Government

How to use COVID-19 testing and quarantining to safely travel for the holidays

How to use COVID-19 testing and quarantining to safely travel for the holidays

With the holidays approaching, many people are considering whether to visit relatives or friends in the coming weeks. At the same time, cases of COVID-19 are surging toward the highest levels since the beginning of the pandemic. As a physician, daughter of vulnerable seniors and mother of young adults, I have been thinking a lot about whether testing will help me decide if it’s safe to see my family.

Testing may help you to make sure you and your loved ones stay healthy, but COVID-19 testing is not as simple as yes or no, infected or safe. There are many factors to keep in mind when using a coronavirus test to plan your holiday travels safely.

Some tests are better than others

Broadly speaking, there are two categories of tests.

Antibody tests – which look for evidence of previous infection – can’t tell you whether you currently have COVID-19 and aren’t useful for planning to visit family.

The other category of tests look for evidence of the virus in your body. There are two types of these viral tests available – RT–PCR tests and rapid antigen tests – and these are the ones to use when trying to prevent the spread of the coronavirus.

No lab test for COVID-19 is 100% accurate. Although false positives are certainly not a good thing, a false negative result – testing negative when you actually have the virus – is the bigger danger if you plan on seeing family. The false negative rates for RT-PCR tests range from 2%-29%. Much of that range is due to different manufacturers and user error. While fairly accurate, these tests often involve a visit to a health care provider and are somewhat expensive – around US$100, though costs vary widely by state – and it can take up to three days to get results. RT-PCR tests are the best tests available, but for some people, especially if you’ll be seeing someone in a vulnerable age group, the high-end 29% false negative rate might leave more uncertainty than you are comfortable with.

Rapid antigen tests, in comparison, are faster and cheaper, but less accurate than RT–PCR tests. You can usually get results within a day of taking the test, but false negative rates can be as high as 50%. They are most likely to be accurate when they are given to people with symptoms within a week of symptom onset, but rapid tests are not meant to be diagnostic tests for an individual. They are much better at monitoring whole populations where people can be tested repeatedly, and quite frankly have little use as a one-time test.

With a rapid test you may get results instantaneously at a lower price, but they should not be the only thing to inform a travel decision. When the health of a family member is on the line, accuracy is your friend. RT–PCR tests are generally considered to be more accurate.

Timing matters

Regardless of which viral test you use, the results are accurate only for the moment when you were tested and reflect only the ability of the test to detect the virus. A negative result today of course doesn’t prevent you from getting infected tomorrow.

But with the coronavirus, neither does a negative test mean you haven’t been exposed to the virus. The time between coming in contact with the virus and beginning to shed infectious virus particles – the incubation period – varies anywhere between two and 14 days. For example, it’s possible you could get exposed today, test negative tomorrow and then go on to be infectious a few days later.

Additionally, it is possible to spread the virus before you show symptoms – when you are presymptomatic – or even if you never develop any symptoms at all.

Minimize risk, accept uncertainty

First off, if you have any symptoms at all, stay home. If you do not have symptoms, then you can start to think about travel for the holidays.

Knowing that tests are imperfect, the safest thing you can do is to strictly self-quarantine for 14 days before your visit. Testing can offer a helpful data point, but a quarantine is the more foolproof option.

If you can’t quarantine for a full 14 days, the next best thing is to limit potential exposure to the virus, isolate as much as possible as long as possible before you travel and get tested.

If you are worried about being an asymptomatic carrier and are unable to isolate, consider getting tested at least five days after your last possible exposure. This maximizes the chance of a test detecting the virus if you are infected.

Remember that traveling itself carries risk of exposure too. Driving with appropriate precautions – wear a mask, wash your hands and social distance – seems to be safer than flying.

The process of flying – the crowded airports, bus rides and close seating on the plane – is a serious exposure risk. Ideally, after flying you would self–isolate again at your destination for as long as possible and consider getting tested. That is a lot of time alone and waiting for test results, but I can think of no higher stakes than the safety of loved ones.

You’re not in it alone

Maintaining health is a group effort, and it takes only one infected person to cause an outbreak. Openly discuss the precautions that the people you are visiting are taking and the possibilities of social distancing during the visit.

[Get facts about coronavirus and the latest research. Sign up for The Conversation’s newsletter.]

Remember that one negative test in a party of travelers is only that, one negative test. Just because you test negative doesn’t mean you can assume that other people in your household are negative too. Everyone needs to get tested and follow the same isolation measures, as much of the spread occurring is happening at smaller private gatherings in close quarters.

Many people want to see our loved ones during the holidays. But there are enormous, life-and-death reasons to plan the visit carefully and to use information, isolation and testing wisely. You may decide that the risk is too high, and that is OK. But, if you decide to visit for the holidays, the safest option is a strict 14-day quarantine. Testing can help inform your decision, but is not the only thing that you should rely on.

Claudia Finkelstein does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

International

EyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

Ramiro Ribeiro

After six years as head of clinical development at Apellis Pharmaceuticals, Ramiro Ribeiro is joining EyePoint Pharmaceuticals as CMO.

“The…

After six years as head of clinical development at Apellis Pharmaceuticals, Ramiro Ribeiro is joining EyePoint Pharmaceuticals as CMO.

“The retinal community is relatively small, so everybody knows each other,” Ribeiro told Endpoints News in an interview. “As soon as I started to talk about EyePoint, I got really good feedback from KOLs and physicians on its scientific standards and quality of work.”

Ribeiro kicked off his career as a clinician in Brazil, earning a doctorate in stem cell therapy for retinal diseases. He previously held roles at Alcon and Ophthotech Corporation, now known as Astellas’ M&A prize Iveric Bio.

At Apellis, Ribeiro oversaw the Phase III development, filing and approval of Syfovre, the first drug for geographic atrophy secondary to age-related macular degeneration (AMD). The complement C3 inhibitor went on to make $275 million in 2023 despite reports of a rare side effect that only emerged after commercialization.

Now, Ribeiro is hoping to replicate that success with EyePoint’s lead candidate, EYP-1901 for wet AMD, which is set to enter the Phase III LUGANO trial in the second half of the year after passing a Phase II test in December.

Ribeiro told Endpoints he was optimistic about the company’s intraocular sustained-delivery tech, which he said could help address treatment burden and compliance issues seen with injectables. He also has plans to expand the EyePoint team.

“My goal is not just execution of the Phase III study — of course that’s a priority — but also looking at the pipeline and which different assets we can bring in to leverage the strength of the team that we have,” Ribeiro said.

— Ayisha Sharma

Remco Steenbergen

Remco Steenbergen→ Sandoz CFO Colin Bond will retire on June 30 and board member Remco Steenbergen will replace him. Steenbergen, who will step down from the board when he takes over on July 1, had a 20-year career with Philips and has held the group CFO post at Deutsche Lufthansa since January 2021. Bond joined Sandoz nearly two years ago and is the former finance chief at Evotec and Vifor Pharma. Investors didn’t react warmly to Wednesday’s news as shares fell by almost 4%.

The Swiss generics and biosimilars company, which finally split from Novartis in October 2023, has also nominated FogPharma CEO Mathai Mammen to the board of directors. The ex-R&D chief at J&J will be joined by two other new faces, Swisscom chairman Michael Rechsteiner and former Unilever CFO Graeme Pitkethly.

On Monday, Sandoz said it completed its $70 million purchase of Coherus BioSciences’ Lucentis biosimilar Cimerli sooner than expected. The FDA then approved its first two biosimilars of Amgen’s denosumab the next day, in a move that could whittle away at the pharma giant’s market share for Prolia and Xgeva.

Sean Marett

Sean Marett→ BioNTech’s chief business and commercial officer Sean Marett will retire on July 1 and will have an advisory role “until the end of the year,” the German drugmaker said in a release. Legal chief James Ryan will assume CBO responsibilities and BioNTech plans to name a new chief commercial officer by the end of the month. Marett was hired as BioNTech’s COO in 2012 after gigs at GSK, Evotec and Next Pharma, and led its commercial efforts as the Pfizer-partnered Comirnaty received the first FDA approval for a Covid-19 vaccine. BioNTech has also built a cancer portfolio that TD Cowen’s Yaron Werber described as “one of the most extensive” in biotech, from antibody-drug conjugates to CAR-T therapies.

Chris Austin

Chris Austin→ GSK has plucked Chris Austin from Flagship and he’ll start his new gig as the pharma giant’s SVP, research technologies on April 1. After a long career at NIH in which he was director of the National Center for Advancing Translational Sciences (NCATS), Austin became CEO of Flagship’s Vesalius Therapeutics, which debuted with a $75 million Series A two years ago this week but made job cuts that affected 43% of its employees six months into the life of the company. In response to Austin’s departure, John Mendlein — who chairs the board at Sail Biomedicines and has board seats at a few other Flagship biotechs — will become chairman and interim CEO at Vesalius “later this month.”

→ BioMarin has lined up Cristin Hubbard to replace Jeff Ajer as chief commercial officer on May 20. Hubbard worked for new BioMarin chief Alexander Hardy as Genentech’s SVP, global product strategy, immunology, infectious diseases and ophthalmology, and they had been colleagues for years before Hardy was named Genentech CEO in 2019. She shifted to Roche Diagnostics as global head of partnering in 2021 and had been head of global product strategy for Roche’s pharmaceutical division since last May. Sales of the hemophilia A gene therapy Roctavian have fallen well short of expectations, but Hardy insisted in a recent investor call that BioMarin is “still very much at the early stage” in the launch.

Pilar de la Rocha

Pilar de la Rocha→ BeiGene has promoted Pilar de la Rocha to head of Europe, global clinical operations. After 13 years in a variety of roles at Novartis, de la Rocha was named global head of global clinical operations excellence at the Brukinsa maker in the summer of 2022. A short time ago, BeiGene ended its natural killer cell therapy alliance with Shoreline Biosciences, saying that it was “a result of BeiGene’s internal prioritization decisions and does not reflect any deficit in Shoreline’s platform technology.”

Andy Crockett

Andy Crockett→ Andy Crockett has resigned as CEO of KalVista Pharmaceuticals. Crockett had been running the company since its launch in 2011 and will hand the keys to president Ben Palleiko, who joined KalVista in 2016 as CFO. Serious safety issues ended a Phase II study of its hereditary angioedema drug KVD824, but KalVista is mounting a comeback with positive Phase III results for sebetralstat in the same indication and could compete with Takeda’s injectable Firazyr. “If approved, sebetralstat may offer a compelling treatment option for patients and their caregivers given the long-standing preference for an effective and safe oral therapy that provides rapid symptom relief for HAE attacks,” Crockett said last month.

Steven Lo

Steven Lo→ Vaxart has tapped Steven Lo as its permanent president and CEO, while interim chief Michael Finney will stay on as chairman. Endpoints News last caught up with Lo when he became CEO at Valitor, the UC Berkeley spinout that raised a $28 million Series B round in October 2022. The ex-Zosano Pharma CEO had a handful of roles in his 13 years at Genentech before his appointments as chief commercial officer of Corcept Therapeutics and Puma Biotechnology. Andrei Floroiu resigned as Vaxart’s CEO in mid-January.

Kartik Krishnan

Kartik Krishnan→ Kartik Krishnan has taken over for Martin Driscoll as CEO of OncoNano Medicine, and Melissa Paoloni has moved up to COO at the cancer biotech located in the Dallas-Fort Worth suburb of Southlake. The execs were colleagues at Arcus Biosciences, Gilead’s TIGIT partner: Krishnan spent two and a half years in the CMO post, while Paoloni was VP of corporate development and external alliances. In 2022, Krishnan took the CMO job at OncoNano and was just promoted to president and head of R&D last November. Paoloni came on board as OncoNano’s SVP, corporate development and strategy not long after Krishnan’s first promotion.

→ Genesis Research Group, a consultancy specializing in market access, has brought in David Miller as chairman and CEO, replacing co-founder Frank Corvino — who is transitioning to the role of vice chairman and senior advisor. Miller joins the New Jersey-based team with a number of roles under his belt from Biogen (SVP of global market access), Elan (VP of pharmacoeconomics) and GSK (VP of global health outcomes).

Adrian Schreyer

Adrian Schreyer→ Adrian Schreyer helped build Exscientia’s AI drug discovery platform from the ground up, but he has packed his bags for Nimbus Therapeutics’ AI partner Anagenex. The new chief technology officer joined Exscientia in 2013 as head of molecular informatics and was elevated to technology chief five years later. He then held the role of VP, AI technology until January, a month before Exscientia fired CEO Andrew Hopkins.

→ Paul O’Neill has been promoted from SVP to EVP, quality & operations, specialty brands at Mallinckrodt. Before his arrival at the Irish pharma in March 2023, O’Neill was executive director of biologics operations in the second half of his 12-year career with Merck driving supply strategy for Keytruda. Mallinckrodt’s specialty brands portfolio includes its controversial Acthar Gel (a treatment for flares in a number of chronic and autoimmune indications) and the hepatorenal syndrome med Terlivaz.

David Ford

David Ford→ Staying in Ireland, Prothena has enlisted David Ford as its first chief people officer. Ford worked in human resources at Sanofi from 2002-17 and then led the HR team at Intercept, which was sold to Italian pharma Alfasigma in late September. We recently told you that Daniel Welch, the former InterMune CEO who was a board member at Intercept for six years, will succeed Lars Ekman as Prothena’s chairman.

Ben Stephens

Ben Stephens→ Co-founded by Sanofi R&D chief Houman Ashrafian and backed by GSK, Eli Lilly partner Sitryx stapled an additional $39 million to its Series A last fall. It has now welcomed a pair of execs: Ben Stephens (COO) had been finance director for ViaNautis Bio and Rinri Therapeutics, and Gordon Dingwall (head of clinical operations) is a Roche and AstraZeneca vet who led development operations at Mission Therapeutics. Dingwall has also served as a clinical operations leader for Shionogi and Freeline Therapeutics.

Steve Alley

Steve Alley→ MBrace Therapeutics, an antibody-drug conjugate specialist that nabbed $85 million in Series B financing last November, has named Steve Alley as CSO. Alley spent two decades at Seagen before the $43 billion buyout by Pfizer and was the ADC maker’s executive director, translational sciences.

→ California cancer drug developer Apollomics, which has been mired in Nasdaq compliance problems nearly a year after it joined the public markets through a SPAC merger, has recruited Matthew Plunkett as CFO. Plunkett has held the same title at Nkarta as well as Imago BioSciences — leading the companies to $290 million and $155 million IPOs, respectively — and at Aeovian Pharmaceuticals since March 2022.

Heinrich Haas

Heinrich Haas→ Co-founded by Oxford professor Adrian Hill — the co-inventor of AstraZeneca’s Covid-19 vaccine — lipid nanoparticle biotech NeoVac has brought in Heinrich Haas as chief technology officer. During his nine years at BioNTech, Haas was VP of RNA formulation and drug delivery.

Kimberly Lee

Kimberly Lee→ New Jersey-based neuro biotech 4M Therapeutics is making its Peer Review debut by introducing Kimberly Lee as CBO. Lee was hired at Taysha Gene Therapies during its meteoric rise in 2020 and got promoted to chief corporate affairs officer in 2022. Earlier, she led corporate strategy and investor relations efforts for Lexicon Pharmaceuticals.

→ Another Peer Review newcomer, Osmol Therapeutics, has tapped former Exelixis clinical development chief Ron Weitzman as interim CMO. Weitzman only lasted seven months as medical chief of Tango Therapeutics after Marc Rudoltz had a similarly short stay in that position. Osmol is going after chemotherapy-induced peripheral neuropathy and chemotherapy-induced cognitive impairment with its lead asset OSM-0205.

→ Last August, cardiometabolic disease player NeuroBo Pharmaceuticals locked in Hyung Heon Kim as president and CEO. Now, the company is giving Marshall Woodworth the title of CFO and principal financial and accounting officer, after he served in the interim since last October. Before NeuroBo, Woodworth had a string of CFO roles at Nevakar, Braeburn Pharmaceuticals, Aerocrine and Fureix Pharmaceuticals.

Claire Poll

Claire Poll→ Claire Poll has retired after more than 17 years as Verona Pharma’s general counsel, and the company has appointed Andrew Fisher as her successor. In his own 17-year tenure at United Therapeutics that ended in 2018, Fisher was chief strategy officer and deputy general counsel. The FDA will decide on Verona’s non-cystic fibrosis bronchiectasis candidate ensifentrine by June 26.

Nancy Lurker

Nancy Lurker→ Alkermes won its proxy battle with Sarissa Capital Management and is tinkering with its board nearly nine months later. The newest director, Bristol Myers Squibb alum Nancy Lurker, ran EyePoint Pharmaceuticals from 2016-23 and still has a board seat there. For a brief period, Lurker was chief marketing officer for Novartis’ US subsidiary.

→ Chaired by former Celgene business development chief George Golumbeski, Shattuck Labs has expanded its board to nine members by bringing in ex-Seagen CEO Clay Siegall and Tempus CSO Kate Sasser. Siegall holds the top spots at Immunome and chairs the board at Tourmaline Bio, while Sasser came to Tempus from Genmab in 2022.

Scott Myers

Scott Myers→ Ex-AMAG Pharmaceuticals and Rainier Therapeutics chief Scott Myers has been named chairman of the board at Convergent Therapeutics, a radiopharma player that secured a $90 million Series A last May. Former Magenta exec Steve Mahoney replaced Myers as CEO of Viridian Therapeutics a few months ago.

→ Montreal-based Find Therapeutics has elected Tony Johnson to the board of directors. Johnson is in his first year as CEO of Domain Therapeutics. He is also the former chief executive at Goldfinch Bio, the kidney disease biotech that closed its doors last year.

Habib Dable

Habib Dable→ Former Acceleron chief Habib Dable has replaced Kala Bio CEO Mark Iwicki as chairman of the board at Aerovate Therapeutics, which is signing up patients for Phase IIb and Phase III studies of its lead drug AV-101 for pulmonary arterial hypertension. Dable joined Aerovate’s board in July and works part-time as a venture partner for RA Capital Management.

Julie Cherrington

Julie Cherrington→ In the burgeoning world of ADCs, Elevation Oncology is developing one of its own that targets Claudin 18.2. Its board is now up to eight members with the additions of Julie Cherrington and Mirati CMO Alan Sandler. Cherrington, a venture partner at Brandon Capital Partners, also chairs the boards at Actym Therapeutics and Tolremo Therapeutics. Sandler took the CMO job at Mirati in November 2022 and will stay in that position after Bristol Myers acquired the Krazati maker.

Patty Allen

Patty Allen→ Lonnie Moulder’s Zenas BioPharma has welcomed Patty Allen to the board of directors. Allen was a key figure in Vividion’s $2 billion sale to Bayer as the San Diego biotech’s CFO, and she’s a board member at Deciphera Pharmaceuticals, SwanBio Therapeutics and Anokion.

→ In January 2023, Y-mAbs Therapeutics cut 35% of its staff to focus on commercialization of Danyelza. This week, the company has reserved a seat on its board of directors for Nektar Therapeutics CMO Mary Tagliaferri. Tagliaferri also sits on the boards of Enzo Biochem and is a former board member of RayzeBio.

→ The ex-Biogen neurodegeneration leader at the center of Aduhelm’s controversial approval is now on the scientific advisory board at Asceneuron, a Swiss-based company focused on Alzheimer’s and Parkinson’s. Samantha Budd-Haeberlein tops the list of new SAB members, which also includes Henrik Zetterberg, Rik Ossenkoppele and Christopher van Dyck.

nasdaq covid-19 vaccine treatment fda therapy rna brazil europeInternational

Deflationary pressures in China – be careful what you wish for

Until recently, China’s decelerating inflation was welcomed by the West, as it led to lower imported prices and helped reduce inflationary pressures….

Until recently, China’s decelerating inflation was welcomed by the West, as it led to lower imported prices and helped reduce inflationary pressures. However, China’s consumer prices fell for the third consecutive month in December 2023, delaying the expected rebound in economic activity following the lifting of COVID-19 controls. For calendar year 2023, CPI growth was negligible, whilst the producer price index declined by 3.0 per cent.

China’s inflation dynamics

Chinese consumers are hindered by the weaker residential property market and high youth unemployment. Several property developers have defaulted, collectively wiping out nearly all the U.S.$155 billion worth of U.S. dollar denominated-bonds.

Meanwhile, the Shanghai Composite Index is at half of its record high, recorded in late 2007. The share prices of major developers, including Evergrande Group, Country Garden Holdings, Sunac China and Shimao Group, have declined by an average of 98 per cent over recent years. Some economists are pointing to the Japanese experience of a debt-deflation cycle in the 1990s, with economic stagnation and elevated debt levels.

Australia has certainly enjoyed the “pull-up effect” from China, particularly with the iron-ore price jumping from around U.S.$20/tonne in 2000 to an average closer to U.S.$120/tonne over the 17 years from 2007. With strong volume increases, the value of Australia’s iron ore exports has jumped 20-fold to around A$12 billion per month, accounting for approximately 35 per cent of Australia’s exports.

For context, China takes 85 per cent of Australia’s iron ore exports, whilst Australia accounts for 65 per cent of China’s iron ore imports. China’s steel industry depends on its own domestic iron ore mines for 20 per cent of its requirement, however, these are high-cost operations and need high iron ore prices to keep them in business. To reduce its dependence on Australia’s iron ore, China has increased its use of scrap metal and invested large sums of money in Africa, including the Simandou mine in Guinea, which is forecast to export 60 million tonnes of iron ore from 2028.

The Chinese housing market has historically been the source of 40 per cent of China’s steel usage. However, the recent high iron ore prices are attributable to the growth in China’s industrial and infrastructure activity, which has offset the weakness in residential construction.

Whilst this has continued to deliver supernormal profits for Australia’s major iron ore producers (and has greatly assisted the federal budget), watch out for any sustainable downturn in the iron ore price, particularly if the deflationary pressures in China continue into the medium term.

unemployment covid-19 bonds shanghai composite housing market africa chinaGovernment

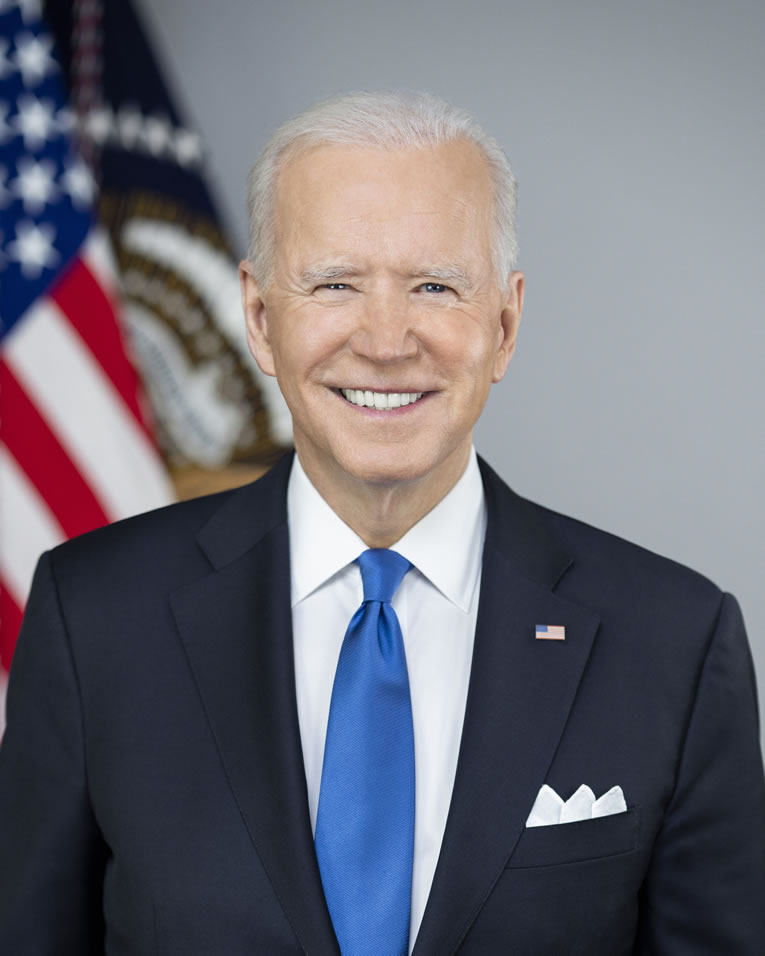

Biden to call for first-time homebuyer tax credit, construction of 2 million homes

The president will announce a series of housing proposals in his 2024 State of the Union address tonight.

The White House announced that President Joe Biden will call on lawmakers in the House of Representatives and the Senate to address a series of housing issues in his State of the Union address, which will be delivered to a joint session of Congress and televised nationally on Thursday night.

In the address, the president will call for a $10,000 tax credit for both first-time homebuyers and people who sell their starter homes; the construction and renovation of more than 2 million additional homes; and cost reductions for renters.

Biden will also call for “lower homebuying and refinancing closing costs and crack down on corporate actions that rip off renters,” according to the White House announcement.

The mortgage relief credit would provide “middle-class first-time homebuyers with an annual tax credit of $5,000 a year for two years,” according to the announcement. This would act as an equivalent to reducing the mortgage rate by more than 1.5% on a median-priced home for two years, and it is estimated to “help more than 3.5 million middle-class families purchase their first home over the next two years,” the White House said.

The president will also call for a new credit to “unlock inventory of affordable starter homes, while helping middle-class families move up the housing ladder and empty nesters right size,” the White House said.

Addressing rate lock-ins

Homeowners who benefited from the post-pandemic, low-rate environment are typically more reluctant to sell and give up their rate, even if their circumstances may not fit their needs. The White House is looking to incentivize those who would benefit from a new home to sell.

“The president is calling on Congress to provide a one-year tax credit of up to $10,000 to middle-class families who sell their starter home, defined as homes below the area median home price in the county, to another owner-occupant,” the announcement explained. “This proposal is estimated to help nearly 3 million families.”

The president will also reiterate a call to provide $25,000 in down payment assistance for first-generation homebuyers “whose families haven’t benefited from the generational wealth building associated with homeownership,” which is estimated to assist 400,000 families, according to the White House.

The White House also pointed out last year’s reduction to the mortgage insurance premium (MIP) for Federal Housing Administration (FHA) mortgages, which save “an estimated 850,000 homebuyers and homeowners an estimated $800 per year.”

In Thursday’s State of the Union address, the president is expected to announce “new actions to lower the closing costs associated with buying a home or refinancing a mortgage,” including a Federal Housing Finance Agency (FHFA) pilot program that would “waive the requirement for lender’s title insurance on certain refinances.”

The White House says that, if enacted, this would save thousands of homeowners up to $1,500 — or an average of $750.

Supply and rental challenges

Housing supply continues to be an issue for the broader housing market, and the president will call on Congress to pass legislation “to build and renovate more than 2 million homes, which would close the housing supply gap and lower housing costs for renters and homeowners,” the White House said.

This would be accomplished by an expansion of the Low-Income Housing Tax Credit (LIHTC) to build or preserve 1.2 million affordable rental units, as well as a new Neighborhood Homes Tax Credit that would “build or renovate affordable homes for homeownership, which would lead to the construction or preservation of over 400,000 starter homes.”

A new $20 billion, competitive grant program the president is expected to unveil during the speech would also “support the construction of affordable multifamily rental units; incentivize local actions to remove unnecessary barriers to housing development; pilot innovative models to increase the production of affordable and workforce rental housing; and spur the construction of new starter homes for middle-class families,” the White House said.

Biden will also propose that each Federal Home Loan Bank double its annual contribution to the Affordable Housing Program, raising it from 10% of prior year net income to 20%. The White House estimates that this “will raise an additional $3.79 billion for affordable housing over the next decade and assist nearly 380,0000 households.”

Biden will propose several new provisions designed to control costs for renters, including the targeting of corporate landlords and private equity firms, which have been “accused of illegal information sharing, price fixing, and inflating rents,” the White House said.

The president will also reference the administration’s “war on junk fees,” targeting those that withstand added costs in the rental application process and throughout the duration of a lease under the guise of “convenience fees,” the White House said.

And Biden is expected to call on Congress to further expand rental assistance to more than 500,000 households, “including by providing a voucher guarantee for low-income veterans and youth aging out of foster care.”

Housing association responses

Housing associations such as the Mortgage Bankers Association (MBA) and the National Housing Conference (NHC) quickly responded to the news. The NHC lauded the development.

“This is the most consequential State of the Union address on housing in more than 50 years,” NHC President and CEO David Dworkin said. “President Biden’s call for Congress to tackle the urgent matter of housing affordability through tax credits, down payment assistance initiatives, and other measures is warranted and represents a crucial step in easing the burden of high rents and home prices.”

MBA President and CEO Bob Broeksmit explained that while the association will review all of the proposals in-depth, it welcomes the Biden administration’s focus on reforms that can expand single-family and multifamily housing supply. It is also wary of some of the proposals.

“MBA has significant concerns that some of the proposals on closing costs and title insurance could undermine consumer protections, increase risk, and reduce competition,” Broeksmit said. “Suggestions that another revamp of these rules is needed depart from the legal regime created by Congress in the Dodd-Frank Act and will only increase regulatory costs and make it untenable for smaller lenders to compete.”

housing market pandemic white house congress senate house of representatives-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges