheer A. Khan1,5, Brian S. Henick1,5, Antoni Ribas8,9, Evan Z. Macosko6,10, Fei Chen6,11, Alison M. Taylor5,12, Gary K. Schwartz1,5, Richard D. Carvajal1,5, Elham Azizi3,5,13,#, Benjamin Izar1,2,4,5,7#

1Department of Medicine, Division of Hematology/Oncology, Vagelos College of Physicians and Surgeons, Columbia University Irving Medical Center

2Department of Systems Biology, Program for Mathematical Genomics, Columbia University

3Department of Biomedical Engineering, Columbia University

4Columbia Center for Translational Immunology, Columbia University Irving Medical Center

5Vagelos College of Physicians and Surgeons, Herbert Irving Comprehensive Cancer Center, Columbia University

6Broad Institute of Harvard and MIT

7Department of Systems Biology, Columbia University Irving Medical Center

8Department of Medicine, Jonsson Comprehensive Cancer Center, University of California, Los Angeles (UCLA)

9Parker Institute for Cancer Immunotherapy, San Francisco

10Department of Psychiatry, Massachusetts General Hospital

11Department of Stem Cell and Regenerative Biology, Harvard University

12Department of Pathology and Cell Biology, Columbia University Irving Medical Center, New York, NY, USA

13Irving Institute for Cancer Dynamics, Columbia University, New York, NY, USA.

FUNDING: Y.W. is supported by National Institutes of Health (NIH), National Institute of Allergy and Infectious Disease training grant (no. T32AI148099). B.I. is supported by the NIH, National Cancer Institute (NCI) (grant nos. K08CA222663, R37CA258829, R01CA266446, and U54CA225088), a Burroughs Wellcome Fund Career Award for Medical Scientists, a Velocity Fellows Award, the Louis V. Gerstner, Jr. Scholars Program and a Young Investigator Award by the Melanoma Research Alliance. R.D.C., E.A., and B.I. are supported by an NCI grant (no. R21CA263381) and a Columbia University Research Initiatives in Science & Engineering Award. E.A. was supported by an NCI grant (no. R00CA230195) and NSF grant (no. CBET-2144542). J.L.F. acknowledges support from the Columbia University Van C. Mow fellowship. G.A.-R. and A.R. are supported by the Parker Institute for Cancer Immunotherapy and an NIH grant (no. P01CA168585). A.M.T. is supported by the NCI (grant no. 5K22CA237733-03). This work was supported by an NIH/NCI Cancer Center Support grant (no. P30CA013696), the Molecular Pathology Shared Resource and its Tissue Bank at Columbia University, and the Flow-cytometry Core Facility supported by a grant (no. S10OD020056).

COI: B.I. has received consulting fees from Volastra Therapeutics Inc, Merck, AstraZeneca, and Janssen Pharmaceuticals and has received research funding to Columbia University from Alkermes, Arcus Biosciences, Checkmate Pharmaceuticals, Compugen, Immunocore, and Synthekine. G.A.-R. has received honoraria from consulting with Arcus Biosciences. A.R. has received honoraria from consulting with Amgen, Bristol Myers Squibb, Chugai, Genentech, Merck, Novartis, Roche, and Sanofi, is or has been a member of the scientific advisory board, and holds stock in Arcus, Compugen, CytomX, Highlight, ImaginAb, Isoplexis, Kite-Gilead, Lutris, Merus, PACT, RAPT, Synthekine, and Tango Therapeutics. A.M.T. receives research support from Ono Pharmaceuticals. B.S.H. participated in advisory boards for AstraZeneca and Ideaya. R.D.C. is a consultant for Alkermes, Bristol Myers Squibb, Castle Biosciences, Delcath, Eisai, Hengrui, Ideaya, Immunocore, InxMed, Iovance, Merck, Novartis, Oncosec, Pierre Fabre, PureTech Health, Regeneron, Sanofi Genzyme, Sorrento Therapeutics and Trisalus, serves on clinical/scientific advisory boards for Aura Biosciences, Chimeron, and Rgenix Research, and has received research funding to Columbia University from Amgen, Astellis, AstraZeneca, BioMed Valley, Bolt, Bristol Myers Squibb, Corvus, Cstone, Foghorn, Ideaya, Immatics, Immunocore, InxMed, Iovance, Merck, Mirati, Novartis, Pfizer, Plexxikon, Regeneron, and Roche/Genentech. B.I. and J.C.M. filed a patent describing the generation of high-quality single-cell genomics data from frozen tissues. The remaining authors declare no competing interests.

###

LINKS:

Paper: https://www.nature.com/articles/s41588-022-01268-9

DOI: 10.1038/s41588-022-01268-9

Journal

Nature Genetics

DOI

10.1038/s41588-022-01268-9

Article Title

Multi-modal single-cell and whole-genome sequencing of small, frozen clinical specimens

Article Publication Date

9-Jan-2023

COI Statement

B.I. has received consulting fees from Volastra Therapeutics Inc, Merck, AstraZeneca, and Janssen Pharmaceuticals and has received research funding to Columbia University from Alkermes, Arcus Biosciences, Checkmate Pharmaceuticals, Compugen, Immunocore, and Synthekine. G.A.-R. has received honoraria from consulting with Arcus Biosciences. A.R. has received honoraria from consulting with Amgen, Bristol Myers Squibb, Chugai, Genentech, Merck, Novartis, Roche, and Sanofi, is or has been a member of the scientific advisory board, and holds stock in Arcus, Compugen, CytomX, Highlight, ImaginAb, Isoplexis, Kite-Gilead, Lutris, Merus, PACT, RAPT, Synthekine, and Tango Therapeutics. A.M.T. receives research support from Ono Pharmaceuticals. B.S.H. participated in advisory boards for AstraZeneca and Ideaya. R.D.C. is a consultant for Alkermes, Bristol Myers Squibb, Castle Biosciences, Delcath, Eisai, Hengrui, Ideaya, Immunocore, InxMed, Iovance, Merck, Novartis, Oncosec, Pierre Fabre, PureTech Health, Regeneron, Sanofi Genzyme, Sorrento Therapeutics and Trisalus, serves on clinical/scientific advisory boards for Aura Biosciences, Chimeron, and Rgenix Research, and has received research funding to Columbia University from Amgen, Astellis, AstraZeneca, BioMed Valley, Bolt, Bristol Myers Squibb, Corvus, Cstone, Foghorn, Ideaya, Immatics, Immunocore, InxMed, Iovance, Merck, Mirati, Novartis, Pfizer, Plexxikon, Regeneron, and Roche/Genentech. B.I. and J.C.M. filed a patent describing the generation of high-quality single-cell genomics data from frozen tissues. The remaining authors declare no competing interests.