Uncategorized

Growth of autocracies will expand Chinese global influence via Belt and Road Initiative as it enters second decade

More autocratic governments, growing urbanization and emerging technologies will bolster the spread of Chinese influence around the world, an expert on…

China currently faces daunting challenges in its domestic economy. But weakness in the real estate market and consumer spending at home is unlikely to stem its rising influence abroad.

In mid-October 2023, China celebrated the 10-year anniversary of its Belt and Road Initiative, or BRI. The BRI seeks to connect China with countries around the world via land and maritime networks, with the aim of improving regional integration, increasing trade and stimulating economic growth. Through the expansion of the BRI, China also sought to extend its global influence, especially in developing regions.

During its first decade, the initiative has faced a barrage of criticism from the West, mainly for saddling countries with debt, inattention to environmental impact, and corruption.

It has also encountered unexpected challenges – notably the COVID-19 pandemic, which led to massive supply chain issues and restrictions on the movement of Chinese workers overseas. Yet, as the BRI heads into its second decade, global economic trends suggest it will continue to play an important role in spreading Chinese influence.

I’m an associate professor of global studies at the Chinese University of Hong Kong, Shenzhen, where I teach about business-government relations in emerging economies. In my new book, “China’s Chance to Lead,” I discuss which countries have already and are now most likely to seek out and benefit from Chinese spending. Understanding this helps explain why China and the Belt and Road Initiative are poised to benefit greatly from the global economy over the next several decades.

Malaysia’s unlikely prominence

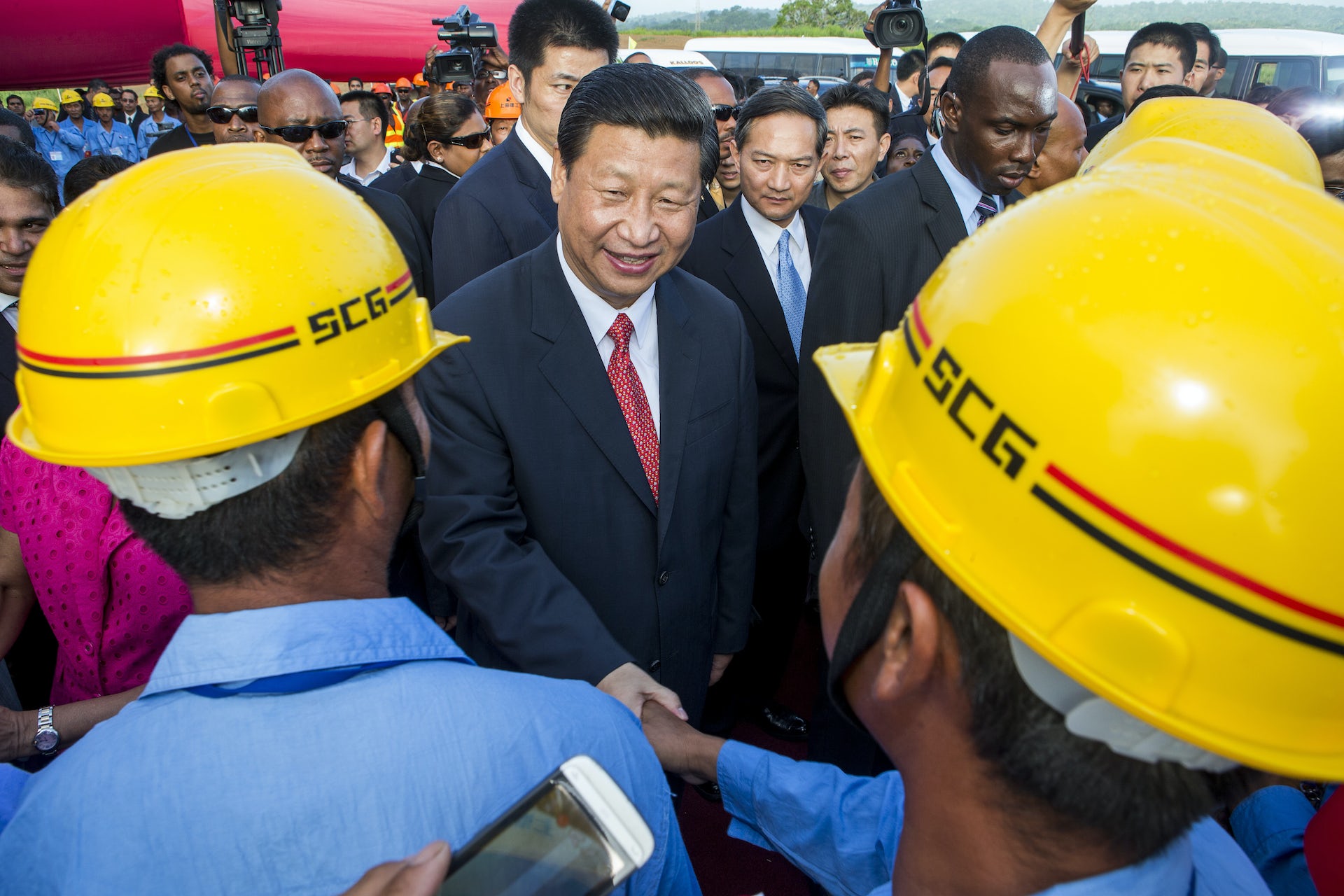

In October 2013, China President Xi Jinping announced the launch of the maritime portion of the BRI during a speech in Jakarta. At the time, Indonesia appeared to be an ideal candidate for Chinese infrastructure spending, yet it was Malaysia – surprisingly – that emerged as a far more avid participant.

In comparison to Malaysia, Indonesia’s economy was three times larger and its population nearly nine times bigger, yet its gross domestic product per capita only was one-third as high. Indonesia also had enormous potential to increase its already substantial natural resources exports to China. Taken together, these factors point to Indonesia’s far greater demand for infrastructure that would aid its economic development.

Furthermore, Indonesia’s democratic institutions were more conducive to attracting foreign investment. Its checks and balances enhanced policy stability and reduced political risk. By contrast, Malaysia’s government, which was dominated by a single ruling party coalition, lacked comparable checks and balances.

Despite Indonesia’s numerous advantages, Malaysia attracted a far larger volume of BRI spending during its first several years. Data provided by the China Global Investment Tracker indicates the value of newly announced infrastructure projects in Malaysia surged from US$3.5 billion in 2012 to over $8.6 billion in 2016. Spending in Indonesia, meanwhile, rose modestly from $3.75 billion to $3.77 billion over the same period.

Malaysia also enthusiastically participated in the Digital Silk Road, or DSR, launched in 2015. The DSR is the technological dimension of the BRI that aims to improve digital connectivity in Belt and Road countries. Malaysia Prime Minister Najib Razak engaged Jack Ma, the co-founder of Chinese tech giant Alibaba, as an adviser to develop e-commerce in 2016. This led to the creation in 2017 of a Digital Free Trade Zone, an international e-commerce logistics hub next to the Kuala Lumpur International Airport.

With this foundation in place, Malaysia’s capital went on to become the first city outside China to adopt Alibaba’s City Brain smart city solution in January 2018. City Brain uses the wealth of urban data to effectively allocate public resources, improve social governance and promote sustainable urban development. Dubai and other cities in the Middle East followed.

Digital Silk Road projects in Indonesia during that period were far fewer, slower and less ambitious. They primarily involved the expansion of Chinese smartphone and e-commerce firms in Indonesia.

What accounts for these contrasting responses? The short answer: their political regimes. And understanding that could be key to the global spread of Chinese influence in the coming years.

State-owned business and clientelism

In the lead-up to the May 2018 election, Malaysia’s ruling party and its allies worried they could lose power after six decades of rule. Desperate to bolster support, Najib quickly identified numerous infrastructure megaprojects in which Chinese state-owned businesses could partner with Malaysian counterparts.

Indonesia, by contrast, placed far greater emphasis on projects led by private business. For example, the Indonesia Morowali Industrial Park, “the world’s epicenter for nickel production,” is one of the largest Chinese investments in Indonesia and a joint venture between private Chinese and Indonesian companies.

As I discuss in my book, when rulers in autocracies with semi-competitive elections, like Malaysia’s, have a weak hold on power, their desire for Chinese spending is amplified. This relates to clientelism, or the delivery of goods and services in exchange for political support.

A higher level of state control in autocracies grants political leaders greater influence over the allocation of clientelist benefits, which aids leaders’ reelection efforts.

Economic trends that will benefit China

Even if China’s future growth is lower than the pre-pandemic period, these four features of the global economy are poised to benefit China and the Belt and Road Initiative over the next several decades.

1. Global rise of autocracies

Over 60% of developing countries are autocratic, according to data provided by the Varieties of Democracy Project. This represented 72% of the global population in 2022, up from 46% in 2012.

For decades, the World Bank and affiliated regional development banks were the only game in town for development financing to low- and middle-income countries. Consequently, these global lenders could demand liberalizing reforms that were sometimes contrary to the interests of incumbent rulers, especially autocrats.

China’s rise has created an attractive alternative for autocratic regimes, especially since it does not impose the same kinds of conditions that often require loosening state controls on the corporate sector and reducing clientelism. Between 2014 and 2019, I find that 77% of total BRI spending on construction projects went to autocracies, and primarily to those with semi-competitive elections.

2. Demand for Chinese infrastructure spending

The economies of developing countries have grown more than twice as quickly as advanced economies since 2000 and are projected to outpace advanced economies in the decades ahead. On the eve of the Soviet Union’s dissolution in 1991, developing economies accounted for 37% of global GDP; by 2030, the International Monetary Fund projects they will account for around 63%.

At the same time, the global infrastructure financing gap – that is, the money needed to build and upgrade existing infrastructure – is estimated to be around $15 trillion by 2040. To fill this gap, the world must spend just under $1 trillion more than the previous year up through 2040, with most of this spending directed toward low-income economies.

Because many of these fast-growing, low-income countries are predominantly semicompetitive autocracies, China is well-positioned to expand its global influence via the Belt and Road Initiative.

3. Emerging tech

The advent of what is known as Industry 4.0 technologies, such as artificial intelligence, big data analytics and blockchain, could enable developing countries to leapfrog stages of development.

By creating new technical standards to be used in these emerging digital technologies, China aims to lock in Chinese digital products and services and lock out non-Chinese competitors wherever its standards are adopted.

In Tanzania, for example, the Chinese company contracted to deploy the national ICT broadband network constructed it to be compatible only with routers made by Chinese firm Huawei.

Incorporating digital technologies into hard infrastructure projects – digital traffic sensors on roads, for example – presents more opportunities for China to use the Belt and Road Initiative to promote adoption of its technologies and standards globally.

4. Urbanization

Finally, the developing world’s urban population is expected to rise from 35% in 1990 to 65% by 2050. The biggest increases will likely occur in the semi-competitive autocracies of Africa. A desire for sustainable urbanization will increase the demand for infrastructure that incorporates digital technologies – once again amplifying the opportunity for China and the BRI.

Understanding what drives the demand for the Belt and Road Initiative, and the trends that will propel it into the future, is vital for the West to devise an effective strategy that counters China’s rising global influence.

Richard Carney does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

blockchain pandemic covid-19 real estateUncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex