It’s Jackson Hole Day And Futures Are Going Nowhere

It’s Jackson Hole Day And Futures Are Going Nowhere

US equity futures are trading where they were on Monday evening, having flatlined in a narrow, boring 20-points range on either side of 4480 for the past week, as virtually nobody wanted…

US equity futures are trading where they were on Monday evening, having flatlined in a narrow, boring 20-points range on either side of 4480 for the past week, as virtually nobody wanted to take on any major new positions ahead of Jackson Hole. Well, the good news is that in less than 3 hours, J-Powell's much overhyped speech at J-Hole where he will barely - if at all - mention the taper is almost behind us which hopefully should unlock some volatility in markets. At 700am, S&P futures were up 12.50 or 0.3% to 4479, Dow futures were up 80 to 0.22% and Nasdaq futures were up 50 or 0.33%. Treasury yields dipped, the dollar was flat and bitcoin was flat around $47,500.

Traders are awaiting Jay "BRRR" Powell’s speech at the Jackson Hole symposium as a now-revering surge in delta variant cases and faster inflation paint a mixed picture for the US central bank. Four of the Fed’s leading hawks are pushing for tapering to begin this year - including Bostic today . Meanwhile President Joe Biden’s advisers are considering recommending Powell for a second term a move that would bolster optimism over accommodative monetary policy. Unless of course Janet Yellen replaces him which would be even more accommodative.

In the premarket, oil majors Exxon, Chevron and Schlumberger rose between 0.6% and 1.4%, tracking crude prices, while big banks, including JPMorgan Chase & Co, were up about 0.4%. ADRs of Chinese companies were mixed after a report that China plans to ban companies with large amounts of sensitive consumer data from going public in the U.S. Alibaba (BABA) drops 3.2%, while Didi Global (DIDI) gains 1% and JD.com (JD) rises 1%. Here are some of other notable movers today:

- Gap (GPS) shares climb 7.2% as analysts were impressed by the apparel retailer’s 2Q results and increased outlook for the year, though noted the potential for disappointment if expectations for the second half aren’t met.

- Peloton (PTON) drops 8.8% as results missed consensus estimates with Vital Knowledge’s Adam Crisafulli saying that the company joins a “long list” of pandemic beneficiaries who are now experiencing “big hangovers.”

- Zomedica (ZOM) shares drop 5.7% in premarket trading, snapping five days of gains, after retail traders on Reddit pushed shares of the developer of a diagnostic tool for veterinarians earlier this week.

- Apparel retailer Gap (GPS) jumped 7.8% after it raised its full-year net sales forecast as socializing makes a comeback with easing pandemic curbs.

- Workday (WORK) added 6.1% as brokerages raised their price targets on the stock after the enterprise cloud applications company beat analyst estimates for second-quarter revenue.

In an exclusive interview to Reuters, Atlanta Fed President Raphael Bostic, who is a voting member of the policy setting committee, said it would be “reasonable” to trim bond purchases beginning in October if strong job gains continue. Powell, who is due to speak via webcast at 10 a.m. at the annual Jackson Hole economic conference, may acknowledge the economy’s progress toward full employment, and likely provide new hints about slowing the $120 billion in monthly asset purchases, with an announcement expected before the end of 2021, possibly as early as next month. Or, more likely, he will not announce anything firm, and just hint that if improvement continues then the Fed is on track to taper.

“Consolidation is the order of the day until the Fed chairman speaks,” Nema Ramkhelawan-Bhana, a strategist at Rand Merchant Bank in Johannesburg, said in a note. “His tone is likely to be more demure than his colleagues who are advocating for policy tightening. Still, volatility is anticipated towards the end of the trading day.”

In Europe, the Stoxx 600 Index was also little changed, with real estate and miners leading the gains, while travel and leisure stocks fell. Stoxx Europe 600 travel and leisure index was down 0.7% in early trading led by airlines after Britain updated its traffic-light rules system, and amid continued uncertainty over transatlantic trips. Goodbody said the U.K. update was “rightly described as ‘lacklustre’ by some,” and the limited country changes will “hardly move the dial.” European movers today:

- Salmar shares jump as much as 4.8%, the most since February, as analysts raise price targets for the fisheries company amid a flurry of corporate announcements.

- MorphoSys shares rise as much as 3.9% after the European Commission grants conditional marketing authorization for Minjuvi.

- Juventus shares gain as much as 4.2%, most in more than a month, amid media speculation that Cristiano Ronaldo could be sold to Manchester City.

- Babcock shares rise as much as 4.1%, co. is returning as an “attractive income play,” Barclays says in note upgrading the British defense contractor to overweight from neutral.

- Brunello Cucinelli shares gain as much as 3.7% after posting first-half results, with Deutsche Bank (hold) saying the luxury-fashion company gave a “solid outlook.”

- Just Eat Takeaway shares fall as much as 4.8% in Amsterdam after New York City lawmakers passed permanent caps on food delivery fees.

Earlier in the session, Asian equities fluctuated in a narrow range, still headed for their biggest weekly gain since early February amid a rebound in Chinese technology stocks. The MSCI Asia Pacific Index was little changed on Friday as the broader market awaited clues on Federal Reserve policy from the Jackson Hole symposium. The regional gauge has rallied more than 3% this week. The Hang Seng Tech Index was set for its first weekly gain in six, surging about 7%, led by gains in internet giants including JD.com, Meituan and Baidu. However, later in the day, The gauge tracking Hong Kong listed Chinese companies erased gains of as much as 2% to trade 0.3% lower in the afternoon session after Dow Jones reported China plans to ban U.S. IPOs for data-heavy tech firms. Tencent -0.8%, Alibaba -3.3%, Meituan -0.2% all dropped in response.

While this news is not a surprise after Didi, it “indicates that the all-clear signal is still some ways off in the ongoing Chinese regulatory reform. At some point, there will be light at the end of the tunnel, its just not now,” says Justin Tang, head of Asian research at United First Partners. Investors have sought bargains in Chinese tech stocks after Beijing’s crackdown drove them to levels that some see as attractively cheap. Others are hopeful of continued central bank liquidity boosts and gradual clarity on the Chinese government’s moves.

“Investors brave enough to predict the profit outlook in China’s turbulent tech sector may shift their gazes to valuation multiples, some of which are at historic lows,” Bloomberg Intelligence analyst Marvin Chen wrote in a note. Realization of how cheap some stocks are “will be the bedrock for any turnaround,” he said. Stock benchmarks in China and Taiwan were among the biggest gainers Friday.

Japanese stocks fell after the Federal Reserve made hawkish comments and blasts in Afghanistan raised geopolitical tension. The Topix fell 0.3% to 1,928.77 as of 3 p.m. Tokyo time, while the Nikkei declined 0.4% to 27,641.14. Hoya Corp. contributed the most to the Topix’s loss, decreasing 1.7%. Today, 1,174 of 2,188 shares fell, while 880 rose; 29 of 33 sectors were lower, led by wholesalers stocks. Shares of Japanese shipping companies gained, with Nomura Securities raising target prices for Nippon Yusen KK, Mitsui OSK Lines and Kawasaki Kisen Kaisha

India’s benchmark equity index climbed, headed for a new peak and its third weekly gain in four. The S&P BSE Sensex Index rose 0.3% to 56,135.67 as of 2:19 p.m. Mumbai time, taking its weekly advance to 1.4%. The NSE Nifty 50 Index climbed by a similar magnitude today, also on course for a record high. Larsen & Toubro Ltd. gave the biggest boost to both gauges, increasing 2.7%. Out of 30 shares in the index, 13 rose and 17 fell. All but one of the 19 sector indexes on the BSE Ltd. advanced; the S&P BSE Capital Goods Index was the best performer, while a gauge of energy companies fell the most.

Australia's S&P/ASX 200 index closed little changed at 7,488.30 as industrials gained and consumer discretionary shares fell. The benchmark added 0.4% over the earnings-heavy week. Clinuvel was the top performer on Friday after broker upgrades. Pilbara Minerals was the worst performer after issuing its FY results. JPMorgan also downgraded its rating on the stock. In New Zealand, the S&P/NZX 50 index was little changed at 13,059.79.

In rates, Treasuries action was also muted on light volumes ahead of Jackson Hole, with yields slightly richer across long-end, mildly flattening the curve. The Treasury 10-year yields around 1.34%, richer by ~1bp on the day and outperforming bunds, gilts by 0.5bp in the sector; curves slightly flatter, although spreads remain within a basis point of Thursday’s close.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed against its Group-of-10 peers and with crosses confined to tight ranges before Powell’s speech; the euro fluctuated at around $1.1750. Sweden’s krona slipped after a slew of economic data, including retail sales, GDP and an economic tendency survey. Australia’s dollar reversed an earlier loss and is heading for its biggest weekly gain since May.

Commodities are holding gains, with Brent up 1.2% to just above $72/bbl, and LME aluminum and copper leading gains in the larger metals complex.

Looking to the day ahead, of course the main highlight will be Fed chair Powell’s speech at the Jackson Hole symposium later. In addition to that, data releases from the US include personal spending and personal income for July, along with the final August University of Michigan consumer sentiment index. And over in Europe there’s also French and Italian consumer confidence for August.

Market Snapshot

- S&P 500 futures up 0.3% to 4,478.00

- MXAP little changed at 197.09

- MXAPJ up 0.2% to 648.17

- Nikkei down 0.4% to 27,641.14

- Topix down 0.3% to 1,928.77

- Hang Seng Index little changed at 25,407.89

- Shanghai Composite up 0.6% to 3,522.16

- Sensex up 0.3% to 56,098.30

- Australia S&P/ASX 200 little changed at 7,488.29

- Kospi up 0.2% to 3,133.90

- STOXX Europe 600 little changed at 470.36

- German 10Y yield rose 0.2 bps to -0.408%

- Euro little changed at $1.1753

- Brent Futures up 1.1% to $71.83/bbl

- Gold spot up 0.2% to $1,795.13

- U.S. Dollar Index little changed at 93.06

Top Overnight News

- Joe Biden’s advisers are considering a recommendation to the president that would pair a second term for Jerome Powell as Federal Reserve chair with the nomination of Lael Brainard as the central bank’s chief regulator, people familiar with the matter said, a plan that could assuage progressives resistant to Powell

- Joe Biden’s bid to complete an already messy U.S. withdrawal from Afghanistan was rocked after a pair of bombings in Kabul killed dozens of people and marked the most trying day yet of his presidency

- China’s regulatory onslaught shows no signs of slowing as President Xi Jinping tries to remake the world’s second-largest economy

- Denmark will phase out the last of its pandemic restrictions next month as Covid-19 no longer will be categorized as a critical disease for the Nordic country

- Emerging markets face new sources of vulnerability from chronically weak growth, rising inflation and worsening fiscal health, and are hardly in a resilient position to weather another 2013-like taper tantrum, according to Nomura Holdings

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac bourses traded mixed although have shown an improvement compared to the losses in global counterparts that were triggered by the deadly terror attack in Kabul which killed dozens including 13 US service members and with the recent hawkish Fed rhetoric also providing headwinds ahead of the Jackson Hole Symposium where all eyes are on potential taper clues from Fed Chair Powell. ASX 200 (-0.1%) was constrained by underperformance in tech and consumer stocks, with the mood not helped by disappointing Retail Sales data and losses in Australia’s largest retailer Wesfarmers despite reporting a 16.3% increase in profits and AUD 2.3bln distribution, as it also flagged a moderation of its Bunnings' trading performance for the current fiscal year. Nikkei 225 (-0.4%) was mildly lower as exporters suffered from recent inflows into the domestic currency and after mixed Tokyo inflation data which despite averting a decline in Core CPI for the first time in 13 months, remained at a far distance from the 2% target. Hang Seng (-0.1%) and Shanghai Comp. (+0.6%) recovered opening losses with sentiment underpinned by continued PBoC liquidity efforts and with analysts speculating that the central bank is likely to cut RRR and step-up credit supply soon, while participants also digested a slew of earnings releases and were unfazed by China’s cyberspace administration’s issuance of draft guidelines on regulating internet-related algorithms. Finally, 10yr JGBs were slightly lower following the indecisive trade seen in T-notes ahead of the key Fed event and with demand sapped by the absence of the BoJ from the market today.

Top Asian News

- Nomura Offers Pizza and Pasta for Tradable Crypto Tokens

- UOB Hires Chew Mun Yew From Julius Baer for New Wealth Arm

- Japan Ruling Party Lawmakers Back Taiwan Joining Trade Pact

- China’s Sovereign Fund CIC Posts 14% Return in Covid-Hit Year

European cash bourses and index futures remain choppy within a caged range in the run-up to a string of Fed commentary alongside Chair Powell’s address (a full preview and schedule on the Newsquawk headline feed). It’s also worth remembering that summer conditions prompt greater volatility in the market even in the absence of catalysts. Further, next week sees the crucial US jobs report which will likely dictate the Fed policy announcement later in the month. Aside from that, the European session thus far has been quiet. Bourses opened with modest losses and have since confirmed to a mixed/directionless picture (Stoxx 600 Cash Unch). Sectors are mixed with no real theme nor bias, and with the breath of price action relatively narrow. Basic resources top the chat at the time of writing as base metal prices have remains somewhat robust since the APAC session, whilst the downside sees Travel & Leisure and Banks – with no clear catalysts. In terms of individual movers, Just Eat Takeaway (-4.5%) have been hit after the New York City council passed a permanent cap on food delivery fees – also seen as a blow to Uber (-0.1% pre-market), DoorDash (-0.5%) and Grubhub (owned by Just Eat Takeaway).

Top European News

- Deutsche Bank’s DWS Rejects Allegations It Overstated ESG Assets

- Billionaire’s Swiss Luxury Hotel to Accept Crypto Payments

- London House Prices Surge in Places Where More People Go Hungry

- U.K. Government Rejects Businesses’ Plea on Trucker Shortage

In FX, several Fed speakers are lined up to appear on CNBC before KC President George officially opens the annual JH event, but markets are waiting in anticipation for Chair Powell to deliver his speech on the economic outlook for any clues on further progress towards the substantial benchmark for igniting the taper that might come at September’s FOMC. Hence, the Buck looks pretty bunkered and in familiar ranges vs most G10 rivals, while the index continues to hold a relatively tight line around 93.000 following its break down from Monday’s loftier levels and w-t-d peak just under 93.500. Indeed, the DXY only managed to match its midweek best despite the hawkish momentum provided by Bullard and Kaplan yesterday, as attention turns to multiple US data points before kick-off in Wyoming. Meanwhile, technicals and mega option expiry interest appear set to keep the Euro in check given another probe, but no sustained breach of the descending 21 DMA (1.1766 compared to 1.1772 on Thursday) and 2.1 bn rolling off between 1.1765-75 for the NY cut.

- AUD/NZD/CAD - The Aussie and Kiwi continue to pivot half round numbers against the Greenback, at 0.7250 and 0.6950 respectively, with the RBA and RBNZ both ahead of the FOMC in terms of signalling or starting policy normalisation. However, Aud/Usd is also benefiting from the recent recovery in metals prices to the extent that it has managed to overcome weaker than forecast retail sales data overnight and another call for the RBA to roll back QE taper plans, this time from the CBA. Elsewhere, some respite for the Loonie or short covering and consolidation after its lurch below 1.2700 in advance of Canadian ppi and budget balances.

- GBP/JPY/CHF - All narrowly mixed vs the Dollar and Euro, as Sterling straddles 1.3700 and sticks within an even tighter band in cross terms where 100 and 50 DMAs form near term support and resistance (for the Pound). Similarly, the Yen is rotating around 110.00, eyeing US Treasury yields in comparison to JGBs plus the 50 DMA that remains in close proximity, and the Franc is still treading water above 0.9200.

In commodities, WTI and Brent front month futures remain firmer on the day but off best levels as traders track a couple of moving parts aside from the usual overarching COVID theme. Firstly, crude operations at the US Gulf of Mexico is threatened by Tropical Storm Ida, which is expected to strengthen – BP, Exxon, Chevron, Shell and BHP are all said to be preparing as the storm nears. According to the latest available EIA data, PADD 3 (The Gulf Coast) accounted for 7.9mln BPD out of the total US production of 11.2mln BPD in May 2021. Elsewhere, the Arabian Gulf Oil Company (AGOCO) announced the suspension of all its activities due to the failure to allocate the necessary funds. AGOCO is the largest subsidiary of Libya’s NOC and a story to keep an eye on for any follow-through to the parent or other subsidiaries. As a reminder, next week sees the decision-making OPEC+ confab, whereby producers have several feasible options on the table for September production – 1) stick with the 400k BPD monthly hike, 2) defer the hike and maintain current production for at least September or 3) increase output by a smaller volume. At this point, it is unclear which way OPEC+ producers will lean towards as members and sources have been less vocal recently, although source reports between now and the meeting cannot be omitted. WTI Oct’ resides around USD 68.50/.bbl (vs low USD 67.52/bbl) while its Brent counterpart trades on either side of USD 72.00/bbl (vs low USD 71.17). Ahead, aside from weather and COVID updates, the complex will be looking to the Fed’s Jackson Hole symposium as a point of catalyst, alongside the monthly PCE data. Elsewhere, spot gold and silver trimmed the gradual gains seen overnight as the Dollar regained some composure throughout the European morning. Spot gold meanders just under USD 1,800/oz but found some support at its 50 DMA at around USD 1791/oz. LME copper remains robust despite China auctioning further state reserves: this time 30k tons of copper, 50k tons of zinc and 70k tons of aluminium – for a total of 150k tons vs the 170k on July 29th. Note, some Chinese consultancies last week noted that that state reserve auctions are expected to be held every month, although August was skipped amid the rise in domestic COVID cases.

US Event Calendar

- 8:30am: July Personal Spending, est. 0.4%, prior 1.0%; Personal Income, est. 0.3%, prior 0.1%

- PCE Deflator MoM, est. 0.4%, prior 0.5%; PCE Deflator YoY, est. 4.1%, prior 4.0%

- PCE Core Deflator MoM, est. 0.3%, prior 0.4%; Core Deflator YoY, est. 3.6%, prior 3.5%

- 8:30am: July Retail Inventories MoM, est. 0.2%, prior 0.3%; Wholesale Inventories MoM, est. 1.0%, prior 1.1%

- 8:30am: July Advance Goods Trade Balance, est. -$90.9b, prior -$91.2b, revised -$92b

- 10am: Aug. U. of Mich. 5-10 Yr Inflation, prior 3.0%;

- 10am: Aug. U. of Mich. Expectations, est. 65.4, prior 65.2

- 10am: Aug. U. of Mich. Sentiment, est. 70.8, prior 70.2

- 10am: Aug. U. of Mich. Current Conditions, est. 77.9, prior 77.9

- 10am: Aug. U. of Mich. 1 Yr Inflation, est. 4.6%, prior 4.6%

DB's Henry Allen concludes the overnight wrap

Here in England and Wales we’ve got a bank holiday this Monday, meaning it’s a three-day weekend for us in London and there sadly won’t be another EMR until Tuesday. So if our international readers are wondering where we’ve all gone for the day, I just want to reassure you that I haven’t forgotten to set my alarm.

Investors certainly won’t want to sleep in today, or indeed for much of the next month as we hit a far more eventful period on the market calendar, which starts today with the Jackson Hole symposium. The big highlight will be in the form of Fed Chair Powell’s speech, which is taking place at 3pm London time, with investors watching closely to see if he outlines in any more depth how the Fed might go about tapering its asset purchases. That’s particularly so after the indication in the July FOMC minutes that “most participants” thought that “it could be appropriate to start reducing the pace of asset purchases this year”. On the one hand, inflation has been well above target (and higher than the Fed originally expected) for much of this year. But on the other, the outlook has been clouded lately by a significant deterioration in the Covid situation, with the US currently seeing cases rise at their fastest pace since January, and the Jackson Hole gathering itself has been shifted to a virtual format. On the Fed’s website, the title of Powell’s speech is simply given as “The Economic Outlook”, and DB’s US economists think that the speech will largely mirror his remarks at the July FOMC press conference, and so aren’t expecting a strong signal on the Fed’s September meeting. Instead they think that a tapering announcement will come at the following meeting in early November.

In terms of the broader market calendar, today’s events at Jackson Hole mark the start of an intense few weeks, and that’s before we even consider the surprises we don’t know about yet. Firstly, Bloomberg have previously reported that President Biden will decide on the next Fed chair around Labor Day (September 6), so we may not have to wait long before we hear who gets the nod, with a further report overnight from them saying that Biden’s advisers were considering making Powell chair again, alongside Lael Brainard as Vice Chair. Separately, there are set to be a number of spending battles in the US Congress too next month: government funding runs out on September 30; a potential debt-ceiling fight will come into view; Speaker Pelosi has committed that the House will vote on the bipartisan infrastructure bill by September 27; and there’s also the debate on the $3.5tn reconciliation bill at the same time. Then in Europe, we’ve got the German federal election on September 26, with potentially big ramifications for EU affairs as well, which comes very soon after a general election in Canada the previous week. And on top of those, we’ll have the continued debate on tapering as the Fed and ECB make their next decisions in September, which will come right on the heels of some incredibly important data releases ahead of those (nonfarm payrolls and CPI). Finally of course, there’ll be an intense focus on Covid-19 and the delta variant, particularly with schools heading back and the northern hemisphere winter ahead, which means more indoor mixing taking place where respiratory viruses spread more easily.

We’ll guide you through all that over the coming weeks, but ahead of Powell’s speech, global equities finally slipped back again yesterday after a succession of fresh highs, thanks to hawkish remarks from a number of Fed officials alongside further turmoil in Afghanistan. However, those moves were fairly contained on the whole, with the major indices still just shy of their all-time records, whilst commodities continued to press ahead in the aggregate in spite of a pullback in oil prices.

In terms of that Fed speak yesterday, we heard from three of the more hawkish Fed officials, who all called for tapering to commence sooner rather than later. Kansas City Fed President George said that the Fed should begin tapering its bond purchases this year, and then St Louis Fed President Bullard followed up by saying that the Fed should finish its tapering in Q1 2022, whilst playing down the risk that the delta variant should delay that process. Finally, Dallas Fed President Kaplan said that he continued to be in favour of announcing tapering at the September FOMC meeting, which concludes on September 22.

Against that backdrop, yields on 10yr Treasuries rose +1.0bps to a 2-week high of 1.349%, with the move entirely coming from higher real yields (+1.7bps) rather than inflation expectations (-0.7bps) as markets slightly brought forward the expected timing of future rate hikes. Sovereign bonds in Europe saw similar moves, with those on 10yr bunds (+1.5bps) rising to a one-month high of -0.41%, as those on OATs (+1.6bps) and BTPs (+0.8bps) moved higher as well. That came as the release of the July ECB minutes said that their reformulated forward guidance “did not necessarily imply “lower for longer” interest rates if it ultimately succeeded in anchoring inflation expectations at the target, as intended.” Furthermore, “a few members” of the Governing Council expressed concern about their new forward guidance, with the concerns “related in particular to the implied likelihood and persistence of overshooting, and being seen as promising to keep interest rates at their present or lower levels for a very long time period without an explicit escape clause.”

Over in equity markets, the backdrop was also less rosy, with the S&P 500 (-0.24%) and the NASDAQ (-0.13%) both coming off their all-time highs the previous day, as Europe’s STOXX 600 (-0.32%) took a similar move lower. The drop in equities was led by economically-sensitive cyclical stocks, with consumer durables (-1.58%), autos (-1.56%) and energy (-1.51%) leading the S&P lower. With sentiment turning to the downside, defensives including real estate and consumer staples were the best performers, though real estate was the only industry to not finish lower on the day. In Europe, basic resources (-1.49%) and travel & leisure (-1.12%) were the worst performers with the latter responding to news that the EU might reinstate travel restrictions on the US.

Overnight in Asia, markets are mostly trading higher with the Hang Seng (+0.54%),Kospi (+0.16%) and Shanghai Comp (+0.49%) all advancing, though the Nikkei (-0.54%) has lost ground this morning. Chinese stocks have been supported by a statement from the PBoC that it will use its monetary policy tools to support the rural sector, with measures including the reserve requirement ratio, along with relending and rediscounting measures. Outside of Asia, futures on the S&P 500 are pointing +0.21% higher.

Turning to the pandemic, New Zealand extended its nationwide lockdown until August 31, with Prime Minister Ardern saying that restrictions likely to stay in force for another two weeks in Auckland, the epicentre of the outbreak. The decision came as the country reported a further 70 new cases, which brings the total number of community cases in the current outbreak to 347. Elsewhere in Australia, Prime Minister Morrison said that 12-15 year olds would be able to book doses of the Pfizer vaccine from September 13.

Over in Afghanistan, there were further negative developments yesterday as two bombs exploded close to Kabul airport and led to a number of casualties, including of 13 US troops. The attack comes as some NATO countries have now concluded their evacuations, with Canada, Denmark, the Netherlands and Belgium announcing they are no longer flying out of Kabul’s airport. Amidst all this, President Biden stood firm on his plans to withdraw American forces by August 31, though he said that “We will hunt you down and make you pay” in reference to those who carried out the attack. Biden said that ISIS-K was responsible, an offshoot of ISIS, and that he’d ordered commanders “to develop operational plans to strike ISIS-K assets, leadership, and facilities.”

With less than a month to go until the German election now, yet another poll from Kantar pointed to an incredibly tight race at the top, with the CDU/CSU and SPD both on 23%, while the Greens lagged behind on 18%. However, as our colleague Barbara Boettcher writes in her latest update on the election (link here), in some sense the election has already begun, as voters have now begun to cast postal ballots ahead of polling day, which means there is little time left for the CDU/CSU and the Greens to win back voter support. As discussed previously, current polls imply that a 3-way coalition will be needed in order to achieve a Bundestag majority, and Barbara writes that a CDU-led Jamaica coalition (CDU/CSU, Greens and FDP) or an SPD-led traffic-light coalition (SPD/Greens/FDP) are the most likely scenarios.

Running through yesterday’s data, the second estimate of Q2 GDP growth in the US was revised up a tenth to show an annualised rate of +6.6% (vs. +6.7% expected). Separately, the weekly initial jobless claims for the week through August 21 came in at 353k (vs. 350k expected). That was a +4k increase on the previous week, but the less volatile 4-week moving average still fell to a post-pandemic low of 366.5k. Meanwhile in Europe, the Euro Area M3 money supply rose by +7.6% in July as expected.

To the day ahead now, and of course the main highlight will be Fed chair Powell’s speech at the Jackson Hole symposium later. In addition to that, data releases from the US include personal spending and personal income for July, along with the final August University of Michigan consumer sentiment index. And over in Europe there’s also French and Italian consumer confidence for August.

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

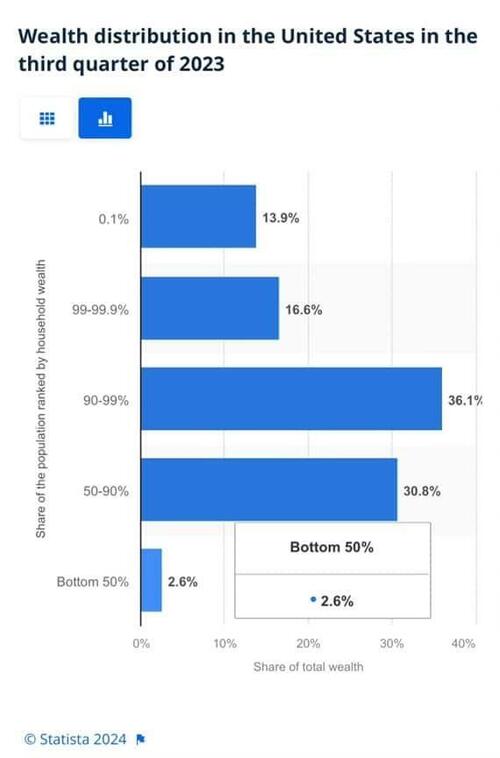

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

Government

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges