Uncategorized

Global Safes and Vaults Market to Reach $13.8 Billion by 2030

Global Safes and Vaults Market to Reach $13.8 Billion by 2030

PR Newswire

NEW YORK, March 14, 2023

NEW YORK, March 14, 2023 /PRNewswire/ — The global economy is at a critical crossroads with a number of interlocking challenges and crises running i…

Global Safes and Vaults Market to Reach $13.8 Billion by 2030

PR Newswire

NEW YORK, March 14, 2023

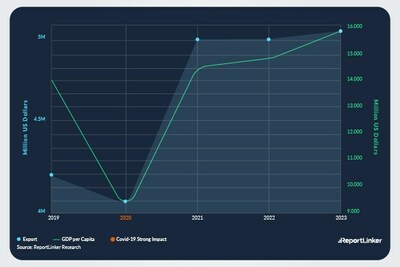

NEW YORK, March 14, 2023 /PRNewswire/ -- The global economy is at a critical crossroads with a number of interlocking challenges and crises running in parallel. The uncertainty around how Russia`s war on Ukraine will play out this year and the war`s role in creating global instability means that the trouble on the inflation front is not over yet. Food and fuel inflation will remain a persistent economic problem. Higher retail inflation will impact consumer confidence and spending. As governments combat inflation by raising interest rates, new job creation will slowdown and impact economic activity and growth. Lower capital expenditure is in the offing as companies go slow on investments, held back by inflation worries and weaker demand. With slower growth and high inflation, developed markets seem primed to enter into a recession. Fears of new COVID outbreaks and China's already uncertain post-pandemic path poses a real risk of the world experiencing more acute supply chain pain and manufacturing disruptions this year. Volatile financial markets, growing trade tensions, stricter regulatory environment and pressure to mainstream climate change into economic decisions will compound the complexity of challenges faced. Year 2023 is expected to be tough year for most markets, investors and consumers. Nevertheless, there is always opportunity for businesses and their leaders who can chart a path forward with resilience and adaptability.

Read the full report: https://www.reportlinker.com/p090635/?utm_source=PRN

Global Safes and Vaults Market to Reach $13.8 Billion by 2030

In the changed post COVID-19 business landscape, the global market for Safes and Vaults estimated at US$7.9 Billion in the year 2022, is projected to reach a revised size of US$13.8 Billion by 2030, growing at aCAGR of 7.3% over the period 2022-2030. Safes, one of the segments analyzed in the report, is projected to record 8.3% CAGR and reach US$9.5 Billion by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Vaults segment is readjusted to a revised 5.3% CAGR for the next 8-year period.

The U.S. Market is Estimated at $2.1 Billion, While China is Forecast to Grow at 12.5% CAGR

The Safes and Vaults market in the U.S. is estimated at US$2.1 Billion in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of US$3.4 Billion by the year 2030 trailing a CAGR of 12.5% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.5% and 6.1% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 3.8% CAGR.

Select Competitors (Total 137 Featured)

- Access Security Products Ltd.

- Acme Safe Company

- Allied Fire & Security

- Alpha Safe & Vault, Inc.

- ASSA ABLOY Hospitality

- BJARSTAL sarl

- Bode-Panzer GmbH

- Bordogna S.r.l

- Brown Safe Manufacturing, Inc.

- Cannon Safe, Inc.

- Citysafe

- Diebold Nixdorf

- dormakaba Holding AG

- FireKing Security Group

- Firelock Fireproof Modular Vaults

- Format Tresorbau GmbH & Co. KG

- Fort Knox Inc.

- Godrej & Boyce Mfg. Co., Ltd.

- Gunnebo AB

- Hall`s Safe Company

- Hayman Safe Company, Inc.

- Juwel Srl

- KASO Oy

- Liberty Safe and Security Products, Inc.

- Onity

- Phoenix Safe Company Limited

- Technomax Srl

Read the full report: https://www.reportlinker.com/p090635/?utm_source=PRN

I. METHODOLOGY

II. EXECUTIVE SUMMARY

1. MARKET OVERVIEW

Influencer Market Insights

World Market Trajectories

Safes and Vaults: Safeguarding and Securing Assets for a Safer

Future

Recent Market Activity

Rising Asset Safety Concerns & an Increasingly Security-

Conscious Society: Foundation for Market Growth

Important Factors Driving Widespread Adoption over the Years

Consumer Perception of Crime

Regulatory Mandates

Product Innovations & Introductions

Global Market Outlook

Developing Countries Continue to Power Current and Future

Market Growth

Rise of Agency Banking Channel Propels Demand for Small and

Mid-Sized Safes and Vaults

Stable Growth Fundamentals Present Optimistic Market Outlook

Safes and Vaults - Global Key Competitors Percentage Market

Share in 2022 (E)

Competitive Market Presence - Strong/Active/Niche/Trivial for

Players Worldwide in 2022 (E)

Impact of Covid-19 and a Looming Global Recession

2. FOCUS ON SELECT PLAYERS

Access Security Products Ltd. (Canada)

Acme Safe Company (USA)

Allied Fire & Security (USA)

Amsec (USA)

Gardall Safe Corporation (USA)

Alpha Safe & Vault, Inc. (USA)

ASSA ABLOY Hospitality (USA)

BJARSTAL sarl (France)

Bode-Panzer GmbH (Germany)

Bordogna S.r.l (Italy)

Brown Safe Manufacturing, Inc. (USA)

Bumil Safe Mfg. Co., Ltd. (Korea)

Cannon Safe, Inc. (USA)

Citysafe (USA)

Diebold Nixdorf (USA)

dormakaba Holding AG (Switzerland)

Firelock Fireproof Modular Vaults (USA)

FireKing Security Group (USA)

Format Tresorbau GmbH & Co. KG (Germany)

Fort Knox Inc. (USA)

GARDEX Inc. (Canada)

Godrej & Boyce Mfg. Co., Ltd. (India)

Gunnebo AB (Sweden)

Chubb Safes Ltd. (UK)

Hamilton Safe (USA)

Fichet-Bauche SA (France)

Hall?s Safe Company (USA)

Hayman Safe Company, Inc. (USA)

Juwel Srl (Italy)

KASO Oy (Finland)

Liberty Safe and Security Products, Inc. (USA)

Onity (USA)

Phoenix Safe Company Limited (UK)

Sentry Group, Inc. (USA)

Stark Safes Srl (Italy)

Technomax Srl (Italy)

3. MARKET TRENDS & DRIVERS

Non-Banking Safes to Witness Higher Growth

Government Regulations Drive Innovations in Data Vaults

Surging Demand for Biometric Safes and Vaults Drives Healthy

Market Growth

Market Drivers

Market Inhibitors

Myriad Benefits of Biometric Safes over Traditional Safes Lead

to Widespread Market Adoption

Limitations of Traditional Lock Systems

Benefits of Fingerprint Recognition

Legal Considerations

Growing Popularity of Smart Safes in Retail Outlets Benefits

Market Expansion

Key Benefits Offered by Smart Safes to Retailers

Increasing ATM Deployments Drive Strong Growth in Demand for

Cash Safes

Multi-Purpose ATMs Spur Demand for Depository Safes

Dial Locks Versus Electronics Locks: Where Does the Future Lie?

Convergence with Advanced Communication Technologies Set to

Become a Norm

Sophisticated Gun Safes and Vaults for Home Defense

Vault Management Systems

Automatic Safe Dialer

Portable Teller Units

Controlled Environment Vault (CEV)

Specialized Vaults with Computerized Locks

Urgent Need to Manage Firearms Possession Boosts Demand for Gun

Safes

Government Compliance Regulations Power Growth for Gun Safes

and Vaults

Key Considerations while Selecting Gun Safe Models

Gun Safes Manufacturers Innovate to Stay Ahead of the Game

Steel

More Stylish Designs

Improved Locking Systems

Alarms and Additional Features

Faster Access

Multifunctional Use

Discrete Concealment

Mounting Digital Media Penetration Augurs Well for Data Media

Safes

Safes and Vaults Emerge as Key Customer Service Strategy in

Hospitality Industry

Portable Safes Emerge as a Potent Instrument of Security for

Frequent Travelers

Government, Military & Security Services: Dominant Users of

Safes and Vaults

Wall & Floor Safes Continue to Remain a Popular Option

Sales of Home Safes Gain Momentum

Modular Safes Offer Easy Portability and Installation

Fireproof Safes Provide Efficient Protection from Intense Heat

Custom Safes: A Suitable Option for Addressing Diverse Needs

Housing Construction & Renovation: An Important Growth Driver

Safes and Vaults Standards: Essential for High-end Security Models

Safes and Vaults Innovations and Advancements: Spearheading Growth

Internet Protocol (IP) Enabled Safes: The Next Big Thing in

Safe Technology

Next-Generation Gun Safes and Vaults for Vehicles

Advanced Storage Options from Tuffy Security Products

TrunkVault and TruckTuff Dog Kennel by TruckVault

Smart Vaults: The Future of Bank Vaults

Sensor Integration Remains Key to Ensuring Security

Portable Safe for Diamonds and Jewelry

Unbreakable Piggy Bank

Select Innovative and Advanced Gun Safes and Vaults

1420M Bundle by Tactical Walls

Beast Safe by Browning

Biometric Pistol Vault by Bulldog

Biometric Wall Safe by Barska

Digital Personal Vault by Bulldog Cases

Hawk Secure-it

Knight TAC-75 by Pendleton

Magnum RFID/LED Quick Vault by Bulldog Cases

PV1000 by Browning

Quick Access Rifle Safe by Barska

Quick Vent and QuickShelf Safes by QuickSafes

RAPiD Safe and RAPiD Safe 2600 by Hornady

Revolution Safe Stronghold XL Tactical Edition

Slide Away Safe by V-Line

SpeedVault by GunVault

Super-Size Biometric Safe by Stack-On

The GunBox

4. GLOBAL MARKET PERSPECTIVE

Table 1: World Recent Past, Current & Future Analysis for Safes

and Vaults by Geographic Region - USA, Canada, Japan, China,

Europe, Asia-Pacific, Latin America, Middle East and Africa

Markets - Independent Analysis of Annual Sales in US$ Million

for Years 2022 through 2030 and % CAGR

Table 2: World Historic Review for Safes and Vaults by

Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2014 through 2021 and % CAGR

Table 3: World 16-Year Perspective for Safes and Vaults by

Geographic Region - Percentage Breakdown of Value Sales for

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa Markets for Years 2014, 2023 & 2030

Table 4: World Recent Past, Current & Future Analysis for Safes

by Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2022 through 2030 and % CAGR

Table 5: World Historic Review for Safes by Geographic Region -

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 6: World 16-Year Perspective for Safes by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2014, 2023 & 2030

Table 7: World Recent Past, Current & Future Analysis for

Vaults by Geographic Region - USA, Canada, Japan, China,

Europe, Asia-Pacific, Latin America, Middle East and Africa

Markets - Independent Analysis of Annual Sales in US$ Million

for Years 2022 through 2030 and % CAGR

Table 8: World Historic Review for Vaults by Geographic Region -

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin

America, Middle East and Africa Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2014 through 2021 and

% CAGR

Table 9: World 16-Year Perspective for Vaults by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2014, 2023 & 2030

Table 10: World Safes and Vaults Market Analysis of Annual

Sales in US$ Million for Years 2014 through 2030

III. MARKET ANALYSIS

UNITED STATES

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in the United States for 2023 (E)

Table 11: USA Recent Past, Current & Future Analysis for Safes

and Vaults by Segment - Safes and Vaults - Independent Analysis

of Annual Sales in US$ Million for the Years 2022 through 2030

and % CAGR

Table 12: USA Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual Sales

in US$ Million for Years 2014 through 2021 and % CAGR

Table 13: USA 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

CANADA

Table 14: Canada Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 15: Canada Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 16: Canada 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

JAPAN

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Japan for 2023 (E)

Table 17: Japan Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 18: Japan Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 19: Japan 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

CHINA

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in China for 2023 (E)

Table 20: China Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 21: China Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 22: China 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

EUROPE

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Europe for 2023 (E)

Table 23: Europe Recent Past, Current & Future Analysis for

Safes and Vaults by Geographic Region - France, Germany, Italy,

UK, Spain, Russia and Rest of Europe Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2022 through

2030 and % CAGR

Table 24: Europe Historic Review for Safes and Vaults by

Geographic Region - France, Germany, Italy, UK, Spain, Russia

and Rest of Europe Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 25: Europe 16-Year Perspective for Safes and Vaults by

Geographic Region - Percentage Breakdown of Value Sales for

France, Germany, Italy, UK, Spain, Russia and Rest of Europe

Markets for Years 2014, 2023 & 2030

Table 26: Europe Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 27: Europe Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 28: Europe 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

FRANCE

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in France for 2023 (E)

Table 29: France Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 30: France Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 31: France 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

GERMANY

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Germany for 2023 (E)

Table 32: Germany Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 33: Germany Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 34: Germany 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

ITALY

Table 35: Italy Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 36: Italy Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 37: Italy 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

UNITED KINGDOM

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in the United Kingdom for 2023 (E)

Table 38: UK Recent Past, Current & Future Analysis for Safes

and Vaults by Segment - Safes and Vaults - Independent Analysis

of Annual Sales in US$ Million for the Years 2022 through 2030

and % CAGR

Table 39: UK Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual Sales

in US$ Million for Years 2014 through 2021 and % CAGR

Table 40: UK 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

SPAIN

Table 41: Spain Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 42: Spain Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 43: Spain 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

RUSSIA

Table 44: Russia Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 45: Russia Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 46: Russia 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

REST OF EUROPE

Table 47: Rest of Europe Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 48: Rest of Europe Historic Review for Safes and Vaults

by Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 49: Rest of Europe 16-Year Perspective for Safes and

Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

ASIA-PACIFIC

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Asia-Pacific for 2023 (E)

Table 50: Asia-Pacific Recent Past, Current & Future Analysis

for Safes and Vaults by Geographic Region - Australia, India,

South Korea and Rest of Asia-Pacific Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2022 through

2030 and % CAGR

Table 51: Asia-Pacific Historic Review for Safes and Vaults by

Geographic Region - Australia, India, South Korea and Rest of

Asia-Pacific Markets - Independent Analysis of Annual Sales in

US$ Million for Years 2014 through 2021 and % CAGR

Table 52: Asia-Pacific 16-Year Perspective for Safes and Vaults

by Geographic Region - Percentage Breakdown of Value Sales for

Australia, India, South Korea and Rest of Asia-Pacific Markets

for Years 2014, 2023 & 2030

Table 53: Asia-Pacific Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 54: Asia-Pacific Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 55: Asia-Pacific 16-Year Perspective for Safes and Vaults

by Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

AUSTRALIA

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Australia for 2023 (E)

Table 56: Australia Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 57: Australia Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 58: Australia 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

INDIA

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in India for 2023 (E)

Table 59: India Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 60: India Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 61: India 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

SOUTH KOREA

Table 62: South Korea Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 63: South Korea Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 64: South Korea 16-Year Perspective for Safes and Vaults

by Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

REST OF ASIA-PACIFIC

Table 65: Rest of Asia-Pacific Recent Past, Current & Future

Analysis for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 66: Rest of Asia-Pacific Historic Review for Safes and

Vaults by Segment - Safes and Vaults Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2014 through

2021 and % CAGR

Table 67: Rest of Asia-Pacific 16-Year Perspective for Safes

and Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

LATIN AMERICA

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Latin America for 2023 (E)

Table 68: Latin America Recent Past, Current & Future Analysis

for Safes and Vaults by Geographic Region - Argentina, Brazil,

Mexico and Rest of Latin America Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2022 through 2030 and

% CAGR

Table 69: Latin America Historic Review for Safes and Vaults by

Geographic Region - Argentina, Brazil, Mexico and Rest of Latin

America Markets - Independent Analysis of Annual Sales in US$

Million for Years 2014 through 2021 and % CAGR

Table 70: Latin America 16-Year Perspective for Safes and

Vaults by Geographic Region - Percentage Breakdown of Value

Sales for Argentina, Brazil, Mexico and Rest of Latin America

Markets for Years 2014, 2023 & 2030

Table 71: Latin America Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 72: Latin America Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 73: Latin America 16-Year Perspective for Safes and

Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

ARGENTINA

Table 74: Argentina Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 75: Argentina Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 76: Argentina 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

BRAZIL

Table 77: Brazil Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 78: Brazil Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 79: Brazil 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

MEXICO

Table 80: Mexico Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 81: Mexico Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 82: Mexico 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

REST OF LATIN AMERICA

Table 83: Rest of Latin America Recent Past, Current & Future

Analysis for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 84: Rest of Latin America Historic Review for Safes and

Vaults by Segment - Safes and Vaults Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2014 through

2021 and % CAGR

Table 85: Rest of Latin America 16-Year Perspective for Safes

and Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

MIDDLE EAST

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Middle East for 2023 (E)

Table 86: Middle East Recent Past, Current & Future Analysis

for Safes and Vaults by Geographic Region - Iran, Israel, Saudi

Arabia, UAE and Rest of Middle East Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2022 through

2030 and % CAGR

Table 87: Middle East Historic Review for Safes and Vaults by

Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of

Middle East Markets - Independent Analysis of Annual Sales in

US$ Million for Years 2014 through 2021 and % CAGR

Table 88: Middle East 16-Year Perspective for Safes and Vaults

by Geographic Region - Percentage Breakdown of Value Sales for

Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets

for Years 2014, 2023 & 2030

Table 89: Middle East Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 90: Middle East Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 91: Middle East 16-Year Perspective for Safes and Vaults

by Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

IRAN

Table 92: Iran Recent Past, Current & Future Analysis for Safes

and Vaults by Segment - Safes and Vaults - Independent Analysis

of Annual Sales in US$ Million for the Years 2022 through 2030

and % CAGR

Table 93: Iran Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 94: Iran 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

ISRAEL

Table 95: Israel Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 96: Israel Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 97: Israel 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

SAUDI ARABIA

Table 98: Saudi Arabia Recent Past, Current & Future Analysis

for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 99: Saudi Arabia Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 100: Saudi Arabia 16-Year Perspective for Safes and

Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

UNITED ARAB EMIRATES

Table 101: UAE Recent Past, Current & Future Analysis for Safes

and Vaults by Segment - Safes and Vaults - Independent Analysis

of Annual Sales in US$ Million for the Years 2022 through 2030

and % CAGR

Table 102: UAE Historic Review for Safes and Vaults by Segment -

Safes and Vaults Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2014 through 2021 and % CAGR

Table 103: UAE 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

REST OF MIDDLE EAST

Table 104: Rest of Middle East Recent Past, Current & Future

Analysis for Safes and Vaults by Segment - Safes and Vaults -

Independent Analysis of Annual Sales in US$ Million for the

Years 2022 through 2030 and % CAGR

Table 105: Rest of Middle East Historic Review for Safes and

Vaults by Segment - Safes and Vaults Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2014 through

2021 and % CAGR

Table 106: Rest of Middle East 16-Year Perspective for Safes

and Vaults by Segment - Percentage Breakdown of Value Sales for

Safes and Vaults for the Years 2014, 2023 & 2030

AFRICA

Safes and Vaults Market Presence - Strong/Active/Niche/Trivial -

Key Competitors in Africa for 2023 (E)

Table 107: Africa Recent Past, Current & Future Analysis for

Safes and Vaults by Segment - Safes and Vaults - Independent

Analysis of Annual Sales in US$ Million for the Years 2022

through 2030 and % CAGR

Table 108: Africa Historic Review for Safes and Vaults by

Segment - Safes and Vaults Markets - Independent Analysis of

Annual Sales in US$ Million for Years 2014 through 2021 and %

CAGR

Table 109: Africa 16-Year Perspective for Safes and Vaults by

Segment - Percentage Breakdown of Value Sales for Safes and

Vaults for the Years 2014, 2023 & 2030

IV. COMPETITION

Read the full report: https://www.reportlinker.com/p090635/?utm_source=PRN

About Reportlinker

ReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.

Contact Clare: clare@reportlinker.com

US: (339)-368-6001

Intl: +1 339-368-6001

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-safes-and-vaults-market-to-reach-13-8-billion-by-2030--301768792.html

SOURCE Reportlinker

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Uncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex