Interview: Discussing Panama’s Crypto Bill With Its Architects

An interview with two architects behind Panama’s proposed cryptocurrency bill, which would legally define bitcoin for the country.

An interview with two architects behind Panama's proposed cryptocurrency bill, which would legally define bitcoin for the country.

What’s the first thing that comes to mind when you hear the word “Panama?” The Panama Canal? Please don’t say Van Halen’s catchy ode to nothing resembling actual Panama.

Having gone there for the first time this September, my eyes were opened to the beauty of the people and their land in this historically key country. While its canal has been contributing greatly to the world’s physical economy since opening in 1914, Gabriel Silva and Felipe Echandi are helping Panama add to the digital economy wave that has been swelling steadily since Bitcoin’s birth. Read on to hear directly from them on this vital bill for Panama and the world.

Silva is an independent deputy in the Panamanian Parliament, where he has served the 8-7 circuit since 2019. In 2016, as a Chevening scholar, he graduated with a master’s degree in public policy at the University of Oxford. In 2017, as part of the Fulbright Program, he completed a master of laws degree at Columbia University. He has presented legislative proposals related to anti-corruption, government transparency, educational reforms, and mental health among others.

Echandi is the cofounder and CEO of Cuanto, a Y-Combinator-backed startup that helps creators monetize their audiences. Echandi is also an independent board member at Panama’s banking regulator. He holds an MBA from The University of Texas at Austin’s Red McCombs School of Business.

How do you plan to educate the people of Panama about the benefits and accessibility of crypto assets like bitcoin as written in your bill?

Silva: My team and I are trying to make the information as easily accessible as possible. When we made the proposal we did several things to educate the general population about it, including posting videos and infographics to explain the bill in English and Spanish on all social media platforms like Twitter, Instagram, Facebook and TikTok.

Thankfully, the cryptocurrency community is very loud and energetic on social media so they have helped us share the message that we’re trying to portray. For example, the one-minute video I posted on Twitter about the bill was the most viewed video I’ve ever posted.

We still have much to do, so we are working with influencers outside of the crypto community to help us educate people on the bill. We are also making a strong campaign on the traditional media platforms such as newspapers, radio and television stations to inform Panamanians about the proposal. The last time I watched TV for the news may have been 10 years ago, but there are many people who use that medium to get informed.

Thankfully, the traditional media here in Panama have been interested in our project so we have been getting a lot of exposure there. This bill follows other bills we have proposed in Parliament to improve financial education in high school and universities. One of the topics we have included in those proposals is teaching about the digital economy, which is part of our macro strategy that we are working on with the ministry of education and the ministry of finance. This approach is to empower our young people with financial education starting from a young age.

Echandi: One more thing I’d like to add, we’ve had coverage in two of our largest newspapers and it was surprisingly positive.

The editorial in the largest paper covered us and basically said we need to open up to this world of cryptocurrencies as a nation. In addition to the efforts that Gabriel mentioned, I believe the good thing about setting the groundwork for an ecosystem to arise is that the people who provide utility for consumers are the best educators in the end.

A good product maker or someone who creates the solution to a real problem is a better educator than any public campaign. If we manage to unlock the roadblocks in the financial system for people to innovate and create products to include people financially, this will lead to more educated consumers and users. This will empower people to move money internationally, make a living on the internet, and participate in this cutting edge of value creation with crypto assets, which will lead to a better ecosystem, because the people in it will be solving problems for their own lives.

So, I believe education will come with more access to better products. The problem has been that there are so many roadblocks for the average Panamanian to access this ecosystem. You first need to have a bank account which already excludes half of the population, you then have to do international wires which is an additional complexity that is not cheap, and then you have to deal with a ton of intermediaries so the banks won’t block you and so everything works.

In contrast, an American citizen for example simply connects their bank account to Coinbase or a similar solution and they have an initial contact with this world and eventually, of course, they become more savvy. I believe a good ecosystem and an openness to create certainty for innovators to create and solve problems for others will in itself bring forth a ton of education.

The last point I want to make on this is in the article regarding the radical digitalization of the government that guarantees universal access to the internet. This may be seen as a by-point in the law, however it is the infrastructure for everything to actually work. Panama already has decent connectivity, especially in urban areas, however we don’t really have a deliberate policy of universal access to the internet. There are many countries that have already experimented with this so we don’t believe it is something that has to be super expensive to be guaranteed. If that happens, we don’t believe we’ll have to underestimate people’s ability to browse online and consume information from good sources.

So, I’m super hopeful that with a good ecosystem in place and decent access to the internet, people will get access to education aside from the efforts we’re making in the public sector.

How does Panama compare to other Latin American countries in the innovation and cryptocurrency landscape?

Echandi: I would say Panama is about average or maybe even under average compared to other Latin American countries in the digital economy boom.

Countries like Mexico, Brazil and Colombia have exploded with many non-crypto-related solutions such as on-demand delivery apps, ride sharing apps, even the more traditional fintech solutions. We have a relative regional lag because we don’t have certainty for many of these business models, even if they’re not related to crypto.

We don’t have banking interoperability like Mexico, Costa Rica or Colombia, and this is something we have attempted to solve in this bill. We don’t have clarity on the licensing for certain activities that in other countries have clear requirements and licensing. Examples are crowdfunding, wallet creation (crypto or otherwise), PayPal, etc. We have a traditionally competitive financial system, however it became inflexible because it didn’t adapt itself to these varied business models that the internet has enabled, even before crypto started emerging. So, we have on-demand delivery apps that the general public uses, we have e-commerce solutions that exploded with the pandemic, however the digital ecosystem is still not there and that’s part of the problem even beyond crypto.

We are reinventing the competitiveness of a country that has already been open to the world. The thing is that the meaning of “openness to the world” has changed with the internet. So, how does a country that was open to the world in “meatspace” become open to the world in “digital space?”

That is this bill, that is what we want to do. We think countries that do not pose this question to themselves will not be sustainable and we want to remain a relevant and sustainable location as physical location starts losing relative importance as part of the total value creation picture.

If you see our coat of arms, it says pro mundo beneficio which means for the benefit of the world, we’re translating that into digital for the benefit of the future. How can we fulfill that promise we have here with the internet? That’s the whole point. Crypto assets are just the latest incarnation of that. It’s also the metaverse, virtual reality, virtual art, and virtual communities. How is that going to be a part of our DNA as a nation and how do we take the steps in that direction? That’s the foundation this bill is trying to build.

Silva: In addition to what Felipe said, I think this project is very important because when you consider the statistics in Panama and how many people have real access to the banks, loans, and credit cards, it’s less than half of the population. Today, without a debit card, credit card, or bank savings account, it’s very difficult to progress, get a job, buy things, and get educated.

So, when you consider that half of the population is not getting that chance to participate in the modern economy, that’s very sad and horrible for our progress as a country. This project seeks to improve the digital economy including the use of cryptocurrencies which has the potential to pick up the people who don’t have bank accounts or access to financial services and help them participate in the 21st century economy, get involved, and progress. That’s the human side of this initiative. This isn’t just about making lots of money, but getting people involved.

What are the key differences between El Salvador’s approach to its law and your approach for Panama?

Echandi: We believe that they’re totally different efforts and they’re trying to solve completely different problems. El Salvador, we think, is a massive push toward Bitcoin adoption specifically, because it mandated adoption of bitcoin as legal tender. In Panama, that would be unconstitutional. We can’t force anyone to take a specific currency because we have monetary freedom established in the constitution.

So, we couldn’t even consider driving adoption in that manner. So, what’s the problem we’re trying to solve? First, we want people who deal with crypto to feel safe here, to provide a location that is open to the cutting edge of the internet. Second, if you’re creating a platform that is decentralized and taking custody of funds, the rules should be clear for you and they should be competitive. They should also mitigate the risks that normally exist with that. Third, if you’re doing something in the decentralized finance (DeFi) space, the rules should also be clear to you.

Next, banking interoperability would need to happen so you could serve people locally. The government has to digitize its operations so it can take tax payments in crypto and make itself more transparent and efficient.

So, we believe we’re solving different problems. What we want to do here in Panama is create an open space to innovate in the crypto and digital economy. We believe adoption will come on its own, whereas in El Salvador we believe they prioritize adoption over ecosystem creation. Both of us will probably end up in a similar place but in El Salvador I don’t think the tax situation is clear for Ethereum or other cryptos. Or if smart contracts take off on Bitcoin via RSK, how will that be dealt with?

Also, El Salvador was ahead of us in some aspects with banking interoperability because they have a central bank. That’s the good part of having a central bank, you have an entity that enforces standard rules. Panama has never had a central bank so we have to make things compatible, that’s a very Panama-specific problem.

Another difference is our focus is serving the rest of the world. El Salvador is focusing a lot on creating adoption within its population, and here we think this ecosystem will benefit our own population but also we want to benefit the rest of the world. Panama has always been a “for the rest of the world” country. We have a huge debt to serve our own population which hopefully will be fixed with measures like our proposal.

So, I would say it’s a completely different approach. We are more about creating clear rules so innovators come and create the future instead of having the government create the future for them. But I am excited to see them growing from the law there and I hope they continue to do well.

How much interest have you found in Panamanian consumers and providers of services to pay in or receive crypto assets?

Echandi: I would say consumers are the most interested in having access to this technology. For example, there are WhatsApp groups of people trying to learn how to get into this, how to use it, how it can benefit them, how they can invest in a way that’s not scammy, how they can learn of this potential in bitcoin, non-fungible tokens (NFTs), and other crypto assets.

We have some really amazing stories of people here for example, Ix.shells is an Afro-Carribean artist from Panama who recently created and sold an NFT for about $2 million. This made her the highest paid female crypto artist at the time, and she’s from Panama!

The point is, how many more Ix.shells are out here in Panama? There are talented people in Panama who haven’t had the chance to connect with all of this and get their big break as she did. So, the interest of the general public is just overwhelming. As you know, people see this as part of the future and maybe feel a little bit uneasy, and sure there’s a little bit of hype and fear of missing out (FOMO), but the general fundamentals of native value for the internet, once you see it you can’t unsee it.

On the provision of services side, I have seen traditional wealth managers try to understand how to offer their clients exposure to these assets. Traditional wealth managers here are very traditional, they don’t even have robo advisors here, like Wellfront or others. So, it has been really manual, but even they are learning about the subject because their customers are demanding exposure to crypto assets in their portfolios.

If you’re earning and saving money, you want to have some exposure to crypto assets. So, I think everything is coming from the demand because on the supply side either the entities are very traditional or they don’t want competition, they fear this. However, with a clearer ecosystem, you might have the supply to match the demand which will hopefully turn the opinions of more traditional entities and help them see this as not just a competition to what they do but also a compliment to all the services they provide. Right now all the adoption has been driven by demand from end consumers, regular people who want to learn. They’re using LocalBitcoins, Binance P2P, they’re doing whatever has to be done to jump through the hoops to get crypto assets. But it is sketchy and not transparent. People are at times having to reinvent the wheel and incur high transaction fees to access crypto assets here. It’s just not optimal for good experiences and good adoption.

What was the thought behind Article 4 about digitizing the identity of those that wish to use crypto services? Is it similar to the know your customer (KYC) measures used by crypto exchanges?

Echandi: Not really. One thing is the KYC requirement is triggered by redeemable value entities, such as exchanges, which will need a license. This license will be compatible with all types of digital economy business models, especially centralized ones. For example, if Coinbase wanted to establish operations in Panama, they would have to get a license because they are actually custodying people’s assets, so that is something that needs to be regulated in a competitive way, and that does require KYC.

However, what we refer to in Article 4 is a completely different issue. Panama, as a unitary country rather than a federation, has certain centralized databases to manage the identity of people. People are already registered in the civil registry which is the electoral tribunal. So, if you’re a Panamanian citizen or resident, you get an identification (ID) card and that card allows you to interact with all public services. That process is extremely manual. What we feel is this whole blockchain technology, with or without crypto assets frankly, is an opportunity to bring more efficiency and transparency to every type of public service and management solution that the government provides.

On the legal citizen or resident side it’s the same thing. We have the public registry that lets you create public persons, legal persons engage in commercial activity, and it’s all currently manual. If we can make Panama’s public services more internet compatible, then we will be able to start automating and programming some of the interactions that used to be manual that can now be way more efficient.

We can even start — this is the more futuristic part — thinking of new ways of governance for people to solve problems. For example, we could think of topic-specific decentralized autonomous organizations (DAOs) for Panama to solve problems at the local level. Things that are not even possible to imagine because the identity itself is not really digitized. Or even very simple things like what Estonia has done in allowing people to create a digital signature even if you’re not a resident of Estonia. Why can’t we do that for the rest of the region or the world? That is not groundbreaking technology but with blockchain solutions we could do it faster or in a more transparent way.

Silva: In addition to what Felipe said, the intention of that article and other related articles is that the public sector welcomes blockchain technology in their internal processes. I’m one of the advocates in Panama of improving public policy transparency and efficiency. So I think it’s super essential that the government has a digital plan and agenda that is implemented in all its institutions. So, this article and others are laying the plans to digitize the government and include blockchain technology in their processes because we know from our experiences from other governments and international organizations that this technology can help with transparency, efficiency, saving costs, and public participation. So, the intention is a little bit broader but the blockchain technology and all its potential is in the government’s digital agenda to provide better services to the public.

Would Panamanian citizens or residents who do not wish to interact with crypto assets be exempt from digitizing their identity?

Echandi: I don’t think we have a lot of control over that. Do some people wish that they didn’t need passports to travel internationally? Yes. Passports were a temporary war measure that emerged after World War I but they became permanent. As Milton Friedman once said, “There is no more permanent thing than a temporary government measure.”

But the point here is, there will be requirements to comply with if you want to be a legal permanent resident in Panama. That isn’t in the scope of this bill. However, what is in our scope is for people to see the benefits in becoming residents of Panama and providing competitive rules in a way that they don’t see this as a crazy encroachment on the products of their labor and innovations. That is related to the tax regime that Panama already has. Panama is a territorial tax system. If you’re already a tax resident of Panama, you only pay taxes on assets that are physically located in Panama. This means that crypto assets like bitcoin or ether are not subject to capital gains tax because they do not have a physical location, they live on the internet. The possible exception could be someone who has dual citizenship and must give preference to their primary country’s transnational tax regime.

We believe we can offer very competitive tax treatment while clarifying the rules that apply to crypto. So if you become a Panamanian tax resident, with the asterisk of whatever your other country requires, Panama would only tax you on assets that are physically invested in the republic of Panama. So, most of the global, internet, crypto, or cloud-based creation of value would be considered foreign-sourced income. Even if you do trigger some of the taxable obligations here, especially capital gains, it would be at a very competitive rate which we’re proposing to be 4%.

The only case in which a crypto asset in Panama would trigger a capital gains event would be if you tokenize a piece of land in Panama or do something like the city DAO that is happening in Wisconsin. If you sell a token that represents a piece of land in Panama, that is a taxable event that would be at rate of 4%. Or if you tokenize a private company, like if a supermarket in Panama that’s not listed in the stock market and you sell that token, you’d be subject to the 4% capital gains tax.

So, we’re proposing to take Panama’s already competitive territorial tax system with crypto and make it attractive for foreign individuals to become Panamanian tax residents. The reason for that is not just for them to keep all their money. We want smart people and innovators living here physically. We want them to live on our beaches, in our rainforests, and in our cities so they can interact with Panamanians who have not been in touch with this technology and maybe create in person solutions that will help affect the immediate environment here in addition to doing whatever they’re doing for the rest of the world.

With the layered system of presenting and passing a bill into law in Panama, is there a time frame that you hope to see this bill become a law?

Silva: This project is definitely a very ambitious and technical project. As we have mentioned, it’s a very new topic in Panama and in the world, and it takes time for people to understand what it’s about. That it does not cause any harm and actually benefits the population.

Secondly, though the bill is very ambitious and positive, Panama’s government system is very different from that of other countries in the region. For example, El Salvador made their bill into a law very quickly. The reality in Panama is very different with its pros and its cons. So, it will take a little bit more time.

Nevertheless, since the project is very well done and thought out, it has already caught the attention of several politicians and government officials. We have already talked with a lot of Parliament members from all political parties who have co-signed the project with me. We’ve talked with high government officials from different ministries related to this topic and we know the executive branch is interested in discussing this.

It might take a while as it’s a very important and technical project, but due to its potential and the interest from different political parties and citizens and the international pressure we’re receiving regarding the gray lists and black lists, it’s important that we don’t fall into these categories and have everything straight. I think all of these things together will help the project succeed. I’m very optimistic about it. It will definitely take a lot of work from my side and everyone on my team to get this into a law. I don’t know how long it will take but we’re pushing it forward as soon as possible.

It also depends strongly on the community, so I would like to take this opportunity to ask them to support the bill, and show their interest. The support from the community has been great so far, just keep pushing and asking for the bill to pass because that pressure definitely helps it move forward faster here in Panama.

Conclusion

At the time of writing, this proposed bill has been admitted into debate in the Legislative Assembly's Commerce Commission and must pass through three separate debates before advancing to the president's office to be signed into law. The first debate is currently in session.

Silva and Echandi are open to all feedback regarding this bill and welcome your ideas via Twitter (@gabrielsilva8_7, @felcheck), and their Telegram group.

This is a guest post by Josh Doña. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

cryptocurrency bitcoin ethereum blockchain crypto btc pandemic cryptoGovernment

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

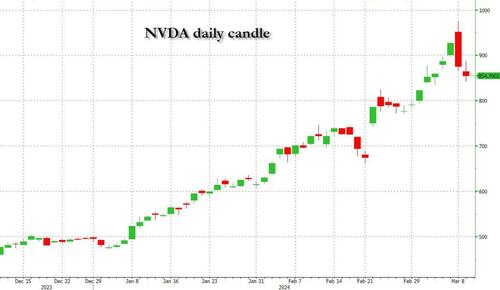

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges