Irrational Exuberance – The Bulls Remain In Control

Irrational Exuberance – The Bulls Remain In Control

Tyler Durden

Sun, 12/13/2020 – 11:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

Bullish Bias Continues

Over the past couple of weeks, we have talked about a short-term…

Authored by Lance Roberts via RealInvestmentAdvice.com,

Bullish Bias Continues

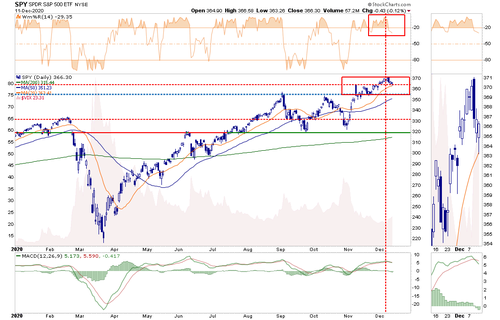

Over the past couple of weeks, we have talked about a short-term correction potential due to selling pressure from annual mutual fund distributions. We saw that taking place this past week with the market struggling to maintain its breakout levels.

The good news is the “bullish bias,” or rather momentum, of the market was strong enough to offset the selling pressure. Notably, the market held support at the recent breakout levels.

The not-so-good news is the markets remain significantly extended and deviated from means, and the bullish sentiment is very lopsided. Furthermore, the MACD signal has triggered a short-term “sell signal.” Such setups have often been coincident with more important short-term corrections.

Nonetheless, we could get a bit more weakness into next week as year-end “options expiration” occurs on Friday. With the heavily skewed “put-call” ratio currently, we could see volatility pick up as options traders roll positions over into 2021, or selling occurs to take “tax losses” for 2020.

Such could provide a reasonable trading entry for a post-Christmas “Santa Claus” rally as portfolio managers add holdings to “window-dress” portfolios for year-end reporting.

However, once we get into 2021, much will depend on getting a stimulus package passed and the vaccine delivered. If either of those fails to occur promptly, or the economy slips back into recession, the downside risk increases.

That is a story for next year. For now, it is all about the “Santa Claus” rally and our year-end price target for the market.

Approaching 3750 Target

In August, I laid out a target for 3750 for the S&P 500 by year-end.

“Technical analysis works well when there are defined “knowns” such as a previous top (resistance) or bottom (support) from which to build analysis. However, when markets break out to new highs, it becomes much more of a ‘wild @$$ guess’ or ‘WAG.’

That target was derived when I previously set out several “risk/reward ranges.”

“With the markets closing just at all-time highs, we can only guess where the next market peak will be. Therefore, to gauge risk and reward ranges, we have set targets at 3500, 3750, and 4000.”

I have updated the chart below. The “black arrow” was where I initially did the analysis.

Since that point, the market spent a couple of months making very little headway. However, as noted in “Market Surges As Election Turns Into Optimal Outcome:”

“It was quite the reversal. The rally pushed the market back above the 50-dma and the downtrend of lower highs. Such sets the market up for a retest of all-time highs next week.”

Since then, not only did the markets set a new high, but they have kept pushing higher despite a rising number of warning signs.

The Disposition Of Risk & Control

The one thing that tends to get investors in trouble, more often than note, is when the market remain irrational longer than logic would predict. When such occurs, individuals are prone to dispose of their regular “risk controls” and chase the markets higher.

Of course, it’s not just the analysts that are overly optimistic. In the short-term, investors cling to the idea that “fundamentals don’t matter.” Such is not entirely incorrect as “market momentum” is a hard thing to kill. When the “Fear Of Missing Out” overrides logic, the markets can make irrational moves. As noted in “Is The Narrative Priced In?”

“You have to wonder precisely how much ‘gas is left in the tank’ when even ‘perma-bears’ are now bullish. Therefore, the question we should ask is ‘if everyone is in, who is left to buy?’”

Excessive bullish sentiment does NOT mean a correction MUST occur. Much like “gasoline” stored in a tank, it requires a “catalyst” to ignite a change in an investor’s outlook.

No One Saw It Coming

Many issues could provide such a “spark.”

-

The vaccine is not readily available until after mid-year.

-

A problem emerges from the vaccine as, during distribution, unexpected side effects occur.

-

Despite the vaccine, the economic data weakens more than expected.

-

Earnings growth falls short of expectations.

-

Corporations continue to hoard cash and reduce share buybacks, which leads to a rising number of earnings “misses.”

-

The Republicans maintain control of the Senate, and expected stimulus bills are smaller.

-

Rent and Mortgage moratoriums do not get reinstated, and defaults and evictions surge.

-

Interest rates rise, and corporate defaults and bankruptcies surge as debt fails to get refinanced.

-

After the next round of stimulus runs out, everyone realizes the real problems with the economy.

-

The dollar surges, and foreign exchange flows into the U.S.

-

The “reflation trade” turns out to be “deflation trade.”

Which one will it likely be?

My best guess is Number 12.

You are correct. There is no “Number 12.” When everyone is long equities and leveraged, it is always an unexpected, exogenous event, which begins the rush for the exit.

If you don’t like my list, here is Jim Reid’s list from Bank of America.

What exactly will that catalyst be? No one knows, just as no one expected the “pandemic” in March.

Whatever the catalyst eventually is, the media’s excuse will be:

“No one could have seen it coming.”

Mid-Cap Moonshot

In the short-term, the market seems headed higher. However, it is worth remembering the reason it is called a “market peak.” Such is the point where prices stopped going up. Previous peaks are the graveyard of investors who believed prices could not go down.

Currently, there are some signs of more extreme conditions that have previously suggested investor caution. For example, the Russell 2000 is now as deviated from its 200-dma as it was in 1999.

Over the past 15-years, there is no point where IWM was more than 3-standard deviations above its 200-week (4-year) moving average, overbought, and trading above 3.5 on its MACD.

While these extreme measures can indeed be maintained “longer than expected,” the very laws of physics require a reversion in price.

S&P Extremes

We also see the same issues presenting themselves in the S&P 500 index as well.

-

Despite the rally since 2018, the market has continued to exhibit a negative divergence in relative strength.

-

The market is once again pushing well into 3-standard deviations above the 4-year (200-week) moving average.

-

The market is now 13.37% above the 4-year moving average, which matches previous highs.

Currently, the evidence is mounting that markets are reaching the limits of the current move. By themselves, these signs reflect the prevailing extremely bullish attitude of market participants.

However, importantly, these more extreme extensions provide the “fuel” for a sell-off given an unexpected catalyst. The ensuing “reversion” tends to catch overly confident “bulls” off guard.

Calculating The Madness

Let me repeat something which seems apropos currently:

Sir Isaac Newton once said:

“I can calculate the motions of the heavenly bodies, but not the madness of the people..”

As we head into year-end, we will be navigating the risk of overly extended and bullish markets against the seasonally strong end of year period.

We believe that over the long-term, capital preservation and risk management leads to better outcomes. However, sometimes, in the short-run, managing risk can undoubtedly be a frustrating endeavor as the “Fear Of Missing Out” overrides common sense and logic.

If you disagree, that is okay.

When the opportunity presents itself, and the “madness has subsided,” these are the questions we will ask ourselves before we add exposure to portfolios:

-

What is the expected return from current valuation levels? (___%)

-

If I am wrong, given my current risk exposure, what is my potential downside? (___%)

-

If #2 is greater than #1, then what actions should I be taking now? (#2 – #1 = ___%)

How you answer those questions is entirely up to you.

What you do with the answers is also up to you.

We are all trying to answer the question, “how much of the ‘narrative’ already got priced into the market?”

By looking at the data, it would be easy to assume the answer is “much.”

Portfolio Positioning Update

While we remain primarily long-biased in our portfolios, we hold a higher than average level of cash. Such is for several reasons.

-

Cash provides a risk-free hedge against market volatility.

-

It provides us an opportunity to add exposure for a year-end “Santa Rally” selectively.

-

It also gives us the ability to reposition into either further defensive or offensive, positioning depending on outcomes.

In short, having cash gives us the flexibility to take advantage of “dumb money,” which is historically wrong near market peaks. The trick is having the patience to wait it out.

Lastly, we are also watching the U.S. Dollar very closely. It is now extremely oversold with a large net-short position. Such is a prime setup for a rather sharp reversal, which would lead to lower prices in commodities, stocks, emerging markets, international markets, and bitcoin.

The markets are indeed currently exceedingly exuberant on many fronts. With margin debt back near peaks, stock prices at all-time highs, and “junk bond yields” near record lows, the bullish media continues to suggest there is no reason for concern.

Of course, such should not be a surprise. At market peaks – “everyone’s in the pool.”

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

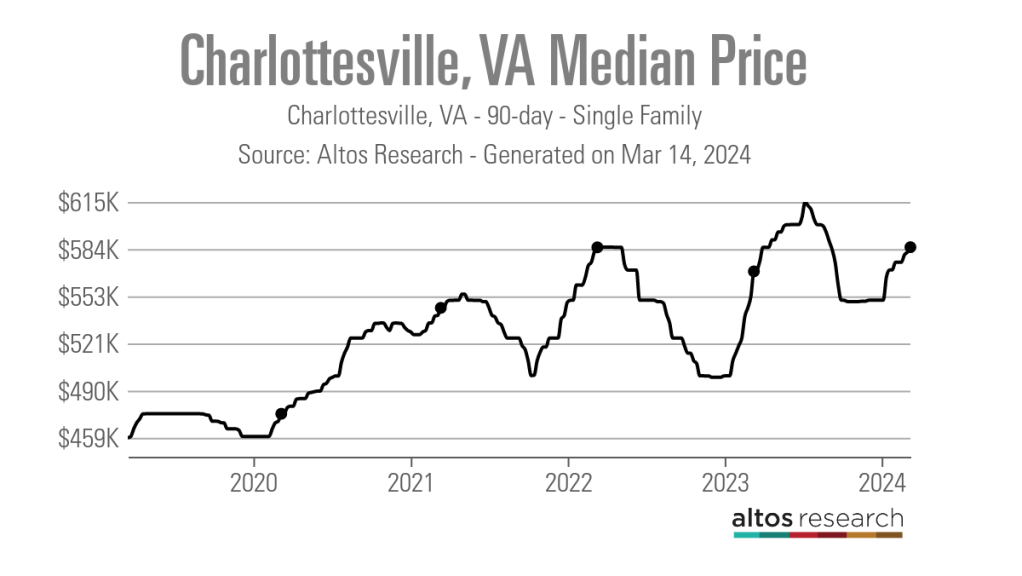

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges