Uncategorized

Higher-For-Longer’s Day Of Reckoning Is Looming

Higher-For-Longer’s Day Of Reckoning Is Looming

Authored by Simon White, Bloomberg macro strategist,

The pressure on the Federal Reserve…

Authored by Simon White, Bloomberg macro strategist,

The pressure on the Federal Reserve to relent on keeping rates higher for longer will become acute in the coming months as recession risk rises and inflation remains benign.

Recessions are rarely surprising, but they are often shocking. They are a feature of the business cycle and therefore their occurrence is to be expected. But their very nature means that the abruptness with which they occur is a shock that catches most people – and the market – unawares.

We are in a period now where the risk of a recessionary shock has risen and will continue to rise - right at the time when a soft or no-landing outcome has become the dominant narrative.

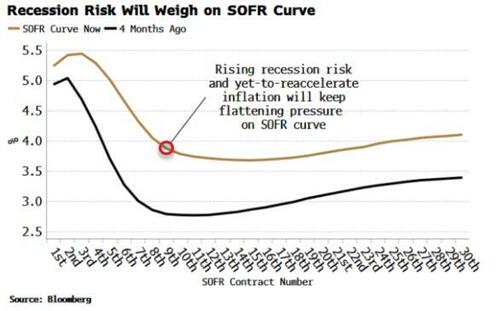

Pressure on the Fed to cut rates will intensify in the coming months, especially if inflation has not yet begun to re-accelerate (as I think it eventually will). These dynamics will add to flattening pressure on the fed funds and SOFR curves, and steepening support for the yield curve.

The shock of recessions is explained by two key features:

-

the suddenness of their onset; and

-

the wide gulf between actual growth and expectations when they occur.

Recessions are regime shifts. They happen when hard, real-economy data and soft, market and survey-based data begin reinforcing one other negatively. Worse-than-expected economic data will negatively impact markets. Weaker markets, if they persist, will negatively affect the real economy through channels such as wider credit spreads and a deterioration in the wealth effect from falling asset prices.

A further weakening in the real economy feeds back into markets and surveys, denting confidence yet more. If this process continues past a certain threshold, there is a cascading effect, and a recession rapidly occurs.

The chart below shows how hard and soft data interact. There are frequent occasions when soft data becomes stressed, but if the hard data does not worsen as well, a recession is averted. However, if soft-data stress bleeds into the hard data, then a recession is highly likely. Moreover, it happens swiftly.

The Fed has been criticized in the past for being influenced too much by the state of markets in deciding how to conduct monetary policy – the so-called Fed put everybody loves to hate. But what it is trying to do is to prevent these feedback loops from germinating in the first place.

The long-and-variable lags of monetary policy are short and consistent in their impact on markets. Therefore if the Fed can nip weaker soft data in the bud, it can hopefully prevent a recession – an economic state where monetary policy is a lot less effective, and the downturn harder to fix.

We can see from the chart above that currently hard data has become stressed along with soft data, and that both are above the threshold that has previously coincided with recessions. We are quite conceivably at the beginning of a feedback loop, and thus the rapid onset of a slump.

Recessions happen as Hemingway described how one goes bankrupt: first gradually, then suddenly. We can see this abruptness by looking at claims data.

Generally the percentage of US states whose continuing claims are rising sharply on an annual basis is subdued. But when it starts to rise past a low threshold, it typically shoots considerably higher, and this coincides with a recession. The very essence of recessions’ abruptness is captured in this chart. Other indicators also capture this regime-shift behavior.

Recessions’ shock power is amplified by the fact that typically economic and market expectations are most wrong when they occur. Predictions invariably extrapolate a trend linearly, so when that trend suddenly changes direction, the gap between expectations and the new trend is at its widest, and market moves can be most extreme.

In fact what we find is that forecasters’ estimates overshoot actual GDP more frequently - and the magnitude of the miss is bigger - when the economy is in recession compared to when it is not. Recessions not only creep up on you, they also deliver the biggest negative surprises.

The Fed’s higher-for-longer stance will be increasingly tested as growth slows.

Downward revisions to payrolls, big drops in job openings and cracks in consumer confidence are some of the recent signs of an economy that is perhaps entering the event horizon of a recession.

Inflation is likely to re-accelerate at some point, but as it is one of the most lagging of indicators, recession risk is poised to rise much more quickly than price growth.

This combination is likely to put significant pressure on the SOFR and fed funds rates curves, especially as the Fed resists cutting rates. The ~100 bps of Fed cuts priced in for next year is prone to rising again (its recent peak was ~160 bps). Similarly, the yield curve should continue to steepen.

It would be a shock, but not a surprise, if and when the Fed moves to cut rates. But until then the notion of higher for longer is going to face an increasingly challenging test.

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

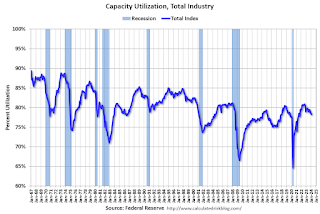

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Uncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex