Uncategorized

Housing Market Tracker: Inventory and purchase applications data fall together

Purchase applications fell 10% and housing inventory decreased by 8.664 units last week, according to the Housing Market Tracker.

Despite mortgage rates briefly falling below the 6% threshold, both housing inventory and mortgage demand fell last week. Let’s dive into the trend lines of the housing market.

First, here is a quick housing market rundown from last week:

- Purchase application data was negative 10% week to week — but still positive for the year

- Housing inventory decreased by 8,664 units, a more extensive inventory decline than we saw in the prior week

- The 10-year yield had a wild week, and mortgage rates did break under 6% for a day and then rose after the more substantial than-expected jobs number

Purchase Application Data

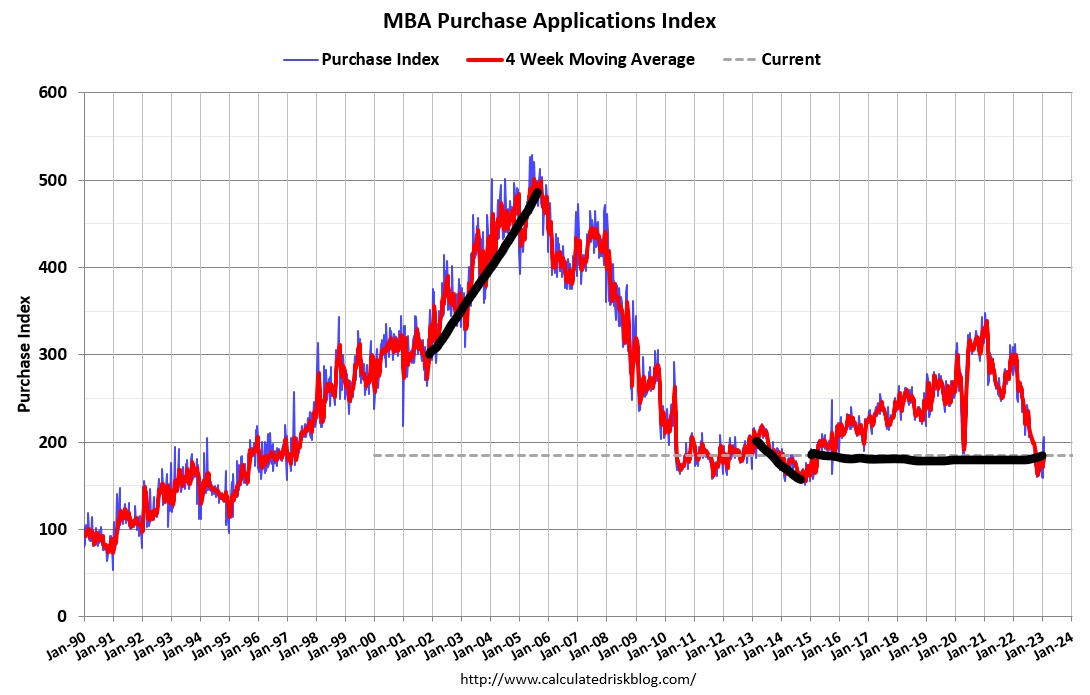

We took a step backward last week with a 10% decline in purchase apps from the prior week. That’s after positive growth of 25% and 3% over the prior two weeks, respectively. It’s disappointing but I ask you to remember a key date – Nov. 9, 2022. Once you make seasonal adjustments with purchase application data, that’s where the data line begins to show improvement.

We are well into the seasonal demand increase for purchase applications if demand grows; this means the heavy volume period on this data line is between the second week of January and the first week of May. After May, total volumes traditionally fall. We are working from a shallow bar in this index – seven years of growth were taken away in one year in 2022. The bar is so low we can trip over it! However, with that said, purchase apps have started to improve from the waterfall dive on Nov. 9, 2022. I put more weight on the year-over-year data, and not only has the bleeding stopped in this data trend line, but even with the 10% weekly decline last week, we have also been able to bounce from the lows created recently.

The show-me part of the housing market starts with this bounce from an extreme bottom. Purchase application data is forward looking for 30-90 days; the bleeding stopping from a low base is a good start. However, we are going to see if 6% mortgage rates are good enough to create some growth in the future or if the housing market needs rates near 5%. Last year, when rates dropped to 5%, we saw some demand pick back up. But that 5% level didn’t last long, and then rates spiked back up to 7.37%. We might see volatility in this data line until it stabilizes, so I cautioned people to read big positive or negative moves with some grain of salt on the weekly data until things settle down. However, one thing is for sure, the housing market found a working bottom, and the weekly tracker is more critical than ever.

Weekly Housing Inventory

A few weeks ago, I was encouraged that we had a slight increase in inventory and a small decline the following week. We have had back-to-back weeks of noticeable decline in the Altos weekly inventory data. This week inventory fell 8,664 units from the previous week.

Altos Research Weekly Chart

Hopefully, we will get the seasonal inventory push sooner in 2023 than we did in the last two years. It’s a small grace that inventory is still higher this year than last year. Last year we saw a decline in inventory during this period; mortgage rates were still much lower last year.

Since purchase application data started to improve from Nov. 9, 2022, it fits into the 30-90 day forward-looking sales data line. We could be getting some lower inventory now because of the slightly better demand. We recently saw the pending home sales data turn positive for the first time in many months.

- Weekly inventory change (Jan. 27 – Feb 3, 2023): Fell From 465,654 to 456,990

- Same week last year (Jan. 28 – Feb 4 ): Fell from 271,954 to 255, 662

One of the concerns I have had with the housing market is the post-2020 inventory channel, which took us to all-time lows. When rates were below 4%, this created massive housing inflation. Now that rates are above 6%, we don’t see the same type of housing inflation data we had from 2020 up until rates broke over 5.875% in 2022. However, as you can see below, we don’t have much breathing room to get back below all-time lows if demand picks up and inventory levels don’t grow. We don’t have a high price growth problem now and shouldn’t be with rates over 6%, as we saw in 2020, 2021, and the early part of 2022 when mortgage rates were lower. As you can see below, we don’t have a lot of housing products available for a country of 330,000,000 people.

NAR Inventory Levels: 970,000

We should be getting the seasonal inventory push higher in inventory soon; I hope we do. The question is, right now, how much is demand hitting the inventory levels? And should we be concerned if new listing data doesn’t grow much this year? I would be concerned if I were you. A great chart from Freddie Mac shows the trouble with having rates too high as new listing data declines. When I am rooting for more inventory, I am rooting for more sellers who are buyers of homes once they sell; this brings us back to a regular housing market.

One thing we have seen post COVID-19 that when new listing data does decline, we can have a waterfall dive in demand. The first time was a global pandemic, and once people got back to standard, new listing data grew, as did sales. In 2022, rates were simply too high for people to want to sell and buy another home after the sale.

10-year yield and mortgage rates

Last week we had a lot of action but didn’t end up anywhere again. The Fed meeting sent bond yields lower only to regain some of that move by the end of the day, and then on Friday bond yields shot up higher after the better-than-expected jobs report. https://www.housingwire.com/articles/positive-jobs-report-sends-mortgage-rates-higher/

I have long stressed that breaking below 3.42% on the 10-year was going to be tough, so much so that I joke that I brought out Gandalf from “Lord of the Rings,” who says you shall not pass. Well we haven’t been able to do so for some time now. Mortgage rates did break below 6% last week for the first time in a while but rose from 5.99% to 6.19% after the stronger-than-anticipated jobs data.

Part of my 2023 forecast for the 10-year yield is that if the economy stays firm, the 10-year yield range should be between 3.21%-4.25%, meaning mortgage rates between 5.75%-7.25%. With economic weakness, bond yields could quickly drop to 2.72%, taking mortgage rates near 5%. So far, the economic data has stayed firm, with some recent positive data from the housing market as the builder’s confidence and pending home sales data have shown some growth from epic dives lower.

The week ahead

Last week we had a bunch of labor data that was very positive, with over 11 million job openings, jobless claims under 200,000, and an unemployment rate of 3.4%. We had all this with the growth rate of inflation still falling and falling wage growth data—so much for us needing a job loss recession for the growth rate of inflation to fall.

This week will be a very light economic data week; we have Tuesday’s trade balance data, the critical jobless claims data on Thursday, and the Michigan consumer index on Friday. We always want to keep a close eye on jobless claims because my entire Fed pivot is only based on the labor market breaking, and that would require jobless claims getting to 323,000 on the four-week moving average, which we are far from as we are at 191,750. The Fed is more focused on inflation and wage growth, so we can have positive economic data without worrying about the Fed’s need to be more aggressive.

I find it hilarious that the people who said we were in a recession last year are now screaming for the Fed to hike more aggressively because the economy is too strong and inflation can grow. I have been on Recession Watch since Aug. 5, 2022, but the two things I need to see to create a softer landing or a lighter recession are the same things I wrote back on Aug. 5.

With that in mind, how might this reverse? Well, the two easy answers are this:

1. Rates fall to get the housing sector back in line

2. Growth rate of inflation falls, and the Fed stops hiking rates and reverses course, as they did in 2018

The inflation growth rate has cooled, and mortgage rates have fallen from recent highs, but the Fed is still hiking. They’re almost done but are not close to cutting rates. We don’t have everything I want, but it’s a start. For housing and going forward, it’s all about mortgage rates, and the growth of inflation and economic data will be critical to monitor each week.

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

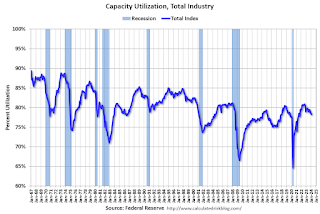

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Uncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex