Spread & Containment

Futures Slide As OPEC+ Cut Sparks Gas Inflation Fears And “Tighter For Longer” Fed

Futures Slide As OPEC+ Cut Sparks Gas Inflation Fears And "Tighter For Longer" Fed

Two days ago, when stocks were melting up even as oil was…

Two days ago, when stocks were melting up even as oil was storming higher and threatened to rerate inflation expectations sharply higher, we mused that algos were clearly ignoring this potentially ominously convergence.

Stock algos still haven't noticed what oil is doing. impressive

— zerohedge (@zerohedge) October 4, 2022

And while yesterday we saw the first cracks developing in the meltup narrative as oil extended gains following OPEC's stark slap on the face of the dementia patient in the White House, it was only today that the "oil is about to push inflation sharply higher" discussion entered the broader financial sphere, with JPM writing this morning that "OPEC+ presents inflation risk", Bloomberg echoing JPM that "OPEC+ alliance’s plan to cut oil supply stoked inflation fears and as traders awaited labor-market data to gauge the risk of recession" and Saxo Bank also jumping on the bandwagon, warning that OPEC+ supply cut will worsen global inflation which "raises the risk of inflation staying higher for longer” and “sends the wrong signal to the US Federal Reserve... It could send a signal that they have to keep on their foot on the brake for longer.”

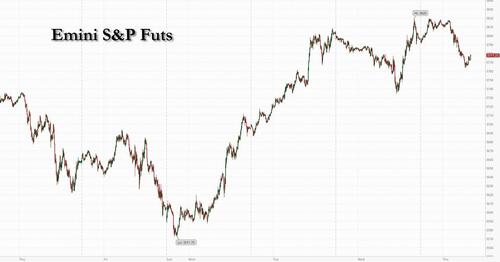

And sure enough, with oil rising above its 50DMA for the first time since Aug 30, futures have slumped overnight as oil kept its gains, with S&P and Nasdaq 100 futures both sliding 0.5% as of 730am, while Europe’s Stoxx 600 erased an advance and traded near session lows. US crude futures held on to weekly gains of about 11% after the oil cartel said it would cut daily output by 2 million barrels. Treasuries were steady, the 10Y trading around 3.77%, with the 2Y rate hovering about the 4.15% level.

In pre-market trading, Credit Suisse jumped as much as 5.2% after JPMorgan upgraded to neutral from underweight, saying it sees $15bn as a minimum value for the lender, in-line with the estimated value of the Swiss legal entity. Shares were 2% higher by 13:20pm CET in Zurich, after Bloomberg News reported that the lender is trying to bring in an outside investor to inject money into a spinoff of its advisory and investment banking businesses, citing people with knowledge of the deliberations. Other banks did not do as well, and slumped in premarket trading Thursday, putting them on track to fall for a second straight day. Twitter shares fell as much as 1.1% to $50.75, trading nearly 7% below Elon Musk’s offer price of $54.20 as investors await progress in the revived deal. Here are the other notable premarket movers:

- Pinterest (PINS US) shares jump as much as 5.8% in US premarket trading after Goldman Sachs upgraded the social networking site to buy from neutral on improving user growth and better engagement trends, even as the backdrop for digital advertising remains uncertain.

- Biohaven Ltd. (BHVN US) shares rise 9.7% in US premarket trading, set to extend a 75% gain over the past two days as regular trading in the newly constituted drug developer began following an unusual deal with Pfizer Inc.

- SurgePays (SURG US) shares soar as much as 11% in premarket trading after the company gave an update on subscriber numbers for its subsidiary SurgePhone Wireless.

- Flutter (FLTR LN) gained 3.3% in premarket trading as it was initiated at outperform at Exane as the best-placed online gambling name, while Entain also at outperform and DraftKings started at underperform.

- Richardson Electronics (RELL US) rose 8.2% in extended trading after reporting year-over-year growth in net sales and earnings per share for the fiscal first quarter.

While higher energy prices could stoke inflation, some have speculated that this will also divert discretionary income from core items thus pushing core inflation lower and hit company earnings -- potentially encouraging the Federal Reserve to slow monetary tightening.

All else equal, as economy slows and oil/gas prices rise due to OPEC/supply constraints, there will be less disposable income for "core" purchases, pushing core PCE lower faster

— zerohedge (@zerohedge) October 6, 2022

While such expectations fueled equity gains this week, several money managers are cautioning that the economic path to a less aggressive Fed could be painful: “If you want to preempt the Fed, you are playing a very high-stakes game,” said Kenneth Broux, a strategist at Societe Generale SA. “The Fed do not want financial conditions to loosen; they don’t want equity markets to take off and get too comfortable.”

That said, investors are wary of placing large-scale equity bets as they await a report on US initial jobless claims later Thursday and the official nonfarm payrolls data Friday. A Bloomberg survey shows the US economy will have added 260,000 jobs last month; a higher-than-anticipated number may spook markets.

In Europe, the Stoxx 50 dropped -0.3% to session lows. Stoxx 600 outperforms peers, adding 0.2%, FTSE MIB lags, dropping 0.5%. Energy and insurance underperform while real estate and travel lead gains. Here are all the notable European movers:

- Imperial Brands shares rise as much as 4.7% after the tobacco company said it will buy back up to £1b worth of stock. The move was welcomed by analysts, with RBC calling it a “big deal” and Citigroup saying the announcement was earlier than expected.

- Home24 SE gains as much as 126% to EU7.53 after XXXLutz offered to buy all outstanding shares in the German online furniture retailer for EU7.50 apiece. The bid is generous and the deal is straightforward from a regulatory perspective, according to Tradition.

- Credit Suisse jumps as much as 5.2% after JPMorgan upgraded to neutral from underweight, saying it sees $15b as a minimum value for the lender, in-line with the estimated value of the Swiss legal entity.

- CMC Markets climbs as much as 6.5% after the online trading firm said it sees first- half net operating income up 21% y/y, with market volatility in August and September boosting the results. Numis upgraded the stock to add from hold following the report.

- Shell drops as much as 5% as analysts say the oil and gas major’s trading update looks “weak” and may mean that FY consensus proves too ambitious.

- Kloeckner falls as much as 12% as the company faces a “high likelihood” of an imminent profit warning, Bankhaus Metzler says, double-downgrading the stock to sell from buy.

- Swiss Re is among the weakest members of the Stoxx 600 insurance index on Thursday, declining as much as 4.0%, as Morgan Stanley lowers its price target ahead of third-quarter earnings.

- Accor drops as much as 2.5% after the hotel chain owner was downgraded to underweight from equal-weight at Barclays, which sees short-term risks as bigger for the company compared with peers and feels investors are looking more at potential negative factors heading into FY23 than 2022 upgrades.

Earlier in the session, Asian stocks rose for a third day as hardware technology stocks in South Korea and Japan advanced on views they may have reached a bottom. The MSCI Asia Pacific Index climbed as much as 0.9%, lifted by TSMC, SoftBank and Sony. The benchmark trimmed gains later in the day, but remains on track to advance for the week, following a seven-week losing streak that was the longest since 2015.Korea’s Kospi Index was the region’s best-performing major benchmark, jumping about 1%. The advance was helped by chipmakers extending their gains amid Morgan Stanley’s bullish view on the sector. Hong Kong stocks retreated after Wednesday’s catch-up rally.

Trading volume in the region was light as mainland China remains closed for the Golden Week holiday. The MSCI’s Asian benchmark has rebounded this week from its lowest in more than two years. The move tracked a nascent revival in global equities on bets that the Federal Reserve may turn less aggressive in its tightening. In a potential harbinger of shifting market views, Morgan Stanley strategists upgraded emerging-market and Asia ex-Japan stocks to overweight from equal-weight. Investors are also optimistic that monetary policies in China and Japan, which have bucked the global wave of tightening to remain loose, could provide further support to the nations’ equities. “While the rest of the world is tightening, Japan and China are still easing, especially China where we are going to see more easing policies going forward,” Chi Lo, senior investment strategist for Asia Pacific at BNP Paribas Asset Management, said in an interview with Bloomberg TV. “That makes us more positive on EM Asia.”

Japanese equities gained for a fourth day as investors awaited domestic corporate earnings coming out later this month. The Topix rose 0.5% to 1,922.47 as of the market close in Tokyo, while the Nikkei 225 advanced 0.7% to 27,311.30. Sony Group contributed the most to the Topix’s gain, increasing 1.7%. Out of 2,168 stocks in the index, 1,564 rose and 490 fell, while 114 were unchanged. “There is relatively little concern about corporate earnings for Japanese stocks with the economy restarting and the yen weakening,” said Shogo Maekawa, a strategist at JPMorgan Asset Management.

In FX, the Bloomberg Dollar Spot Index consolidated within the recent day’s ranges, while Britain’s pound slipped 0.4% and gilt yields rose after Fitch Ratings lowered its outlook on the nation to negative. The greenback advanced against most of its G-10 peers. The euro steadied just below $0.99. Euro hedging costs are on the rise again as traders position ahead of Friday’s payrolls print and next week’s US inflation report. Commodity currencies were the worst performers along with the pound. Australian and New Zealand dollars gave up an Asia-session advance. The yen traded in a narrow range.

In rates, Treasuries were slightly cheaper across the curve after paring declines led by gilts in London trading after a Bank of England survey found expectations for higher prices. Focal points of US session include several Fed speakers and potential for risk-reduction ahead of Friday’s September jobs report Friday. US yields cheaper by less than 2bp across the curve in bear- flattening move, 10-year by 2bp vs 17bp for UK 10-year, the downside leader in developed market sovereign bonds. German and Italian bond curves flattened modestly as yields on shorter-dated notes rose, while those further out fell.

In commodities, West Texas Intermediate futures traded near $88 a barrel, while Brent crude held near $93.30. The output-cut plan drew a warning from the White House about negative effects on the global economy. Goldman Sachs Group Inc. increased its fourth-quarter price target for Brent to $110 a barrel.

To the day ahead now, and data releases include German factory orders for August, the German and UK construction PMIs for September, Euro Area retail sales for August, and the weekly initial jobless claims from the US. Meanwhile from central banks, we’ll get the ECB’s account of their September meeting, as well as remarks from the Fed’s Evans, Cook, Kashkari, Waller and Mester, and the BoE’s Haskel.

Market Snapshot

- S&P 500 futures down 0.3% to 3,783.50

- STOXX Europe 600 up 0.3% to 400.25

- MXAP up 0.4% to 145.05

- MXAPJ up 0.3% to 471.37

- Nikkei up 0.7% to 27,311.30

- Topix up 0.5% to 1,922.47

- Hang Seng Index down 0.4% to 18,012.15

- Shanghai Composite down 0.6% to 3,024.39

- Sensex up 0.6% to 58,403.02

- Australia S&P/ASX 200 little changed at 6,817.52

- Kospi up 1.0% to 2,237.86

- German 10Y yield little changed at 2.05%

- Euro little changed at $0.9886

- Brent Futures up 0.3% to $93.62/bbl

- Gold spot up 0.0% to $1,716.69

- U.S. Dollar Index little changed at 111.24

Top Overnight News from Bloomberg

- UK bond markets face a potential “cliff edge” when the Bank of England exits the market at the end of next week, leaving traders to navigate a turbulent backdrop without the support of a buyer of last resort

- Millions more Britons will be dragged into higher rates of income tax over the next three years, costing twice as much as Prime Minister Liz Truss’s personal tax cuts, according to calculations by the Institute for Fiscal Studies

- Britain’s construction industry turned more pessimistic in September after rising interest rates and the risk of recession held back new orders

- The European Union plans to examine whether Germany’s massive plan to shelter companies and households from surging energy costs respects the bloc’s rules on public subsidies, EU Commissioner Thierry Breton said

- German factory orders dropped in August after the previous month was revised to show an increase, hinting at a lack of momentum as the economy stands on the brink of a recession

- Societe Generale SA cut its exposure to counterparties on trades in China by about $80 million in the past few weeks as global banks seek to guard against any potential fallout from rising geopolitical risks in the world’s second-largest economy

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed as the region partially shrugged off the lacklustre lead from the US where the major indices snapped a firm two-day rally and finished the somewhat choppy session with mild losses amid higher yields and as Fed rhetoric essentially pushed back against a policy pivot. ASX 200 lacked direction amid underperformance in the Real Estate and the Consumer sectors, although the downside was also limited by strength in energy after oil prices were lifted by the OPEC+ output cut. Nikkei 225 was positive with notable gains in exporter names and with Rakuten leading the advances as Mizuho looks to acquire a 20% stake in Rakuten Securities for USD 555mln. Hang Seng was lacklustre and took a breather after the prior day’s more than 5% jump with the mood also not helped after Hong Kong PMI slipped into contraction territory for the first time in 6 months.

Top Asian News

- Haikou city in China's Hainan imposed a COVID lockdown for Thursday, according to Bloomberg.

- Malaysia PM May Propose Parliament Dissolution, Bernama Reports

- Why Polio, Once Nearly Eradicated, Is Rebounding: QuickTake

- Legoland Korea’s Default Flags Risks for Nation’s Developers

- Paris Club Seeks China Collaboration in Sri Lanka Debt Talks

- Yen Rout Is Over on Peak US Rate Hike Bets, Says Top Forecaster

European bourses are under modest pressure as sentiment broadly takes a slight turn for the worst amid limited newsflow as participants look to Friday's NFP. Currently, European benchmarks are lower by 0.1-0.3% while US futures are posting slightly larger losses of circa 0.7 ahead of Fed speak.

Top European News

- Fitch affirmed the UK at AA-; Outlook revised to Negative from Stable, while it stated that the fiscal package announced as part of the new UK government's growth plan could lead to a significant increase in deficits over the medium-term, according to Reuters.

- The UK Treasury is set to impose GBP 21bln of additional income taxes despite the "tax-cutting mini-budget", according to a study by the Institute for Fiscal Studies. (Times)

- BoE Monthly Decision Maker Panel data - September 2022; looking ahead, DMP members expected CPI inflation to be 9.5% one-year ahead, up from 8.4% in the August survey, and 4.8% in three years’ time.

- BoE's Cunliffe says the FPC will publish its next financial policy statement and record on October 12th, liquidity conditions in the run up to the BoE gilt intervention were "very poor", MPC will make a full assessment of recent developments at its November 3rd meeting.

- UK government has proposed easing the fee cap for illiquid assets in pensions, according to a rule consultation publication by the government.

- Swedish Economy Shrinks More Than Estimated on Weak Industry

- UK Tech M&A Spree Pauses as Buyers Pull Out Amid Chaotic Markets

FX

- USD benefits from the mentioned risk tone, with the DXY extending to a 111.35 peak to the modest detriment of peers.

- However, EUR is relatively resilient and holding around 0.99 vs the USD as we await the ECB Minutes account for near-term guidance.

- Cable faded sub-1.1400 and reversed through 1.1300 again amid the USD's move and prior to a letter exchange from the BoE to Treasury re. the Gilt Intervention.

- Antipodeans under pressure given the USD move and associated action in metals, while the Yuan initially lent a helping hand but this has since dissipated.

- Given the broader tone, the traditional havens are holding near unchanged levels though yield dynamics are a hinderance.

Fixed Income

- Gilts are once again the standout laggard following rating agency action and the BoE DMP showing inflation pressures were already elevated MM before the fiscal update.

- As such, the UK yield has extended back above 4.10%; in the US, yields are also bid though to a much lesser extent before Fed speak and Friday's jobs.

- Back to Europe, Bunds are pressured though only modestly so vs UK counterparts awaiting the ECB's September account

Commodities

- Crude benchmarks are modestly firmer at present, extending marginally above yesterday’s best levels with fresh newsflow limited as participants digest yesterday’s OPEC+ action.

- WTI and Brent are towards the mid-point of circa. USD 1/bbl ranges, though Brent Dec’22 briefly surpassed the 200-DMA at USD 94.11/bbl before moving back below the figure.

- Acting Kuwaiti Oil Minister said the OPEC+ decision to cut output will have positive ramifications for oil markets, while they understand consumers' concerns about prices increasing but added that the main motive in OPEC+ is balancing supply and demand, according to Reuters.

- US National Security official stated the US sanctions policy on Venezuela remains unchanged and there are no plans to change the sanctions policy without constructive steps from Maduro, according to Reuters.

- Norway's Budget proposes changing the temporary tax rules for the petroleum sector, entails that the uplift is reduced to 12.40% (prev. 17.69%), via Reuters.

- Saudi sets the November Arab Light OSP to N.W Europe at Ice Brent +USD 0.90/bbl; to the US at ASCI +USD 6.35/bbl, via Reuters citing a document; to Asia at Oman/Dubai +USD 5.85 (Unch.), via Reuters sources.

Geopolitics

- North Korea launched two short-range ballistic missiles which were fired from Pyongyang and landed outside of Japan's exclusive economic zone, according to the South Korean military cited by Yonhap. Furthermore, North Korea said that its missile launches are counteraction measures against the US and South Korean military drills.

- North Korean jets and bombers have been seen flying in an exercise, according to Yonhap; South Korean jets take off in response, via Reuters.

- US State Department condemned North Korea's ballistic missile launch and said North Korea's missile launches pose a threat to regional neighbours and the international community, while it added that the US remains committed to a diplomatic approach to North Korea and called on North Korea to engage in dialogue, according to Reuters.

- The EU has approved the 8th round of Russian sanctions; as expected.

US Event Calendar

- 08:30: Sept. Continuing Claims, est. 1.35m, prior 1.35m

- 08:30: Oct. Initial Jobless Claims, est. 204,000, prior 193,000

Central bank Speakers

- 08:50: Fed’s Mester Makes Opening Remarks

- 09:15: Fed’s Kashkari Takes Part in Moderated Q&A

- 13:00: Fed’s Evans Takes Part in Moderated Q&A

- 13:00: Fed’s Cook Speaks on the Economic Outlook

- 13:00: Fed’s Kashkari Discusses Cyber Risk and Financial Stability

- 17:00: Fed’s Waller Discusses the Economic Outlook

- 18:30: Fed’s Mester Discusses the Economic Outlook

DB's Henry Allen concludes the overnight wrap

After an astonishing rally at the beginning of Q4, markets reversed course yesterday as investors became much more sceptical that we’ll actually get a dovish pivot from central banks after all. The idea of a pivot has been a prominent theme over recent days, particularly after the financial turmoil during the last couple of weeks, thus sparking the biggest 2-day rally in the S&P 500 since April 2020 as the week began. But over the last 24 hours, solid US data releases have created a pushback against that narrative, since they were seen as giving the Fed more space to keep hiking rates over the coming months. And if markets had any further doubt about the Fed’s intentions, San Francisco Fed President Daly explicitly said yesterday that she didn’t expect there to be rate cuts next year, in direct contrast to futures that are still pricing in rate cuts from Q2. Indeed for a sense of just how volatile the reaction has been, 10yr bund yields were up by +16.3bps yesterday, which is their largest daily rise since March 2020 during the initial wave of the pandemic.

Looking at the details of those releases, it was evident that markets are still treating good news as bad news at the minute, since they sold off even as data pointed to a more resilient performance from the US economy than had been thought. For example, the ISM services index came in above expectations at 56.7 (vs. 56.0 expected), and the employment component moved up to a 6-month high of 53.0. So that’s a noticeably different picture to the manufacturing print on Monday, when there was a surprise contraction in the employment component. Furthermore, there was another sign of labour market strength from the ADP’s report of private payrolls, which came in at +208k in September (vs. +200k expected), and the previous month’s reading was also revised upwards. We’ll see if that picture is echoed in the US jobs report tomorrow, but there was a clear reaction to the ISM print in markets, as investors moved to upgrade the amount of Fed hikes they were expecting whilst the equity selloff accelerated.

Those expectations of a more hawkish Fed were given significant support by comments from Fed officials themselves. The most obvious came from San Francisco Fed President Daly, who was asked about the fact that futures were pricing in rate cuts, and said “I don’t see that happening at all”. In fact when it came to rates, she not only said that they were raising them into restrictive territory, but that they would be “holding it there” until inflation fell. Atlanta Fed President Bostic struck a similar tone, emphasising rate cuts in 2023 were not likely and that “I am not advocating a quick turn toward accommodation. On the contrary.” He said he wanted fed funds rates between 4% and 4.5% by the end of this year, “and then hold at that level and see how the economy and prices react.”

That backdrop led to a sizeable cross-asset selloff yesterday on both sides of the Atlantic. The effects on the rates side were particularly prominent, with 10yr US Treasury yields bouncing back +12.0bps to 3.75%. And that move was entirely driven by real yields, which rose +15.1bps as investors moved to price in a more hawkish Fed over the months ahead. You could see that taking place in Fed funds futures too, with the rate priced in for December 2023 up by +8.9bps to 4.19%, thus partially reversing the -22.2bps move lower over the previous two sessions. This morning, 10yr yields are only down -1.0 bps, so far from unwinding those moves.

The hawkish tones also proved bad news for equities, with the S&P 500 taking a breather following its blistering start to the week, retreating -0.20% after being as low as -1.80% in the New York morning. European equities did not enjoy the benefits of a New York afternoon rally, leading to a transatlantic divergence, and the STOXX 600 was down -1.02% on a broad-based decline. The energy sector outperformed in both the S&P 500 and STOXX 600 following a rally in crude oil which saw both Brent crude (+2.81%) and WTI (+2.53%) oil prices hit a 3-week high. That followed a decision from the OPEC+ group, who cut output by 2 million barrels per day. Those gains have continued in overnight trading as well, with Brent Crude now at $93.48/bbl.

In Europe, the performance of sovereign bonds echoed that for US Treasuries, as yields on 10yr bunds (+16.3bps), OATs (+17.6bps) and BTPs (+29.0bps) all saw their largest daily increases since March 2020. As in the US, that reflected growing scepticism about a dovish pivot from the ECB, but another factor not helping matters was the rebound in energy prices, with natural gas futures up +7.25% on the day to close at €174 per megawatt-hour, alongside the oil rebound mentioned above. That’s been reflected in inflation expectations too, with the 10yr German breakeven up another +8.0bps yesterday to 2.15%, after having closed beneath 2% on Monday for the first time since Russia’s invasion of Ukraine began.

Here in the UK, we also saw several key assets lose ground once again following their rally over the last week. For instance, sterling ended a run of 6 consecutive daily gains against the US Dollar to close -1.31% lower, closing back at $1.13. And that wasn’t simply a story of dollar strength, as the pound weakened against every other G10 currency as well. Gilts were another asset to struggle, with real yields in particular seeing significant daily rises of at least +30bps across most of the yield curve, including a +33.0bps rise for the 10yr real yield, and a +36.7bps rise for the 30yr real yield. That came as the Bank of England said they didn’t buy any gilts under their emergency operation for a second day running. In the meantime, there were fresh signs that the turmoil after the fiscal announcement was impacting the mortgage market, with Moneyfacts saying that the average 2yr fixed-rate mortgage had risen to 6.07%, which is the highest since November 2008. Last night that was then followed up by the news that Fitch had downgraded the UK’s outlook from stable to negative.

Overnight in Asia there’s been a mixed performance from the major equity indices. Both the Nikkei (+0.94%) and the Kospi (+1.25%) have recorded solid advances, which continues their run of having risen every day this week. In addition, futures in the US and Europe are both pointing higher, with those on the S&P 500 up +0.49%. However, the Hang Seng is down -0.43% and Australia’s S&P/ASX 200 is down -0.05%, whilst markets in mainland China remain closed for a holiday. The dollar index has also lost ground overnight, falling -0.25%, which comes in spite of those hawkish comments from Fed officials pushing back against rate cuts next year.

Looking at yesterday’s other data, the final services and composite PMIs mostly echoed the data from the flash readings. The composite PMI for the Euro Area was revised down a tenth to 48.1, and the US composite PMI was revised up two-tenths to 49.5. There was a bigger rise in the UK however, where the composite PMI was revised up seven-tenths to 49.1.

To the day ahead now, and data releases include German factory orders for August, the German and UK construction PMIs for September, Euro Area retail sales for August, and the weekly initial jobless claims from the US. Meanwhile from central banks, we’ll get the ECB’s account of their September meeting, as well as remarks from the Fed’s Evans, Cook, Kashkari, Waller and Mester, and the BoE’s Haskel.

Spread & Containment

Separating Information From Disinformation: Threats From The AI Revolution

Separating Information From Disinformation: Threats From The AI Revolution

Authored by Per Bylund via The Mises Institute,

Artificial intelligence…

Authored by Per Bylund via The Mises Institute,

Artificial intelligence (AI) cannot distinguish fact from fiction. It also isn’t creative or can create novel content but repeats, repackages, and reformulates what has already been said (but perhaps in new ways).

I am sure someone will disagree with the latter, perhaps pointing to the fact that AI can clearly generate, for example, new songs and lyrics. I agree with this, but it misses the point. AI produces a “new” song lyric only by drawing from the data of previous song lyrics and then uses that information (the inductively uncovered patterns in it) to generate what to us appears to be a new song (and may very well be one). However, there is no artistry in it, no creativity. It’s only a structural rehashing of what exists.

Of course, we can debate to what extent humans can think truly novel thoughts and whether human learning may be based solely or primarily on mimicry. However, even if we would—for the sake of argument—agree that all we know and do is mere reproduction, humans have limited capacity to remember exactly and will make errors. We also fill in gaps with what subjectively (not objectively) makes sense to us (Rorschach test, anyone?). Even in this very limited scenario, which I disagree with, humans generate novelty beyond what AI is able to do.

Both the inability to distinguish fact from fiction and the inductive tether to existent data patterns are problems that can be alleviated programmatically—but are open for manipulation.

Manipulation and Propaganda

When Google launched its Gemini AI in February, it immediately became clear that the AI had a woke agenda. Among other things, the AI pushed woke diversity ideals into every conceivable response and, among other things, refused to show images of white people (including when asked to produce images of the Founding Fathers).

Tech guru and Silicon Valley investor Marc Andreessen summarized it on X (formerly Twitter): “I know it’s hard to believe, but Big Tech AI generates the output it does because it is precisely executing the specific ideological, radical, biased agenda of its creators. The apparently bizarre output is 100% intended. It is working as designed.”

There is indeed a design to these AIs beyond the basic categorization and generation engines. The responses are not perfectly inductive or generative. In part, this is necessary in order to make the AI useful: filters and rules are applied to make sure that the responses that the AI generates are appropriate, fit with user expectations, and are accurate and respectful. Given the legal situation, creators of AI must also make sure that the AI does not, for example, violate intellectual property laws or engage in hate speech. AI is also designed (directed) so that it does not go haywire or offend its users (remember Tay?).

However, because such filters are applied and the “behavior” of the AI is already directed, it is easy to take it a little further. After all, when is a response too offensive versus offensive but within the limits of allowable discourse? It is a fine and difficult line that must be specified programmatically.

It also opens the possibility for steering the generated responses beyond mere quality assurance. With filters already in place, it is easy to make the AI make statements of a specific type or that nudges the user in a certain direction (in terms of selected facts, interpretations, and worldviews). It can also be used to give the AI an agenda, as Andreessen suggests, such as making it relentlessly woke.

Thus, AI can be used as an effective propaganda tool, which both the corporations creating them and the governments and agencies regulating them have recognized.

Misinformation and Error

States have long refused to admit that they benefit from and use propaganda to steer and control their subjects. This is in part because they want to maintain a veneer of legitimacy as democratic governments that govern based on (rather than shape) people’s opinions. Propaganda has a bad ring to it; it’s a means of control.

However, the state’s enemies—both domestic and foreign—are said to understand the power of propaganda and do not hesitate to use it to cause chaos in our otherwise untainted democratic society. The government must save us from such manipulation, they claim. Of course, rarely does it stop at mere defense. We saw this clearly during the covid pandemic, in which the government together with social media companies in effect outlawed expressing opinions that were not the official line (see Murthy v. Missouri).

AI is just as easy to manipulate for propaganda purposes as social media algorithms but with the added bonus that it isn’t only people’s opinions and that users tend to trust that what the AI reports is true. As we saw in the previous article on the AI revolution, this is not a valid assumption, but it is nevertheless a widely held view.

If the AI then can be instructed to not comment on certain things that the creators (or regulators) do not want people to see or learn, then it is effectively “memory holed.” This type of “unwanted” information will not spread as people will not be exposed to it—such as showing only diverse representations of the Founding Fathers (as Google’s Gemini) or presenting, for example, only Keynesian macroeconomic truths to make it appear like there is no other perspective. People don’t know what they don’t know.

Of course, nothing is to say that what is presented to the user is true. In fact, the AI itself cannot distinguish fact from truth but only generates responses according to direction and only based on whatever the AI has been fed. This leaves plenty of scope for the misrepresentation of the truth and can make the world believe outright lies. AI, therefore, can easily be used to impose control, whether it is upon a state, the subjects under its rule, or even a foreign power.

The Real Threat of AI

What, then, is the real threat of AI? As we saw in the first article, large language models will not (cannot) evolve into artificial general intelligence as there is nothing about inductive sifting through large troves of (humanly) created information that will give rise to consciousness. To be frank, we haven’t even figured out what consciousness is, so to think that we will create it (or that it will somehow emerge from algorithms discovering statistical language correlations in existing texts) is quite hyperbolic. Artificial general intelligence is still hypothetical.

As we saw in the second article, there is also no economic threat from AI. It will not make humans economically superfluous and cause mass unemployment. AI is productive capital, which therefore has value to the extent that it serves consumers by contributing to the satisfaction of their wants. Misused AI is as valuable as a misused factory—it will tend to its scrap value. However, this doesn’t mean that AI will have no impact on the economy. It will, and already has, but it is not as big in the short-term as some fear, and it is likely bigger in the long-term than we expect.

No, the real threat is AI’s impact on information. This is in part because induction is an inappropriate source of knowledge—truth and fact are not a matter of frequency or statistical probabilities. The evidence and theories of Nicolaus Copernicus and Galileo Galilei would get weeded out as improbable (false) by an AI trained on all the (best and brightest) writings on geocentrism at the time. There is no progress and no learning of new truths if we trust only historical theories and presentations of fact.

However, this problem can probably be overcome by clever programming (meaning implementing rules—and fact-based limitations—to the induction problem), at least to some extent. The greater problem is the corruption of what AI presents: the misinformation, disinformation, and malinformation that its creators and administrators, as well as governments and pressure groups, direct it to create as a means of controlling or steering public opinion or knowledge.

This is the real danger that the now-famous open letter, signed by Elon Musk, Steve Wozniak, and others, pointed to:

“Should we let machines flood our information channels with propaganda and untruth? Should we automate away all the jobs, including the fulfilling ones? Should we develop nonhuman minds that might eventually outnumber, outsmart, obsolete and replace us? Should we risk loss of control of our civilization?”

Other than the economically illiterate reference to “automat[ing] away all the jobs,” the warning is well-taken. AI will not Terminator-like start to hate us and attempt to exterminate mankind. It will not make us all into biological batteries, as in The Matrix. However, it will—especially when corrupted—misinform and mislead us, create chaos, and potentially make our lives “solitary, poor, nasty, brutish and short.”

International

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

Government

For-profit nursing homes are cutting corners on safety and draining resources with financial shenanigans − especially at midsize chains that dodge public scrutiny

Owners of midsize nursing home chains drain billions from facilities, hiding behind opaque accounting practices and harming the elderly as government,…

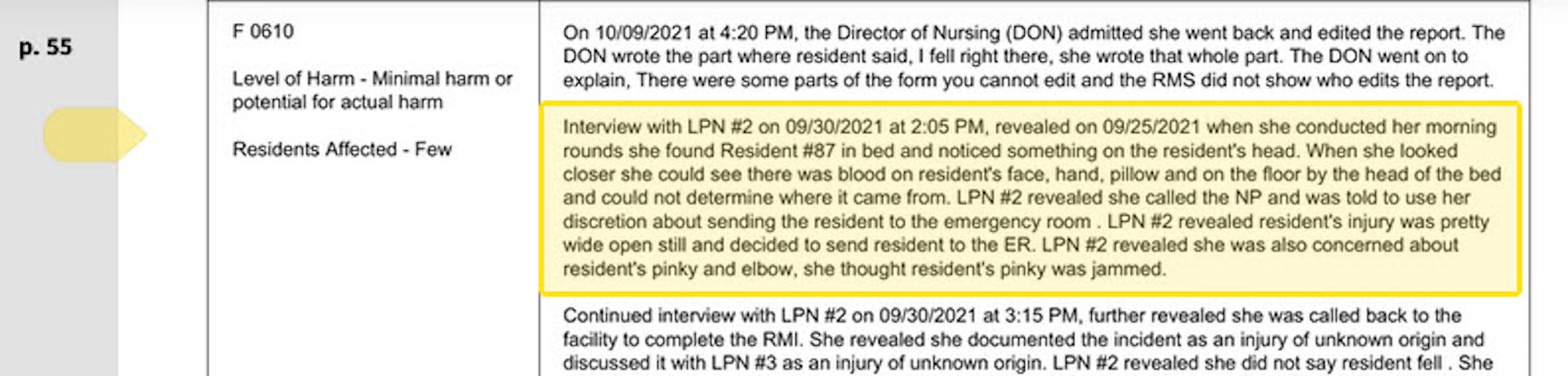

The care at Landmark of Louisville Rehabilitation and Nursing was abysmal when state inspectors filed their survey report of the Kentucky facility on July 3, 2021.

Residents wandered the halls in a facility that can house up to 250 people, yelling at each other and stealing blankets. One resident beat a roommate with a stick, causing bruising and skin tears. Another was found in bed with a broken finger and a bloody forehead gash. That person was allowed to roam and enter the beds of other residents. In another case, there was sexual touching in the dayroom between residents, according to the report.

Meals were served from filthy meal carts on plastic foam trays, and residents struggled to cut their food with dull plastic cutlery. Broken tiles lined showers, and a mysterious black gunk marred the floors. The director of housekeeping reported that the dining room was unsanitary. Overall, there was a critical lack of training, staff and supervision.

The inspectors tagged Landmark as deficient in 29 areas, including six that put residents in immediate jeopardy of serious harm and three where actual harm was found. The issues were so severe that the government slapped Landmark with a fine of over $319,000 − more than 29 times the average for a nursing home in 2021 − and suspended payments to the home from federal Medicaid and Medicare funds.

Persistent problems

But problems persisted. Five months later, inspectors levied six additional deficiencies of immediate jeopardy − the highest level − including more sexual abuse among residents and a certified nursing assistant pushing someone down, bruising the person’s back and hip.

Landmark is just one of the 58 facilities run by parent company Infinity Healthcare Management across five states. The government issued penalties to the company almost 4½ times the national average, according to bimonthly data that the Centers for Medicare & Medicaid Services first started to make available in late 2022. All told, Infinity paid nearly $10 million in fines since 2021, the highest among nursing home chains with fewer than 100 facilities.

Infinity Healthcare Management and its executives did not respond to multiple requests for comment.

Such sanctions are nothing new for Infinity or other for-profit nursing home chains that have dominated an industry long known for cutting corners in pursuit of profits for private owners. But this race to the bottom to extract profits is accelerating despite demands by government officials, health care experts and advocacy groups to protect the nation’s most vulnerable citizens.

To uncover the reasons why, The Conversation’s investigative unit Inquiry delved into the nursing home industry, where for-profit facilities make up more than 72% of the nation’s nearly 14,900 facilities. The probe, which paired an academic expert with an investigative reporter, used the most recent government data on ownership, facility information and penalties, combined with CMS data on affiliated entities for nursing homes.

The investigation revealed an industry that places a premium on cost cutting and big profits, with low staffing and poor quality, often to the detriment of patient well-being. Operating under weak and poorly enforced regulations with financially insignificant penalties, the for-profit sector fosters an environment where corners are frequently cut, compromising the quality of care and endangering patient health. Meanwhile, owners make the facilities look less profitable by siphoning money from the homes through byzantine networks of interconnected corporations. Federal regulators have neglected the problem as each year likely billions of dollars are funneled out of nursing homes through related parties and into owners’ pockets.

More trouble at midsize

Analyzing newly released government data, our investigation found that these problems are most pronounced in nursing homes like Infinity − midsize chains that operate between 11 and 100 facilities. This subsection of the industry has higher average fines per home, lower overall quality ratings, and are more likely to be tagged with resident abuse compared with both the larger and smaller networks. Indeed, while such chains account for about 39% of all facilities, they operate 11 of the 15 most-fined facilities.

With few impediments, private investors who own the midsize chains have quietly swooped in to purchase underperforming homes, expanding their holdings even further as larger chains divest and close facilities. As a result of the industry’s churn of facility ownership, over one fifth of the country’s nursing facilities changed ownership between 2016 and 2021, four times more changes than hospitals.

A 2023 report by Good Jobs First, a nonprofit watchdog, noted that a dozen of these chains in the midsize range have doubled or tripled in size while racking up fines averaging over $100,000 per facility since 2018. But unlike the large, multistate chains with easily recognizable names, the midsize networks slip through without the same level of public scrutiny, The Conversation’s investigations unit found.

“They are really bad, but the names − we don’t know these names,” said Toby Edelman, senior policy attorney with the Center for Medicare Advocacy, a nonprofit law organization.

“When we used to have those multistate chains, the facilities all had the same name, so you know what the quality is you’re getting,” she said. “It’s not that good − but at least you know what you’re getting.”

In response to The Conversation’s findings on nursing homes and request for an interview, a CMS spokesperson emailed a statement that said the CMS is “unwavering in its commitment to improve safety and quality of care for the more than 1.2 million residents receiving care in Medicare- and Medicaid-certified nursing homes.”

The statement pointed to data released by the oversight body on mergers, acquisitions, consolidations and changes of ownership in April 2023 along with additional ownership data released the following September. CMS also proposed a rule change that aims to increase transparency in nursing home ownership by collecting more information on facility owners and their affiliations.

“Our focus is on advancing implementable solutions that promote safe, high-quality care for residents and consider the challenging circumstances some long-term care facilities face,” the statement reads. “We believe the proposed requirements are achievable and necessary.”

CMS is slated to implement the disclosure rules in the fall and release the new data to the public later this year.

“We support transparency and accountability,” the American Health Care Association/National Center for Assisted Living, a trade organization representing the nursing home industry, wrote in response to The Conversation‘s request for comment. “But neither ownership nor line items on a budget sheet prove whether a nursing home is committed to its residents. Over the decades, we’ve found that strong organizations tend to have supportive and trusted leadership as well as a staff culture that empowers frontline caregivers to think critically and solve problems. These characteristics are not unique to a specific type or size of provider.”

It often takes years to improve a poor nursing home − or run one into the ground. The analysis of midsize chains shows that most owners have been associated with their current facilities for less than eight years, making it difficult to separate operators who have taken long-term investments in resident care from those who are looking to quickly extract money and resources before closing them down or moving on. These chains control roughly 41% of nursing home beds in the U.S., according to CMS’s provider data, making the lack of transparency especially ripe for abuse.

A churn of nursing home purchases even during the COVID-19 pandemic shows that investors view the sector as highly profitable, especially when staffing costs are kept low and fines for poor care can easily be covered by the money extracted from residents, their families and taxpayers.

“This is the model of their care: They come in, they understaff and they make their money,” said Sam Brooks, director of public policy at the Consumer Voice, a national resident advocacy organization. “Then they multiply it over a series of different facilities.”

Investor race

The explosion of a billion-dollar private marketplace found its beginnings in government spending.

The adoption of Medicare and Medicaid in 1965 set loose a race among investors to load up on nursing homes, with a surge in for-profit homes gaining momentum because of a reliable stream of government payouts. By 1972, a mere seven years after the inception of the programs, a whopping 106 companies had rushed to Wall Street to sell shares in nursing home companies. And little wonder: They pulled in profits through their ownership of 18% of the industry’s beds, securing about a third of the hefty $3.2 billion of government cash.

The 1990s saw substantial expansion in for-profit nursing home chains, marked by a wave of acquisitions and mergers. At the same time, increasing difficulties emerged in the model for publicly traded chains. Shareholders increasingly demanded rapid growth, and researchers have found that the publicly traded chains tried to appease that hunger by reducing nursing staff and cutting corners on other measures meant to improve quality and safety.

“I began to suspect a possibly inherent contradiction between publicly traded and other large investor-operated nursing home companies and the prerequisites for quality care,” Paul R. Willging, former chief lobbyist for the industry, wrote in a 2007 letter to the editor of The New York Times. “For many investors … earnings growth, quarter after quarter, is often paramount. Long-term investments in quality can work at cross purposes with a mandate for an unending progression of favorable earnings reports.”

One example of that clash can be found at the Ensign Group, founded in 1999 as a private chain of five facilities. Using a strategy of acquiring struggling nursing homes, the company went public in 2007 with more than 60 facilities. What followed was a year-after-year acquisition binge and a track record of growing profits almost every year. Yet the company kept staffing levels below the national average and levels recommended by experts. Its facilities had higher than average inspection deficiencies and higher COVID infection rates. Since 2021, it has racked up more than $6.5 million in penalties.

Ensign did not respond to requests for comment.

Even with that kind of expense cutting, not all publicly traded nursing homes survived as the costs of providing poor care added up. Residents sued over mistreatment. Legal fees and settlements ate into profits, shareholders grumbled, and executives searched for a way out of this Catch-22.

Recognizing the long-term potential for profit growth, private investors snapped up publicly traded for-profit chains, reducing the previous levels of public transparency and oversight. Between 2000 and 2017, 1,674 nursing homes were acquired by private-equity firms in 128 unique deals out of 18,485 facilities. But the same poor-quality problems persisted. Research shows that after snagging a big chain, private investors tended to follow the same playbook: They rebrand the company, increase corporate control and dump unprofitable homes to other investment groups willing to take shortcuts for profit.

Multiple academic studies show the results, highlighting the lower staffing and quality in for-profit homes compared with nonprofits and government-run facilities. Elderly residents staying long term in nursing homes owned by private investment groups experienced a significant uptick in trips to the emergency department and hospitalizations between 2013 and 2017, translating into higher costs for Medicare.

Overall, private-equity investors wreak havoc on nursing homes, slashing registered nurse hours per resident day by 12%, outpacing other for-profit facilities. The aftermath is grim, with a daunting 14% surge in the deficiency score index, a standardized metric for determining issues with facilities, according to a U.S. Department of Health and Human Services report.

The human toll comes in death and suffering. A study updated in 2023 by the National Bureau of Economic Research calculated that 22,500 additional deaths over a 12-year span were attributable to private-equity ownership, equating to about 172,400 lost life years. The calculations also showed that private-equity ownership was responsible for a 6.2% reduction in mobility, an 8.5% increase in ulcer development and a 10.5% uptick in pain intensity.

Hiding in complexity

Exposing the identities of who should be held responsible for such anguish poses a formidable task. Private investors in nursing home chains often employ a convoluted system of limited liability corporations, related companies and family relationships to obscure who controls the nursing homes.

These adjustments are crafted to minimize liability, capitalize on favorable tax policies, diminish regulatory scrutiny and disguise nursing home profitability. In this investigation, entities at every level of involvement with a nursing home denied ownership, even though the same people controlled each organization.

A rule put in place in 2023 by the Centers for Medicare & Medicaid Services requires the identification of all private-equity and real estate investment trust investors in a facility and the release of all related party names. But this hasn’t been enough to surface the players and relationships. More than half of ownership data provided to CMS is incomplete across all facilities, according to a March 2024 analysis of the newly released data.

Even the land under the nursing home is often owned by someone else. In 2021, publicly traded or private real estate investment trusts held a sizable chunk of the approximately $120 billion of nursing home real estate. As with homes owned by private-equity investors, quality measures collapse after REITs get involved, with facilities witnessing a 7% decline in registered nurses’ hours per resident day and an alarming 14% ascent in the deficiency score index. It’s a blatant pattern of disruption, leaving facilities and care standards in a dire state.

Part of that quality collapse comes from the way these investment entities make their money. REITs and their owners can drain cash out of the nursing homes in a number of different ways. The standard tactic for grabbing the money is known as a triple-net lease, where the REIT buys the property then leases it back to the nursing home, often at exorbitant rates. Although the nursing home then lacks possession of the property, it still gets slammed with costs typically shouldered by an owner − real estate taxes, insurance, maintenance and more. Topping it off, the facilities then must typically pay annual rent hikes.

A second tactic that REITs use involves a contracting façade that serves no purpose other than enriching the owners of the trusts. Since triple-net lease agreements prohibit REITs from taking profits from operating the facilities, the investors create a subsidiary to get past that hurdle. The subsidiary then contracts with a nursing home operator − often owned or controlled by another related party − and then demands a fee for providing operational guidance. The use of REITs for near-risk-free profits from nursing homes has proven to be an ever-growing technique, and the midsize chains, which our investigation found generally provided the worst care, grew in their reliance on REITs during the pandemic.

“When these REITs start coming in … nursing homes are saddled with these enormous rents, and then they wind up going out of business,” said Richard Mollot, executive director of the Long-Term Care Community Coalition, a nonprofit organization that advocates for better care at nursing homes. “It’s no longer a viable facility.”

The churn of nursing home purchases by midsize chains underscores investors’ perception of the sector’s profitability, particularly when staffing expenses are minimized and penalties for subpar care can be offset by money extracted through related transactions and payments from residents, their families and taxpayers. Lawsuits can drag out over years, and in the worst case, if a facility is forced to close, its land and other assets can be sold to minimize the financial loss.

Take Brius Healthcare, a name that resonates with a disturbing cadence in the world of nursing home ownership. A search of the federal database for nursing home ownership and penalties shows that Brius was responsible for 32 facilities as of the start of 2024, but the true number is closer to 80, according to BriusWatch.org, which tracks violations. At the helm of this still midsize network stands Shlomo Rechnitz, who became a billionaire in part by siphoning from government payments to his facilities scattered across California, according to a federal and state lawsuit.

In lawsuits and regulators’ criticisms, Rechnitz’s homes have been associated with tales of abuse, as well as several lawsuits alleging terrible care. The track record was so bad that, in the summer of 2014, then-California Attorney General Kamala Harris filed an emergency motion to block Rechnitz from acquiring 19 facilities, writing that he was “a serial violator of rules within the skilled nursing industry” and was “not qualified to assume such an important role.”

Yet, Rechnitz’s empire in California surged forward, scooping up more facilities that drained hundreds of millions of federal and state funds as they racked up pain and profit. The narrative played out at Windsor Redding Care Center in Redding, California. Rechnitz bought it from a competing nursing home chain and attempted to obtain a license to operate the facility. But in 2016, the California Department of Public Health refused the application, citing a staggering 265 federal regulatory violations across his other nursing homes over just three years.

According to court filings, Rechnitz formed a joint venture with other investors who in turn held the license. Rechnitz, through the Brius joint venture, became the unlicensed owner and operator of Windsor Redding.

Brius carved away at expenses, slashing staff and other care necessities, according to a 2022 California lawsuit. One resident was left to sit in her urine and feces for hours at a time. Overwhelmed staff often did not respond to her call light, so once she instead climbed out of bed unassisted, fell and fractured her hip. Other negligence led to pressure ulcers, and when she was finally transferred to a hospital, she was suffering from sepsis. She was not alone in her suffering. Numerous other residents experienced an unrelenting litany of injuries and illnesses, including pressure ulcers, urinary tract infections from poor hygiene, falls, and skin damage from excess moisture, according to the lawsuit.

In 2023, California moved forward with licensing two dozen of Rechnitz’s facilities with an agreement that included a two-year monitoring period, right before statewide reforms were set to take effect. The reforms don’t prevent existing owners like Rechnitz from continuing to run a nursing home without a license, but they do prevent new operators from doing so.

“We’re seeing more of that, I think, where you have a proliferation of really bad operators that keep being provided homes,” said Brooks, the director of public policy at the Consumer Voice. “There’s just so much money to be made here for unscrupulous people, and it just happens all the time.”

Rechnitz did not respond to multiple requests for comment. Bruis also did not respond.

Perhaps no other chain showcases the havoc that can be caused by one individual’s acquisition of multiple nursing homes than Skyline Health Care. The company’s owner, Joseph Schwartz, parlayed the sale of his insurance business into ownership of 90 facilities between mid-2016 and December 2017, according to a federal indictment. He ran the company out of an office above a New Jersey pizzeria and at its peak managed facilities in 11 states.

Schwartz went all-in on cost cutting, and by early 2018, residents were suffering from the shortage of staff. The company wasn’t paying its bills or its workers. More than a dozen lawsuits piled up. Last year, Schwartz was arrested and faced charges in federal district court in New Jersey for his role in a $38 million payroll tax scheme. In 2024, Schwartz pleaded guilty to his role in the fraud scheme. He is awaiting sentencing, where he faces a year in prison along with paying at least $5 million in restitution.

Skyline collapsed and disrupted thousands of lives. Some states took over facilities; others closed, forcing residents to relocate and throwing families into chaos. The case also highlights the ease with which some bad operators can snap up nursing homes with little difficulty, with federal and state governments allowing ownership changes with little or no review.

Schwartz’s lawyer did not respond to requests for comment.

Not that nursing homes have much to fear in the public perception of their reputation for quality. CMS uses what is known as the Five-Star Quality Rating System, designed to help consumers compare nursing homes to find one that provides good care. Theoretically, nursing homes with five-star ratings are supposed to be exceptional, while those with one-star ratings are deemed the worst. But research shows that nursing homes can game the system, with the result that a top star rating might reflect little more than a facility’s willingness to cheat.

A star rating is composed of three parts: The score from a government inspection and the facility’s self-reports of staffing and quality. This means that what the nursing homes say about themselves can boost the star rating of facilities even if they have poor inspection results.

Multiple studies have highlighted a concerning trend: Some nursing homes, especially for-profit ones, inflate their self-reported measures, resulting in a disconnect from actual inspection findings. Notably, research suggests that for-profit nursing homes, driven by significant financial motives, are more likely to engage in this practice of inflating their self-reported assessments.

At bottom, the elderly and their families seeking quality care unknowingly find themselves in an impossible situation with for-profit nursing homes: Those facilities tend to provide the worst quality, and the only measure available for consumers to determine where they will be treated well can be rigged. The result is the transformation of an industry meant to care for the most vulnerable into a profit-driven circus.

The pandemic

Nothing more clearly exposed the problems rampant in nursing homes than the pandemic. Throughout that time, nursing homes reported that almost 2 million residents had infections and 170,000 died.

No one should have been surprised by the mass death in nursing homes − the warning signs of what was to come had been visible for years. Between 2013 and 2017, infection control was the most frequently cited deficiency in nursing homes, with 40% of facilities cited each year and 82% cited at least once in the five-year period. Almost half were cited over multiple consecutive years for these deficiencies − if fixed, one of the big causes of the widespread transmission of COVID in these facilities would have been eliminated.

But shortly after coming into office in 2017, the Trump administration weakened what was already a deteriorating system to regulate nursing homes. The administration directed regulators to issue one-time fines against nursing homes for violations of federal rules rather than for the full time they were out of compliance. This shift meant that even nursing homes with severe infractions lasting weeks were exempted from fines surpassing the maximum per-instance penalty of $20,965.

Even that near-worthless level of regulation was not feeble enough for the industry, so lobbyists pressed for less. In response, just a few months before COVID emerged in China, the Trump administration implemented new regulations that effectively abolished a mandate for each to hire a full-time infection control expert, instead recommending outside consultants for the job.

The perfect storm had been reached, with no experts required to be on site, prepared to combat any infection outbreaks. On Jan. 20, 2020 − just 186 days after the change in rules on infection control − the CDC reported that the first laboratory-confirmed case of COVID had been found at a nursing home in Washington state.

The least prepared in this explosion of disease were the for-profit nursing homes, compared with nonprofit and government facilities. Research from the University of California at San Francisco found those facilities were linked to higher numbers of COVID cases. For-profits not only had fewer nurses on staff but also high numbers of infection-control deficiencies and lower compliance with health regulations.

Even as the United States went through the crisis, some owners of midsize chains continued snapping up nursing homes. For example, two Brooklyn businessmen named Simcha Hyman and Naftali Zanziper were going on a nursing home buying spree through their private-equity company, the Portopiccolo Group. Despite poor ratings in their previously owned facilities, nothing blocked the acquisitions.

One such facility was a struggling nursing home in North Carolina now known as The Citadel Salisbury. Following the traditional pattern forged by private investors in the industry, the new owners set up a convoluted network of business entities and then used them to charge the nursing home for services and property. A 2021 federal lawsuit of many plaintiffs claimed that they deliberately kept the facility understaffed and undersupplied to maximize profit.

Within months of the first case of COVID reported in America, The Citadel Salisbury experienced the largest nursing home outbreak in the state. The situation was so dire that on April 20, 2020, the local medical director of the emergency room took to the local newspaper to express his distress, revealing that he had pressed the facility’s leadership and the local health department to address the known shortcomings.

The situation was “a blueprint for exactly what not to do in a crisis,” medical director John Bream wrote. “Patients died at the Citadel without family members being notified. Families were denied the ability to have one last meaningful interaction with their family. Employees were wrongly denied personal protective equipment. There has been no transparency.”

After a series of scathing inspection reports, the facility finally closed in the spring of 2022. As for the federal lawsuit, court documents show that a tentative agreement was reached in 2023. But the case dragged out for nearly three years, and one of the plaintiffs, Sybil Rummage, died while seeking accountability through the court.

Still, the pandemic had been a time of great success for Hyman and Zanziper. At the end of 2020, they owned more than 70 facilities. By 2021, their portfolio had exploded to more than 120. Now, according to data from the Centers for Medicare & Medicaid Services, Hyman and Zanziper are associated with at least 131 facilities and have the highest amount of total fines recorded by the agency for affiliated entities, totaling nearly $12 million since 2021. And their average fine per facility, as calculated by CMS, is more than twice the national average at almost $90,000.

In a written statement, Portopiccolo Group spokesperson John Collins disputed that the facilities had skimped on care and argued that they were not managed by the firm. “We hire experienced, local health care teams who are in charge of making all on-the-ground decisions and are committed to putting residents first.” He added that the number of facilities given by CMS was inaccurate but declined to say how many are connected to its network of affiliates or owned by Hyman and Zanziper.

With the nearly 170,000 resident deaths from COVID and many related fatalities from isolation and neglect in nursing homes, in February 2022 President Biden announced an initiative aimed at improving the industry. In addition to promising to set a minimum staffing standard, the initiative is focused on improving ownership and financial transparency.

“As Wall Street firms take over more nursing homes, quality in those homes has gone down and costs have gone up. That ends on my watch,” Biden said during his 2022 State of the Union address. “Medicare is going to set higher standards for nursing homes and make sure your loved ones get the care they deserve and expect.”

Still, the current trajectory of actions appears to fall short of what’s needed. While penalties against facilities have sharply increased under Biden, some of the Trump administration’s weak regulations have not been replaced.

A rule proposed by CMS in September 2023 and released for review in March 2024 would require states to report what percentage of Medicaid funding is used to pay direct care workers and support staff and would require an RN on duty 24/7. It would also require a minimum of three hours of skilled staffing care per patient per day. But the three-hour minimum is substantially lower than the 4.1 hours of skilled staffing for nursing home residents suggested by CMS over two decades ago.

The requirements are also lower than the 3.8 average nursing staff hours already employed by U.S. facilities.

The current administration has also let stand the Trump administration reversal of an Obama rule that banned binding arbitration agreements in nursing homes.

It breaks a village

The Villages of Orleans Health and Rehabilitation Center in Albion, New York, was, by any reasonable measure, broken. Court records show that on some days there was no nurse and no medication for the more than 100 elderly residents. Underpaid staff spent their own cash for soap to keep residents clean. At times, the home didn’t feed its frail occupants.

Meanwhile, according to a 2022 lawsuit filed by the New York attorney general, riches were siphoned out of the nursing home and into the pockets of the official owner, Bernard Fuchs, as well as assorted friends, business associates and family. The lawsuit says $18.7 million flowed from the facility to entities owned by a group of men who controlled the Village’s operations.

Although these men own various nursing homes, Medicare records show few connections between them, despite them all being investors in Comprehensive Healthcare Management, which provided administrative services to the Villages. Either they or their families were also owners of Telegraph Realty, which leased what was once the Villages’ own property back to the facility at rates the New York attorney general deemed exorbitant, predatory and a sham.

So it goes in the world of nursing home ownership, where overlapping entities and investors obscure the interrelationships between them to such a degree that Medicare itself is never quite sure who owns what.

Glenn Jones, a lawyer representing Comprehensive Healthcare Management, declined to comment on the pending litigation, but he forwarded a court document his law firm filed that labels the allegations brought by the New York attorney general “unfounded” and reliant on “a mere fraction” of its residents.

The shadowy structure of ownership and related party transactions plays an enormous role in how investors enrich themselves, even as the nursing homes they control struggle financially. Compounding the issue, the figures reported by nursing homes regarding payments to related parties frequently diverge from the disclosures made by the related parties themselves.

As an illustration of the problems, consider Pruitt Health, a midsize chain with 87 nursing homes spread across Georgia, South Carolina, North Carolina and Florida that had low overall federal quality ratings and about $2 million in penalties. A report by The National Consumer Voice For Quality Long-Term Care, a consumer advocacy group, shows that Pruitt disclosed general related party costs nearing $482 million from 2018 to 2020. Yet in that same time frame, Pruitt reported payments to specific related parties amounting to about $570 million, indicating a $90 million excess. Its federal disclosures offer no explanation for the discrepancy. Meanwhile, the company reported $77 million in overall losses on its homes.