Uncategorized

Introducing RFK Jr. to Bitcoin’s Nashian Orientation

After RFK Jr.’s recent remarks regarding US Treasuries backed by Bitcoin, it might be time to seriously consider the Nashian interpretation of Bitcoin…

The Bitcoin-Backed Dollar in Dialogue

In July a bitcoin-related topic was broached by Robert Kennedy Jr., which to my knowledge has not been addressed by anyone holding the top office of the executive branch or a notable candidate for the position of President. Of course, John Nash’s Ideal Money is a perennial topic, one I have explored conversationally in the past. It can be a controversial and divisive position, just like other opinions RFK Jr. holds, with a few proponents endorsing even more radical thoughts than the common consensus. How meta…

But to contextualize the totality of what RFK Jr. said regarding a Bitcoin-backed dollar requires us to do a little homework. Luckily, Bitcoin Magazine’s Editor-in-Chief Mark Goodwin has done a lot of the informational legwork for us in a piece he published in 2021.

“I had understood the concept of the Nash equilibrium in regards to Bitcoin for a while, but it wasn’t until 2021 that I got really into his work and decided to read all his papers. Ideal Money was introduced to me by a couple of gentlemen on Twitter who had been writing about Nash and Bitcoin for years, Jal Torrey and Jon Gulson. I know the ultimate monetary showdown is between the U.S. dollar and Bitcoin, and the Ideal Money concept really outlines an articulate path forward for monetary policy and inflation targeting as political and apolitical money collide. Money is just a technological tool for bargaining, and no one understands the axioms of bargaining better than John Nash. I recommend reading The Essential John Nash by Kuhn and Nasar, Parallel Control, as well as the various iterations of his Ideal Money lectures to begin to grok the Nashian Orientation.”

Mark Goodwin - Editor-in-Chief of Bitcoin Magazine

In the past, we covered the concepts of inflation, Nash’s Equilibrium, and Breton-Woods with enough depth to point to these conversations as milestones along the path to giving Ideal Money the attention it deserves.

So why is this concept important now?

Motion images created via Pika Labs

The Asymptotic Approach to a Beautiful Mind

Well, there are plenty of cultural and social angles but I think an important one regarding productivity and value erosion is the international uncoupling of gold and the US dollar that occurred during the Nixon administration.

While not all of the zealots advocating for the ideas in John Nash’s final white paper agree on how to interpret everything in the eight total pages, it is a short read and you are welcome to make your own conclusions about it.

One constellation that is critical to grasp is how a “basket of goods”, referred to by the International Monetary Fund (IMF) as “special drawing rights” (SDR), is fairly congruent to Nash’s Industrial Consumer Price Index (ICPI). Let’s keep this simple: imagine a scale. On the left side is an amount of fiat currency of your choice, on the right, is a collection of goods, assets, or commodities (I use these terms very loosely) in all the various combinations you can imagine that would be equivalent to the dollars on the first side at a given rate that is publicly recognized. The right side could even be a collection of currencies. There are those that believe Bitcoin is enough in itself, operating as both the fulcrum and the right side of the scale. This implies an understanding of token mining and, by extension, the value of energy - I am unqualified to expound on this in a way that I believe is satisfactory so I will leave that topic to those more experienced and more knowledgeable about the idea.

“The ICPI concept was used by Nash to illuminate a vector of quality for money we can dub ‘Idealness'. The asymptotically 'ideal' nature of Bitcoin derives from the apolitical and invariant nature of the cost to produce a valid block. Bitcoin is asymptotically (rather than perfectly) ideal because it (self-)adjusts the cost to produce blocks (aka difficulty) to the previous period's mining computational expenditure and it is invariant in that the adjustment is pre-defined (constitutionally) at Genesis and locked in as such by the ever-increasing entropy of the totality of each of the network participant's utility functions.

Any major currency that (constitutionally) pegs to Bitcoin thus necessarily inherits the benefits of this quality of idealness.”

Over the last three and a half years we have watched as central banks have flooded the markets with currency. The cost of goods has increased in the wake of trade route bottlenecks and the excess liquidity available to outbid the competition. We are still seeing commodity price spikes occurring globally, such as in the European energy markets.

Now imagine, if you will, that the scale embodies the concept of Ideal Money. This tool offers a more complete view of the price inflation occurring on the fiat currency side of things because it can be possessed as an asset itself in an effort to pursue a more conservative monetary policy, riding out the surprise shocks that occur when people pile into an attractive market (the things they really want on the right side of the scale).

And that’s why the US needs bitcoin in its treasury, though it does not explicitly need to back the dollar with bitcoin - whatever that might mean. This creates a situation similar to how corporations can hold Bitcoin on their books while issuing common stock to trade and raise capital from the market.

Attracting Economic Opposites

Economic satirists might seem to be endorsing Modern Monetary Theory (MMT) but their positions lack conviction, we see grand announcements of leaving behind triple-ledger accounting only to flirt with the concept most devotedly. Or worse, embittered positions that seemingly reflect the chanters missed opportunities. Disingenuous at the least, it’s probably an integrity issue.

It’s important to note that these ideas aren’t particularly “modern” in the 21st century, they have been championed by Keynesians since the early 1900s. While the macroeconomic ideas are attributed to John Maynard Keynes, it is worth adding that Nash felt Keynes’ intent was more grounded than the bastardized forms they have taken under the wings of the advocates that affiliated their efforts to Keynes’ original framework.

Elasticity, the capacity for expansion and contraction of the money supply, accommodates opportunity when it arises, to provide a platform for credit and creativity as well as to reign things in when the velocity of a currency is becoming overheated. It’s important to realize that liquidity is what lights up a market’s opportunity. Sure, social capital can potentially do that, however, that doesn’t always translate into the urgency required to execute against the conditions within the timeframe needed for meaningful gains to be produced.

That’s why it is excellent that RFK Jr. has put Bitcoin into the public economic discussion, though the implementation he is recommending lacks the nuanced understanding of how it operates as a balancing mechanism for the equation.

Of course, there is room for everyone’s ideas to be tested in the market. If you like efficiently sized blockspace, or would prefer a more cashlike experience, or want to store data on-chain - the various forks of Bitcoin offer dedicated functionality for the use cases listed here. Still don’t see one that meets your requirements? Fork it! Put it out there and see if it gains traction with users and miners.

This is where the waters get murky…

Any particular chain could be the right one for a time and a location, circumstances determine that. I’m not convinced that we know right now how all of these experiments will play out, it’s only been fourteen years since blockchains were introduced. We wouldn’t give it a driver’s license yet. However, his ideas about how blockchain creates transparency are spot on.

“The opportunity is the prospect of [bitcoin] being used as a medium of exchange. RFK Jr. wants to reduce capital gains tax for bitcoin, which would be good but we should get rid of the capital gains tax entirely. Bitcoin eliminates the need for a central bank digital currency (CBDC) [and] ensures that everyone is accountable, including governments. Forking could be good but there is no provision to handle that legally. Right now if there is a chain split, you have to treat [the new coins] as income.”

Daniel Krawisz - Bitcoiner

To me, forking enables customization. As open as the Bitcoin network is, our internet networks are not. In addition to the discussion of security is jurisdiction. Creating dedicated subnetworks of Bitcoin has already occurred for functionality and I believe that we will see more that are akin to fashion (such as we see in the cryptocurrency industry at large) as well as legal boundaries in accordance with governments.

Dedicating Blockspace to the UTXO-Dollar

So, how does Robert Kennedy Jr. know this is the direction we should go regarding US monetary policy? Sure, there is a latent interest in returning to metal-backed currency and some would conflate this idea with what he is saying in regards to a bitcoin-backed dollar. However, they should not. As the asymptotic model implies, it is a pursuit - a platform to expose low-integrity economic policies and to increasingly reduce the space it has to grasp additional mindshare.

The short of it is: he doesn’t. The position is flawed from the outset but that is all right. In totality, the Bitcoin experiment is flexible, and while fifteen years in, the concept has established itself, that doesn’t mean every application has been explored through each potential iteration. Users must continue to test its viability and we are the government. There is room to run, to see how much territory exists beyond the map, whether that be through forks or merely holding Bitcoin on balance sheets. Inevitably, our politicians will have to grapple with these issues and if Nash has anything to say about it, we will shift toward equilibrium.

For more on John F. Nash Jr.

Mark Goodwin’s “The Birth of Bitcoin”

cryptocurrency bitcoin blockchain currencies us dollar commodities goldUncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

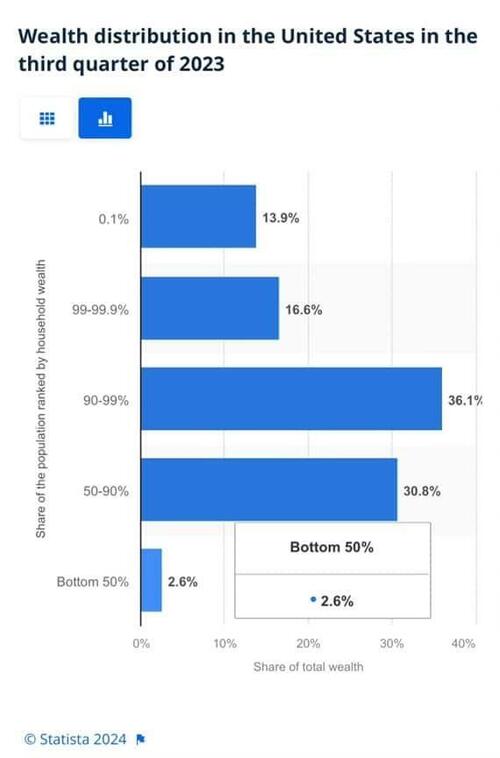

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges