Uncategorized

Houseparty’s founder launches Towns, an open source group chat web app and protocol

After launching a pair of well-loved but ultimately star-crossed social apps, Ben Rubin is going all-in on decentralization. Rubin previously founded Meerkat…

After launching a pair of well-loved but ultimately star-crossed social apps, Ben Rubin is going all-in on decentralization.

Rubin previously founded Meerkat and Houseparty — apps that pioneered mobile livestreaming and group video chat, respectively — shaping massive social trends in their earliest stages. After working on Slashtalk, an “anti-meeting tool” for the workplace, Rubin is now back to working on consumer apps, albeit in a roundabout way.

These days, Rubin’s vision for social media bears little resemblance with the colorful, user-friendly apps he’s known for popularizing. He’s clearly internalized the lessons of Meerkat’s unfortunate demise and Houseparty’s premature pre-pandemic death-by-acquisition via Epic Games. Rubin is something of a Web3 true believer now, happy to weather the frenzied speculative investment cycles and Sam Bankman-Frieds while holding out hope that the underlying technologies can still unlock a better future for some aspects of the web.

Rubin is currently running Here Not There Labs — “a team of web3 creators dropping projects as we go.” Brian Meek, a longtime former Microsoft employee who worked on Skype’s mobile app, serves as the company’s co-founder and CTO.

Their new project is Towns, a protocol and a web-based chat app designed to facilitate self-owned, self-governed online communities. Because web3, there’s also a crypto component, so Towns will likely initially appeal much more to enthusiasts in that community than the average app store-goer like his past projects.

Out of the gate, Here Not There Labs has picked up a $25.5 million Series A round from A16z Crypto, which joins its existing backers Benchmark and Framework Ventures. It’s also picked up the Towns.com domain (for the low, low price of a couple hundred thousand dollars), a point of pride for Rubin and a mark of his plans for a long game.

“This is this is not just a crypto project — this is a new way of thinking about social networking as a network that is owned and operated by its constituents,” Rubin told TechCrunch. “And I think that’s very exciting to me, especially coming from the experience I had with Meerkat and then Houseparty, where a lot of us didn’t want to sell… But we didn’t govern our own product at [that] point and that’s a product that got to 150 million users.”

The Towns protocol will offer users an Ethereum-based smart contracts system (think miniature programs that live on and are executed through the blockchain) and end-to-end encrypted chat. Here Not There Labs says Towns’ smart contracts that are “extensible, composable, and upgradeable” and will ultimately empower communities to draft their own rules for who gets to participate, what is allowed and how and if they’ll monetize. The Towns backend will run on a relatively centralized proof-of-authority algorithm initially while the team builds out the protocol and will then move to a proof-of-stake system à la Ethereum 2.0 in time.

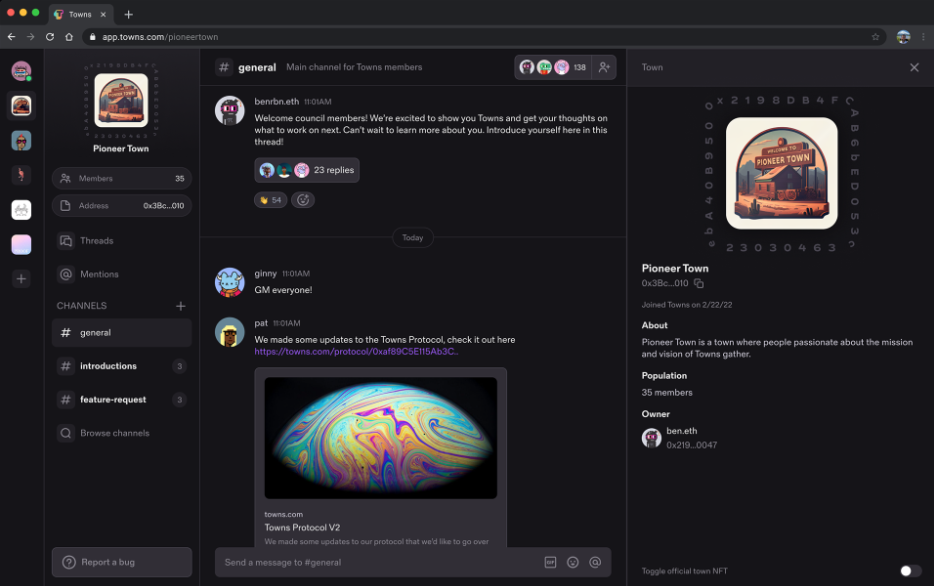

If the interface looks familiar, it’s not just you. Image Credits: Towns

For users less interested in the wonkier crypto aspects but still intrigued by the promise of decentralization, Towns will also manifest as a set of apps, starting with an invite-only alpha web app that’s live today. As the company explains it, “The Towns app takes all the technical things the protocol implements and makes them available in an open-source, end-to-end encrypted delightful chat experience” — an experience more appealing for users whose eyes glaze over at the mention of NFTs and DAOs.

A broader beta launch that will let anyone create their own community with the protocol is slated for September with a mobile web app on the way in the coming months and native apps thereafter. Down the road, Rubin expects there to be many user-created Towns apps built using the project’s protocol.

For now, the earliest users will have to log in to town with their crypto wallet — a landing page that your average non-crypto person is likely to find confusing at best — but Towns plans to add support for Passkeys, Apple’s next-generation login technology.

Towns wants communities to “truly own their town squares,” though notably the project plans to take a cut of the crypto that gets traded around in those communities to sustain itself. Those specifics will be ironed out as the governance structure gets set up, according to Rubin. Here Not There Labs says it will only run the show in the beginning and decentralize over time, handing the reins over to a Towns-specific DAO (decentralized autonomous organization) that will oversee its governance and make decisions.

“It’s kind of funny, there’s one person who’s controlling one platform that everybody uses, which is Facebook, and then now there’s another person who’s controlling the other platform that everybody uses, which is Twitter,” Rubin said, noting his unease with consolidation in other industries, like Nestlé’s big bottled water play in North America.

The user experience of the Towns web app bears a striking resemblance to Discord and it seems obvious that the project plans to lure disenchanted members of that more traditional chat app’s crypto community. Towns might be inspired by Discord’s design and utility, but if you ask Rubin, Discord isn’t a community model that should inspire its users. “They rent — they have a landlord called Discord and they rent from them,” he said.

What’s less clear is if Towns could have more mainstream appeal to the kind of people who’ve grown uncomfortable with Twitter’s Elon Musk era and are willing to decamp for decentralized but still pretty user-friendly social spaces like Mastodon. Mastodon takes more after Twitter — Towns is very much a chat tool — but the ethos is similar, even if the emphasis on crypto isn’t shared.

Since the project is still in its early days and does have a heavy crypto tie-in, Towns seems designed to appeal strongly to Rubin’s fellow web3 true believers for now. If that will change in time remains to be seen but there’s certainly a growing appetite for online social experiences that aren’t subject to the whims of the mercurial billionaire du jour.

“I think there’s something really exciting about securing that the ability of humans to coordinate and collaborate,” Rubin said. “The idea that it’s censorship-resistant, that it’s encrypted and is owned and operated by the users.”

Houseparty’s founder launches Towns, an open source group chat web app and protocol by Taylor Hatmaker originally published on TechCrunch

ethereum blockchain crypto pandemic cryptoUncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges