Hot Reddit Penny Stocks For Your Watch List In March 2021

Popular Penny Stocks On Reddit Gain Interest But Will They Gain In The Market?

The post Hot Reddit Penny Stocks For Your Watch List In March 2021 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

Reddit Penny Stocks Continue Surging But Are They Worth The Risk?

The stock market continues selling off today and many penny stocks weren’t immune to this drop either. Even some of the sectors that tend to perform well in environments like this were seen pulling back during Friday’s morning session. There’s no single root cause but several moving parts to consider.

First, the most recent reaction or lack thereof by Federal Reserve Chairman, Jerome Powell didn’t warm the hearts of investors this week. His commentary on the economic outlook did very little to quell fears of rising rates. Friday morning another bomb was dropped as bond yields continue surging. The 10 year note was trading at 1.57% at 10:30 a.m. EST. This came after reaching an intraday high of 1.626%. The 30-year Treasury bond yield rose to 2.34%. These higher yields triggered more fears on the interest rate outlook and, in turn, markets continued sliding.

[Read More] Personalized Medicine Should Be At The Top Of Your List In 2021 & Here’s Why

Tech helped lead the charge lower on Friday. One of the benchmark Technology ETFs (NYSE: XLK) posted its 4th consecutive day of losses dropping to levels not seen since December. Thursday’s sell-off, by far, was one of the highest days of trading volume for the XLK in almost a year. In fact, the last time the ETF traded 38 million shares or more was March 23rd of 2020. So it makes sense that some traders have experienced some flashbacks to when the pandemic began hitting stocks last year.

Where Should Traders Look Next?

In an email to CNBC, Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, said, “This should continue to push treasury yields higher and will present a headwind to those sectors that did so well last year like Technology, Communication Services and, to a lesser extent, Consumer Discretionary (particularly because of Amazon).”

While this doesn’t necessarily mean all penny stocks in these sectors are selling off, it could mean there’s a more negative sentiment to fight through than other sectors. Traders will likely need to be a bit pickier when it comes to making money with penny stocks while markets trade lower. For instance, one of the standout penny stocks this morning was Second Sight Medical (NASDAQ: EYES). Shares gapped up early after the company made premarket headlines. Second Sight announced that it received FDA approval for its Argus 2s retinal prosthesis system.

Right now, Second Sight is working on completion of its business combination with Pixium Vision. So as to when or if the company begins production of the newly approved hardware is still up in the air. if the combination goes through, obviously the new management will have to review the viability of the platform as it pertains to its business model. While EYES stock surged over 100%, many biotechs were getting hit hard. My point is that just because a sector is getting sold, that doesn’t mean all penny stocks follow suit.

What Penny Stocks Are Retail Traders Talking About Right Now?

This brings me to my point earlier. Retail traders continue looking for new opportunities. In this instance, many continue looking at social media outlets like Reddit to get certain ideas. There was even a new ETF launched this week that is based on the premise of trading Reddit stocks.

The VanEck Vectors Social Sentiment ETF (NYSE: BUZZ) tracks the performance of the “75 large-cap U.S. stocks which exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources including social media, news articles, blog posts, and other alternative datasets.”

The BUZZ ETF has been trading for 2 days and is down around 9% from its opening debut. This week, some of the largest holdings of the ETF included Ford (NYSE: F), DraftKings (NASDAQ: DKNG), Twitter (NYSE: TWTR), and Facebook (NASDAQ: FB). All of these stocks traded lower on Friday in tandem with the broader markets. But those on Reddit are actually looking for different names that aren’t on that BUZZ list of stocks.

[Read More] Are Penny Stocks Worth It? Bally’s Just Made A $100 Million Bet On 1

Checking out subreddits like r/PennyStocks shows that attention is more on OTC penny stocks and lower-priced NASDAQ/NYSE names right now believe it or not. In the case of OTC stocks, however, these tend to be much more high-risk, have minimal information available, and, in general, are more likely to fall victim to manipulation in certain circumstances. However, that hasn’t stopped Reddit traders from talking about these penny stocks.

Popular Penny Stocks On Reddit

While r/PennyStocks isn’t the only sub that discusses penny stocks, it is one of the larger ones. Among all of the loss porn Memery, there were a few penny stocks gaining attention.

Aside from EYES, other popular penny stocks on Reddit included:

- Enzolytics Inc. (OTC: ENZC)

- Assertio Holdings (NASDAQ: ASRT)

- Citius Pharmaceuticals (NASDAQ: CTXR)

However, none of these penny stocks were the embodiment of bullish momentum. Needless to say, these were among a list of penny stocks that were actively being discussed. Now, it’s important to keep in mind that just because they’re popular doesn’t mean they’re the best penny stocks to buy. However, they may be worth a closer look as some retail traders have begun discussions on them.

Enzolytics Inc.

This is one of the OTC penny stocks on the list. The company specializes in drug development. Its lead compound, ITV-1, is known as a “suspension of Inactivated Pepsin Fraction.” According to the company, studies have shown that it is effective in treating things like HIV/AIDS. This Inactivated Pepsin Fraction is the active ingredient in ITV-1. What’s more, is that ITV-1/IPF was tested against human coronavirus 229E Strain (HCoV-229E) and “exhibited comparable efficacy but with a 20-fold lower toxicity than the widely used anti-influenza medicine Tamiflu®.”

ENZC stock has been under considerable amounts of pressure for the better part of the last month, falling from highs of $0.958 to recent lows of $0.2204. However, the same day (3/5) it hit those lows, ENZC stock also bounced back nearly 30%. So, is momentum back in the market for this OTC penny stock, or is this just a short reprieve in a larger downtrend?

Assertio Holdings

Shares of Assertio have also been under pressure for weeks now. After reaching a high of $1.45 early last month, the penny stock has been sliding. ASRT stock reached a low on Friday of $0.76, just shy of its 50-day moving average. The commercial pharmaceutical company has been working on restructuring its business, including raising millions in capital over the last few months.

The company has built up a portfolio of branded prescription products targeting multiple indications. These include neurology, pain, and inflammation. Considering the current market conditions, it doesn’t look like ASRT stock is doing anything much different from other sector stocks. Something Redditors may be asking is, what will the future hold after this restructuring process? Is there hope, or will ASRT continue dropping?

Citius Pharmaceuticals

Finally, Citius Pharmaceuticals Inc. mirrored the market for the last few weeks. Since February 22nd, shares of CTXR stock have slid lower. One of the catalysts for this slide was the announcement of a $76.5 million raise at $1.505 per share.

Obviously, when companies raise money, it can add to the potential for dilution in the market and, in turn, potentially lower prices due to more shares being sold. However, on the other side of this event comes fresh capital. In this case, Citius earmarked some of the proceeds for things like pre-clinical and clinical development of its product candidates.

Read More

- Looking For Penny Stocks To Buy Now? 3 Cheap Stocks To Watch

- Are Penny Stocks Worth It? These 4 Surged As Markets Sold Off

Next week the company presents at the H.C. Wainwright Global Life Sciences Conference. On March 9th, Citius will give an overview and an update on its pipeline, including lead product, Mino-Lok, which is currently in Phase 3 trials. Mino-Lok is Citius’ antibiotic lock solution used to treat patients with catheter-related bloodstream infections.

The post Hot Reddit Penny Stocks For Your Watch List In March 2021 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq stocks pandemic coronavirus federal reserve etf penny stocks otc fdaGovernment

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

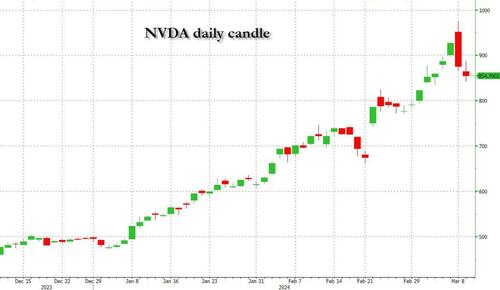

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Spread & Containment

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges