A medical waste treatment system, which is capable of 99.9999 percent sterilization by using high-temperature and high-pressure steam, has been developed for the first time in the country.

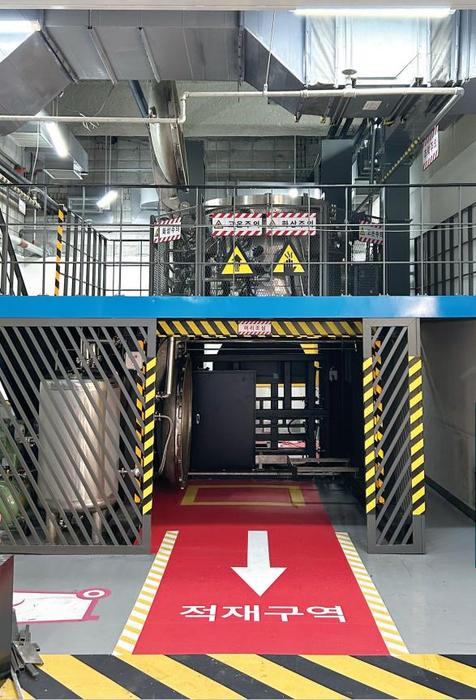

The Korea Institute of Machinery and Materials (President Seog-Hyeon Ryu, hereinafter referred to as KIMM), an institute under the jurisdiction of the Ministry of Science and ICT, has succeeded in developing an on-site-disposal type medical waste sterilization system that can help to resolve the problem caused by medical waste, which has become a national and social issue as the volume of medical waste continues to increase every year. This project was launched as a basic business support program of the KIMM and was expanded into a demonstration project of Daejeon Metropolitan City. Then, in collaboration with VITALS Co., Ltd., a technology transfer corporation, the medical waste treatment system was developed as a finished product capable of processing more than 100 kilograms of medical waste per hour, and was demonstrated at the Chungnam National University Hospital.

Moreover, the installation and use of this product have been approved by the Geumgang Basin Environmental Office of the Ministry of Environment. All certification-related work for the installation and operation of this product at the Chungnam National University Hospital has been completed, including the passage of an installation test for efficiency and stability conducted by the Korea Testing Laboratory.

Through collaboration with VITALS Co., Ltd., a corporation specializing in inhalation toxicity systems, the research team led by Principal Researcher Bangwoo Han of the Department of Urban Environment Research of the KIMM’s Eco-Friendly Energy Research Division developed a high-temperature, high-pressure steam sterilization-type medical waste treatment system by using a high-temperature antimicrobial technology capable of processing biologically hazardous substances such as virus and bacteria with high efficiency. After pulverizing medical waste into small pieces so that high-temperature steam can penetrate deep into the interior of the medical waste, steam was then compressed in order to raise the boiling point of the saturated steam to over 100 degrees Celsius, thereby further improving the sterilization effect of the steam.

Meanwhile, in the case of the high-pressure steam sterilization method, it is vitally important to allow the airtight, high-temperature and high-pressure steam to penetrate deep into the medical waste. Therefore, the research team aimed to improve the sterilization effect of medical waste by increasing the contact efficiency between the pulverized medical waste and the aerosolized steam.

By using this technology, the research team succeeded in processing medical waste at a temperature of 138 degrees Celsius for 10 minutes or at 145 degrees Celsius for more than five (5) minutes, which is the world’s highest level. By doing so, the research team achieved a sterilization performance of 99.9999 percent targeting biological indicator bacteria at five (5) different locations within the sterilization chamber. This technology received certification as an NET (New Excellent Technology) in 2023.

Until now, medical waste has been sterilized by heating the exposed moisture using microwaves. However, this method requires caution because workers are likely to be exposed to electromagnetic waves and the entrance of foreign substances such as metals may lead to accidents.

In Korea, medical waste is mostly processed at exclusive medical waste incinerators and must be discharged in strict isolation from general waste. Hence, professional efforts are required to prevent the risk of infection during the transportation and incineration of medical waste, which requires a loss of cost and manpower.

If medical waste is processed directly at hospitals and converted into general waste by applying the newly developed technology, this can help to eliminate the risk of infection during the loading and transportation processes and significantly reduce waste disposal costs. By processing 30 percent of medical waste generated annually, hospitals can save costs worth KRW 71.8 billion. Moreover, it can significantly contribute to the ESG (environmental, social, and governance) management of hospitals by reducing the amount of incinerated waste and shortening the transportation distance of medical waste.

[*Allbaro System (statistical data from 2021): Unit cost of treatment for each type of waste for the calculation of performance guarantee insurance money for abandoned wastes (Ministry of Environment Public Notification No. 2021-259, amended on December 3, 2021). Amount of medical waste generated on an annual basis: 217,915 tons; Medical waste: KRW 1,397 per ton; General waste from business sites subject to incineration: KRW 299 per ton]

As the size and structure of the installation space varies for each hospital, installing a standardized commercial equipment can be a challenge. However, during the demonstration process at the Chungnam National University Hospital, the new system was developed in a way that allows the size and arrangement thereof to be easily adjusted depending on the installation site. Therefore, it can be highly advantageous in terms of on-site applicability.

Principal Researcher Bangwoo Han of the KIMM was quoted as saying, “The high-temperature, high-pressure steam sterilization technology for medical waste involves the eradication of almost all infectious bacteria in a completely sealed environment. Therefore, close cooperation with participating companies that have the capacity to develop airtight chamber technology is very important in materializing this technology.” He added, “We will make all-out efforts to expand this technology to the sterilization treatment of infected animal carcasses in the future.”

President Seog-Hyeon Ryu of the KIMM was quoted as saying, “The latest research outcome is significantly meaningful in that it shows the important role played by government-contributed research institutes in resolving national challenges. The latest technology, which has been developed through the KIMM’s business support program, has been expanded to a demonstration project through cooperation among the industry, academia, research institutes, and the government of Daejeon Metropolitan City.” President Ryu added, “We will continue to proactively support these regional projects and strive to develop technologies that contribute to the health and safety of the public.”

Meanwhile, this research was conducted with the support of the project for the “development of ultra-high performance infectious waste treatment system capable of eliminating 99.9999 percent of viruses in response to the post-coronavirus era,” one of the basic business support programs of the KIMM, as well as the project for the “demonstration and development of a safety design convergence-type high-pressure steam sterilization system for on-site treatment of medical waste,” part of Daejeon Metropolitan City’s “Daejeon-type New Convergence Industry Creation Special Zone Technology Demonstration Project.”

###

The Korea Institute of Machinery and Materials (KIMM) is a non-profit government-funded research institute under the Ministry of Science and ICT. Since its foundation in 1976, KIMM is contributing to economic growth of the nation by performing R&D on key technologies in machinery and materials, conducting reliability test evaluation, and commercializing the developed products and technologies.

This research was conducted with the support of the project for the “development of ultra-high performance infectious waste treatment system capable of eliminating 99.9999 percent of viruses in response to the post-coronavirus era,” one of the basic business support programs of the KIMM, as well as the project for the “demonstration and development of a safety design convergence-type high-pressure steam sterilization system for on-site treatment of medical waste,” part of Daejeon Metropolitan City’s “Daejeon-type New Convergence Industry Creation Special Zone Technology Demonstration Project.”